Cavan Images

The North American directional drilling services market is expected to grow at a CAGR from 4.3% to 7.96% in the 2020s, by the end of which the global market size may reach US$13.87 billion, mostly in North America.

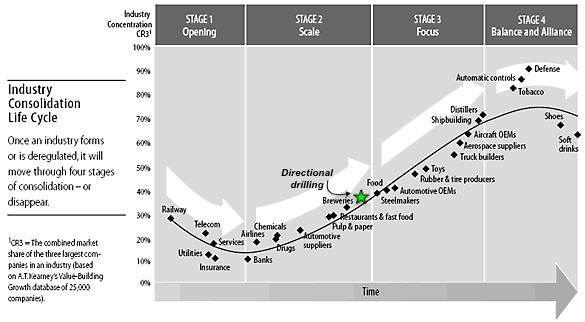

Numerous oilfield services providers cater to the directional drilling demand, including Nabors Industries Ltd. (NBR), NOV Inc. (NOV), Halliburton Company (HAL), Schlumberger N.V. (SLB), Weatherford International plc (WFRD) and Baker Hughes Company (BKR). However, beyond those big players, the rest of the directional drilling services market consists of a large number of small companies and is highly fragmented, characteristic of stage 2 of the industry consolidation life cycle (Fig. 1).

Fig. 1. Directional drilling on the industry consolidation curve (modified from Deans, Kroeger and Zeisel on HBR)

Not long after having survived the worst ever industry depression, today’s directional drilling service providers mostly focus on repairing balance sheets and rewarding shareholders, and are still gun-shy about M&A. Such an industry condition is perfect for a growth-oriented firm – that is able to secure low-cost financing, negotiate value-accretive acquisitions, integrate diverse operations, and retain technical talents – to consolidate the directional drilling space.

Here comes Cathedral Energy Services Ltd. (OTCPK:CETEF), a North American directional drilling company that emerges to take advantage of that opportunity. Below, I present an analysis of this small-cap oilfield service opportunity, using the investment approach as discussed in detail in the 2021 and 2022 Seeking Alpha interviews.

Cathedral Energy Services

Founded in 1998 under the original moniker of Directional Plus, publicly listed on TSX in 2000, and transitioned to an income trust in 2002, Cathedral Energy Services was converted back to a corporation in 2009 to concentrate on directional drilling, a rather challenging segment of the oilfield service industry.

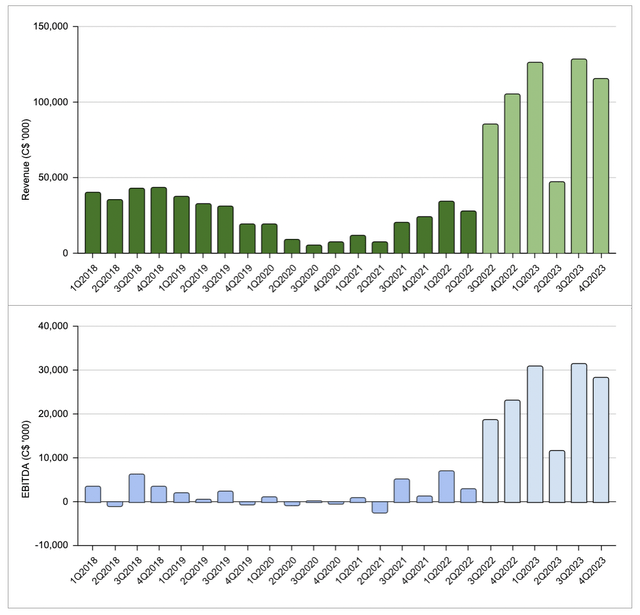

Cathedral managed to grow its annual revenue to a high of $275.4 million by 2014 before the industry downturn the following year. By 2019, its market share in Canada had declined below 3%, and profits had all but evaporated (Fig. 2). Then, the Covid-19 pandemic hit, sending the company into a struggle for survival along with the entire OFS industry.

Fig. 2. Quarterly revenue and EBITDA of Cathedral Energy Services, actual and projected (Laurentian Research, based on data from Seeking Alpha and Cathedral)

Tom Connors

Just when everybody thought it had fallen into oblivion for good, Cathedral Energy Services announced in February 2021 the appointment of Tom Connors as the new president, CEO and director. Connors was previously EVP at Ensign Energy Services Inc. (OTCPK:ESVIF), where he was in charge of seven business lines, including directional drilling and business restructuring and expansion into new regions. He oversaw the acquisition and integration of two directional drilling businesses at Ensign.

