Sundry Photography/iStock Editorial via Getty Images

We should all be hunting for value-oriented growth stocks. Right now, the market is very ambivalent about its direction. Some weeks we see sharp corrections downward, only to be reversed by a monster relief rally in the next. But throughout both the up and down cycles, we want to make sure we are eventually positioned for a rebound – and the best way to do so is by buying high-quality stocks that have plenty of room, valuation-wise, to rise.

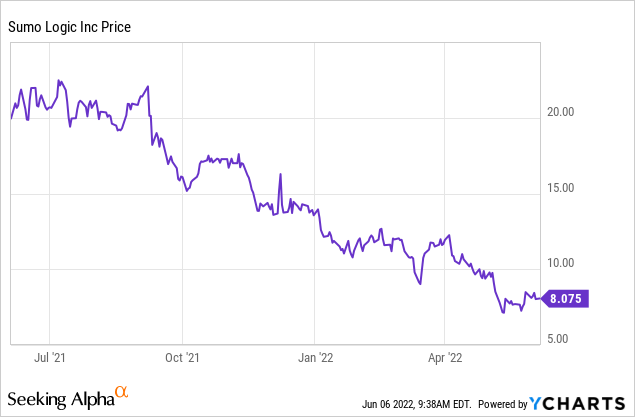

Sumo Logic (NASDAQ:SUMO) is a perfect example of this. A big data stock that was popular upon its IPO during the pandemic, Sumo Logic has now lost more than 40% of its value year to date, and nearly 80% of its value relative to its early 2021 peaks near $40. And yes, while part of the value crunch relates to Sumo Logic’s own growth deceleration, the large majority of the reason why Sumo Logic crashed has nothing to do with fundamentals and all to do with sentiment. There was once a time every investor was chasing the bandwagon stocks in the AI, big data, and cloud themes (I could go on and list more catchphrases). Now, investors are dumping tech, and news headlines about tech fund mogul Cathie Wood have gone from heaping praise to hurling insults.

But when we peel back all the short-term noise of the past few months, I still find Sumo Logic to be a high-quality company with top-notch customers and a very attractive recurring-revenue product. It’s a great time, in my view, for investors to re-assess the bullish thesis here, especially after a strong Q1 earnings print.

At $8, and after seeing revenue growth accelerate in Q1 with bullish remarks for the rest of the year, I am upgrading my viewpoint on Sumo Logic to very bullish. There’s a huge opportunity here to buy this one-time high flyer while it’s very much a diamond in the rough.

For investors who are slightly newer to Sumo Logic, what the company provides is a machine data analytics platform. Its software helps companies log and make sense of the data already generated by its internal systems. One of the closest publicly-traded competitors to Sumo Logic is Splunk (SPLK). This technology has a wide variety of uses, from security to analytics. Here’s a full recap of all the reasons, in my view, to be bullish on Sumo Logic:

- Big data has limitless use cases across industries and functions. Think about it in these terms: Sumo Logic is not a product but a platform. It’s a tool by which you can do many things. As more and more companies attempt to harness the value of big data, use cases will explode – and though Sumo Logic is in a competitive space with high-profile competitors, this is a large enough market for multiple key players. Sumo Logic estimates its TAM at a hefty $55 billion, indicating that it’s currently only about ~0.5% penetrated into this overall market.

- Recharged sales leadership. Sumo Logic knows that its growth in 2021 was disappointing to the markets and that it needed a go-to-market overhaul. The fact that the company just brought on a new President to lead its field teams may produce new ideas and new results in 2022.

- Consistency is better than boom and bust. Sumo Logic is far from the most exciting software company these days. There are competitors like Datadog (DDOG) growing much faster (but also, priced much higher). But Sumo Logic has also gotten into a nice cadence of producing ~20% y/y revenue growth, which is on the cusp of what investors would consider to be a growth stock.

- Substantial cash war chest. For a company of Sumo Logic’s relatively small revenue size, the fact that the company has ~$350 million of cash, unencumbered of debt, on its balance sheet is a promising sign that the company can continue to invest in further growth.

- Cheap enough to invite M&A chatter. While I’m of the opinion that we should never bank an investment thesis on the hopes of M&A alone, I think Sumo Logic is exactly the type of declining software company that invites potential buyers’ attention as a small, tuck-in acquisition.

More to the last point: if nothing else, Sumo Logic is cheap. At current share prices just north of $8, Sumo Logic has a market cap of $929 million. After we net off the $359 million of cash on Sumo Logic’s most recent balance sheet, the company’s resulting enterprise value is just $570 million.

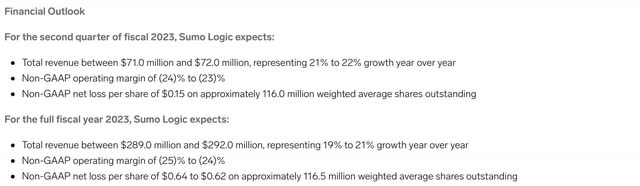

Sumo Logic FY23 outlook (Sumo Logic Q1 earnings release)

Meanwhile, for the current fiscal year FY23 (ending next January 2023), Sumo Logic has guided to a revenue range of $289-$292 million for the year, representing 19-21% y/y growth. Note that this guidance only represents a $1 million bump to the low end of the range, and no change to the high end – despite the fact that Sumo Logic saw growth accelerate in Q1, and beat its internal forecast for the quarter by almost $3 million. In other words, I think the company is being quite conservative in its outlook, which has room for further upside.

