jimkruger

Investment Thesis

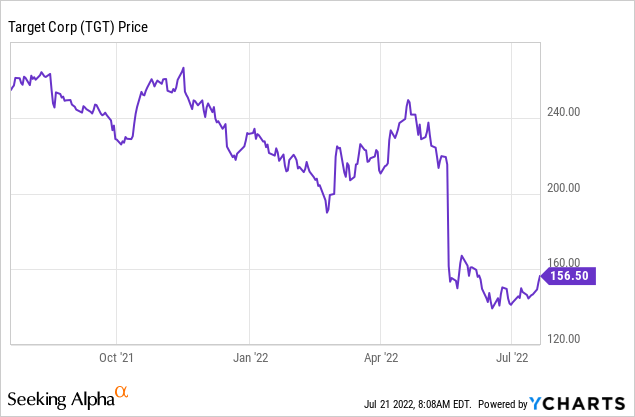

Target (NYSE:TGT) has had a rough go of it the past few months. Indeed, in their Q1 2022 earnings release we learned they stocked the shelves with pandemic-era inventory nobody wanted. Target was forced to take inventory markdowns and increase promotional activity to clear the shelves and make way for in-demand goods such as food and household essentials. Target’s operating margin dropped from 9.8% to 5.3% as a result. Shares fared even worse, tanking 25% in a single day. Investors shouldn’t expect Q2 2022 to be any better. The company has already guided to an operating margin of 2% on the back of continued inventory headaches and inflationary pressures.

But if you take a long-term perspective and ask yourself, “what really changed in Target’s business between May 17-18?”, the answer is – not a whole lot. Yes, Target has some short-term headwinds to work through, but with an impressive long-term track record, I believe they will successfully navigate these issues and return to business as usual. They have already guided to 6% operating margins for the back half of 2022.

The only thing May 18 did for investors was offer a discount on shares of Target. Long-term investors may take advantage of Mr. Market’s offer for this iconic company.

Inventory Optimization Plan

The market was surprised by Target’s Q1 2022 earnings miss as evidenced by the 25% decline in stock price, but management is taking the inventory issue very seriously. On June 7, Target announced a “Plan Focused on Inventory Optimization.” Some investors don’t like when companies provide long-term financial targets (i.e. perceived unrealistic expectations) or post-earnings PRs (to save face), but I’m not one of them. I appreciate management’s openness in addressing issues, but even more so, I appreciate the accountability these sort of announcements create.

Unprecedented economic times

Investors are upset with Target because they didn’t correctly predict the future, but is this fair? In December 2019, how many of us predicted a global pandemic, lockdowns, flash-crash, free money give-a-way, historic rebound, crazy inflation, recession, and war? I, for one, foresaw none of these.

Over the past 2 years, Target has had to evolve and remain nimble to meet demand of the ever-changing consumer. With record profitability of $6.9 billion in 2021, I say they did a pretty good job. Perhaps Target got a bit complacent late last year and fell for the Fed’s head-fake of “transitory” inflation, but who can really fault them for that? A short-term memory will aid the investor at this point in time.

Ripping off the Band-Aid

Target has and continues to take quick and decisive action to right the inventory ship. They could’ve dragged it out, refusing to markdown inventory or increase promotions, thereby allowing margins and earnings to deteriorate slowly, but they didn’t. This indicates Target means business and other retailers, such as Walmart (WMT), could learn a thing or two from this approach.

Target’s Q2 will be even more painful than Q1. Management has already guided to 2% operating margins as a result of continued inventory markdowns, removing excess inventory, and order cancellations. Investors should view this as a blessing more than a curse.

Brian Cornell, chairman and chief executive officer, had this to say in the Plan Focused Inventory press release:

While these decisions will result in additional costs in the second quarter, we’re confident this rapid response will pay off for our business and our shareholders over time, resulting in improved profitability in the second half of the year and beyond.

Target is working to re-establish a firm foundation to build for the long-term, which includes:

- Focusing on Food & Beverage and Household Essentials & Beauty and being very conservative in discretionary categories such as Home

- Working with vendor partners to reduce costs and increase operating efficiencies

- Adding additional supply chain capacity to meet demand by adding five new distribution centers over the next two years

Lest You Forget

Target is an iconic brand with an enviable long-term track record. This investment thesis is predicated on the assumption Target will continue to do what it has done over the past 100+ years – grow EPS organically and via share repurchases and return excess cash to shareholders in the form of dividends.

