SrdjanPav

Introduction

The new wave of scrutiny from the Biden administration to reclassify workers as employees has prompted us to evaluate whether such driver classification risks have been fully priced in by the market. Therefore, the aim of this article is to answer the following questions:

- What metrics should we pay attention to going forward?

- What are the more suitable comps for LYFT?

- How much of the driver classification risk has been priced in?

- What is the potential upside?

LYFT’s Gig Economy

According to Oxford English Dictionary:

A Gig Economy is a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs.

Lyft (NASDAQ:LYFT) is one of the companies that has benefited and is thriving in the gig economy. Some of the major benefits include:

- Lower costs: The gig economy’s labor condition has saved the company an estimated 20-30% in costs.

- Lower operating risks: The gig business model allowed LYFT to reduce operational risk by reducing fixed costs. Rather than incurring fixed costs by hiring full-time drivers and worrying about demand, LYFT can pay drivers only when there’s demand. Then, the only major operational risk we foresee is the demand for its services.

- Incentives to increase supply: LYFT drivers are heavily incentivized to provide more supply and can mitigate the “quiet quitting” problem. LYFT claimed that LYFT drivers earn at least 120% of the minimum wage while maintaining the autonomy of their time. This aligns with our estimation. According to the Department of Labor (‘DOL’), the national minimum wage is $7.25 per hour. According to salary.com, an LYFT driver’s median pay is $18. Based on $0.30 per mile and $0.14 gas price (assumed), LYFT drivers earn about $9.40 per hour after gas expenses, which is about 20% higher than minimum wage.

‘Work Hours’ And ‘Number of Jobs’ Are Key Metrics Going Forward

About a month ago, the Gig Economy is met with material risk of structural changes after the Federal Trade Commission (‘FTC’) stated the agency is scrutinizing several aspects of the gig economy. These aspects include:

- Misrepresentations of the flexibility of gig work

- Diminished bargaining power

- Reducing competition by exploiting concentrated markets

- Deceptive or unfair pay practices like misleading pay structures

- Undisclosed costs or terms of work

- Unfair or deceptive practices by AI “bosses”

- Unfair contractual terms, including restrictions on finding other work

- Wage fixing and coordination to reduce competition

- Market consolidation and monopolization

Although no companies were named in FTC’s statements, there are hints that led stakeholders to believe LYFT could be one of FTC’s targets. The latest effort to “crackdown” misrepresentations of gig work came from the Department of Labor (‘DOL’) under the Biden administration.

LYFT and Uber (UBER) are both quick to respond to the proposal and stated that the new proposal does not impact them in terms of reclassification of their drivers and that the extent of the impact will only see them return to the policies during the Obama Administration. Hence, investors should not be too concerned. LYFT seemed to imply that the reasons are based on 2 metrics:

- Work Hours: 95% of its drivers work less than 20hrs a week

- Has work elsewhere: 96% of its drivers are students or are working more than 1 job.

Therefore, we should continue to pay close attention to these 2 metrics going forward in the short term. However, none of these should matter in the long term.

LYFT’s Eventual End-Game Might Not Be As Pretty As We Thought

In our opinion, LYFT’s end game is the deployment of self-driving cars to remove the need for human drivers. This means that the “contractors or employees” dilemma shouldn’t affect LYFT in the long term, right?

No, the risk is still substantial. The lower reliance on human capital will most likely reduce the compensation packages offered to human drivers and fuel further scrutiny to maintain the driver’s welfare. Early studies estimate that 47% of American jobs will to lost to automation in the next 15 years. The rise of Boston Robotics and the Tesla (TSLA) Bot has provided more evidence to support this claim. Therefore, we expect the next wave of scrutiny in the coming years will be driven by public interests.

Elon Musk foresaw these problems back in 2016 as he spearheads automation efforts at Tesla. Although the FTC and the DOL are looking to improve worker benefits and protection today such as minimum wage guarantee by reclassifying contractors as employees, Elon Musk thinks that these efforts will eventually take the form of Universal Basic Income (‘UBI’). UBI is a government policy in which residents receive monthly payments. Many countries are already testing the feasibility of UBI.

Therefore, we perceive today’s effort to scrutinize the classification of contractors and the experiments of UBI around the world as the beginning of increasing worker protection in this era of automation and artificial intelligence (‘AI’). The impact of these efforts on business will come as increased operating cost or taxation. We could also see LYFT spending more money to fight these efforts through lobbying.