- To establish an immediate alignment of his interest with that of shareholders, Connors bought 1.15 million common shares at the then market price (C$0.20 per share) along with 575,000 warrants exercisable at C$0.24 within three years.

- Connors immediately set out to boost liquidity by announcing a non-brokered private placement to raise C$3 million, which was over-subscribed including 5,060,000 (40%) by insiders. He extended the existing credit facility to June 30, 2023, with full access to C$12 million revolving credit line, and secured an additional $1 million of liquidity through the Highly Affected Sectors Credit Availability Program that sees Business Development Bank of Canada guarantee a fixed interest rate loan from its lender.

- Connors then hired ex-Trican Well Services (OTCPK:TOLWF) director Ian Graham as CFO, and ex-Precision Drilling Corp. (PDS) executive Fawzi Irani as SVP-U.S. operations.

With liquidity and the core management team in place, Connors then began to implement a new strategy of accretive acquisitions, organic growth, and technological innovation to expand the company’s operating footprint in Canada and the U.S.

Acquisitions

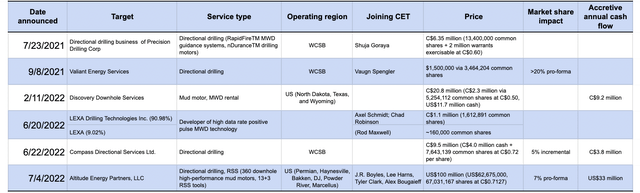

Under Connors, Cathedral went on an acquisition spree, to consolidate the fragmented directional drilling market. To that end, the company made six acquisitions within the last two years, paying a combination of cash and common shares at progressively higher per-share valuation (Table 1).

Table 1. Acquisitions made by Cathedral Energy Services under Tom Connors (Laurentian Research for The Natural Resources Hub based on company news releases)

The acquisition of Altitude in July 2022 – the biggest transaction so far – expands Cathedral’s footprint in the U.S. beyond the Anadarko basin in Oklahoma, giving it a significantly larger share in North American directional drilling market, including a 9% market share in the prolific Permian Basin.

The impact of these transactions are manifold:

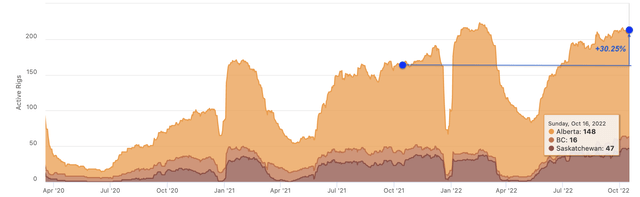

- They helped Cathedral gain scale in North American directional drilling market. Thanks to these deals, the company increased its market share in Canada from 5% in 2020 to 18-21%, and that in onshore U.S. from 1% to 7%. I especially like the company strengthening its presence in Canada, which is one of the few regions in the world where oil companies are aggressively drilling (Fig. 3).

- They enhanced the technological capability of the company, particularly in MWD and RSS.

- They strengthened the technical and managerial capability of the company, thanks to retained key employees, e.g., Shuja Goraya (director; CTO at Precision Drilling Corp), Chad Robinson (Cathedral CFO), Rod Maxwell (director), Lee Harns (president of the Altitude division), and J.R. Boyles (founder of Altitude, director of Cathedral).

Fig. 3. Active drilling rigs in Canada, showing 2022-over-2021 activity ramp-up (modified after Borreport)

Financial performance

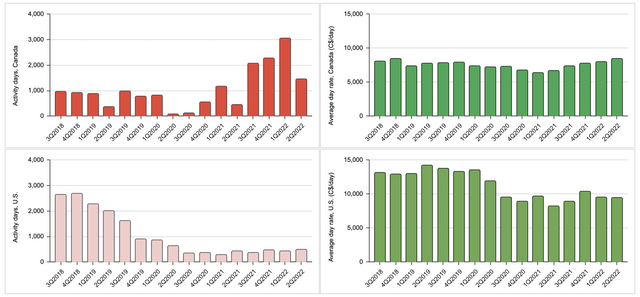

With seasonality considered, activity days in Canada increased substantially from the mid-2020 low. Average day rate in the country rose by 17.4% since 1Q2020.