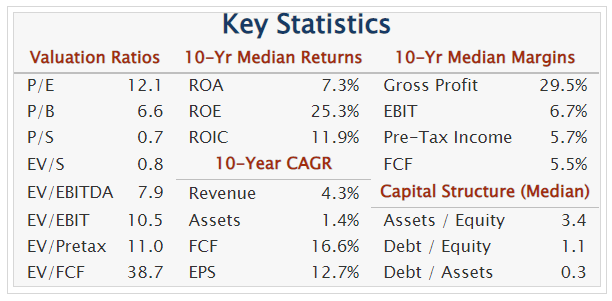

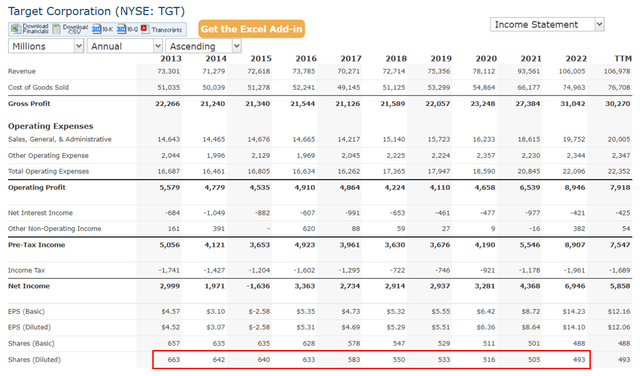

Target 10YR Operating Metrics (Quickfs.com)

Earnings growth

As shown above, Target has grown EPS at an enviable 12.7% CAGR over the past 10 years. Much of this growth has been bolstered by share repurchases which served to reduce total number of shares outstanding. Target reduced total number of shares outstanding from 663 million in 2013 to 493 million in 2021. This a reduction of 2.9% per year. Shareholders reap the benefits as they’re left with a larger piece of the pie.

Target has given no indication they won’t continue buying back shares at a similar rate in the future, enabling similar EPS growth even with slow or stagnating revenue.

Target Income Statement (Quickfs)

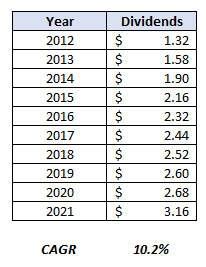

Dividend growth

In addition to share repurchases, Target also has a long history on paying dividends and increasing those dividends over time. Target has increased their dividend at a 10.2% CAGR over the past 10 years. More recently, Target announced a 20% increase to their quarterly dividend which shows additional confidence in their ability to navigate through short-term inventory headwinds.

TGT Dividends Per Share (Author’s personal data)

Valuation

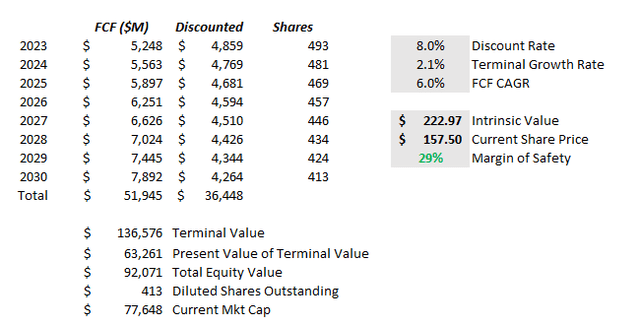

I performed a DCF analysis as well as a market multiple valuation for Target. Conclusion: Target’s current share price of $157.50 is undervalued, no matter how I slice it.

Using the DCF, I arrive at an intrinsic value of $223 which offers a 29% margin of safety at current prices. I used an 8% discount rate and 2.1% terminal growth rate. I assumed Target will continue reducing total number of shares outstanding by 2.5% annually and grow FCF by 6% annually (well below the 10 YR CAGR of 16.6%).

Discounted Cashflow – TGT (Author’s personal data)

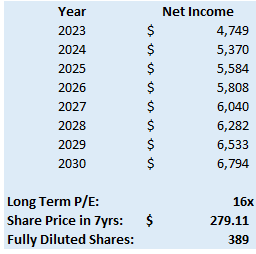

Using the market multiple approach, I arrive at a fair value of $280, which includes share repurchases but excludes dividends. I assumed revenue growth of 4%, net margins of 4.7%, and a long-term P/E of 16, near its 5YR average.

TGT – Market Multiple Valuation (Author’s personal data)

Bear Case

To be honest, it’s difficult to come up with a bear case for Target because they have such a long operating history of success. They’ve been around for more than 100 years for goodness sake! Nonetheless, I’ll give it my best shot.

My bear case is that it takes Target a lot longer to work through their inventory problems, leading to subprime operating margins and profitability beyond 2022. This coupled with demand destruction brought about by a looming recession could pose a risk to this investment thesis. Indeed, tough economic times could lead to a halt in share repurchases and a cut to the dividend, both of which would cause my valuations to be too optimistic. I don’t believe it negates the thesis, but it most assuredly would extend the time needed for it to play out.

Conclusion

Target is an iconic brand with strong fundamentals. And while past performance is not indicative of future results, it certainly lends credibility to Target’s ability to dig themselves out of this hole. They are addressing issues head-on, taking swift and decisive action while holding themselves accountable to shareholders.

Ripping off the Band-Aid is painful, but it’s the first step toward healing. At a 30% discount to intrinsic value, I’m willing to take a chance on Target and their ability to right the ship.

Be the first to comment