Felbaba Volodymyr/iStock via Getty Images

To power more of humanity from the sun now more than at any other time in contemporary human history has a clear and direct route to becoming reality. Herzliya, Israel-based SolarEdge (NASDAQ:SEDG) has been helping deliver on this reality since its founding in 2006. The company develops and retails solar inverters for photovoltaic arrays. An inverter is a component of solar panel systems which changes the direct current electricity captured by the panels into alternating current. AC current is the standard flow of electricity required to connect to the electricity grid and power household appliances.

The company began commercial shipments in 2010 and has since shipped at least 34.2 GW of its DC inverter systems, with its products installed in solar photovoltaic systems in 133 countries. The company also sells home EV chargers, energy generation monitoring software, battery energy storage products, and other solar-related products to residential, commercial and utility-scale customers. This renders SolarEdge as a direct play on the ongoing solar boom that is about to become a big bang on the back of the recently signed Inflation Reduction Act. The Act allocates $370 billion over 10 years to decarbonization initiatives and is the largest climate and clean energy investment in US history.

The big bang comes from the Act supercharging an even faster shift to solar by bringing forward new utility-scale solar deployments through what is set to be an unprecedented level of fiscal government intervention in the industry SolarEdge serves. The Boston Consulting Group has forecasted that the incentives included in the Inflation Reduction Act could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030. This would be up from around 20% of production currently. Indeed, utility-scale solar deployments alone are set to increase by 40%, around 62 GW, over pre-IRA projections through 2027. The Act provides incentives for all of SolarEdge’s customer base and should see the company’s revenue growth rate potentially speed up in the years ahead.

Scaling Revenues And Profits As Solar Demand Soars

SolarEdge last reported earnings for its fiscal 2022 second quarter, which saw revenue come in at $727.8 million. This was an increase of 51.6% over the year-ago quarter, but a miss of $1.89 million on consensus estimates. This came on the back of robust demand for the company’s many products, with 251 MWh of batteries, 5.2 million power optimizers, and 228.4k inverters shipped during the quarter.

Revenue from the solar segment reached $687.6 million, up 59% from $431.5 million in the year-ago quarter and 13% sequentially from $608 million in the first quarter of fiscal 2022.

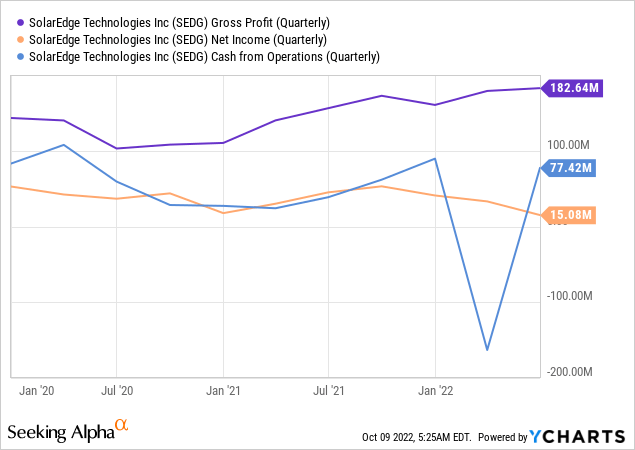

This strong revenue growth supported a gross margin of 25.1% during the quarter. However, this was down from a gross margin of 32.5% in the year-ago quarter, a 740 basis point movement that was due to unfavourable forex movements. Gross margin was also down sequentially by 220 basis points as the euro-to-dollar forex rates deteriorated and management not raising prices to counter the negative movement.

Cash flow from operations still remained strong on the back of this and came in at $77.4 million during the quarter, up from $38.7 million in the year-ago period, as the lower margins were countered by higher revenue. This meant cash and equivalents and other sources of short-term liquidity net of debt totalled $973.3 million as of the end of the quarter. Adjusting the company market cap for this provides an enterprise value of $10.78 billion. This is a 4.38x multiple against SolarEdge’s trailing 12 months’ sales. Whilst cheaper compared to its 52-week high, it is around 70% higher than its sector average. Bulls would be right to state that SolarEdge comes with higher growth and a strong market position. Indeed, using forecasted revenue for 2022 and this multiple is compressed to 3.51x.

A Future Under The Sun

The recently passed Inflation Reduction Act represents an 800-pound gorilla set to further bolster an industry already experiencing long-term structural growth. The Act will materially ramp up the rollout of clean energy in the United States and will catalyze a generational boom in utility-scale solar.

The sun will last for another 7 billion to 8 billion years, so it seems like an obvious choice to more extensively use it as a source of power for our economy. SolarEdge has been a big winner in the historical growth of solar. This is now set to experience a big bang in the years ahead as national governments around the world make clean energy a critical building block for their post-pandemic economic recoveries and as part of their long-term response to the current energy crisis. Hence, SolarEdge remains a strong play for investors looking to ride the growth of solar. The drive towards clean and renewable solar energy is picking up, and current margin headwinds will eventually normalize.

Be the first to comment