bugphai

Emerging markets (EM) hard-currency bonds could remain volatile given the challenging global macroeconomic backdrop, but we see pockets of opportunities. In particular, metal exporters in the frontier markets may be underappreciated.

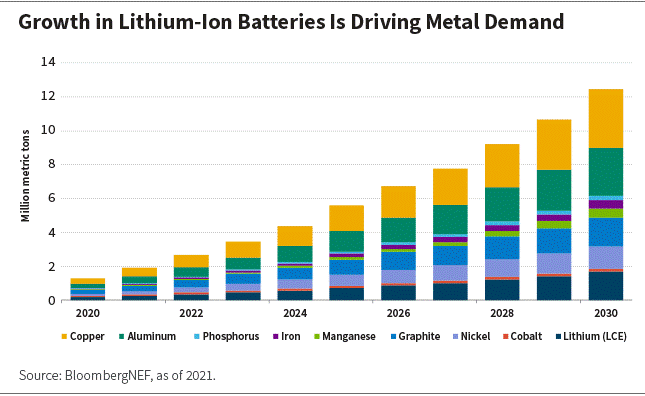

That’s because regulation and consumer preferences are creating demand for clean transportation, and we believe this demand will drive strong growth in what we call the commodities of the future: copper, aluminum, nickel, cobalt, and lithium. This could bolster the outlook for commodity exporters, and could also improve the prospects for markets with burgeoning mining investments.

Other raw materials used in the lithium-ion batteries that are critical to electric vehicles – manganese and graphite – could also see strong demand growth.

Governments Bid to Increase Public Sector Rent from Mining Industry

In terms of regulation, commodity-rich emerging and frontier markets have adopted an array of policy measures in a bid to boost the public sector rent from mining activities in their countries. This has included changes in tax regimes and the imposition of export bans on unprocessed ores.

In recent years, proposals to increase taxes were considered in Peru, Chile, and Zambia. Some of these plans could put marginal mines at risk while discouraging investment in new mines. With the resurgence of populist and left-leaning politics in Latin America, we believe there is a risk of natural resources being targeted opportunistically.

In Chile, for example, proposals under consideration in the senate and the constitutional review process are likely to present challenges to the development of the mining sector as well as existing investment. And in Peru, the Castillo administration is looking for ways to maximize the government’s rent from the mining sector in a way that risks private investment in the sector.

In our view, a healthy tax regime gives governments the opportunity to increase revenues from the mining sector as mineral prices rise but also protects investors’ return on investment. This can include features such as a variable/progressive mineral royalty tax that is deductible from the corporation income tax calculation. Countries such as Liberia have adopted even more innovative taxes, which are imposed once a rate of return exceeds a set threshold.

How Strong Is Demand?

Just how strong is demand potential? BloombergNEF believes total metal demand from lithium-ion batteries will reach 13.5 million metric tons by 2030. This implies that overall cobalt demand from the lithium-ion industry will grow 1.5 times between 2021 and 2030. Over the same time, demand for nickel is expected to be five times its 2021 level, and demand for both copper and aluminum is expected to be six times the 2021 level, according to BloombergNEF. The chart below illustrates.

This growing demand could present an enormous opportunity for EMs – frontier markets in particular.

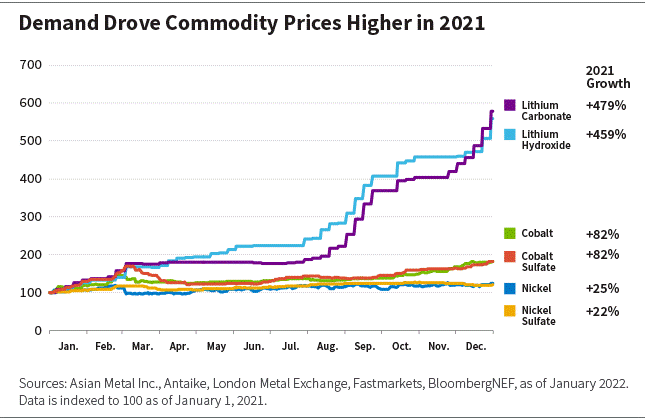

Strong demand for commodities of the future contributed to higher prices for these metals in 2021, and this demand strength has continued thus far in 2022. For example, nickel prices rose by 18% in the first two months of 2022 alone, reaching close to $25,000 per metric ton. And copper prices are now close to $10,000 per metric ton, their highest level since 2011. The chart below illustrates.

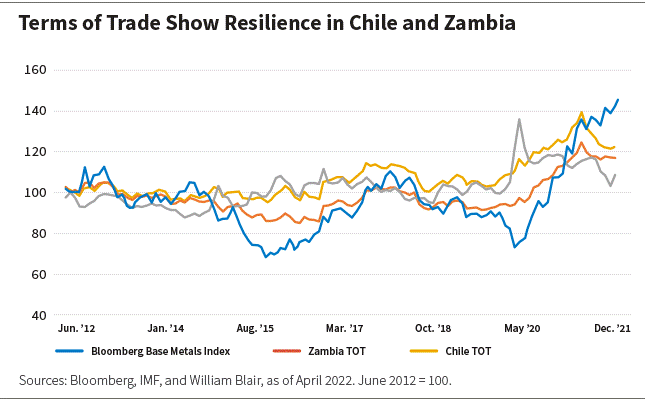

Rising prices, in turn, have supported terms of trade in emerging and frontier markets, improving foreign exchange for many countries in early 2022. The currencies of established copper exporters such as Zambia and Chile, for instance, showed resilience against a backdrop of tightening financial conditions and higher import prices – oil in particular. The chart below illustrates.

In subsequent blog posts, we’ll go into more detail about the contribution of emerging and frontier markets to global trade in clean energy metals, and discuss where we see pockets of opportunity.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment