Wolterk

Before the market opened on September 28th, the management team at Paychex (NASDAQ:PAYX) announced financial results covering the first quarter of the company’s 2023 fiscal year. In addition to topping expectations when it came to both revenue and earnings per share, the company also revised higher some of its expectations for the fiscal year as a whole. Add on top of this the fact that shares of the entity are getting cheaper over time, and a case could be made that the firm is more attractive now than it has been in a long while. Having said that, shares are not quite cheap enough, in my opinion, to warrant meaningful upside relative to what the broader market can achieve. And because of that, I have decided to retain my ‘hold’ rating on the entity for now.

Paychex Q1 2023 earnings

The last time I wrote an article about Paychex was back in early April of this year. In that article, I mentioned that the company had done well for the most part in recent years. Overall, I viewed the company’s potential as positive and felt as though the long-term trajectory would be favorable. Normally, this could make me want to acquire stock in the business in question. But given how shares were priced at that time, I felt as though the company was not cheap enough to warrant material upside potential. This led me to rate the enterprise a ‘hold’, reflecting my belief that it would likely generate returns that more or less matched with the broader market would achieve for the foreseeable future. Since then, that call has been fairly solid. While the S&P 500 is down by 17.3%, shares of Paychex have generated a loss for investors of 14.5%. In the grand scheme of things, this is not a significant disparity.

One of the beautiful things about the market that we are seeing today is that investor pessimism makes it possible for companies that are performing incredibly well to trade lower as the market declines. Although this can be frustrating if you already own shares of one of these types of firms, it can be incredibly rewarding for those who either don’t own shares or don’t own as many as they would like. From a purely fundamental perspective, Paychex is an enterprise that should not be seeing really any downside. To see what I mean, we need only touch on some of its key fundamental figures that management just reported.

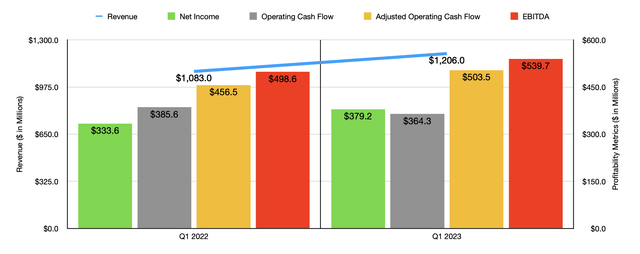

For the first quarter of the firm’s 2023 fiscal year, Paychex generated revenue of nearly $1.21 billion. This represents an increase of 11.4% over the $1.08 billion in sales generated the same quarter just one year earlier. From a strictly dollar perspective, the greatest growth for the company came from its Management Solutions activities, with revenue rising by 12.4% from $805.5 million in the first quarter of its 2022 fiscal year to $905.5 million the same time this year. This increase, management said, which driven by growth in the number of client employees served for HCM and additional worksite employees under the company’s HR Solutions operations. Improved revenue per client resulting from higher pricing and higher product penetration also contributed, as did the expansion of HCM ancillary services. Professional Employer Organization and Insurance Solutions revenue grew a more modest 7.6%, while the interest on funds held for clients that the company gets to keep jumped by 23.4%. It’s worth noting that in addition to seeing revenue rise nicely year over year, the sales reported by management also beat what analysts anticipated to the tune of $40 million.

Profitability for the company was also strong. Earnings per share came in at $1.03. This represents an increase over the $0.89 per share reported for the first quarter of 2022. On an adjusted basis, earnings of $1.05 beat out the $0.92 per share in adjusted earnings experienced one year earlier and topped analysts’ expectations by $0.06 per share. In absolute dollar terms, net income for the quarter came in at $379.2 million. This is 13.7% higher than the $333.6 million the company generated in the first quarter of 2021. On top of benefiting from rising sales, the company also saw its selling, general, and administrative costs decrease from 30.2% of revenue to 29.8%. Although this may not seem like a lot, when applied to the company’s revenue, this would translate to an extra $4.8 million in profitability.

Other profitability metrics for the company also came in strong. Operating cash flow did admittedly decline year over year, dropping from $385.6 million to $364.3 million. But if we adjust for changes in working capital, the metric actually would have risen from $456.5 million to $503.5 million. And over that same window of time, we also saw EBITDA improve, climbing from $498.6 million to $539.7 million.

Although the state of the economy is dubious right now, and likely to worsen, management is optimistic about what the future holds. When the firm reported financial results covering the latest quarter, they forecasted that revenue would climb by between 7% and 8% compared to the $4.61 billion in sales reported in all of 2022. At the midpoint, that would translate to revenue of $4.96 billion. This is in line with what the company anticipated when it reported financial results for the final quarter of its 2022 fiscal year. Earnings per share, meanwhile, are now forecasted to be between 11% and 12% above what they were in 2022. This compares to the 9% to 10% range management was forecasting previously. At the midpoint, and assuming the company’s share count does not change moving forward, this should translate to net income of $1.55 billion. When it comes to EBITDA, the current forecast is for a margin of roughly 44%. That should translate to a reading of $2.18 billion. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, then we should anticipate a reading of $1.99 billion for the year.

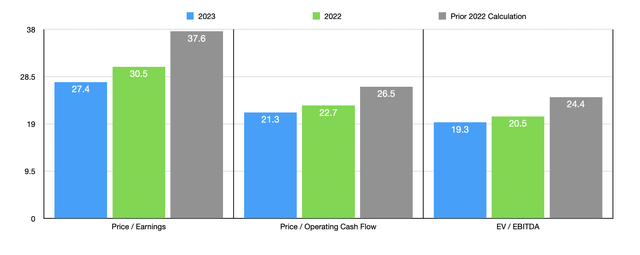

Given these figures, we can calculate that the company is trading at a forward price-to-earnings multiple of 27.4. The price to adjusted operating cash flow multiple should be 21.3, while the EV to EBITDA multiple of the company should come in at 19.3. If, instead, we were to use the data from the 2022 fiscal year, these multiples would be higher at 30.5, 22.7, and 20.5, respectively. And as the chart above illustrates, pricing for the company for the 2022 fiscal year is considerably lower than what it was forecasted to be when I last wrote about the enterprise. As part of my analysis, I also compared Paychex to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 31.2 to a high of 614.8. Our prospect was the cheapest of the group irrespective of whether we used the 2022 data or the 2023 projected figures. Using the price to operating cash flow approach, the range was between 11 and 43.1. And when it comes to the EV to EBITDA approach, the range was between 11.8 and 254.8. In both of these scenarios, three of the five companies were cheaper than Paychex.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Paychex | 30.5 | 22.7 | 20.5 |

| Global Payments Inc. (GPN) | 614.8 | 11.0 | 17.9 |

| Fidelity National Information Services (FIS) | 56.0 | 9.8 | 11.8 |

| Fiserv (FISV) | 31.2 | 16.6 | 13.5 |

| Block (SQ) | 451.7 | 43.1 | 254.8 |

| Automatic Data Processing (ADP) | 33.1 | 31.5 | 21.9 |

Takeaway

Although the market is concerned because of the economy, Paychex seems to be holding up quite well. It is possible that business could deteriorate if market conditions continue to worsen. But so far, management remains optimistic about the future. I definitely recognize that shares of the enterprise have gotten cheaper. And for investors who are bullish on the firm, now might make for a good time to jump in. Having said that, shares look more or less fairly valued compared to similar businesses and shares are not yet cheap enough on an absolute basis for me to be particularly bullish. So while I do acknowledge that the company is getting closer to the point where it might make sense to buy into, it’s not quite there for me yet. And as such, I’ve decided to retain my ‘hold’ rating on it for now.

Be the first to comment