z1b

I saw a billboard recently for a CD at an online bank that offered an attention-grabbing 4% yield. This was something that was simply unheard of 2 years ago, when interest rates were at historic lows. I don’t plan on taking them up on the offer, though, as that means missing out on potentially great opportunities in beaten down stocks. Plus, I wouldn’t want to lock my money up at a sub-inflation rate of return for a year, when I can buy a high-quality and higher yielding stock at a discount.

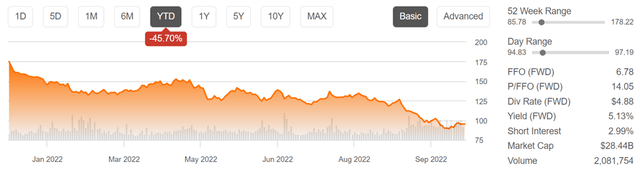

This brings me to Digital Realty Trust (NYSE:DLR), which is now trading very cheaply relative to its recent levels. As shown below, DLR is now trading 46% off its high from the start of the year. This article highlights why now may be a great time to layer into this high income REIT, so let’s get started.

DLR Stock (Seeking Alpha)

Why DLR?

Digital Realty is the largest global provider of cloud and carrier-neutral data center, colocation, and interconnection solutions. Its international footprint spans across 290 facilities in over 50 metro areas across 26 countries on 6 continents. This gives DLR the benefits from the so-called “network effect”, as its size and scope enables it to offer its tenants a full array of solutions and connection needs. Its top tenants include Meta Platforms (META), Oracle (ORCL), and Microsoft (MSFT).

DLR got its start by providing basic wholesale data center services to its clients, and has transformed itself into a full service provider of space and interconnection across six continents. This is especially valuable to the aforementioned global players who rely on a seamless connection across their respective vast global footprints. This sets DLR apart from other data center players, as it, along with peer Equinix (EQIX), is the only two players that can provide this level service.

I find DLR to be rather immune to macroeconomic effects as it counts some of the largest and most influential companies in the world that have a strong need for its services, like cloud growth with Microsoft’s Azure platform and Meta Platform’s impending expansion into the Metaverse, which will require enormous amounts of investment and colocation.

The long-term tailwinds are reflected by DLR’s continued growth with 4% YoY growth in revenue during the second quarter amidst a challenging economic backdrop, driven by strong demand for data center solutions. Moreover, over half of DLR’s record development schedule is pre-leased, and management noted that tight conditions in many global markets have resulted in rising occupancy and improved pricing.

Potential headwinds to DLR include the ongoing war in Ukraine, with Russia cutting off energy supplies to Western Europe. Management, however, expressed confidence in customers’ ability to shoulder higher power costs, as noted during last month’s Bank of America Global Real Estate Conference:

Q: How vexing is the European power situation for Digital Realty in terms of expectations around growth and sustainability?

A: Most of our utility expenses are being passed throughout our portfolio, but particularly in Europe to our customers ultimately. We have the ability to push through pricing broadly throughout the European portfolio.

And what’s happening now in terms of real-time, what people are paying, what our customers are paying is a reflection and large of hedged pricing that was put in place and communicated and hedged a year ago.

So we are hedging today for 2023. We have been hedging all year for 2023 and that will be communicated to customers, is being communicated now and will be over the course of the next, call it, 30 days, 45 days. This is what you will be paying come January 2023. So there will be an impact.

So there’s going to be an impact, but these data centers are in place because these customers are driving or driving revenue. They are saving money or enhancing their efficiency or productivity across their businesses and there’s probably not a tremendous amount of leeway to just turn them off.

Meanwhile, DLR sports a strong BBB rated balance sheet with a net debt to adjusted EBITDA ratio of 5.8x, and a strong fixed charge coverage ratio of 6.2x. This puts DLR’s dividend in great shape. The recent share price weakness has driven the yield to 5.1%. The dividend is well-protected by a 71% payout ratio (based on Q2 core FFO per share of $1.72) and has a 5-year CAGR of 5.6%.

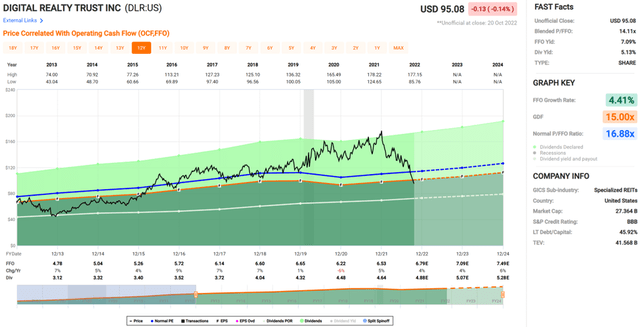

I find DLR to be rather attractive at the current price of $95 with a forward P/FFO of 14.0, sitting well below its normal P/FFO of 16.9 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $136.68, which translates to potential double-digit annual returns.

DLR Valuation (FAST Graphs)

Investor Takeaway

Digital Realty Trust is one of the two largest datacenter REITs and sports an impressive global footprint, with a large customer base of well-known companies. It currently has a record development pipeline and plenty of growth opportunities. Meanwhile, it pays a sturdy and growing dividend that currently yields an attractive 5.1%. I believe the current share price presents a great opportunity for income and growth investors alike.

Be the first to comment