Piotrekswat

Genworth Financial (NYSE:GNW) is a company that again provides an incredible margin of safety. It is an insurer of both mortgages and provides long-term care and life insurance policies. The company trades at a highly compressed valuation, and it is because its long-term care insurance business issued policies at very uneconomical rates for many years, which has created a substantial policy liability for the company. While it is true that this business isn’t great, with clear anchors of value for the other parts of the business including the mortgage insurance business which has gone through a minority IPO (trading also as Enact Holdings (ACT) on the NASDAQ) and the substantial non-operating loss tax assets on the books, we see that on a sum-of-the-parts basis the health and life insurance part of Genworth’s business has been given a negative value. Since investments still cover liabilities for the life and health insurance business, and we know this from being able to deconsolidate the separately trading Enact Holdings from the books, that negative value makes no sense. This is essentially a no-brainer buy.

Sum of the Parts

The Genworth Financial thesis is ultimately a sum-of-the-parts logic that can be easily followed. There are three elements to the business. The mortgage insurance business, which went through a minority IPO meaning Genworth still owns 81% of the shares (and therefore their results are still consolidated into Genworth’s), the tax assets that arise from a tax sharing agreement among the constituent subsidiaries of Genworth’s business and can now be realized thanks to their profitability, and finally the wart on the company’s face which is the life and health insurance business.

Life Insurance Segment

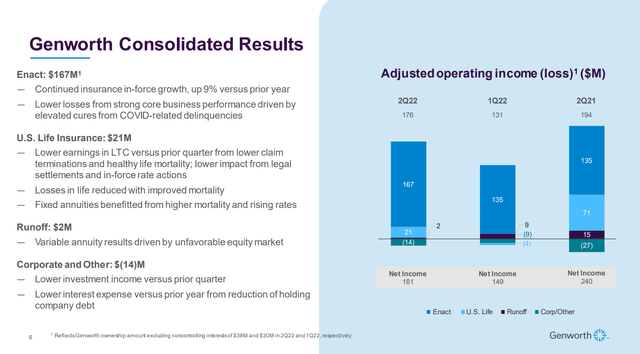

The life insurance segment as a whole isn’t such a problem, the issue is the long-term care business. It is currently very profitable, but this is very temporary.

As the years come, its covered groups are going to be exactly the age in which they will be making claims for the benefits insured by Genworth for their long-term care. As the name suggests, these benefits will be paid out for a while, and this nearing obligation is bloating the ‘future policy and benefits’ line in the balance sheet.

