D-Keine

Co-produced with Treading Softly

Are you seeing a lot of red lately? Your portfolio and the market as a whole seem to be taking it on the chin?

You’re likely not alone.

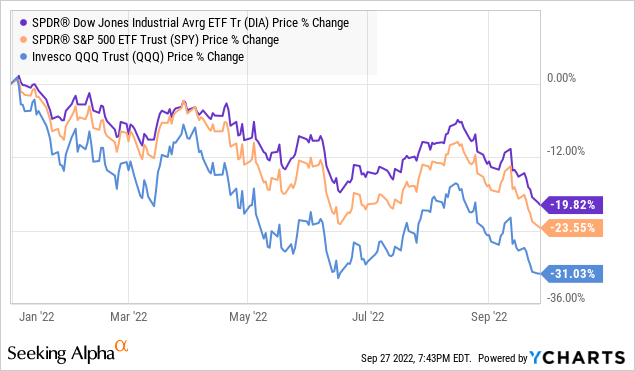

All three major indexes are down double-digits so far this year, and it isn’t looking like we’ll be marching to breakeven before the year ends.

Why?

One buzzword: Recession.

Another buzzword has been helping cause it: Inflation.

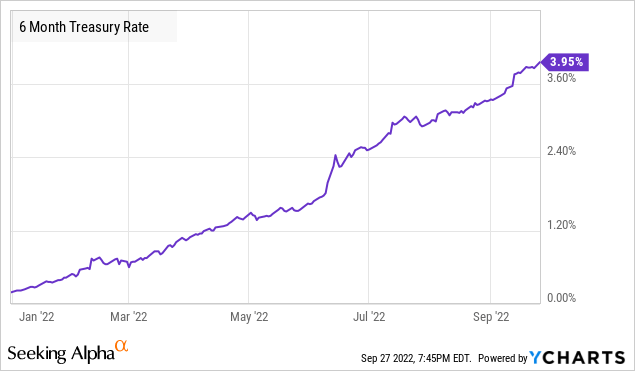

Interestingly, to combat inflation the Federal Reserve is driving the economy rapidly towards a recession as the solution. They’ve been highlighting that to combat inflation, interest rates will need to be higher for longer – raising rates and keeping them elevated until high inflation levels quell to a 2% run rate.

This means that the “easy money” period we’ve spent decades basking in has come to a sudden close on the back of massive government stimulus spending and complete disregard for the cost of debt – which has long been hallmarks of multiple past administrations.

Those in power spend. Those not in power cry out about spending.

So with higher rates, we’ve seen a reset in many fixed income investments as what is deemed high-yield vs. mid- or even low-yield investments.

The Ongoing Great Reset

As Treasury rates climb, other debt adjusts accordingly

Investors are constantly forced to evaluate a basic equation. If I can get 3.8% yields risk-free, why would I own a 4% yielding bond or fixed income investment?

The answer? Most would not.

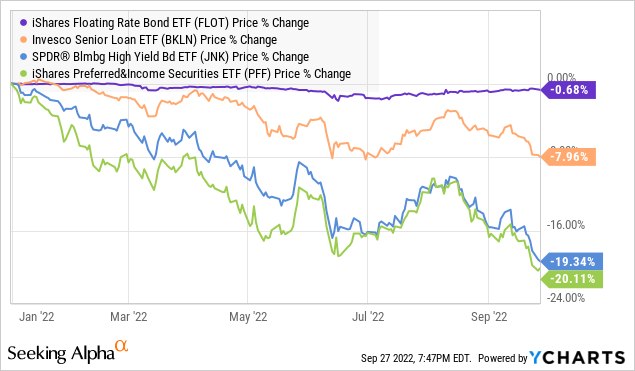

So we are seeing low-rate preferreds sell off heavily all over the market. Investors who once believed their investments were “low-risk” and “safe” are being shell-shocked by the constant bomb drops of higher rates hitting their precious investments.

These are the same investors who make an often repeated mistake: they sell in fear instead of holding. This has led to large sell-offs in otherwise “reliable” investments.