In the U.S., activity days and average day rate are on the mend. Please note, the 2021 day rate was down due to lower revenue from rotary steerable system (or RSS) services, which are rented from a third party, and a reduction in ancillary sales (Fig. 4).

Fig. 4. Activity days and average day rates of Cathedral Energy Services in Canada and the U.S. (Laurentian Research for The Natural Resources Hub based on Cathedral financial filings)

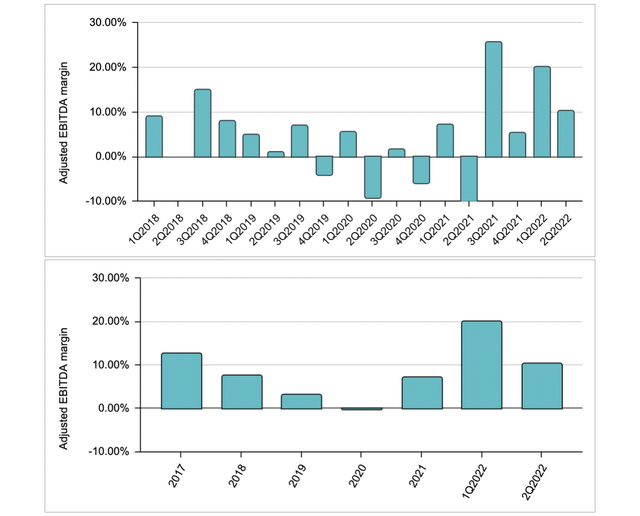

Consolidated revenue more than tripled from 2Q2020 to 2Q2022, with 2Q2022 top line reaching the highest level since 2019 (Fig. 2). Adjusted for seasonality, EBITDA margins also improved materially (Fig. 5).

Between revenue growth and margin expansion, adjusted EBITDA grew materially from 2020 to 2Q2022. As a matter of fact, Cathedral posted the highest level of second-quarter adjusted EBITDA since 2014 (Fig. 2).

Fig. 5. Adjusted EBITDA margin of Cathedral Energy Services (Laurentian Research for The Natural Resources Hub based on Cathedral financial filings)

Despite the impressive performance in the last two years, what Cathedral is projected to report in the 3Q2022 will most probably be a real jaw-dropper, because the company gains a full quarter from Compass and nearly a full quarter from Altitude. The powerful impact of the consolidation strategy will finally manifest itself.

- Indeed, with a confidence underpinned by booked jobs, Cathedral guided toward C$250 million in revenue, C$57 million in EBITDA and C$28 million in FCF for 2022 and C$417 million in revenue, C$102 million in EBITDA and C$62 million in FCF for 2023. In other words, Cathedral will clock a top line growth rate at ~300% in 2022 followed by an additional 67% in 2023, and EBITDA growth at 1,161% in 2022 and 79% in the following year.

Various signs seem to point to Cathedral possibly ripping the faces off short sellers in the next few quarters. Cathedral appears to be at the inflection point of a hockey stick-like growth curve (Fig. 2).

Upside and risks

Given the recent accretive acquisitions, It is incredible that all the explosive growth projected for the next few quarters has not been reflected in the valuation. The stock currently trades at 3.2X 2022E EV/EBITDA or 1.8X 2023E EV/EBITDA; FCF yield is estimated to reach 19% this year and 42% in 2023. According to Seeking Alpha data, small-cap peers of Cathedral, including Independence Contract Drilling (ICD), PHX Energy Services (OTCQB:PHXHF), and Precision Drilling Corp, capture 3.5-6.2X forward EV/EBITDA, while its larger-cap competitors Helmerich & Payne (HP) and NOV Inc. trade at 11.5-13.3X forward EV/EBITDA. Obviously, Cathedral trades at a discount relative to its peers.

Cathedral’s undervaluation may be explained by its misunderstood strategy as well as its smaller size. Firstly, six acquisitions in a span of one year (Table 1) led to a rapidly changing business, with all the moving parts for analysts to get a handle on. It does help some of the acquisitions are private companies. Secondly, investment money typically trickles down from large-cap such as Schlumberger, via mid-cap such as NOV, to small-cap stocks, in an oil upcycle; consequently, small-cap gems such as Cathedral are yet to be discovered by institutional investors.

I believe the next few quarterly earnings reports will serve as a powerful catalyst that may drive re-rating of the stock, possibly in the magnitude of 3-4X. Between a possible re-rating and the projected profit growth, there will likely be a lot of capital appreciation to be had. Once Cathedral has shaken off the penny stock stigma, institutional money is expected to chase the stock to the next level in market cap.

