kmatija/E+ via Getty Images

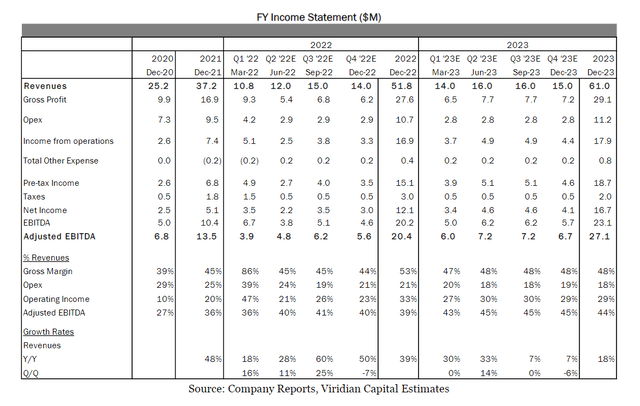

Vext Science Inc. (OTCQX:VEXTF) (VEXT) reported Q1/22 earnings results of $10.8M in revenues and $3.9M in adjusted EBITDA. Results were modestly above our estimates of $10M/$3.8M and reflected strong profitability for the company despite continued inflationary pressures on consumer spending and Arizona wholesale pricing pressure. As in Q4, VEXT was one of few Arizona operators to not be significantly impacted by macro headwinds in Q1 and we believe results can be attributed to the solid execution capabilities of management and the positioning of VEXT’s Vapen brand amongst customers. Moving forward, we expect further strong results and for the Vapen brand to gain additional share as a top value play for consumers and the benefit of capacity expansion initiatives completed in Arizona during Q1/22. We are confident that growth and share gains, coupled with the launch of operations in Ohio in the coming months will drive enhanced awareness amongst investors and peers for VEXT with the latter eventually bringing a takeout for the company by a larger operator looking for a trusted partner to scale with that brings a proven track record of brand development, cash generation and leading profitability while still being valued at a meaningful discount. We also believe VEXT’s management team could become the target to lead a consolidated entity post a takeout which would provide an additional motivation for M&A.Our estimates are unchanged for now with our Q2/22 estimates reflecting a modest sequential revenue and adjusted EBITDA uptick on seasonality while we continue to expect a stronger second half inclusive of greater cultivation capacity access and an expanded retail presence. Any Ohio contributions, which are likely in Q4, remain incremental to our forecasts until we have greater clarity on the scope and scale of operations. With that said, we continue to expect Ohio contributions to be meaningful particularly if VEXT can eventually convert its JV in the state into a fully owned operation.Our price target remains $0.83. Our price target reflects an EV/EBITDA multiple of 7.3x our ‘22 estimate and 5.2x 2023 so still well below the current multiples of the broader peer group respectively.

Company Reports, Viridian Capital Estimates

Required Research Disclosures

|

Distribution of Ratings/IB Services |

||||

|

IB Services in Past 12 months |

||||

|

Rating |

Count |

Percent |

Count |

Percent |

|

Buy (Buy) |

15 |

100% |

0 |

0% |

|

Hold (Hold) |

0 |

0% |

0 |

0% |

|

Sell (Sell) |

0 |

0% |

0 |

0% |

|

Not Rated (NR) |

0 |

0% |

0 |

0% |

Analyst Certification

The research analyst responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to Bradley Woods & Co. Ltd.; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in this report.

Meaning of Ratings

Bradley Woods & Co. Ltd.’s rating system of Buy, Hold, Sell, Not Rated reflects the analyst’s best judgment of risk-adjusted assessment of a security’s 24-month performance.

Buy: A Buy recommendation is assigned to stocks with low risk and approximately 10% expected return or stocks with high risk and approximately 25% expected return. The analyst recommends investors add to their position.

Hold: A Hold recommendation is assigned to stocks with low risk and less than 10% upside or less than 15% downside or to stock with high risk and less than 25% upside or less than 15% downside.

Sell: A Sell recommendation is assigned to stocks with an expected negative return of approximately 15%. The analyst recommends investors reduce their position.

Not Rated: A Not Rated recommendation makes no specific Buy, Hold or Sell recommendation.