Implications Of The Worst-Case Scenario

We view LYFT’s worst-case scenario as the relegation down to a traditional last/first-mile delivery business model where LYFT hires a number of full-time drivers to offer multimodal first/last-mile trips. This view considers the full extent of the proposal to classify drivers as employees. One can think of it as United Parcel Service (UPS) for ride-hailing because UPS drivers are full-time hired drivers.

However, we think that it is more likely for LYFT to be more similar to FedEx (FDX) where FDX uses a combination of contractors and full-time hired drivers.

This view suggests material changes in 2 aspects:

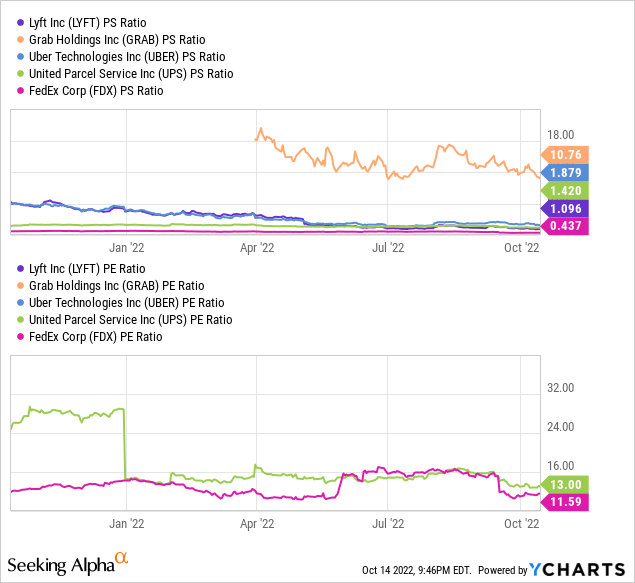

- Comps: LYFT is commonly compared to UBER, Grab (GRAB), and DoorDash (DASH) and is perceived to be more undervalued because of its lower price-to-sales (‘PS’) ratio. However, LYFT is drastically different in the sense that LYFT focuses only on ride-hailing and does not have a marketplace for merchants. Hence, FDX and UPS are more suited as comps.

- Cost of Revenue: LYFT’s cost of revenue should be revised upwards by 20%-30% to reflect risk in the classification of drivers. This is because of cost of revenue includes costs such as insurance costs.

Valuation: Risks Fully Priced In With Plenty Of Upside

For reasons stated above, we expect LYFT to be valued lower than the multidimensional business modeled UBER and GRAB but higher than UPS and FDX for being a technology play and having the gig economy cost advantage.

According to Fig 1, LYFT is indeed valued below GRAB and UBER. What surprised us was that LYFT is priced between UPS and FDX. We interpret this as the risk of driver reclassification has been priced in and the market is only deciding on whether LYFT will adopt FDX’s combination of contractors and full-time drivers model or UPS’s full-time drivers model. The gap between UPS’s and FDX’s topline multiple does not reflect one being mispriced because their bottom line multiple is valued similarly (Fig 1).

Fig 1. Comps: Top-line multiples and Bottom-line multiples (YCharts)

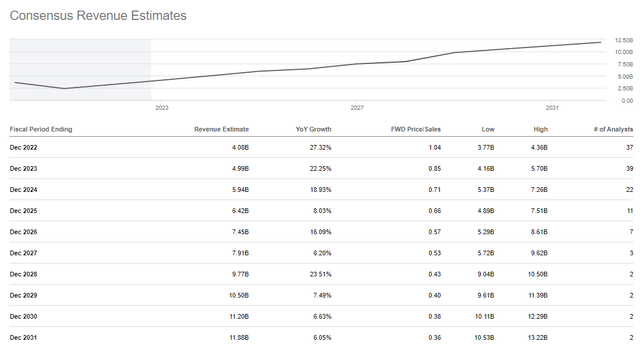

The consensus estimate provided by Seeking Alpha (Fig 2) indicates that LYFT is expected to grow linearly over the next decade which will see LYFT capturing $6bn in revenue. Table 1 shows that the LYFT’s average gross margin is conservatively around 30%. By taking into account the potential 20%-30% (assume midpoint 25%) increase in Cost of Revenue (‘COR’), we should expect around 20% gross margins. Other expenses such as R&D, marketing, and general administration seem to be stable and without material growth, hence we can assume them to remain at current levels through 2024.

