jetcityimage

After months of attempts to contain inflationary pressures, the likelihood of a recession is beginning to increase. Some articles argue that we should be more concerned about the recession next year than rising inflation.

Kroger (NYSE:KR) is no exception to the effects of the predicted economic downturn, which are now evident in its margins. In fact, its price has fallen by more than 25% since the last time I examined KR. Despite its weaker outlook than last year, KR’s growing dividend yield and positive margin make the company more appealing in its further drop.

Company Overview

While economic challenges linger, KR is committed to making a difference in society. According to management, as part of their Zero Hunger | Zero Waste initiative, they are on track to donate 3 billion meals by 2025.

KR also succeeds in looking after its employees, averting possible union strikes after reaching an agreement with union workers. Additionally, it maintained its reputation for its affordable prices, strengthening its digital operations, and providing unprecedented customer discounts.

During the quarter, digital coupon engagement hit an all-time high with 750 million digital offers downloaded, totaling almost $1 billion in savings. Our fuel rewards program continues to resonate with customers as more than 600,000 incremental households engaged with our fuel rewards program this quarter compared to last year. And our fuel reward redemption rates were also up significantly. Source: Q2 2022 Earnings Call Transcript

It is also worth mentioning that KR is still in a better position when it comes to cooking at home rather than eating out. KR and Rachel Ray, a well-known TV Host, have collaborated to promote home-cooked meals. These initiatives will help its top line to grow in the future, despite the expected economic downturn.

Leading To A Sustainable Top Line

KR’s total revenue increased by 9.33% year-over-year to $34,638 million this Q2 ’22 from $31,682 million during the same period last year. The company’s top line performance remains relatively strong compared to its peers. Looking at its trailing year-over-year growth, we can see that it has dropped to 2.09% from 4.07% in the previous fiscal year, slower compared to 2.84% of Albertsons Companies (NYSE:ACI) but is still stronger than 2.05% of Walmart (NYSE:WMT).

A piece of this growth was attributed to its digital sales, which increased by 8% year over year and reinforced by its delivery solution, which increased by 34% year over year. In addition, KR is further investing in enhancing its seamless digital ecosystem, as stated below.

…Additionally, we are excited to expand the Kroger Delivery network to more customers in four new geographies during the quarter through spoke facilities in Austin, Birmingham, Oklahoma City and San Antonio. This brings our total CFC and spoke count to 18.

We also continue to invest in our pickup business, where demand remains strong. During the quarter, we increased capacity and shortened wait times to improve our customer experience. We also invested in technology and implemented process efficiencies, which helped lower our cost to serve. Source: Q2 2022 Earnings Call Transcript

Appealing Dividend Yield

With its steady top line growth and good dividend yield in comparison to its peers, KR presents an attractive dividend income prospect. Analysts estimated its total revenue to be around $146.72 billion to $151.11 billion in FY22 or a midpoint annual growth rate of 7.67% YoY in FY22, above its 5-year CAGR of 4.08%. Its payout ratio also shows an improvement to 25.5% from the 35.59% recorded last fiscal year.

Given its growing dividend yield of 2.38%, higher than the 5-year average of 2.05%, KR seems attractive, especially considering the potential fear-driven drop. Although the company’s margin remains pressured, another point of concern is its declining FCF outlook amounting to around $2,300 million to $2,500 million compared to its $3,576.00 million recorded in the previous fiscal year. A part of the decline relates to its increasing CAPEX spending for this fiscal year, which amounts to $3,500 million on average, up from $2,614 million last year.

Another value-adding factor, KR’s dividend yield of 2.38%, remains high compared to dividend-paying peers such as ACI’s 1.90% and WMT’s 1.70%.

Pressured Margin

This quarter’s operating income grew to $975.00 million from $920.00 million recorded in Q2 ’21. However, looking at its operating margin this quarter, it actually slowed to 2.81% compared to its 2.90% recorded in the same period last year. As quoted below, this decline is mainly due to LIFO charges due to rising inflation.

Due to continued heightened levels of product cost inflation, we recorded a LIFO charge for the quarter of $148 million compared to $47 million in the prior year. Source: Q2 2022 Earnings Call

Given the one-time nature of the LIFO charge, KR’s margin will likely be affected by prolonged inflationary pressures.

With the management forecast of operating income to be $4.6 billion to $4.7 billion this FY22, we can estimate that KR’s operating margin this fiscal year will be approximately 3.12%, up from its 2.69% recorded in the last fiscal year. Finally, Its trailing ROE of 31% increased from 17% in ’21 to 28% in ’20, making it more appealing.