Compensation or Securities Ownership

The analyst(s) responsible for covering the securities in this report receives compensation based upon, among other factors, the overall profitability of Bradley Woods & Co. Ltd. including profits derived from investment banking revenue and securities trading and market making revenue. Unless noted in the Company Specific Disclosuressection above, the analyst(s) that prepared the research report did not receive any compensation from the Company or any other companies mentioned in this report in the previous 12 months, or in connection with the preparation of this report. Unless noted in the Company Specific Disclosuressection above, neither the analyst(s) responsible for covering the securities in this report, nor members of the analyst(s’) household, has a financial interest in the Company, but in the future may from time to time engage in transactions with respect to the Company or other companies mentioned in the report.

For compendium reports (a research report covering six or more subject companies) please see the latest published research to view company-specific disclosures.

Other Important Disclosures

This report is provided for informational purposes only. It is not to be construed as an offer to buy or sell a solicitation of an offer to buy or sell any financial instruments or to a particular trading strategy in any jurisdiction. The information and opinions in this report were prepared by registered employees of Bradley Woods & Co. Ltd. The information herein is believed by Bradley Woods & Co. Ltd. to be reliable and has been obtained from public sources believed to be reliable, but Bradley Woods & Co. Ltd. makes no representation as to the accuracy or completeness of such information.

Bradley Woods & Co. Ltd. is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers.

Opinions, estimates, and projections in this report constitute the current judgment of the author as of the date of this report. They do not necessarily reflect the opinions of Bradley Woods & Co. Ltd. and are subject to change without notice. In addition, opinions, estimates, and projections in this report may differ from or be contrary to those expressed by other business areas or group of Bradley Woods & Co. Ltd. and its affiliates. Bradley Woods & Co. Ltd. has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Bradley Woods & Co. Ltd. does not provide individually tailored investment advice in research reports. This report has been prepared without regard to the particular investments and circumstances of the recipient. The securities discussed in this report may not suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Estimates of future performance are based on assumptions that may not be realized. Furthermore, past performance is not necessarily indicative of future performance. Investment involves risk. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Bradley Woods & Co. Ltd. salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Bradley Woods & Co. Ltd. may seek to offer investment banking services to all companies under research coverage. Bradley Woods & Co. Ltd. and/or its affiliates expect to receive or intend to seek investment-banking related compensation from the company or companies mentioned in this report within the next three months.

This research report (the “Report”) is investment research, which has been prepared on an independent basis by Bradley

Woods & Co. Ltd., a member of FINRA and SIPC, with offices at 805 Third Avenue, 18th Floor, New York, NY USA, 10022. Electronic research is simultaneously available to all clients. This research report is provided to Bradley Woods & Co. Ltd. clients and may not be redistributed, retransmitted, disclosed, copied, photocopied, or duplicated, in whole or in part, or in any form or manner, without the express written consent of Bradley Woods & Co. Ltd. Receipt and review of this research report constituted your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion or information contained in this report (including any investment recommendations, estimates, or target prices) without first obtaining express permission from Bradley Woods & Co. Ltd. In the event that this research report is sent to you by a party other than Bradley Woods & Co. Ltd., please note that the contents may have been altered from the original, or comments may have been added, which may not be the opinions of Bradley Woods & Co. Ltd. In such case, neither Bradley Woods & Co. Ltd., nor its affiliates or associated persons, are responsible for the altered research report.

This report and any recommendation contained herein speak only as of the date of this report and are subject to change without notice. Bradley Woods & Co. Ltd. and its affiliated companies and employees shall have no obligation to update or amend any information or opinion contained in this report, and the frequency of subsequent reports, if any, remain in the discretion of the author and Bradley Woods & Co. Ltd.

Bradley Woods & Co. Ltd. may effect transactions in the securities of companies discussed in this research report on a riskless principal or agency basis. Bradley Woods & Co. Ltd.’s affiliated entities may, at any time, hold a trading position (long or short) in the securities of the companies discussed in this report. Bradley Woods & Co. Ltd. and its affiliates may engage in such trading in a manner inconsistent with this research report. All intellectual property rights in the research report belong to Bradley Woods & Co. Ltd. Any and all matters related to this research report shall be governed by and construed in accordance with the laws of the State of New York.

This report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject Bradley Woods & Co. Ltd. and its affiliates to any registration or licensing requirements within such jurisdictions.

The Bradley Woods Form CRS, Client Relationship Summary, can be accessed here.

Be the first to comment