Althom/iStock Editorial via Getty Images

The Best Athletic Apparel Brand on the Market

Founded in 1998 by Chip Wilson in Vancouver, Canada, Lululemon (NASDAQ:LULU) is a yoga-inspired, technical athletic apparel company for women and men. What started off as a design for women’s yoga apparel is now a multi-billion dollar business and one of the top global athletic apparel brands. In this article, I will conduct a deep dive into Lululemon and why I recently bought the business despite its slightly premium valuation.

Overview

Per its 10-k, Lululemon is a designer, distributor, and retailer of healthy lifestyle athletic apparel and accessories. The company’s vision is to be the experiential brand that ignites a community of people through sweat, grow, and connect, which it calls “living the sweatlife.”

With a focus on curating the most technically advanced and high-quality fabrics for its customers, Lululemon is primarily focused on the yoga, running, and training segments of athletics. In recent years, Lululemon has expanded its product depth by adding accessories and footwear to its merchandise (more on this later).

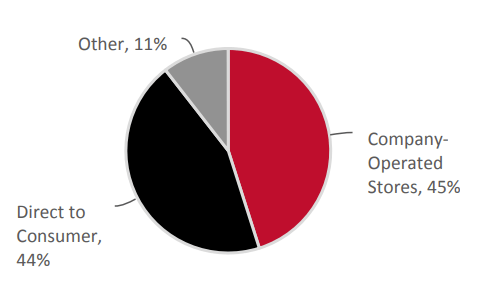

Currently, Lululemon has three primary revenue channels through its customers.

- Company-Operated Stores

- Direct to Consumer

- Other

Revenue Breakdown (Annual Report)

The other category comprises temporary outlet stores, its MIRROR segment, certain supply and license agreements, and warehouse sales. However, the primary revenue drivers are comprised of retail in-store sales and e-commerce (D2C).

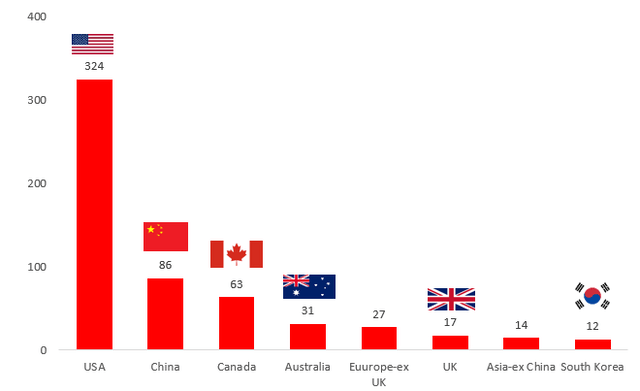

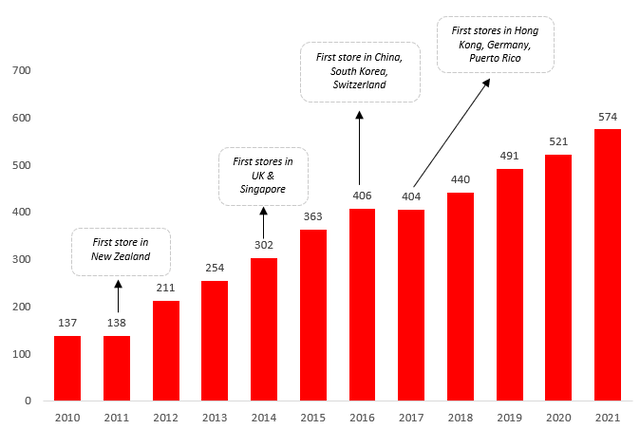

As of fiscal year-end 2022, Lululemon operated a total of 574 stores across the globe. As of Q1-23, the company opened 5 net new stores, bringing this total up to 579. The bar chart below shows the stores by country/region.

