cmart7327/iStock via Getty Images

The sell thesis

The redemption requests seen in November are just the tip of the iceberg. Blackstone (NYSE:BX) closing the gates on BREIT redemptions will stimulate more withdrawals both from the signaling aspect and because withdrawals are frankly rational.

The assets under management, or AUM, were largely raised in recent years, aided by the outperformance that private vehicles like BREIT had over public REITs. As it becomes clear that the outperformance will likely reverse as markets normalize I think investors will flood to the exits.

High nominal NAV facilitated raise in AUM

The world of asset management is often focused on assets under management. Managers are paid to grow assets under management and indeed a large chunk of Blackstone’s income comes from fees.

This problem is not unique to Blackstone, but it is epitomized by them as the extraordinary AUM growth at BREIT fueled BX earnings.

Back in July I warned about Blackstone’s AUM growth as they used NAV numbers that were unrealistically high relative to public REIT valuations at BREIT, its flagship product, to suggest an outperformance over public REITs.

Somehow, Blackstone’s industrial and residential properties managed to deliver strong NAV growth when publicly traded industrial and residential properties were crashing.

What was really happening was a disconnect between the prices paid in the private market and the sentiment of public markets. The actual property level NOI performance was nearly identical yet BX reported somewhere around 20%-40% outperformance depending on asset type and timing.

They discussed the nature of outperformance as superior asset selection.

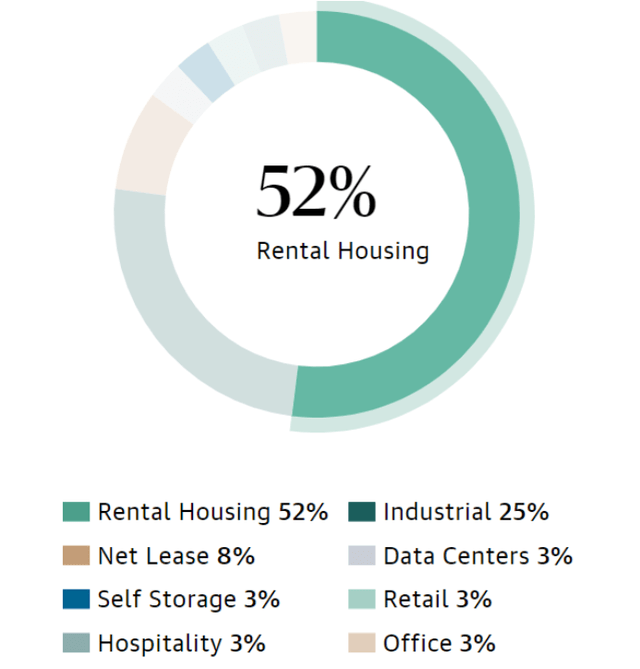

BREIT was founded in 2017 and acquired most of its properties in 2019 or later due to timing of capital raise. They invested most of their capital in rental housing and industrial.

Sure, these are fine sectors, but at that point in time these were already the hot sectors. Cap rates were low and to get the high quality properties BX was seeking they had to pay top dollar.

These assets have legitimately performed well at a property level. Net operating income has generally increased and occupancies remain healthy. That is also true of publicly traded residential and industrial REITs.

As you know, interest rates rose dramatically this year and caused a repricing of all assets. So while the fundamentals remained strong, higher discount rates caused values to drop significantly.

Public markets are forward looking and reacted very swiftly, selling down the industrial and residential REITs.

S&P Global Market Intelligence

Private markets are much slower to react. Property values largely stayed up.

Thus, the only difference between BREIT and the public REITs of similar sectors is really just the method with which they display their price. BREIT uses a Blackstone determined NAV while public REITs use the collective wisdom of the market.

I think actual value is probably somewhere in the middle, but the point here is that there is no significant difference in actual performance, so Blackstone’s extreme outperformance was really just reporting methodology differences between public and private markets.

Where it went wrong

The asset management of BREIT is largely fine. They may have slightly overpaid for some of their properties, but generally they are buying reasonably good real estate.

The problem here, is that investors chased the outperformance and likely did not understand the temporary nature of it.

Money came pouring in.

Stephen Shwartzman on the 3Q22 call:

“Our clients entrusted us with $45 billion of inflows in the third quarter and $183 billion year to date, and we grew total assets under management 30% year over year to a record $951 billion. The Blackstone brand has never been stronger.”

