Kiran Ridley/Getty Images News

Dear readers/Followers,

Rheinmetall (OTCPK:RNMBY) would probably have qualified as one of the most uninteresting companies around before the Ukraine-Russian War. The conflict that sparked in Europe has renewed interest in European defense stocks, as virtually every nation is looking to its own defenses and potentially stocking up and expanding on its weaponry and defense.

That puts companies like this one in a massively attractive position – and one worth considering for your portfolio. I pushed money to work relatively quickly after the invasion – not just in Rheinmetall, but in ancillary and sector-similar companies as well.

Let’s see how things have gone and what we can expect from Rheinmetall here.

Rheinmetall – Revisiting the Company

Rheinmetall AG is one of the largest defense companies in Germany. It has a history that goes back well over 130 years, a market cap of around €6.6B, and it’s one of the companies that has seen perhaps the most interest from the recent changes in German defense policy. You might expect this company, based on its name, to be a basic materials/mining company, but this is not the case.

Rheinmetall is an international arms manufacturer, and it’s one of the few that remain in Germany after two world wars and the cold war. The company is a European play on Aerospace, vehicles, weapons, and defense. It’s a defense conglomerate with five business segments: Weapons & Ammo, Vehicle Systems, Electronic Solutions, Sensors/actuators, and aftermarket parts. A pretty big portfolio coverage for what is essentially foundational defense products and offerings.

However, Rheinmetall doesn’t just build defense-related products, or it wouldn’t have survived years of low defense spending in Germany and Europe which we’ve seen a drop over the past few years. The Rheinmetall business model focuses on two distinct revenue streams, from the segments above. The first is the obvious defense industry. The second is automotive supply parts. The latter has been more crucial historically to offset the lack of appeal from the former.

Obviously, this has now changed.

Still, insofar as the automotive branch goes, Rheinmetall is a leading, Tier-1 automotive supplier with high-tech products across the ICE, EV and FC value chain, with components and subsystems for hydrogen technology. Plenty of appeals here.

This revenue split means that fundamentally speaking, Rheinmetall is in a very good position to really take advantage of the increased geopolitical instability we’re seeing here, while at the same time seeing safety and conservative appeal from its more basic segments in the appealing automotive sector. The company has seen significant success even prior to the war, due to portfolio reorganization, divestments, and actions that have led to increased overall margins, sales, and results.

And – the other advantage is dividends and debt. Rheinmetall has negative debt, and it has a solid payout with a good history that even managed to mostly survive COVID-19 without too much of a blow, while other companies were structurally weakening their dividend thesis.

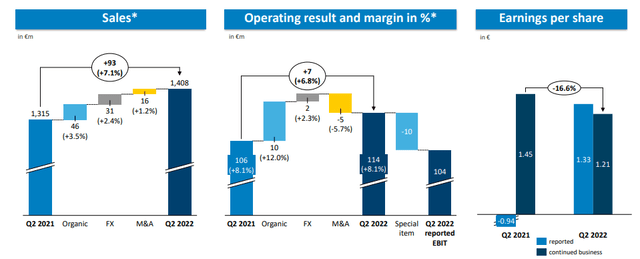

Recent results have been good as well. 1H22 is the latest we have, and the results here are impressive. Top-line sales growth was 7.1% YoY, with operating profit growth as well, and a stable margin of over 8% despite all ongoing cost increases and inflation.

It wasn’t just war/defense that’s seeing interest – the civil business saw top-line growth of 34%, and Rheinmetall also presented a new tank.

Rheinmetall IR (Rheinmetall IR)

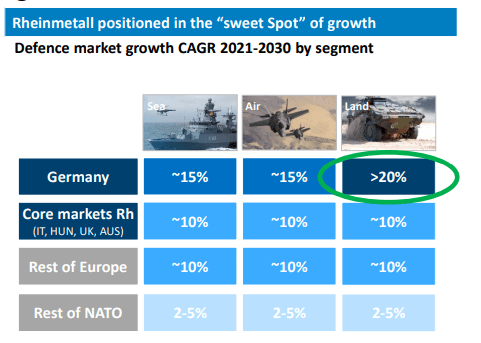

The company has excellent growth prospects when we look at what we can expect from the current macro, with increased importance from NATO and the like. This is based on a significant increase in the defense budgets throughout the EU until 2027, and the corresponding increase in actual land systems investment volume for the various nations.