Author Created (Company Filings)

The Bull Case

Combination of an Established Business & Growth

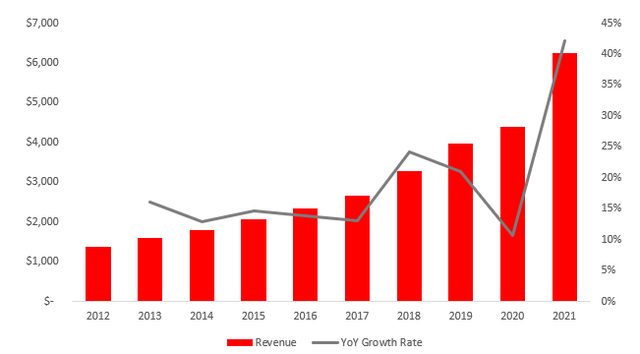

Lululemon’s combination of a well-established business and growth is a key reason to own this business. Since its inception, Lululemon has continued to deliver on its promises and has realized massive sales growth over the last 9 years. The chart below exemplifies LULU’s ability to consistently grow revenue in double digits for the past 9 years. What’s even more impressive is that even during the height of the COVID-19 pandemic, which bankrupted many retailers, Lululemon managed to grow annual revenue by 11% YoY due to Omni channel strength, digital adoption, and a strong brand.

Author Created (Company Filings)

In times of significantly overvalued tech and SaaS companies, it almost appears that investors have two choices. 1) Sacrifice returns for an established business with high profitability, minimal growth, and a strong moat, or 2) buy companies that are not established, have a weak moat, no profitability, but may encounter hyper-growth and provide investors with market-beating returns. Lululemon provides the best of both worlds with an established business, exceptional profitability, and a significant runway of growth ahead.

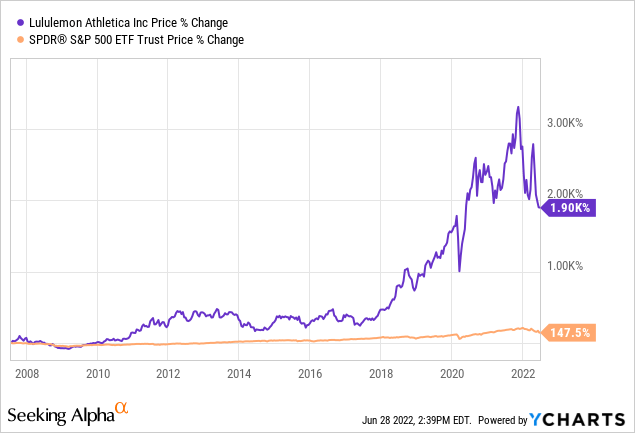

A key indicator of whether a company will provide shareholders with market-beating returns is the management’s ability to follow through on its promises. Simply put, if management is able to achieve its objectives, it is likely shareholders will witness exceptional returns. As depicted by the chart below, Lululemon has provided wonderful returns to shareholders since its IPO, significantly outperforming the broader market (SPY).

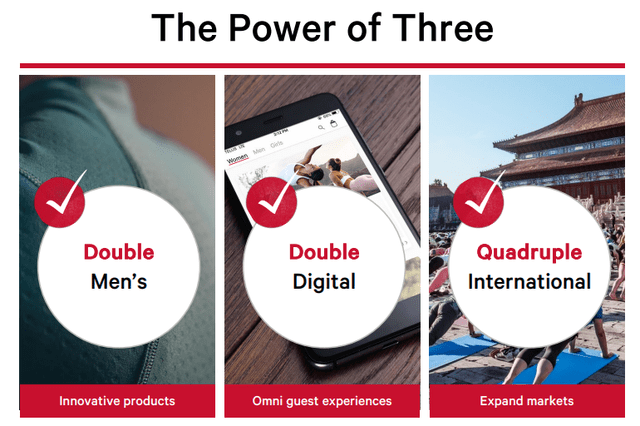

In 2018, Lululemon implemented its Power of Three growth strategy focused on three main categories.

1. Product Innovation

Lulu’s mission in this segment was to expand its product depth through more product selection with a focus on men’s products.

2. Omni Channel Experience

The omnichannel was focused on Lululemon increasing its online presence to further engage customers digitally.

3. International Market Expansion

Relatively straightforward, LULU’s main focus was to penetrate international markets and continue to penetrate the athletic apparel market, of which it has a mere 1% market share. Of course, as a premium retailer, Lululemon will never capture all of the TAM (total addressable market). However, it is clear based on its revenue growth and future growth plans, which I’ll describe below, that the retailer is still in the early innings of growth and has a significant runway ahead.

