Morsa Images/E+ via Getty Images

Introduction

Recently, Berkshire Hathaway (BRK.A) (BRK.B) increased its stake in Markel (NYSE:MKL) to 467,611 shares in the second quarter. Their stake in Markel is currently worth approximately $552 million. Warren Buffett sees value in Markel, Markel is also seen as the baby-Berkshire because it invests their premiums in fixed maturities, stocks, and companies.

Markel is no stranger to me either, Markel is one of my largest holdings and I have owned the shares since mid-2020.

Markel’s ambitious goal is to build one of the world’s largest companies, driven by the idea and architecture of win-win-win. From Markel’s Annual Report 2021, CEO Tom Gayner:

Customers win when we serve them. We provide something they want or need, and we do it in such a way that they end up better off because they did business with us. Employees win because they can provide for their families and their communities. Our people win because they can continuously learn, be creative, and reach their full personal potential over time. Shareholders win because when our customers and our employees win, the capital our shareholders provided us with to operate the business earns a fair and durable return.

This win-win-win structure is strongly embedded in Markel’s ethos, an excellent standard with perfect principles to create value in the interest of everyone.

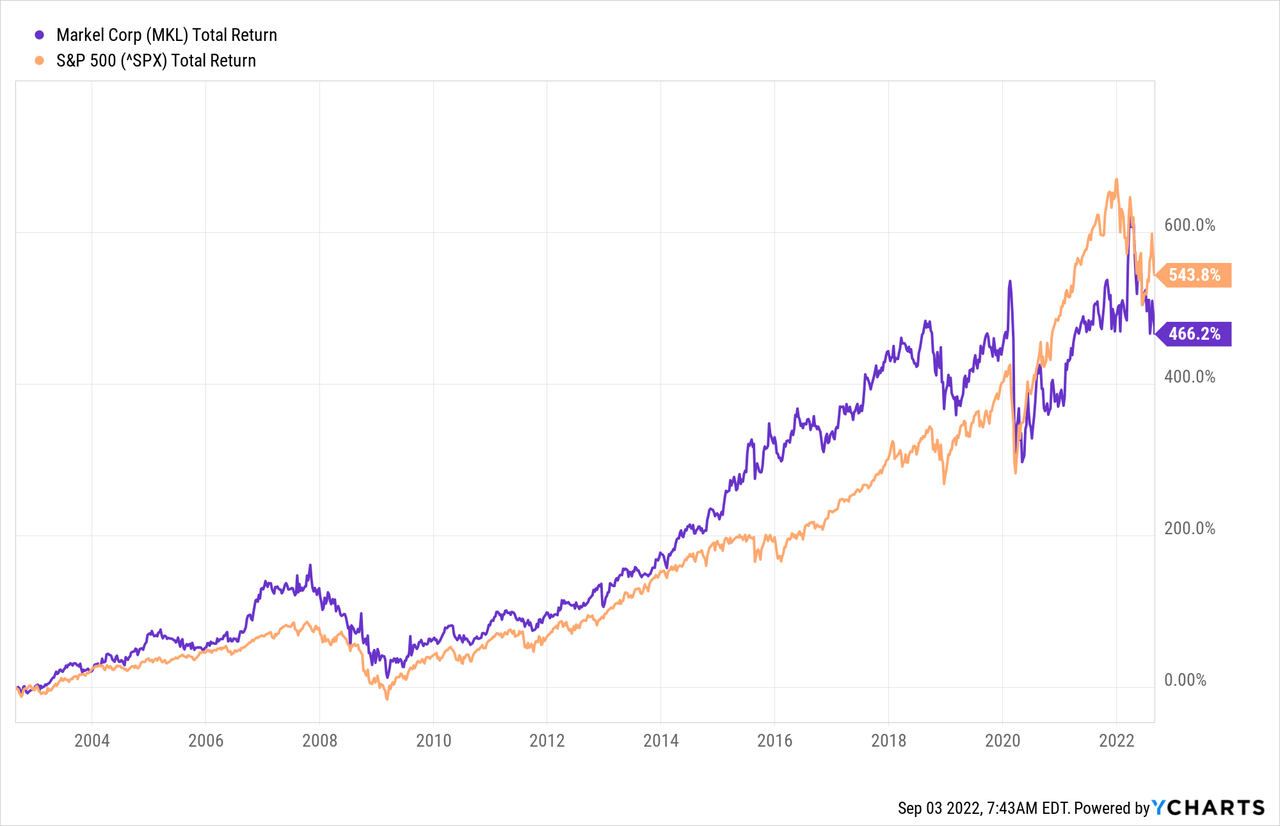

This added value is reflected in their stock return. The stock has risen sharply over the past 20 years. Still, Markel’s total return is slightly lower than the S&P500, but Markel’s stock valuation is more attractive than the S&P 500. Markel’s PE ratio (non-GAAP earnings) is 16.7, compared to the S&P 500 PE ratio of 19.8.

Markel’s continued strong growth in written premiums, the expected strong growth in their fixed maturity portfolio due to higher interest rates, the expected growth in their undervalued equity portfolio, and Markel’s significant undervaluation make the stock a strong buy.