Fundamentally Attractive

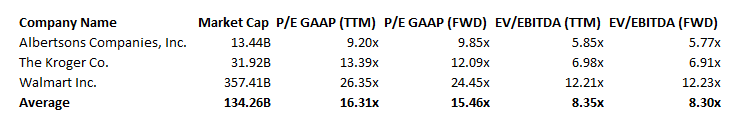

KR: Relative Valuation (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

KR’s trailing P/E of 13.93x unlocks a considerable discount to its peer group’s trailing P/E of 16.31x. WMT looks to be the most expensive stock in the group, while ACI appears to be the most undervalued, with a trailing P/E multiple of 26.35x and 9.20x, respectively. Furthermore, KR is already trading at Wall Street’s low range target of $43, making a further drop attractive as of this writing.

Trading Near Support Zone

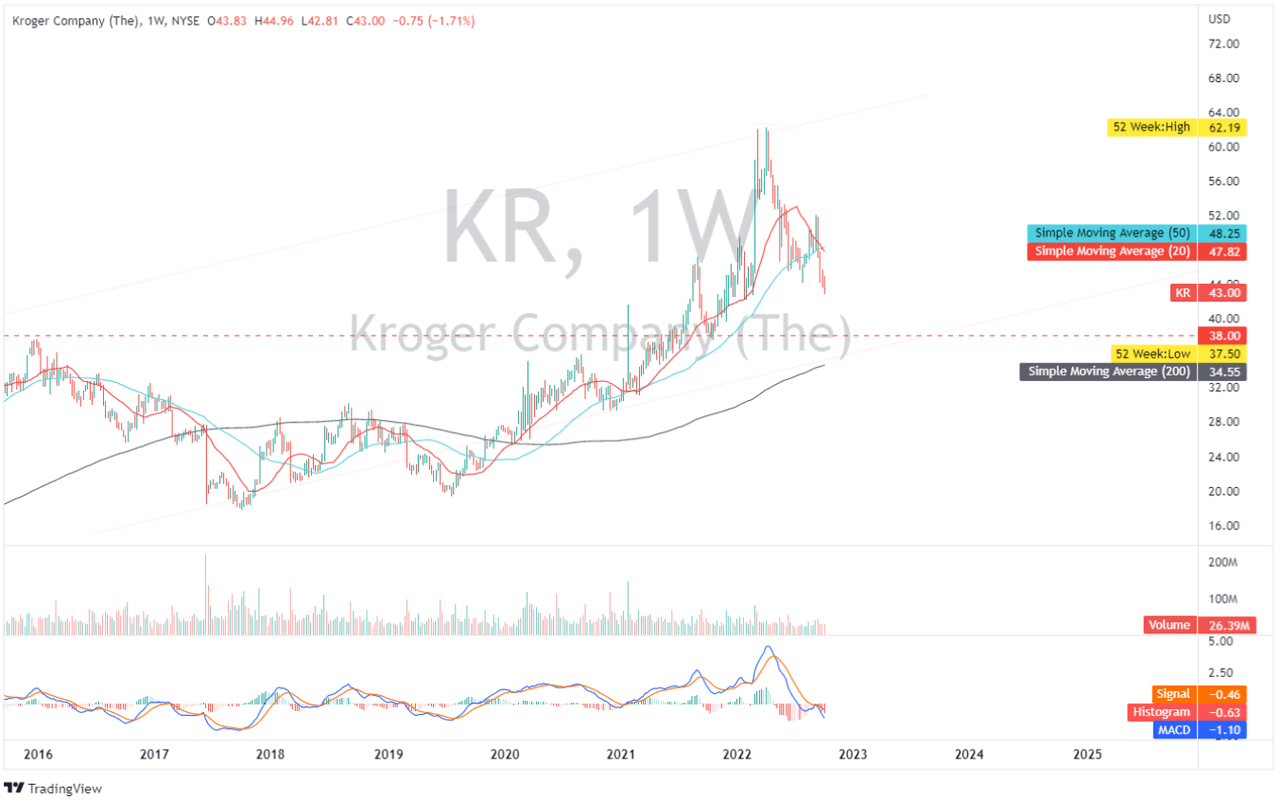

KR: Weekly Chart (Source: TradingView.com)

KR just broke below its 20- and 50-day simple moving averages, as shown in the chart above, signaling that the bearish trend might continue. Furthermore, it broke its immediate support of around $44. If the negative trend continues, I think the $41 to $38 zone will act as its next logical support, revealing a solid long entry target in the next trading weeks.

Conclusive Thoughts

KR reassured its investors with a new $1 billion share buyback program and a higher CAPEX forecast than last year, shedding light on its FCF and operational margin concerns.

I believe KR remains liquid, as seen by its improving debt-to-equity ratio of 2.11x, which is better than its 5-year average of 2.19x. In addition, according to the management, KR remains liquid with a total net debt to adjusted EBITDA ratio of 1.63x, which is better than its previous ratio of 1.78x and below its goal range of 2.30x to 2.50x.

Lastly, the management reassures its investors that they can still deliver a total shareholder return of 8% to 11%. KR is trading at logical support and fundamentally undervalued again, making this stock a buy on today’s weakness.

Thank you for reading and good luck!

Be the first to comment