Power of Three Growth Strategy (Investor Presentation)

The future looks even brighter with the business achieving its 5-year goals in three years through doubling its revenue from F’18. On April 2022, Lululemon hosted its investor day meeting and gave shareholders more to look forward to through the introduction of a new five-year growth strategy called the “Power of 3 X 2”. In short, Lululemon expects to double revenue over the next five years into F’2026 through the same core pillars: doubling men’s, doubling digital, and quadrupling international, which will result in revenue of $12.5B in the next 5 years.

As a retailer, Lululemon has plenty of optionality and growth levers it can pull, significantly reducing the risk to shareholders. Rather than being a one-trick pony solely focusing on international expansion, Lululemon continues to drive growth within the Men’s segment and is expanding from its core run, train, and yoga merchandise. Despite its focus on growth within the three pillars, Lululemon remains focused on obtaining double-digit growth in its women and within North America.

Strong Comparable Sales & Industry-Leading Metrics/Best-In Class Financials & Valuation

One of the most important metrics in evaluating the success of a retailer is same-store-sales (SSS), also known as comparable sales. Essentially, SSS is a metric that doesn’t factor in sales from new stores and gauges how existing stores have performed on a YoY or QoQ basis. In LULUs most recent Q1 earnings report, the company boasted SSS of 29%.

For Q1, total net revenue increased 32% to $1.613 billion, ahead of our guidance, driven by outperformance in North America. Comparable sales increased 29% with a 24% increase in stores and a 33% increase in digital. On a three-year CAGR basis, total revenue increased 27%, an acceleration from Q4.

This proves that Lululemon is not solely reliant on opening new stores to supercharge growth. While new store openings are still a key driver of revenue growth for Lululemon as depicted in the YoY store count chart below, the twin engines of new store openings and existing SSS growth will be the core drivers of LULU’s growth.

Author Created (Company Filings)

The retail industry is also known for razor-thin net and gross margins due to the high COGS and operating expenses required. Industry giants such as Costco (COST) and Walmart (WMT) boast 2% and 1% net margins, respectively. Contrary to tech companies that are asset-light, retailers have high inventory costs and are significantly affected by macroeconomic conditions such as inflation and the supply chain.

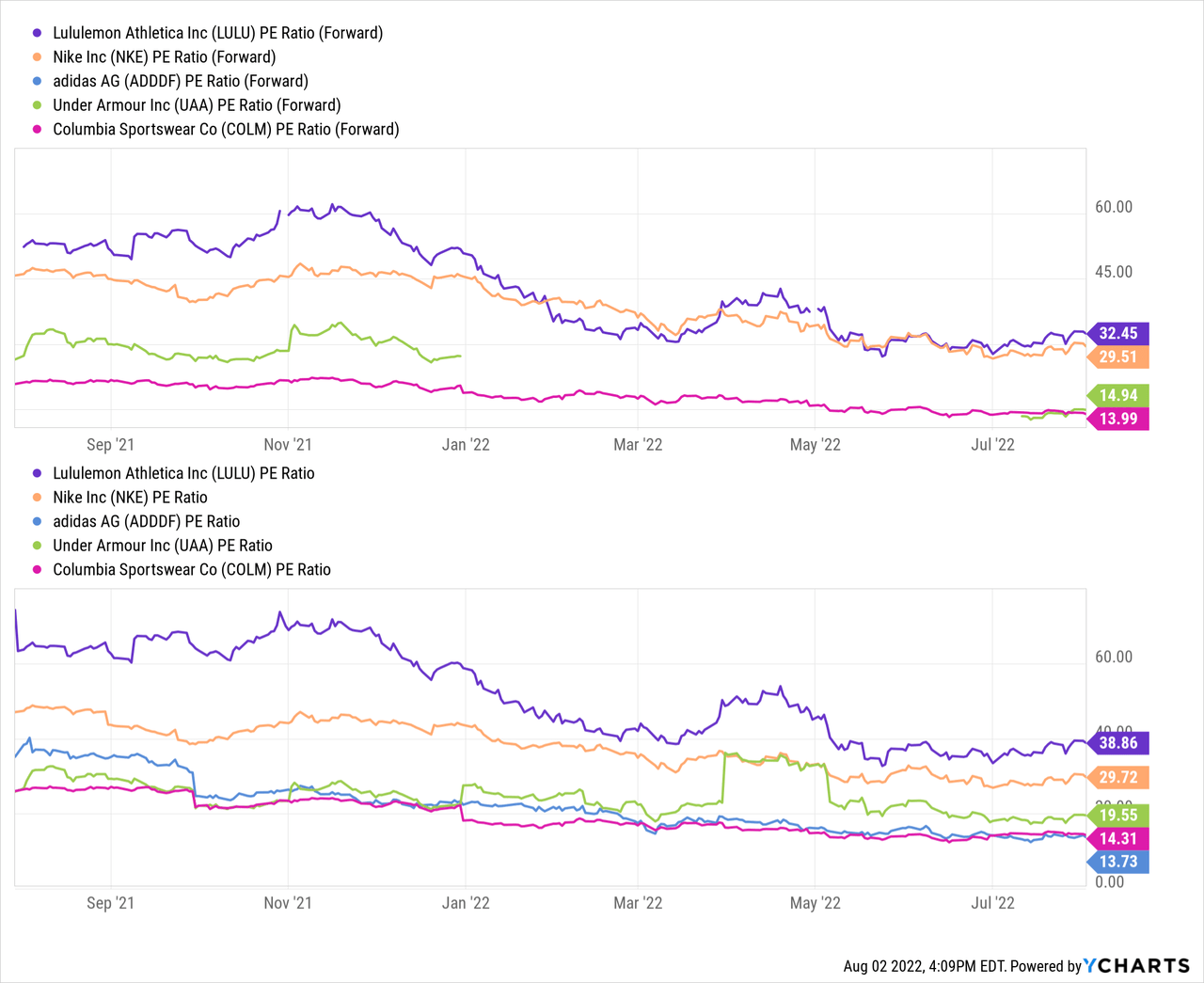

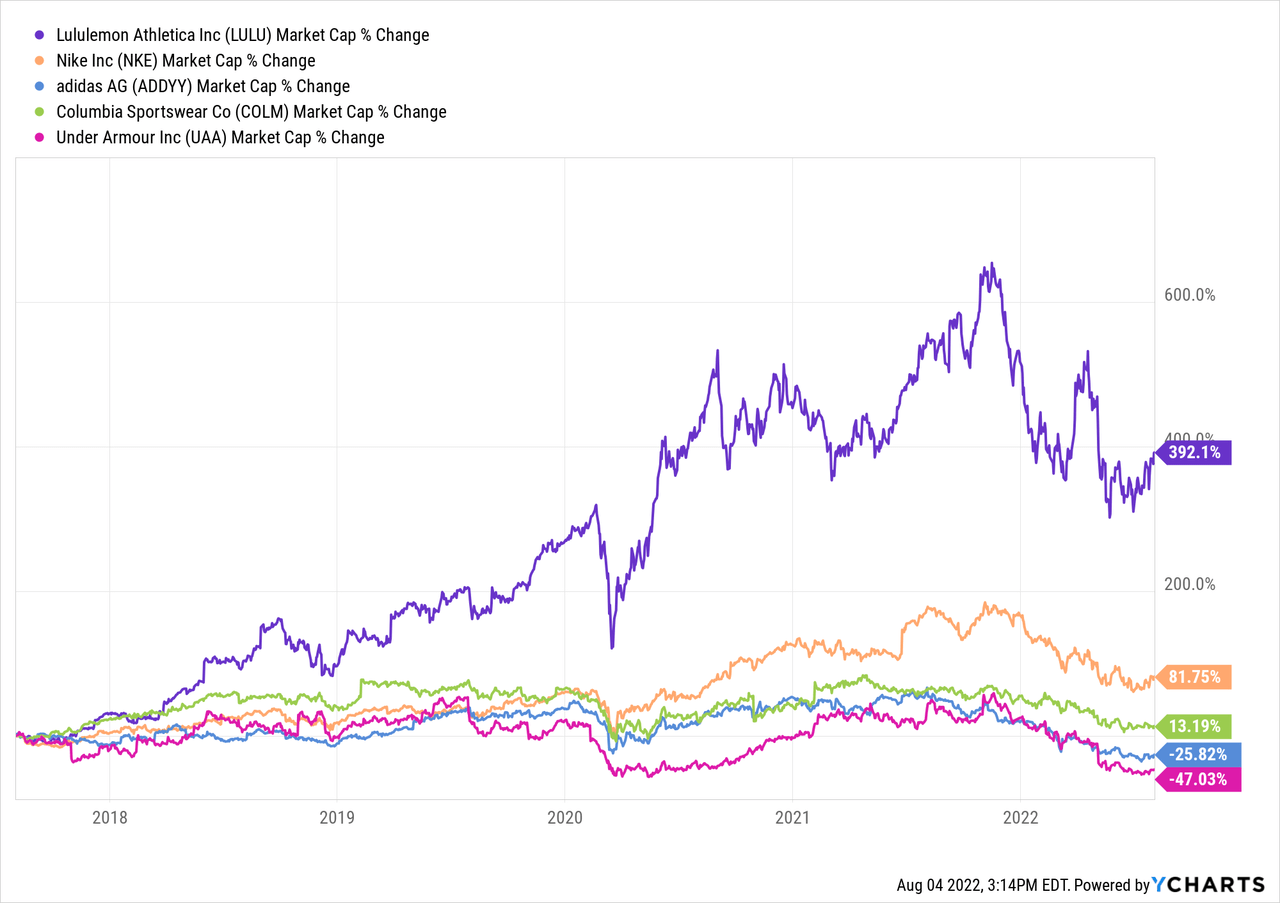

Nevertheless, despite the ongoing challenges of operating a retail business, Lululemon continues to have best-in-class margins and growth relative to its peers. As identified in the company’s 10-K, Lululemon identifies its pureplay competitors as NIKE (NKE), adidas (OTCQX:ADDYY), Under Armour (UAA), and Columbia Sportswear (COLM).