Using well-known proxies for preferreds (PFF) and high-yield fixed-rate bonds (JNK), we can see that as rates have risen, they have sold off similar to the market in general.

Unlike common equity, fixed income has two major factors to compete with – inflation and interest rates. High inflation means that one’s returns on a stable interest rate investment must be adjusted downward for inflation. In an environment with 5%+ inflation, you need a higher return than you do in an environment where inflation is below 2%.

Meanwhile, future rate increases mean a fixed-rate bond or preferred has a less attractive yield relative to Treasuries and floating rate debt. To achieve a yield that is viewed as favorable for new buyers, sellers have to sell at a discounted price to exit their position – driving trading values downward.

Interestingly, floating-rate bonds (FLOT) and senior bank loans (BKLN) – the building blocks of CLOs – have withstood much more effectively. Why? Their rates move with the rising tide. So when the Fed hikes rates, their coupon rises with it. This makes them much more attractive than fixed-rate investments and less prone to the needed discount pricing issues we discussed above.

Fixed-income investments are not alone in these headwinds. REITs and other bond proxies are facing pricing pressure as well. The Vanguard Real Estate ETF (VNQ) is down 31% YTD alone, beating only the Nasdaq for its performance.

So holders of fixed income currently have a few options:

- Sell their holdings and sit on cash

- Continue to hold their positions for the locked-in returns they liked originally

- Optimize their portfolio of holdings via trading

- Add to their portfolio at the new higher yields offered

The Sell-Off is Overdone But Ongoing

While the market is selling off preferreds and other fixed income heavily, it will not continue to do so for long.

Why do we think so? The future economic outlook is getting starker as rates rise. The headwinds of inflation and rate hikes is weakening as investors are going to move from riskier holdings to safe havens for their recession resilience. With each rate increase, the outlook for a recession rises.

So we are active buyers while others are exiting their positions. During the COVID-19 sell-off, High Dividend Opportunities members were locking in higher than normal yields on low-risk investments due to market pessimism, only to see investors flock back to those same investments and drive their share prices higher.

When a recession comes knocking, rates will begin to be cut again. When this occurs, investors looking to lock in attractive income will buy what you should already be holding.

Consider that many great preferreds are trading hands in the mid-teens – like Bank OZK Series A 4.625% non-Cumulative Perpetual Preferred Stock (OZKAP) trading under $18 for a forward yield of 6.7% with $7+ of upside to reach its call value of $25, while AT&T Inc. Series A 5.00% Depositary Shares Perpetual Preferred Stock (T.PA) trades around $20 for a forward yield of 6.3% and $5 per share of upside to reach its call value. We can see the new “floor” rate for lower-risk preferreds has reached the 6% level.

We can spot-check this assumption with other low-risk preferreds:

| Ticker | FWD Yield |

| BAC-L | 6.1% |

| C-K | 6.7% |

| WFC-Q | 6.5% |

Investors can buy exceptionally low-risk investments and lock in excellent yields that were previously unavailable. By dollar cost averaging, they can potentially increase their yields over time as rates reach their terminal level and before other investors clamor in for income from safer sources.

Conclusion

The time to buy heavily into fixed income has arrived. While we may see better prices in the future, by dollar cost averaging and accepting excellent yields offered presently, we can see long-term income without cranking up the risk level of our portfolio.

For our High Dividend Opportunities Model Portfolio, we like to see our lowest yields be in the 6% range, this means as yields have climbed across the market, we have a wider range of outstanding income sources to scoop up. History has proven that yields will drop again as the economy falters under the weight of high-interest rates. We want to take the opportunities presented to us to hold outstanding income producers at decades-high yields, so when their yields do drop again, we will still be enjoying the fruits of our choices now.

That sounds like an excellent retirement to me. That’s the benefit of being an income investor and always having money pouring in to reinvest into the market. No need to sell anything to capitalize on new opportunities. Your old ones are paying you what you need to get new ones into your portfolio.

Be the first to comment