Regardless, if we take the guidance at face value, Sumo Logic trades at just 2.0x EV/FY23 revenue – whereas many similarly-growing peers command multiples of at least 4-5x revenue.

The bottom line here: especially at current prices, there is very little reason not to be bullish on Sumo Logic. Take advantage of the huge dislocation between market sentiment and actual company performance to build up or boost a stake in this beaten-down stock.

Q1 download

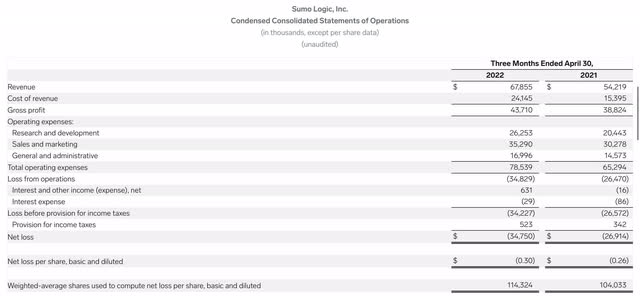

Let’s now dig into Sumo Logic’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Sumo Logic Q1 results (Sumo Logic Q1 earnings release)

Sumo Logic hit $67.9 million of revenue in Q1, growing 25% y/y and outmaneuvering Wall Street’s expectations of $66.1 million (+22% y/y) by a three-point margin. Consensus was also in-line with what Sumo Logic itself had guided to for the quarter, which was $65.5-$66.5 million in revenue. Note as well that Sumo Logic’s growth accelerated versus 24% y/y growth in Q4.

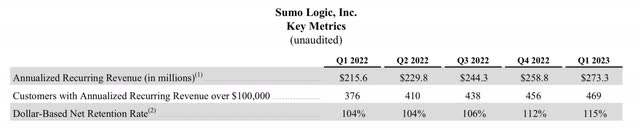

More good news: Sumo Logic’s dollar-based net retention rates also got a boost. As software investors are well aware, net retention rates are a highly watched metric because they represent a profitable source of growth for a company – it’s easier and cheaper to upsell to an existing client than it is to spend sales resources to land a new one. In Q1, dollar-based net retention hit a multi-quarter high of 115%.

Sumo Logic key customer metrics (Sumo Logic Q1 earnings release)

Additionally, Sumo Logic added roughly $15 million of net-new ARR in the quarter to end at $273.3 million, representing healthy 27% y/y growth in ARR. We note as well that Sumo Logic’s current ARR is already at 94% of the company’s annual revenue guidance for the year, further suggesting there could be upside.

Some further anecdotal commentary from CFO Stewart Grierson’s prepared remarks on the Q1 earnings call, detailing the quarter’s top-line strength:

Our Q1 revenue and ARR growth was driven by continued traction with our customers that spend more than 100k a year with us as these customers grew 25% year-over-year. As highlighted by the customer use cases, we shared. We are winning new customers in both the security and observability markets, while also successfully cross selling the benefits of our entire cloud analytics platform as we enable our customers to deliver reliable and secure cloud applications […]

Our dollar base net retention was 115% for the quarter as part of the sales re-segmentation we’ve seen the strongest early traction in the expansion teams combined with a continued improvement in customer retention. Both these factors have contributed to the improvement in retention rate quarter-over-quarter. We believe over time the realignment of our go-to-market team will result in a relatively higher focus on new customer acquisition.“

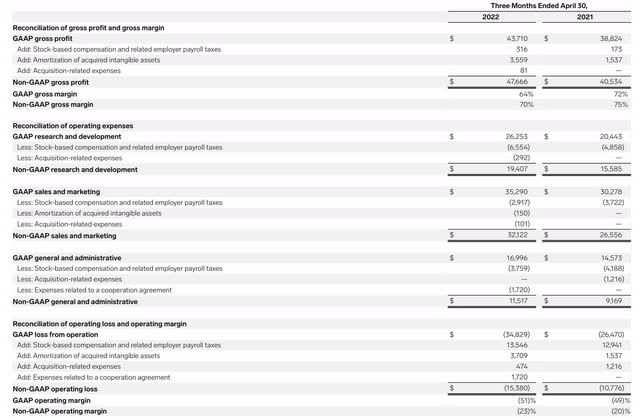

Now admittedly, margin performance left something to be desired in the quarter. Namely, Sumo Logic’s pro forma gross margins pulled back to 70% in the quarter, down five points from 75% in the year-ago quarter:

Sumo Logic margins (Sumo Logic Q1 earnings release)

However, this was due entirely to higher data ingest volumes. As customers use more and more data, they upgrade their subscriptions into higher tiers, which will have a trailing benefit on revenue. The company was able to slightly offset this 5-point hit to gross margins with opex efficiencies, primarily in sales and marketing – so pro forma operating margins were down only three points to -23%, versus -20% in the year-ago Q1.

Key takeaways

There’s a lot to like about Sumo Logic, especially at its ultra-low valuation. Big data and machine analytics is still a nascent space with plenty of room to grow, so I think the future for Sumo Logic is bright – profitability will scale as it continues to grow thanks to its relatively high gross margins, or the company will end up folded into a larger software portfolio as an M&A target. Stay long here.

Be the first to comment