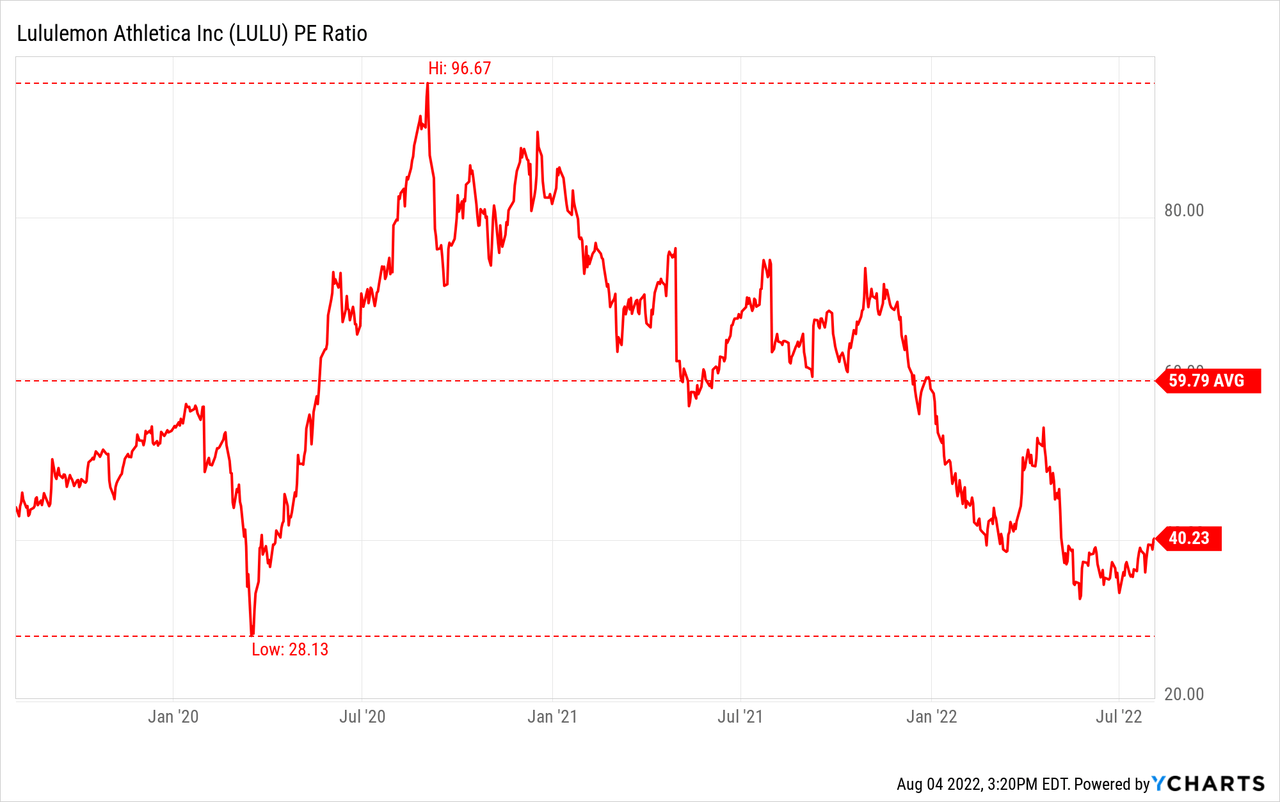

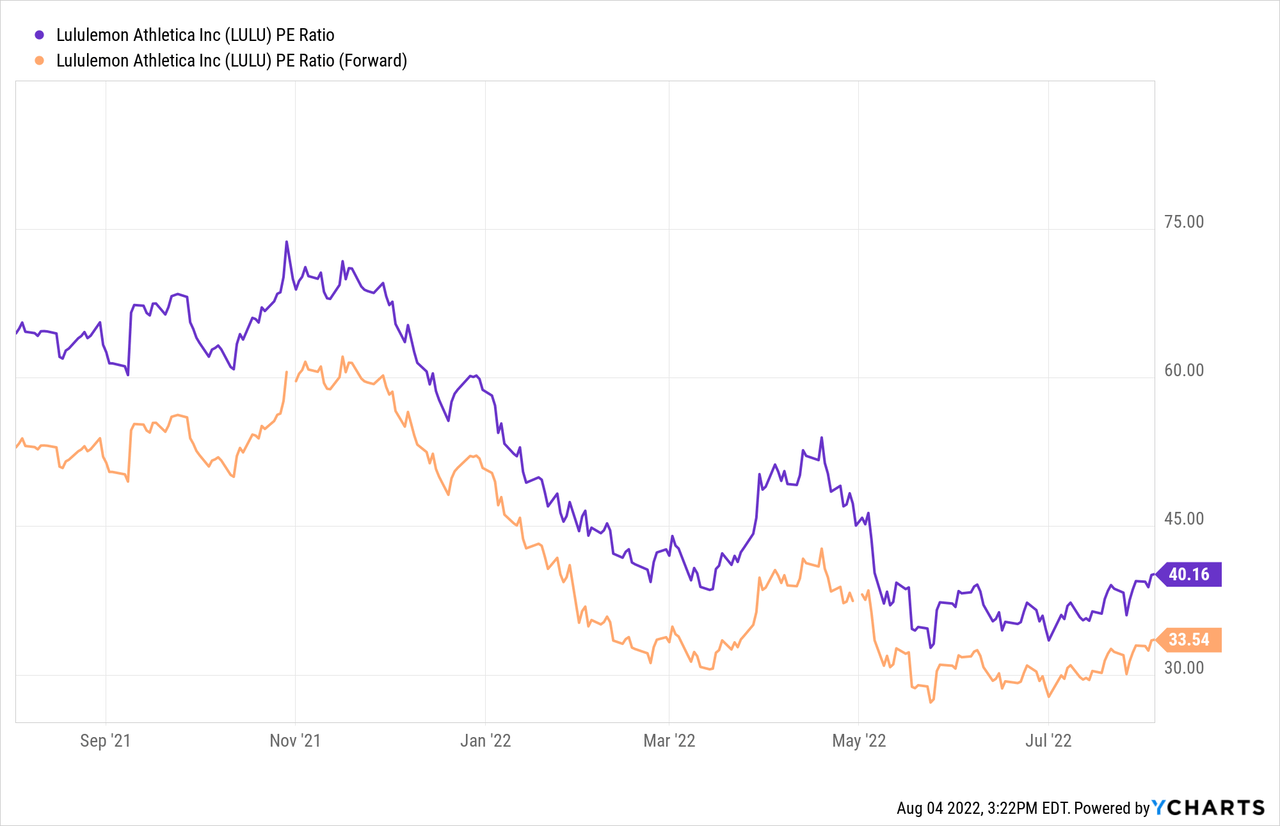

As depicted by the chart below, Lululemon appears to be overvalued based on its P/E ratio. However, relative to its peers, LULU’s best-in-class margins and growth rates justify its higher trading multiple relative to its peers.

By almost doubling its revenue in three years and continuing its plan to double revenue to $12.5B in 5-years, 32.45x forward earnings is a fair price to pay for a high-growth and well-established business.