Today, with the wave of redemption requests at BREIT, that flow of capital is starting to reverse. Investors likely bought assuming the 30% outperformance would continue and it is now clear that such performance cannot realistically be repeated and in fact is likely to reverse.

Over time public and private valuations realign and that means there will be a 30% delta the other direction. Either private market NAVs are coming down or public market REITs are coming up or some combination of the 2.

Healthy sustainable AUM raise versus temporary fleeting capital raise

The good way to raise AUM is to have a project lined up in which you intend to invest the capital such that the money can be put to work immediately. It also allows the money manager to discuss the specs of the project with the investor so that they can have a realistic expectation of return profile.

Everybody wins. The manager gets the AUM and fee while the investor gets roughly the return they were anticipating (subject to real world risks and future uncertainty).

I don’t think this is what happened at BREIT.

- The aforementioned nominal performance may have resulted in investors assuming a much higher level of return than is plausible.

- No clear project lined up

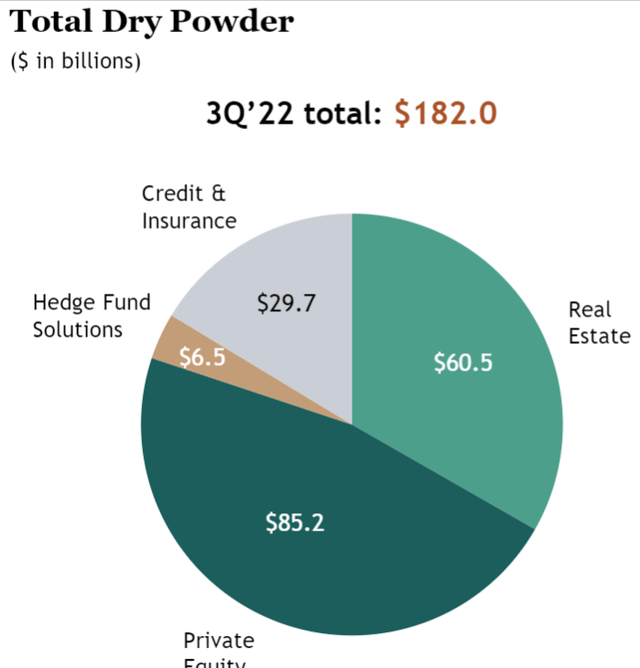

Blackstone already had more capital than they had investment ideas. Their dry powder was $182B, $60.5B of which was in real estate where BREIT lies.

At a certain point, investments get sloppy. There are very intelligent people working at BX and at BREIT specifically. I have no doubt that they can come up with some really good purchases but the thing about real estate is that it is very local. Individual buildings need to be examined within the context of their individual submarkets and it is this granular approach that can lead to real outperformance in property selection.

It is not possible to take that granular approach to hundreds of billions of investments over the course of just a few years. Thus, in order to put that much capital to work that quickly they start having to do portfolio deals.

When portfolios get involved there is something called the portfolio premium. While the individual assets may have gone for 6% cap rates, their assembly into a portfolio causes them to go for maybe a 5% cap rate. Blackstone has been buying up public REITs at 10%-30% premiums to their market prices.

That is not granular, intelligent asset selection. That is investment driven by needing to get the freshly raised billions put to work.

Actionable conclusions

I believe BREIT will materially underperform public REITs going forward.

Investors in BREIT may be wise to put in a redemption request to avoid the future underperformance. They could put that same money into public REITs and get close to 30% more property per dollar invested.

It may also be wise to sell BX. I think the roughly 3% outflows from BREIT per month are just the tip of the iceberg. There are 2 catalysts for further withdrawals

- Gating redemptions scares investors. Suddenly what was a semi-liquid investment becomes something in which investors feel like their money is trapped.

- Realigning of NAV’s with public market prices will result in underperformance which in turn leads to outflows.

Outflows reduce BX fee income which could have an adverse impact on the stock.

Potential upside to Blackstone

Many of the withdrawals were coming from Asian investors, presumably as a result of weakness in related markets/economies causing people to need liquidity. That driver of withdrawal will potentially subside which does provide a pathway for overall withdrawals to slow down.

Be the first to comment