krblokhin/iStock Editorial via Getty Images

Homebuilders Corporate Governance Comparison

The comments received in response to my recent article on PulteGroup, Inc. (NYSE:PHM) (“Pulte”) highlighted that Pulte’s management team might be overpaid. I decided to look deeper into this assertion and did an analysis of the corporate governance of Pulte and the ten largest homebuilders by reviewing their proxy statements.

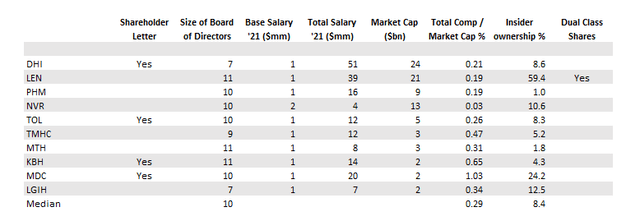

The metrics within the proxy statements that I looked at were: 1. Inclusion of letter to shareholders, 2. Number of board of directors, 3. CEO total pay as percentage of market capitalization, 4. Inside ownership by directors and executives, and 5. Existence of dual share classes.

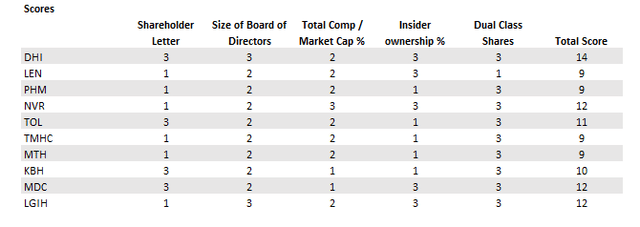

The companies were given a score based on a criteria that took account for best practices. The scores I gave were completely subjective. I gave a score of 3 points for best performance, 2 points for average, and 1 point for below average.

Proxy Overview (Company Filings)

1. Inclusion of letter to shareholders

Studies have shown that increase in transparency can lead to higher share prices. Four companies included shareholder letters, scoring 3 points, those that did not include a letter received 1 point.

2. Number of board of directors

Studies have also shown that a smaller number of persons on the board of directors can lead to higher shareholder returns. The stand-out in this category was D.R. Horton (DHI). The company has the smallest board along with LGI Homes (LGI), despite having the largest market capitalization.

3. CEO total pay as percentage of market capitalization

The third metric I looked at was the total CEO or Executive Chairman pay as a percentage of market capitalization. Research has shown that there is no correlation between total pay and company performance. The stand-out in the group was NVR, Inc (NVR) with total compensation as a percentage of market capitalization of 0.3%. The worst was M.D.C. Holdings (MDC), where the company paid out a full 1% of the company’s market cap in executive compensation in 2021. Overall, most of the companies had base salaries of around $1 million.

4. Inside ownership by directors and executives

The most powerful link between shareholder wealth and executive wealth is direct stock ownership by the CEO, according to studies. The fourth metrics that I looked at was the insider ownership of stock that the board and the executives had. The companies with the highest insider ownership were Lennar (LEN), MDC, LGI, NVR and DHI.

5. Existence of dual share class.

It has been shown that dual-class stocks tend to underperform the stock market. Only Lennar has dual class stock ownership, and it scores negatively because of it.

Corporate Governance Scores (Author Calcs)

Summary

In total, the best corporate governance performance was scored by DHI with 14 points, followed by NVR, MDC and LGI.

Pulte’s score was the lowest, with LEN, THMC and MTH. Pulte’s score can be improved through higher shareholder transparency via a shareholder letter, a smaller board, and higher insider ownership.

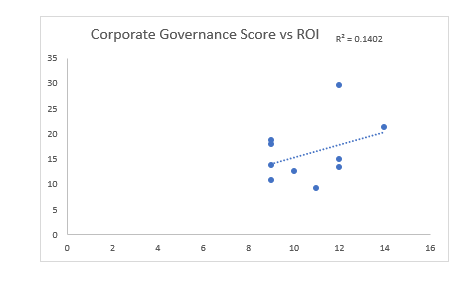

Investment decisions should not be based purely on this analysis, but instead should add to the pros and cons when evaluating a company. If we compare the scores to the return on total capital of the companies, the corporate governance does not seem to be correlated with a R-squared of 0.14.

Corp Governance Score vs Return on Capital (Author Calcs)

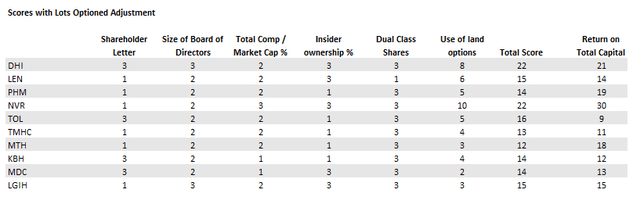

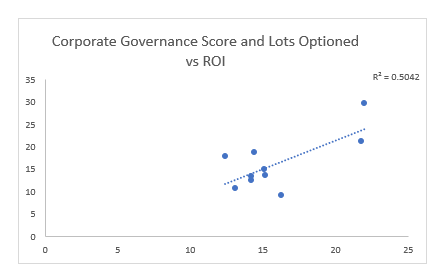

Percentage of Lots Controlled via Options

To try and find a R-squared that is higher I added an additional factor to the analysis. I adjusted each company’s score for the amount of land controlled via options. The score that was given to each company was the total percentage of lots controlled via options divided by 10. The result from adding in this factor results in a R-squared of 0.50.

Corp Governance Scores with Lots Optioned Adjustment (Author Calcs)

Adjusted Corp Governance Score vs Return on Capital (Author calcs)

The results would seem to indicate that Pulte CEO’s pay is inline with peers. However, the company can make improvements. Most importantly, Pulte should continue to pursue a policy of increasing the land controlled via options as it has recently.

Be the first to comment