Company Overview

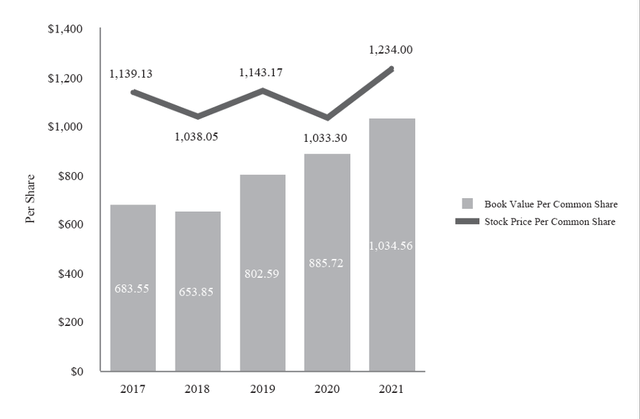

Markel measures its success by measuring book value growth. And Markel does that well, the book value has grown by an average of 11% over the past 5 years. While a few years ago a high premium was paid for the share price compared to the book value, the premium is now much lower. The stock is attractively valued.

Book value per common share, and share price (Markel 2021 Annual Report)

Book value growth is achieved through Markel’s 3 growth engines, which drive their win-win-win structure:

- Insurance Engine (2021: $11.4B in gross premium volume)

- Markel Ventures (2021: $3.6B in operating revenue)

- The investment portfolio (2021: $0.4B investment income + $2B investment gains from their $7B equity portfolio)

These three growth engines ensure a strong consolidated growth in revenue, earnings and investment income. Let’s take a closer look at the three business segments.

1. Insurance Engine

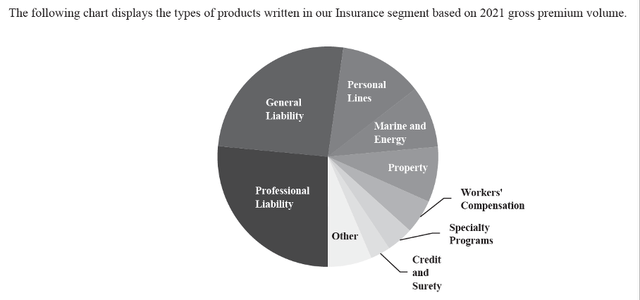

Markel’s main activity is their insurance activities. These include Markel’s property and casualty insurance, credit and suretyship products, collateral insurance products and Markel offers reinsurance policies. About 85% of the gross premium volume consists of the insurance activities of Markel and 15% of the reinsurance activities. Insurance activities are broken down as follows.

Types of insurance products provided by Markel (2021 Annual Report)

For policyholders, the financial strength of Markel’s insurance and reinsurance business is important. Rating agencies assign Financial Strength Ratings (FSRs) based on quantitative data such as profitability, leverage and liquidity, etc. Seventeen of Markel’s eighteen insurance operations receive an “A” FSR from Best.