Rheinmetall IR (Rheinmetall IR)

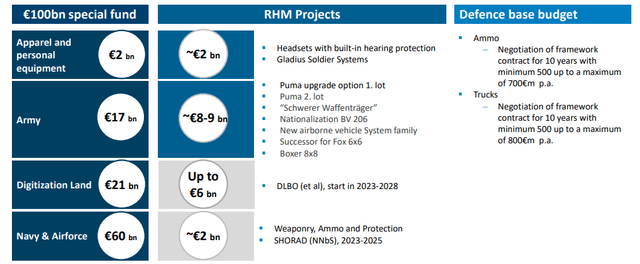

As you can see, Rheinmetall is very well-positioned in these segments and in these markets. The characteristic of this spending, at least when it comes to Germany, is that it’s very backend-loaded, which means that we already have decent visibility for what happens in 2024-2026, with a base defense budget stable at around €50B, as well as a €100B special fund spent across 5 years, meaning about €20B extra per year, which together will reach the NATO goal of 2%.

The current orders that include Rheinmetall are significant. They go from personal equipment and apparel, but also into digitization and into the navy/air force.

Rheinmetall IR (Rheinmetall IR)

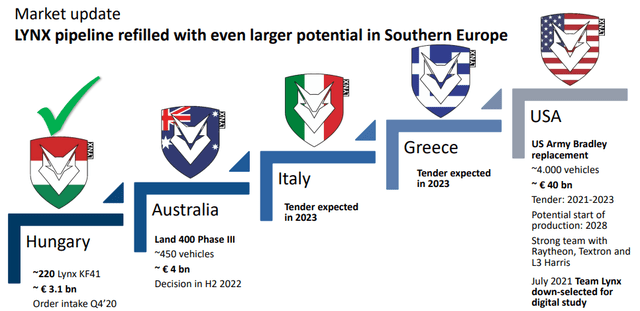

Why we’re not seeing any significant order growth yet because the intake of these orders starts later than initially expected, with 2H22 for some of the contracts, but most of the more significant ones in 2023, and late 2023 at that. Still, Rheinmetall has advantages in adjacent geographies as well, with plenty of contracts to work with.

Rheinmetall IR (Rheinmetall IR)

You must also consider the fact that many European nations are currently sending their older vehicles to Ukraine, meaning that there is plenty of replacement potential incoming – which is a direct advantage for Rheinmetall and the way it operates. There is potential for delivery of several key vehicles, many of them from existing inventories, as well as around 100 new vehicles and ammunition to several nations, and Ukraine as well.

Headwinds do still exist and are significant. They come in the form of semi shortages, SCM, Zero Covid in China, harbor blockages, inflation, increased costs, and the like. The company’s estimates for 2022, at least insofar as the Civil Divisions go, hinge on recovery in 2H22. While I see some recovery as likely, I don’t think the market will recover in full, which to my mind puts significant normalization outside the realm of possibility for the company.

Still, that leaves the company’s defense-related organic sales growth, which is still estimated at 15%, and a 3% margin improvement based on current trends. That is all things considered, superb. The current macro has to lead to significant sales growth and stable margin in a very difficult environment, even if some of the challenges are trickling down to the company’s bottom line.

Rheinmetall IR (Rheinmetall IR)

However, the company’s fundamentals are beyond safe. I said the company had negative net debt. The company still has undrawn credit lines of close to €700M as it stands, a Cash position of a quarter billion, and additional securities valued at over €130M. Maturities are extremely well-laddered with next to nothing in 2022.