Brand Loyalty & Product Depth

As previously mentioned, SSS is a very positive trend for Lululemon indicative of the strong brand loyalty amongst customers across all channels. As a premium brand priced significantly higher than its peers, brand loyalty, among other factors, and key to Lululemon’s success. In its most recent Q1 earnings report, Lululemon posted double-digit growth in all three growth categories listed earlier in this article (see table below):

| Women’s Revenue 3yr CAGR | 24% |

| Men’s Revenue 3yr CAGR | 30% |

| Company Operated Store Revenue 3yr CAGR | 13% |

| Digital Revenue 3yr CAGR | 51% |

| International Revenue 3yr CAGR | 37% |

| North American Revenue 3yr CAGR | 26% |

While Lululemon does not provide investors with concrete customer retention metrics, it is evident based on its long track record of success that there is a high level of brand loyalty amongst Lululemon customers. Cultivating a community of loyal customers and selling the highest quality fabrics have contributed to LULU’s success in the athletic apparel industry.

In Q1, Lululemon launched its first official footwear product called Blissfeel. Lululemon is using its technical design expertise to further its product depth and immerse itself in footwear, launching the “Blissfeel” shoe in March. Here’s what management had to say in the first quarter conference call 2 months ago:

We designed our shoe for women first. We introduced our first shoe, Blissfeel in March, and we were proud that it was named the best women’s specific shoe in 2022 by Runner’s World. The response has been enthusiastic. And since we were prudent with our inventory buys, we have seen out of stocks. Although we expect to be in a better inventory position in the coming weeks, demand has far exceeded our sales forecast. As a result, we do anticipate that we will be chasing into additional inventory for the remainder of the year.

While footwear is not yet a major part of the thesis, Lululemon intends to tackle the footwear market with full force. Despite the footwear market being fragmented with major players, Lululemon seems to be up to the task. Management noted that there will be two more styles at the end of the year.

We just launched our second style, the Restfeel slide this week, and we remain on track to roll out our next two styles later this year, Chargefeel and Strongfeel. This is just the beginning for us within this category, which has considerable opportunity.

Footwear aside, Lululemon has also committed to expanding within existing categories such as Golf, Running, Tennis, Throwbacks, and Hiking. It’s safe to say that with an already strong product line and the commitment to expand within its categories, Lululemon is still in the early innings of growth.

Financials

As mentioned prior, many companies with exceptional growth prospects have not yet achieved profitability. Unlike many, Lululemon has seen robust revenue growth since its inception and turned that into – dare I say it – actual profits.

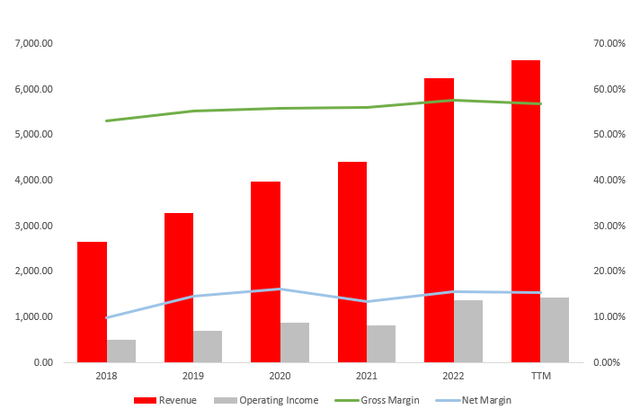

Author Created (Company Filings)

With around $6.2B in 2022 revenue, Lulu’s operating and net margins continue to widen, supercharging its profitability and cash flow. With plans to increase its revenue to $12.5B in the next 5 years (implying a 15% CAGR), Lululemon shows no signs of slowing down its growth.