The insurance engine is Markel’s main activity and is developing stable revenue and profit growth. The gross premium volume grew by an average of 14% per year between 2019 and 2021 and the combined ratio improved to 90%. The profit is invested in the fixed maturities, stocks, or companies.

2. Markel Ventures

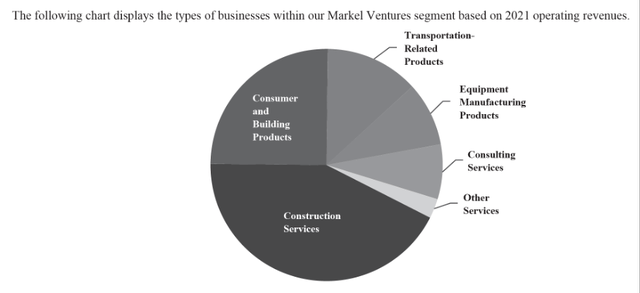

Like Berkshire Hathaway, Markel invests his premiums in a variety of companies. The largest allocation goes to construction services companies, followed by consumer and construction products.

Types of businesses within Markel Ventures (2021 Annual Report)

Construction Services provides distribution services for outdoor construction products, crane rental and fire protection and life safety services to other companies. These companies may experience revenue fluctuations over time due to the cyclical nature of the business.

Consumer and construction products include companies that produce or build ornamental plants, residential houses, luxury handbags and construction products. The revenues of these companies can also fluctuate during the business cycle.

Markel’s companies are very sensitive to the economic cycle and therefore pose a risk, but on the other hand they are growing strongly (2019-2021 Turnover CAGR 33%). Markel Ventures’ revenue is small compared to Markel’s other 2 growth engines.

3. Investment Portfolio

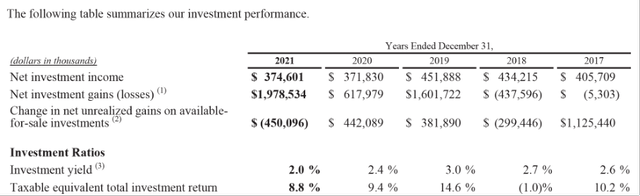

The investment portfolio invests the premiums in both equities and bonds. As a result, the risk is better distributed, and the consolidated return remains strong. Taxable Equivalent Total Investment Return for 2021 is 8.8%.

Investment performance (2021 annual report)

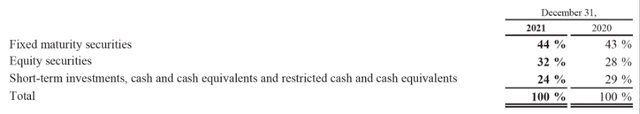

The investment portfolio is divided into fixed maturities, equities and short-term investments, and cash or cash equivalents. The majority of the portfolio is allocated to fixed maturities.

Allocation of fixed maturities, equities, and short-term investments (2021 Annual report)

With interest rates rising, new bond issues will have higher returns. This is beneficial for investment returns.

A turning point is that the value of bonds falls when interest rates rise. But when these are kept until maturity, the face value will be paid out.

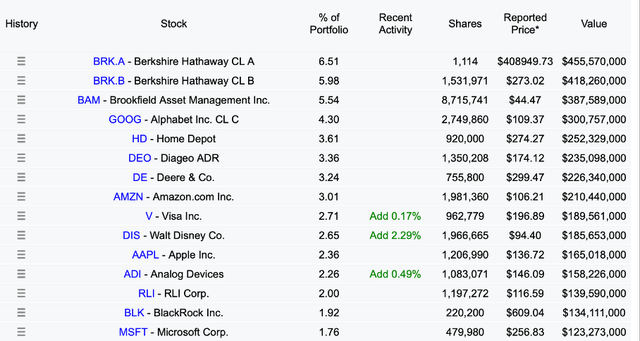

Stocks generally give higher returns, but this entails higher volatility. 32% of their investment portfolio consists of equities. Markel’s stock portfolio is well distributed, their 15 largest allocations to stocks are shown below.