Risks

That attractive upside comes with a slew of risks, including operational, liquidity, and transactional factors:

- Cathedral is not directly exposed to daily gyrations of oil and gas prices as its customers – E&P operators – are. However, medium-term commodity price variations still have a strong impact on rig contracting and equipment rentals.

- Labor shortage continues to be a bottleneck for oilfield service vendors, although Cathedral has done a good job at retaining talent that used to be with the acquired businesses. Going forward, Cathedral still faces challenges in crewing reactivated equipment, as does the rest of oilfield service industry. The silver lining, however, is industry-wide tight labor conditions will help maintain a constructive pricing environment.

- Aggressive M&A exposes Cathedral to transactional risks. It may fail to consummate transactions. Anticipated growth and synergies may not come to fruition due to ineffective integration of the acquired and existing business functions. As the oil cycle reaches higher, it may become increasingly harder to identify attractive acquisition targets and secure favorable transactional terms. It is worth noting that, when value can no longer be added on a per-share basis, the investment thesis as presented here will cease to be valid.

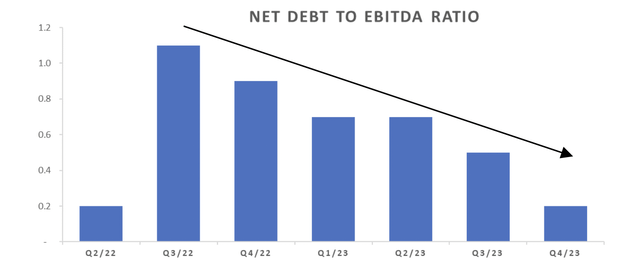

- To finance M&A, Cathedral needs to raise debt and issue equity. Cathedral has a relatively conservative balance sheet; however, additional debt may over-extend its book, while equity issuance may dilute the existing shareholders. The acquisition of Altitude helped increase net debt to C$98 million and the net debt to EBITDA ratio to 1.1X. Cathedral plans to reduce the ratio to sub-1.0X levels by the end of the year, using cash at hand, free cash flow and revolving credit (Fig. 6). The company has a $12 million bank credit facility, and expects to generate C$28 million of FCF in 2022.

Fig. 6. Net debt to EBITDA ratio of Cathedral Energy Services by quarter (Cathedral Energy Services)

It is reassuring the directors and executives of Cathedral control ~7% of the common shares, giving them substantial skin in the game and aligning their interest with that of retail shareholders. It is also comforting to know that, thanks to Connors, the company counts Precision Drilling Corp. and Wilks Brothers as strategic shareholders, who will likely play an important role in securing financing for future M&A deals.

Investor takeaways

Once struggling to maintain market share, Cathedral Energy Services – a North American directional drilling specialist – has transformed itself into a vibrant consolidator of its highly fragmented industry.

The company is at the inflection point of a hockey stick-like curve of growth. Recent acquisitions are estimated to result in imminent, explosive growth in top line, EBITDA and free cash flow. Yet the under-the-radar stock still trades at attractive EV/EBITDA multiples, and is still deeply-undervalued relative to industry peers.

The bargain stock price may not last for much longer. The neck-breaking growth and deep undervaluation could become impossible to ignore when the company reports its 3Q2022 results in early November 2022.

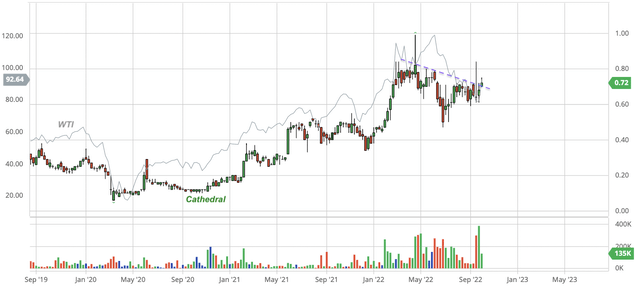

Therefore, I believe it is an opportune time to establish a speculative long position in Cathedral, in the hope of reaping significant gains as the company executes its consolidation strategy in a bullish industry environment over the next few years (Fig. 7).

Fig. 7. Stock chart of Cathedral Energy Services (CET.TSX), shown with WTI benchmark oil price (modified from Seeking Alpha and Barchart)

Be the first to comment