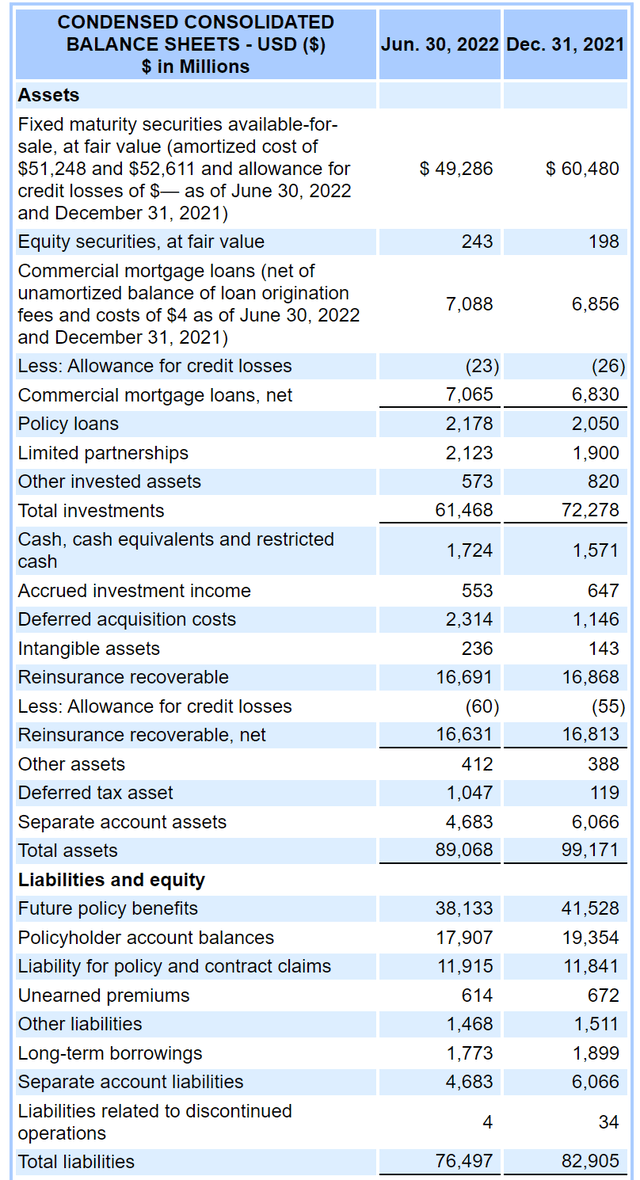

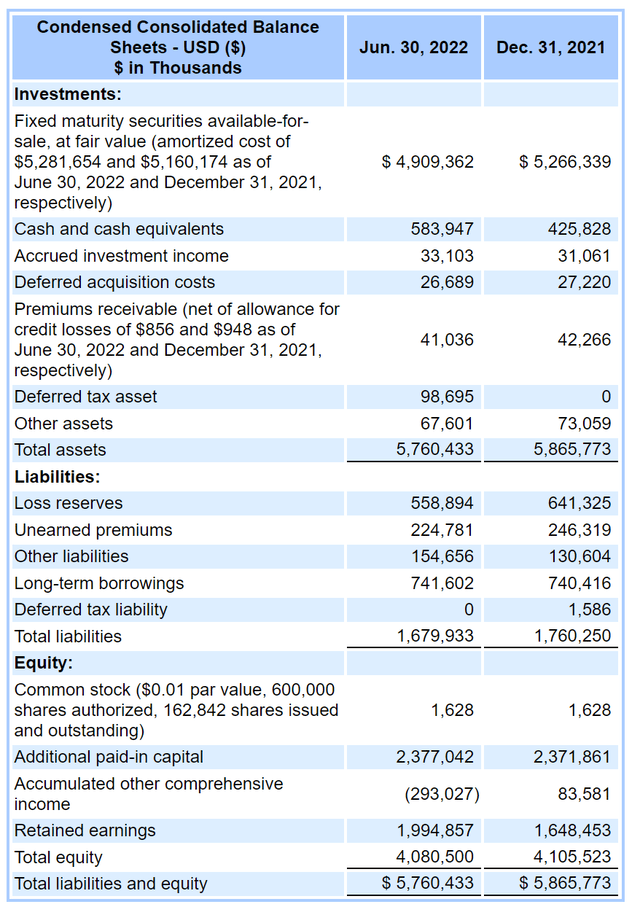

Q2 Balance Sheet GNW (sec.gov)

For some FIG review, that line in the balance sheet is the difference between the NPV of the benefits to be paid out according to company models, using things like morbidity and mortality assumptions and the ages of the insured pool, and the NPV of the net premiums which just means the part of annual premiums meant to cover claims, and are not for creating incremental economic return. Naturally, the aim of the insurance company is to gain premiums in excess of this net figure, as that is where the economic earnings come from.

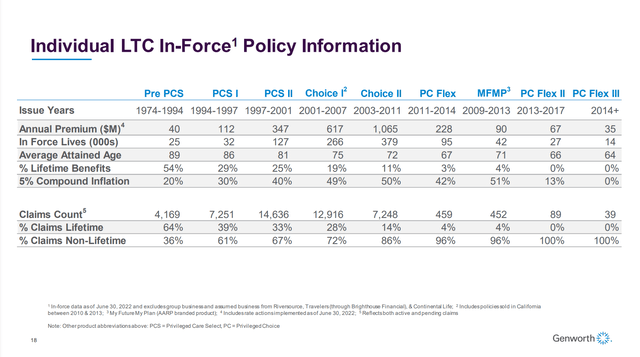

As you can see from the more granular data provided by GNW regarding the LTC segment, the bulge in their covered groups is just now beginning to see incremental benefit from their coverage and are still quite young. It’ll be a decade before the herd begins to meaningfully thin on account of regular age-related mortality. Pain is coming for this segment.