Given the assumptions above, LYFT’s expected EBIT is between $0.64bn (=$6bn * 20% gross margins – $0.218bn R&D – $0.113bn Marketing – $0.233 General Admin) and $1.2bn (with 30% gross margins) This aligns with LYFT’s 2024 guidance of $1bn EBITDA. This will put LYFT at around the 3.5 to 6.5 Price-EBIT ratio range.

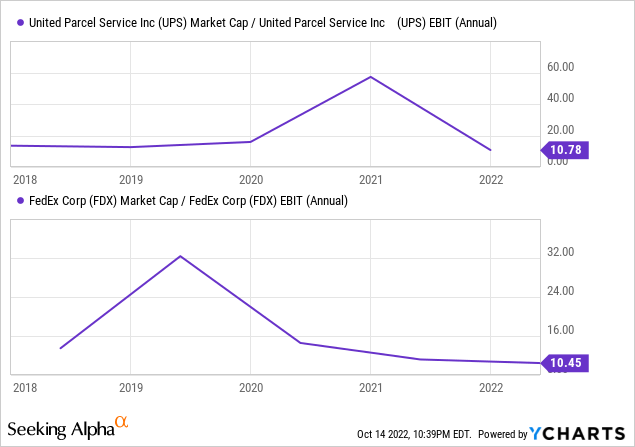

The current price-to-EBIT ratio of FDX and UPS are 10.45 and 10.8 respectively. According to Seeking Alpha-aggregated estimates, analyst consensus suggests FDX and UPS are not expected to grow their toplines much through 2024. Any growth would be fueled primarily by cost savings. The resulting EBIT per share estimates for FDX and UPS are $25.85 (= $18.26 2024 (‘E’) EPS / 0.782 tax expense + $2.5 estimated interest expense per share) and $14.75 (no change from 2021) respectively, or Price-to-EBIT ratio of 6.07 (=$157 FDX share price / $25.85 EBIT per share) and 10.96 (= $161.7 share price / $14.75 EBIT per share).

Based on these 2024 comps, LYFT is priced lower than both FDX and UBER. This also suggests that the driver reclassification risk is fully priced in and is undervalued (when considering the growth potential beyond 2024).

Fig 2. LYFT Sales Estimates (Seeking Alpha)

Table 1. Quarterly Performance ($mil unless stated otherwise)

| QR (‘CY’) | Revenue | COR | Operations & Support | Gross Margins (‘GM’) | GM after a 25% COR increase | R&D | Sales & Marketing | General & Admin |

| 2022Q2 | 990.7 | 650.3 | 105.3 | 24% | 5% | 201.8 | 140.8 | 265.7 |

| 2022Q1 | 875.6 | 440.3 | 98.6 | 38.50% | 23% | 192.7 | 126.3 | 217 |

| 2021Q4 | 969.9 | 527 | 109.2 | 34.40% | 18% | 195 | 123 | 264 |

| 2021Q3 | 864.4 | 364 | 110 | 45% | 31% | 227 | 109 | 232 |

| 2021Q2 | 765 | 347 | 94 | 42% | 27.5% | 252 | 100 | 212.5 |

| 2021Q1 | 609 | 412 | 89 | 17% | -4% | 238 | 79 | 207.6 |

| Average | 218 | 113 | 233 |

Source: Author

Fig 3. Price-to-EBIT ratios (YCharts)

Verdict

This analysis showed that LYFT’s driver reclassification has been fully priced in, while growth potential isn’t. This provides LYFT investors very sufficient margin of safety and a 70% to 185% conservative upside (based on FDX and UPS 2024 comps). However, we encourage investors to continue exercising patience under the Federal Reserve indicates peaking inflation and interest rates.

With reference to the questions this article aimed to address:

- Driver work hours and employment status are the 2 metrics we should track to follow the developments of worker reclassification.

- FDX and UPS are more suitable as comps because they reflect the possible contractor-employee hiring structure should the reclassification of workers take full effect.

- Based on the 2024 consensus and FDX and UPS as comps, the driver reclassification risks are probably fully priced in.

- We think LYFT provides investors with a 70% to 185% upside based on comps.

Be the first to comment