Markel’s 15 largest stock holdings (Dataroma)

The largest part of the portfolio concerns shares in Berkshire Hathaway, these make up approximately 12.5% of the equity portfolio.

In general, I am pessimistic about the performance of the S&P 500 for the coming years, as I mentioned in my previous article. Especially expensive stocks will crash, I avoid these stocks. Markel’s portfolio does not contain expensive growth stocks. the portfolio contains shares of companies that are profitable and whose profits are steadily growing, at a normal valuation. Markel’s stock portfolio looks fine.

Quarterly Earnings and Future Developments

Second quarter results were strong as earned premiums increased by 17% and the combined ratio improved from 90% to 89%. Markel Ventures also performed well, as product revenue grew 31% and service revenue grew 13%. Investment income was down 2% and there were significant unrealized investment losses on the investment portfolio due to the decline in share prices in their equity portfolio, and unrealized losses on fixed maturities as bond values decline in a higher interest rate environment.

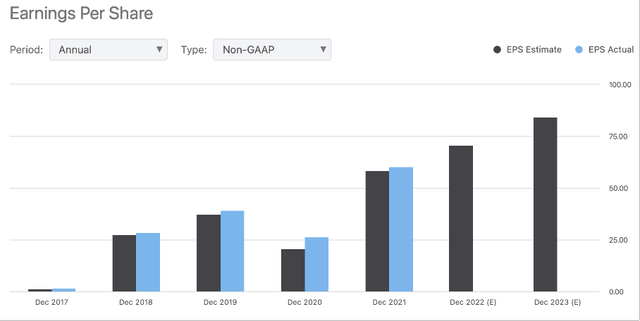

GAAP takes into account unrealized investment losses when calculating profit. Because stock prices fluctuate in short periods of time, it doesn’t give a clear picture of earnings.

In the short term, unrealized investment gains or losses fluctuate widely. But in the long run, they contribute a large return to the book value of the company.

Excluding unrealized investment gains or losses, earnings per share grew well.

Markel’s earnings per share (Seeking Alpha)

Earnings per share are expected to rise in the coming year as a result of higher interest rates, which will benefit their bond portfolio. And because their stock portfolio consists of growing companies at a cheap stock valuation, I expect growth here as well.

Markel Ventures also see strong growth in their business, but I expect that there could be difficulties here in the coming years. The housing market is at a high level, the end of the boom is in sight, as I wrote earlier in my article. Nevertheless, Markel Ventures’ turnover is small compared to the rest of Markel’s business. And since this risk is still immaterial, why worry about it? The increase in investment income due to higher interest rates will outperform Markel’s activities in the coming years. Markel is in a favorable financial position, just like any other insurer. Let’s take a look at Markel’s stock valuation.

Valuation

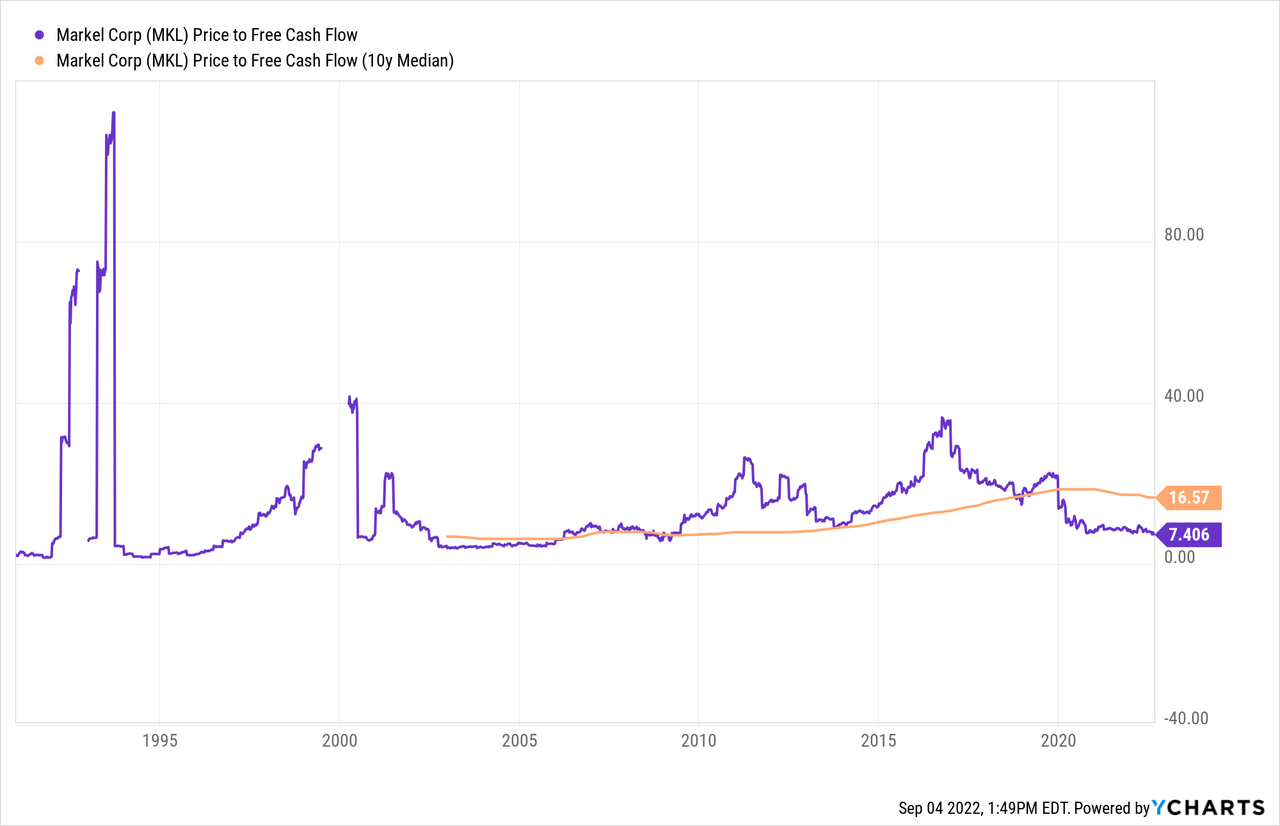

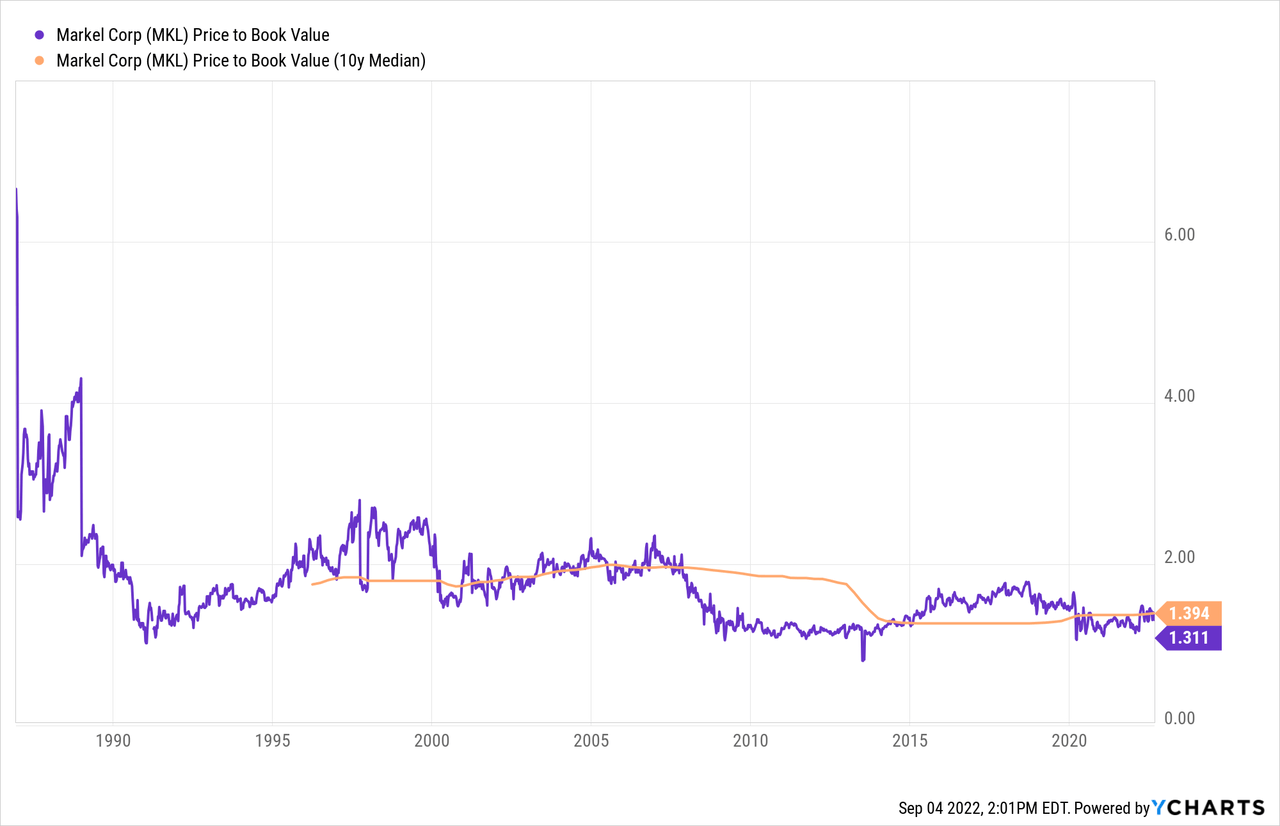

To map the valuation of the Markel share, I show the price/free cash flow and price/book value of Markel and compare these with the past. I also take the 10-year median of both ratios to compare the current stock valuation to the 10-year median of the ratios.

The price/free cash flow divides the market value by the free cash flow. In Markel’s case, free cash flow is preferred because unrealized gains from investments are not included. Markel’s Price to Free cash flow is 7.4, compared to the 10-year median of 16.6, Markel’s shares are grossly undervalued.

The price to book value tells us what premium we pay relative to book value. The current price to book value is 1.3 and the 10-year median is 1.4. Markel seems undervalued here too.

In addition to the strong undervaluation, Markel announced in February 2022 that it would initiate a new $750 million share repurchase program. After 2Q22 results, there is still $668 million available to buy back shares. This results in a high buyback yield of 4.2%.

The share repurchase program will drive the share price up because there is less supply of shares and demand increases. The price of the Markel share will therefore rise sharply in the coming periods.

Conclusion

Markel is an insurance company with characteristics like Berkshire Hathaway. The company invests its premiums not only in fixed maturities, but also in companies and stocks, much like Berkshire Hathaway does. Warren Buffett sees value in Markel, he has built a $0.5B stake in Markel.

Markel is growing strongly in revenue, earnings and book value. The book value has grown by an average of 11% per year over the past 5 years.

The 3 growth engines of Markel are their insurance engine, Markel Ventures and the investment portfolio. Each of these contribute strongly to Markel’s growth.

The Insurance Engine is Markel’s main business, gross premium volume increased by an average of 14% from 2019 to 2021 and their combined ratio improved to 89%. The investment portfolio will grow strongly in the coming years due to higher interest rates. Markel Ventures includes companies that are cyclical in nature, their revenues can fluctuate greatly during a boom-bust cycle. Fortunately, Markel Ventures contributes a small part of the earnings, so the risk is foreseeable.

Markel is severely undervalued on both price/free cash flow and price/book value ratios. The strong growth in premiums, the strong expected growth in their investment portfolio and significant undervaluation make Markel a ‘strong buy’.

Be the first to comment