LTC Policyholders (Q2 2022 GNW Pres)

How could this have happened? Essentially actuarial failure meant they mispriced these policies. Because it puts this obligation pressure on GNW, the company has been able to work with state regulators to change run-rate premiums from these policies in order to better shore up the GNW position. Because it is actuarially justified and is basically the correction of a ‘mistake’, they have been able to implement about $20 billion worth of rate changes on a discounted basis, and there are probably more coming although the process is onerous and multi-lateral. The regulators benefit from improving an insurer’s solvency, and the mistakes were actuarial and shouldn’t have happened in the first place. While customers suffer with premium hikes, they were benefiting from sub-market premiums for years.

But it’s not so important that further rate changes work out, because while the policies are still technically running uneconomically, the margin of diseconomy is already smaller than what you’d need to justify a negative value for this business segment, and you’ll see in a moment why when we discuss Enact.

Enact Holdings

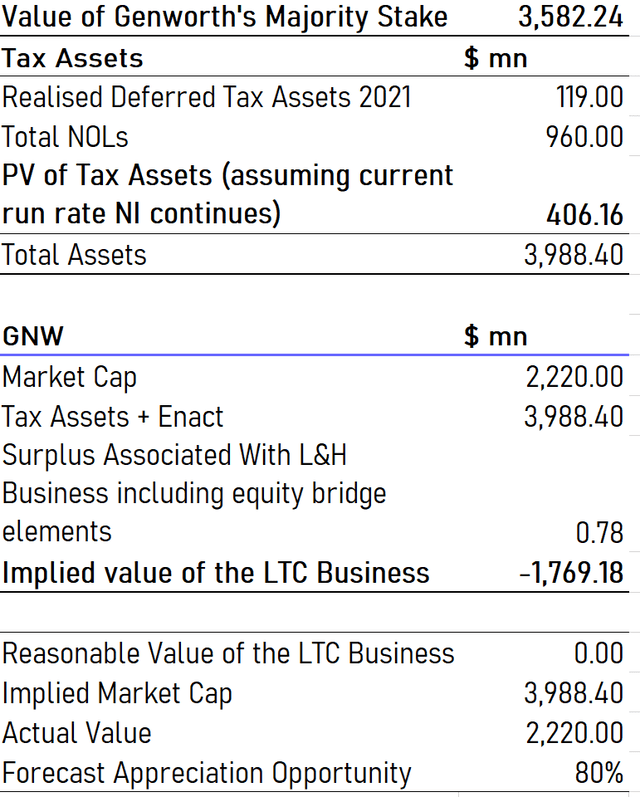

Enact is the second pillar of the thesis. It went through a minority IPO where GNW still owns 81% of the company, but the market has valued it at $4.39 billion. Therefore GNW’s stake is already $3.5 billion. GNW’s stock is worth $2.22 billion, so you can probably already see where this is going when we do the SotP later.

But first, very briefly on their business. ACT insured mortgages and its market is that in order for banks to sell-off originated mortgages to GSEs, to free up capital for further lending, risk requirements need to be met. Where a mortgage might be too risky on a vanilla basis for GSEs to buy, a company like Genworth or Essent (ESNT) will insure just enough of the mortgage in order for the mortgage to qualify for sale off banks’ balance sheets. Mortgages are too risky when essentially the LTV ratios are too high, usually because of low down-payment. With Millennials being the next generation of homebuyers, and with the secular trends for housing in the US being rather good, more of these mortgages are going to be needed to house the next generation of newly forming families. It’s not a bad business, and WFH is another tailwind that is requiring more square footage per household, stealing area from offices and requiring larger total mortgages.

In any case, because Enact is fully consolidated as per consolidation accounting, we can look at its balance sheet and deconsolidate it from Genworth’s to get an idea of what the balance sheet looks like for the residual L&H business so get an idea of how problematic its balance sheet actually is.

Enact has about $5.5 billion in assets to cover essentially $1.2 billion in current claims associated with mortgage defaults. While rate increases could mean more defaults, nothing is signaling higher default rates yet, so the net coverage of claims is about $4.3 billion from Enact.

Going back to the GNW balance sheet, they have about $80 billion in investments and reinsurance of liabilities to cover about $75 billion in gross claims. Subtracting the assets from Enact of $4.3 billion puts them at actually a small surplus of $780 million. The claims here are coming from both future policy obligations, current reserves, long-term borrowings and also separate accounts liabilities and policyholder account balances (accounts held by essentially investors in GNW annuity and other cash generating securitised products, because remember fees and commissions earned on those sorts of things are a traditional way for insurance companies to make money without creating claim liabilities, the risk of those products are on the owners).

