John Blottman

A new survey of economists suggests that the Federal Reserve will keep rates higher, longer, with no declines in 2023.

To me, this is not surprising given what the Federal Reserve is supposed to be doing in terms of reducing the size of its securities portfolio.

Remember, the thing that got the U.S. economy in the state that it is in was the massive buying of securities to add to its portfolio to combat the effects of the Covid-19 pandemic.

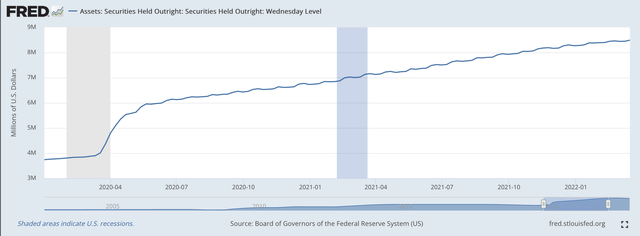

Securities Held Outright (Federal Reserve)

First of all, the amount of securities held outright on the Fed’s balance sheet on January 1, 2020, was $3,740.0 billion.

On March 16, 2022, the time when the Fed activated its efforts to fight inflation, the amount of securities held outright on the Fed’s balance sheet totaled $8,490.5.

This represents an increase in the securities portfolio of $4,750.5 billion…or, $4.8 trillion.

This is the injection of money into the U.S. financial system that generated the asset bubble that we are now attempting to exit.

Looking at the chart, we see that there were two stages to the Fed’s actions.

First, there was the initial stage in which the Fed threw about everything it had to combat the threat of the Covid-19 pandemic.

Second, there is the “quantitative easing” that followed, where the Federal Reserve added $120.0 billion in securities to its portfolio every month to make sure that no “bump in the road” could upset the efforts of the Fed to save the economy.

The rise, again, in the securities portfolio over this time period?

The total was $4.8 trillion!!!

This asset bubble contributed to, among other things, the explosion of money that went into the cryptocurrency market where Sam Bankman-Fried and TFX were able to amass a $32.0 billion valuation, and where “blank check companies” were able to raise massive amounts of money to acquire other companies.

Both areas have experienced substantial setbacks as the Fed has moved events to the “other side of the asset bubble.”

But, we are now also facing consumer price inflation. And, the Fed’s fight is on.

The Question Facing The Fed

To me, the major question now facing the Fed is not how high it will raise its policy rate of interest.

This is important, but the major question to me concerns how far the Fed will go in reducing its securities portfolio so as to eliminate most of the disequilibrium that now exists in the financial markets.

The record:

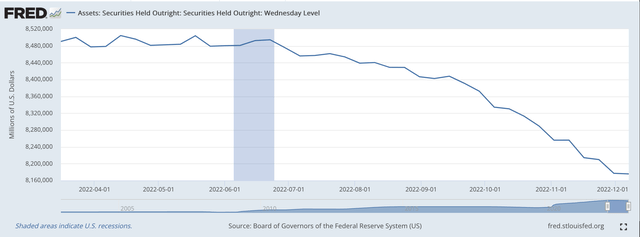

Securities Held Outright (Federal Reserve)

On Wednesday, December 7, 2022, the amount of securities held outright by the Fed had dropped to $8,175.6 billion. The securities portfolio had declined by $314.9 billion.

Not quite $4.8 trillion.

So, the Fed is reducing the size of its securities portfolio but is far away from the amount of securities it jammed into the financial system in 2020 and 2021.

This implies to me that there remains a gigantic amount of excess liquidity still existing in the financial system that needs to be removed to help the markets return to a “more normal” equilibrium.

How much is, of course, unanswerable at this time. We just don’t know what needs to be done to return the financial markets to fundamental operating conditions.

Here, we are in the field of radical uncertainty.

The only thing that I think we can say is that there is a substantial amount of money that still needs to be removed from the banking system.

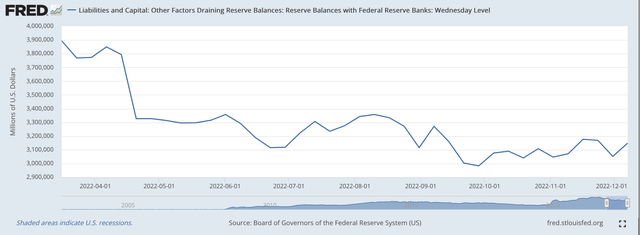

Commercial Bank Reserves

Right now, commercial banks are holding $3,149.1 billion in reserve balances with Federal Reserve banks.

In one respect, these reserve balances can be looked upon as “excess reserves” as they indicate how much the banking system is swimming in liquidity.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Note that on March 16, 2022, these reserve balances were $744.3 billion higher than they are at the current time.

So, the Federal Reserve is making progress.

But, with $3.1 trillion of “excess reserves” on their balance sheets, the feeling is that the is still a tremendous amount of liquidity still in the banking system…and, consequently, in the financial system.

So, how much more is the Fed going to do?

The Major Question

This, to me, is the major question. How much more will the Fed’s securities portfolio have to decline to get the banking system…and the financial system…back to a “more normal” position.

Then, I ask the question, “how much higher does the Fed’s policy rate of interest have to go?”

I don’t think that we can answer this last question without understanding how far the Fed will need to go in reducing its securities portfolio.

So, pay attention to what the Fed is saying about what it is doing with respect to its policy rate of interest, but realize that this is just a part of the story.

The real question, to me, is about how far the Fed will need to reduce its securities portfolio in order to get the banking system…and the financial system…back into some more sustainable condition.

Looking at things this way causes me to conclude that the Federal Reserve still has a long way to go.

Can it stick to its plan?

Be the first to comment