Nordroden

Investment Thesis

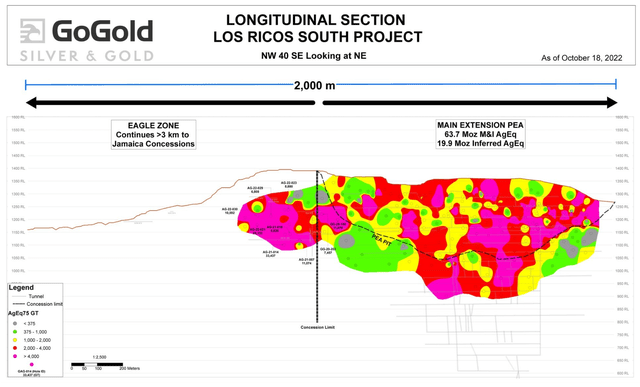

This is an update on GoGold (OTCQX:GLGDF) following the recent drill results at the new Eagle concession, which is a direct extension to the main area in the Los Ricos South PEA. Given the excellent lengths and grades of the mineralization, the Eagle zone will very quickly grow the size of Los Ricos South going forward and also improve the economics of the project.

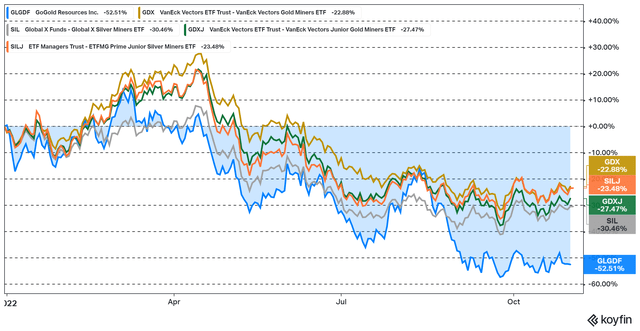

The stock price of GoGold has underperformed many peers and the regular precious metals mining ETFs this year. The GDX exclusion has certainly had an impact together with inflationary fears of development companies. The Mexican government’s less than accommodative stance on mining has probably had some impact as well. However, GoGold has had very good returns in the prior three years, so a correction might be understandable for that reason as well.

Permitting Open Pit Projects in Mexico

Another point I wanted to touch on is the difficulty in getting new open pit projects permitted in Mexico. The environmental ministry SEMARNAT has made comments throughout the year that no new open pit projects will be permitted. However, when pressed on the matter, the government has also commented that it is not a ban and companies need to operate sustainably.

So, it is extremely difficult to get conclusive information on this point, but the fact is that very few open pit projects have been approved in Mexico lately.

The relatively good thing for GoGold and Los Ricos South especially, is that pivoting to an underground project should likely be very manageable given that the high-grade portion accounts for a substantial part of total ounces and capital costs would likely decrease in an underground scenario. A pivot to underground mining will likely decrease the NPV somewhat, but the excellent Eagle zone drill results should more than offset any decrease in the NPV though.

Los Ricos North has a few areas which might not be amenable to underground mining. So, that project would likely see more of a decrease in the NPV if there was a pivot to underground mining there. However, given that GoGold is looking to move forward with Los Ricos South initially, the rules might change by the time Los Ricos North is in a permitting stage.

Eagle Zone

Over the last few weeks, GoGold has announced the acquisition of the Eagle concession for $2.1M to be paid over four years and started releasing drill results, which have been really good. The Eagle zone is directly adjacent to the main resource used in the Los Ricos South PEA.

Figure 2 – Source: GoGold Press Release

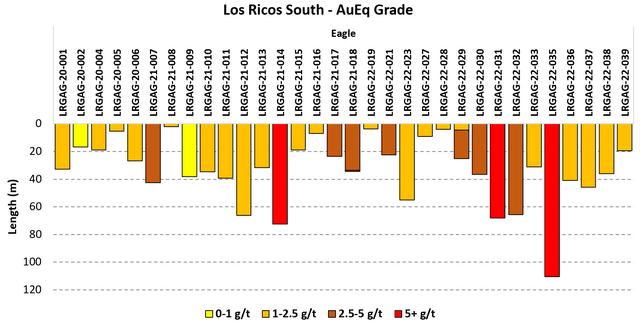

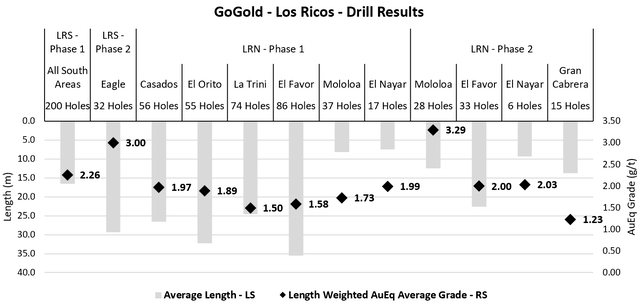

The grades and lengths of the drill results are excellent compared to both the rest of Los Ricos South and the better areas of Los Ricos North.

GoGold will be adding ounces very quickly if this continues. Very roughly calculated, Eagle could already be 40% the size of the initial resource at Los Ricos South, in ounces. That is why the company will be putting most of the focus on this area going forward.

Figure 3 – Source: Press Release Data Figure 4 – Source: My Calculations

Valuation & Conclusion

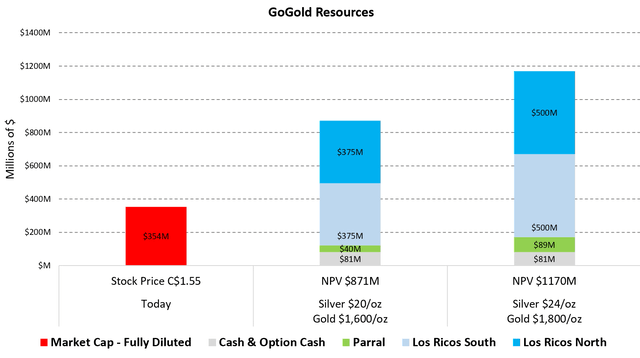

Considering the recent drill results at the Eagle zone, which is not just a handful of drill holes, but 32 drill holes, I have increased my valuation of Los Ricos South by 25% compared to the numbers in the PEA. It can certainly be much more than that if these grades continue for a while, but this revision also assumes some value is lost with a pivot toward underground bulk mining. That will need to be confirmed in a PFS, expected in Q2-2023.

I have on the other hand revised the value of Los Ricos North down to 125% of the PEA value of Los Ricos South, down from 175% be on the conservative side for open pit projects. Note that his might turn out to be a non-issue once Los Ricos North is ready for permitting.

Figure 5 – Source: My Estimates

GoGold is in my view a very good risk-reward at this level, following the poor stock price performance in the first three quarters of 2022. The ongoing drilling at the Eagle zone has the potential to provide the stock with some much needed momentum as well.

Be the first to comment