That surplus can easily be increased by new rate action or just new properly priced business in L&H or elsewhere that can be built over the next several years without too much urgent pressure creating incremental spread between NPV of premiums and claims. They’ll have time to improve their book as claims will come out relatively gradually (although they’ll necessarily speed up as older people start claiming for LTC). The fact that the assets cover the liabilities even if only slightly is a great start for the SotP and for the operational margin of safety for the company.

Tax Assets

We already see that Enact Holdings’ shares that GNW owns are more than GNW’s market cap by quite a lot. But there’s more: substantial NOLs that are tax assets for the company. These come from some tax sharing agreements between company subsidiaries, but ultimately they’re on the balance sheet in black and white and are of serious value to the business. In 2021 they realized $119 million in NOLs to offset taxes. There are $960 million in NOL assets of the latest balance sheet date. While that book value is a decent way to value them, let’s consider discounting effects because those NOLs only come into action as profits are realized. Assuming around $80 million in realized assets (lower than the current $119 million on the basis of some headwinds from the poorly priced LTC policies) create cash flow for the next 5 years, we get a $406 million value when discounting at a pretty reasonable 7% rate. Discount rates are bit arbitrary, but this assumes CAPM assumptions for cost of equity.

SotP

Now we can build the SotP valuation.

Valuation (VTS)

Because we used long-term borrowings, cash and other liabilities and assets in the surplus calculation for the LTC business standalone, after deconsolidating Enact’s balance sheet, we have all we need for the valuation treating Enact like a non-operating asset, and of course paying attention to tax assets. The market implies a negative value for the L&H business which includes substantially the LTC business. Just giving that business a 0 valuation rather than a very negative one means a lot of upside.

Again, while the L&H business didn’t charge enough for an economic return in its LTC policies, it’s not enough to drive the company under. With more potential rate actions on the way, the economic value of that business, represented for now by our surplus figure which came from netting assets that are supposed to cover claims and obligations on the balance sheet, can only grow. They will not make the actuarial mistakes of the past again. Enact clearly has value, as do the tax assets. The L&H business shouldn’t have a less than 0 value, with 0 already being pessimistic.

Risks and Conclusions

The margin of safety is clearly there as seen in the SotP, but also in a 3x PE ratio. GNW is likely to be the most undervalued mortgage/L&H insurer, if not the most undervalued insurer on the US market.

But there are risks…

While the valuation case is clearly there, and would excuse any issues facing the markets broadly, sentiment can still hurt IRRs if markets decide that certain verticals are un-investable. The development in the L&H business should actually be under clearer skies, even if traditionally beleaguered, than the mortgage insurance business, just because sentiment around housing can affect mortgage insurers. Loan growth is still alright as per the latest reports during the rate hiking environment. That should suggest that mortgages are still growing. However, housing sales are slowing as sellers pull-back listings waiting for better conditions and buyers wait for lower prices and rates. Then again, rents are growing regardless, signaling a significant housing shortage that will only get worse with late family formation among Millennials, which is about to really kick in, WFH requiring office space at home in plenty industries, and steady demographic growth in US markets. The risk of a housing crisis like in 2008, where leverage in the system causes massive defaults, seems unlikely given regulatory developments since then. The housing fundamentals are actually pretty good even if rising rates do affect velocities by a fair amount.

The other risk is rising reserves in mortgage insurance causes declines in income and a lessened ability to realize tax assets. Otherwise, lower issued policy volumes could weigh on income. That wouldn’t be great, but the tax assets aren’t responsible for all the upside, and Enact will have some value to keep a decent amount of upside there even if its stock sees concurrent declines.

Housing sentiment could weigh on GNW’s performance in terms of price, and the capacity for price discovery, but the valuation is still difficult to argue with. Because of regulation of dividends among insurance companies, you’d not be able to rely on that for a payout, but the earnings yields are there and the margin of safety is clear and defensible according to valuation logic for insurance companies. I’d feel relatively safe in this stock in terms of markets, and the valuation is a no-brainer. This is a very rare and high conviction buy, especially for the US market which is so well parsed.

Be the first to comment