With free cash flow of $994M on $6.25B in revenue, Lululemon generates a whopping 16% FCF margin. In short, for every dollar of revenue, Lululemon generates $0.16 in free cash flow (OCF – CAPEX).

| LULU | 16% |

| NIKE | 9.5% |

| Columbia | 10.2% |

| Under Armor | 10.5% |

| adidas | 9.2% |

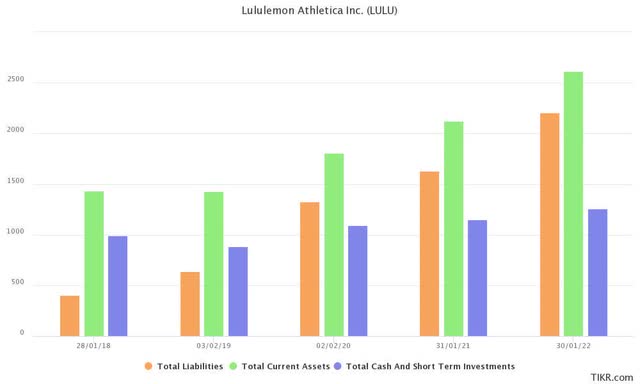

With a healthy $1.3B cash balance as of F’21 and low leverage, Lulu’s strong balance sheet furthers its attractiveness to shareholders.

As a retailer and company as a whole, all three of LULU’s financial statements are exceptional. With high profitability and free cash flow generation combined with robust revenue growth and a strong balance sheet, there is no question about LULU’s financial health.

Risks

Inflation & Supply Chain

A key risk to all retailers as of late is the macroeconomic threats of inflation affecting the cost of freight and raw materials. As input costs rise, retailers’ already thin margins are threatened, posing significant risks to shareholders. Management commented on the Q’1 earnings call, discussing air freight costs and whether they will be passing them on to the customer.

So in terms of gross margin, we’re guiding to 200 basis points of pressure in Q2 and then approximately 100 to 150 basis point decline for the full year. The second quarter does include 150 basis points of air freight pressure year-over-year. And then we also have increased our outlook for the year in terms of air freight pressure to 30 basis points.

With a strong brand, it’s safe to say that Lululemon has a level of pricing power and the ability to transfer some of those costs to its customers. Despite this, Lululemon doesn’t seem to be in a rush to make this decision.

In terms of pricing, we’re taking modest price increases on about 10% of our assortment. As we said before, we strategically look at prices in terms of quality and make of our goods and the competitive landscape, and we’ll continue to use that as a strategy as we move forward.

While inflation and supply chain are macroeconomic risks for every business, Lulu seems poised to overcome this risk without thinning margins due to its strong competitive positioning in the market, cost control, and pricing power.

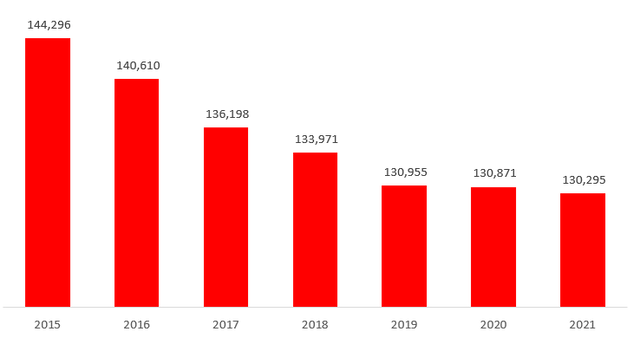

Share Buybacks

As if growth and a strong moat aren’t enough, Lululemon is buying back shares as a form of capital allocation. As depicted by the chart below, Lululemon has committed to reducing its diluted weighted average share count, providing further value to shareholders. While many businesses who buy back shares do so due to a lack of reinvestment and slowing growth, it is clear that is not the case for LULU.

Author Created (Total Share Count)

In Q1, we repurchased approximately 700,000 shares at an average price of approximately $328. At the end of the quarter, we had approximately $955 million remaining on our recently authorized $1 billion repurchase program.

While buybacks are by no means a thesis for owning a business, bolstering EPS via reducing the outstanding shares coupled with a strong competitive advantage and high growth will reward existing shareholders that hold on.

Final Takeaway

Ultimately, Lululemon has carved out a large niche in the extremely competitive athletic apparel space. Starting out as a women-first brand, Lululemon continues to expand its offering for men, growing its store count and customer base.

As visualized above, Lululemon has outperformed its peers in terms of market capitalization, providing its shareholders with outstanding returns. Despite this, Lululemon continues to capitalize on its Power of Three strategies, with significant growth across all pillars. As it continues to expand its categories, product depth, and store count, Lululemon has plenty of room ahead.

It is not often that you come across Lululemon this cheap, and I believe now is a great entry point for new shareholders or to increase your position size for existing shareholders.

For the reasons stated in this article, I recommend a Strong Buy for this top dog retailer as a long-term holding in your portfolio.

Be the first to comment