gorodenkoff

Generally, no sector is safe from losses during a bear market. In a bear market, the best performing sectors are usually the ones that fall the least, while the worst performing sectors are usually the ones that fall the most.

Volatility and Beta

A useful indicator for helping to determine which sectors will likely fall the least or most in a bear market is beta. Beta measures individual stock and sector volatility relative to the overall stock market.

Stocks or sectors with a beta less than 1.0 have historically been less volatile than the S&P 500, while those with a beta greater than 1.0 have historically been more volatile than the S&P 500. That means, sectors with a beta less than 1.0 typically fall less than the S&P 500 in a bear market, while those with a beta greater than 1.0 typically fall more than the S&P 500 in a bear market.

The list below shows the major US stock market sectors ranked from lowest to highest beta (with the sector’s beta in parentheses), which means lowest to highest historical volatility:

- Utilities (0.53)

- Consumer Staples (0.57)

- Healthcare (0.70)

- Real Estate (0.87)

- Communication Services (1.07)

- Materials (1.10)

- Technology (1.11)

- Industrials (1.13)

- Financials (1.21)

- Consumer Discretionary (1.24)

- Energy (1.58)

Naturally, less economically sensitive sectors like Utilities, Consumer Staples, and Healthcare are typically more “defensive” and less volatile. By contrast, highly cyclical sectors like Energy, Consumer Discretionary and Financials are much more volatile.

Beta and economic sensitivity are useful guides to follow in a bear market, but every bear market is different.

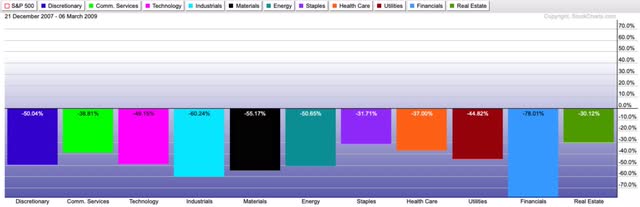

Sector Performance During The 2008-2009 Bear Market

The performance of major stock sectors from near the beginning of the Great Recession bear market in late 2007 until the bottom in early March 2009 is shown in the chart below. The S&P 500 fell 54% during this time, while sector performance ranged from negative 31.7% for Consumer Staples to negative 78.0% for Financials.

Sector performance in 2008-2009 bear market (StockCharts.com)

The four best performing sectors during the Great Recession were:

- Real Estate

- Consumer Staples

- Healthcare

- Communication Services

It makes sense that Consumer Staples and Healthcare were among the best performing sectors then, given their low betas. Real Estate is a bit surprising as the best performer given the housing bust then, but Real Estate stocks generally own commercial real estate and Real Estate does have the fourth-lowest beta among the sectors. Communication Services (which includes major Tech companies such as Alphabet [Google], Meta [Facebook] and Netflix) has the fifth-lowest beta, but it is surprising that the sector outperformed Utilities, which has the lowest beta.

The four worst performing sectors then were:

- Financials

- Industrials

- Materials

- Energy

These are not particularly surprising, although it is noteworthy that until oil peaked in mid-2008, Energy was the best performing sector and the only one with positive returns up to that time.

Sector Performance In 2022 (So Far)

The chart below shows sector performance since the S&P 500 peaked in early January this year. Since then, the S&P 500 has fallen 11.6% and sector performance has ranged from positive 34.3% for Energy to negative 24.7% for Communication Services.

Stock sector performance in 2022 (so far) (StockCharts.com)

The four best performing sectors so far have been:

- Energy (by far)

- Utilities

- Consumer Staples

- Healthcare

Utilities, Consumer Staples and Healthcare are not surprising, given their low betas. Energy has been aided by Covid-19 policies – particularly the Fed’s aggressive monetary policy and the lockdowns that disrupted energy production. But again, Energy was also the best performing sector in the first part of the Great Recession, as we discussed above. Since this bear market may not be over given the inverted yield curve and aggressive Fed rate hikes, it is possible that Energy could end this bear market as one of the worst performers, as it did in the Great Recession.

The four worst performing sectors so far have been:

- Communication Services

- Consumer Discretionary

- Technology

- Financials

Consumer Discretionary and Financials are not surprising given their high betas, but Communications Services and Technology are somewhat surprising. We believe their weakness is similar to that of the early 2000s Tech Bust. In both 2000 and 2021, extremely bullish investor speculation bid tech stocks up to very high valuation levels.

Conclusions

Generally, in a bear market, there are no clear stock sectors to profit from throughout the entire downturn. But there are always ways to profit during a bear market on shorter time frames. As a rule, this is best done with defensive sectors and stocks, as well as any unique situations that are present at the time.

Be the first to comment