Based on the projected budget spend, the explosive growth in the company’s share price is not exuberant in the least. It might even, as I see it, be somewhat underestimated.

I view the new defense budget projections as completely changing the next 10 years for Rheinmetall.

The company has already identified €42B in sales, and this is likely only the beginning, given that most of the segments have sales periods and contract lengths of between 5-12 years. Expectations for order intakes are up massively. The geopolitical macro means that not only is Germany “tooling up”, but the tailwinds are coming from the entire world.

So – tailwinds are significant. I’m sticking to my previously moderated EPS guidance somewhat for the years 2022 and 2023 due to slightly overestimating ammunition spending and underestimated vehicle spending. But the adjustment is slight – less than 5% for 2022E.

On a high level, I still expect a 22%+ EPS growth this year, followed by another ~30% in 2023, and yet another 24% in 2024. After that and once all the contracts are mostly in, I expect it to start slowing down. But in the end, military spending is on the rise, and Rheinmetall is absolutely one of the primary beneficiaries of these trends.

That makes this one an easy positive for me.

Rheinmetall’s updated valuation

The EU seems set on arming itself, so defense companies are something we must be looking at here. Due to a 2022 valuation explosion in Rheinmetall which we also saw in most defense companies, the fundamentals-based valuation targets are all relatively tepid.

What I mean by this, and what I’ve covered before is that the current upside for Rheinmetall is extremely tilted toward future growth estimates.

I typically forecast Rheinmetall from DCF, P/E/other multiples, NAV, and peers and analyst estimates to see what we have going for us here. From a DCF perspective, I’m continuing to guide Germany to follow through with its 2% of GDP (NATO Target), which would be a doubling of the previous ones, and it will then rise to above 2% of the GDP. It’s also the fact that the operating margin for this business is extremely favorable.

On the back of this, I’m assuming a growth rate in EBITDA of 6-8% and sales growth of 4-6% for the coming 3-5 years. I’m also assuming a 3% CapEx/sales growth, which is in line with the historicals. My PT from DCF continues to show me a range of between €225-€250, somewhat moderated down on the high end due to interest rate increases.

Public comps include Thales, Leonardo (OTCPK:FINMY), Valeo (OTCPK:VLEEY), BAE Systems, and others. The average valuation for these companies ranges between 5-18X P/E (a widespread), with an average of around 11X – but we’ve been through this before, and we do need to see Rheinmetall as sort of “its own” thing.

It’s difficult to give the company an accurate target – it’s essentially a correlation or proxy to the German defense budget, and this shows current signs of explosion without signs of slowing down. However, anything except a DCF or SOTP, or analysts that are exuberant on the company, are currently considering it somewhat overvalued here.

If you believe that Germany will stick to and maybe even increase its plans here, then this isn’t just a good company, it’s a great play overall. The more positive you’re on this, the higher you can weigh the DCF/Growth-related estimates.

Considering S&P global analysts, we find ourselves looking at 10 analysts with a range of €195 to €264, with an average of €222/share, an upside of 31.6%. Out of those 10 analysts, 9 are at a “BUY” or similar rating, communicating extreme positivity for this stock and the prospects that the company offers here.

I’ve been slowly adding share to Rheinmetall as the valuation and price has fluctuated, but I’m in no way ready to go “all in” yet – though I do give the company a positive rating and would bump my conservative PT for the business to a €180/share on the high end.

On this conservative basis, Rheinmetall is a “BUY”.

Thesis

My thesis for Rheinmetall is as follows:

- Rheinmetall is one of the significantly important German arms and civil production companies, with an appealing sales mix, great margins, and exposure to the current flows when it comes to orders and spending that makes it one of the most attractive plays on the German market.

- At a cheap valuation, I continue to believe you can generate a significant alpha here, and you could be looking at 20-30% annual RoR if the company reaches some of the heights that seem to be implied.

- I consider the company a “BUY” with a PT of €180/share – and that is conservative for the current ordering environment.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment