imaginima/E+ via Getty Images

Investment Thesis

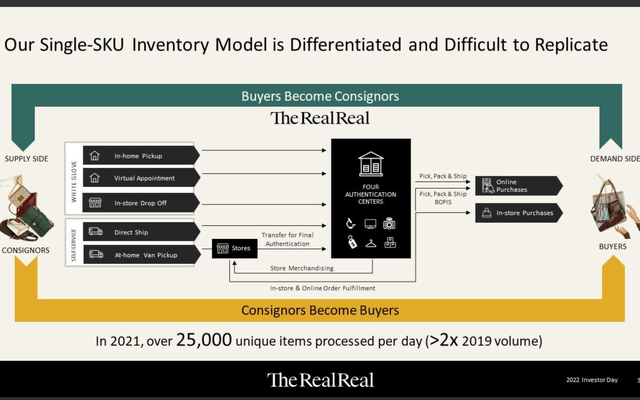

The RealReal (NASDAQ:REAL) is a US-based high-end resale commerce company founded by Julie Wainwright in 2011. Unlike most e-commerce companies, the RealReal operates as an online marketplace solely for authenticated and resale luxury goods. It doesn’t source items from brands rather it receives supplies from consignors, it then authenticates and lists those items online. When an item is sold, the RealReal takes a commission fee on the sale price. The company provides an end-to-end service for consignors and aims to aggregate and curate unique, pre-owned luxury items.

The company saw a huge boost in share price due to the pandemic accelerating commerce sales online and the liquidity that the Fed injected into the economy, like stimulus checks. Its stock price rocketed from $6.4 in March 2020 to over $28 in February 2021, up over 400% within a year. However, as the inflation rate started to rise combined with the broad market sell-off in speculative stocks, the company’s share price plummeted over 90% from its all-time high, now trading at $2.77.

Despite the huge drop in share price, I believe the RealReal is still a sell. It has a large TAM and is posting decent growth, but profitability remains a huge concern. The company has little moat and competition is getting very fierce with newcomers entering the market. The uncertainty within the macro environment and weakening economy will also likely post significant headwinds on the RealReal as it is a consumer-facing company.

Market Opportunity

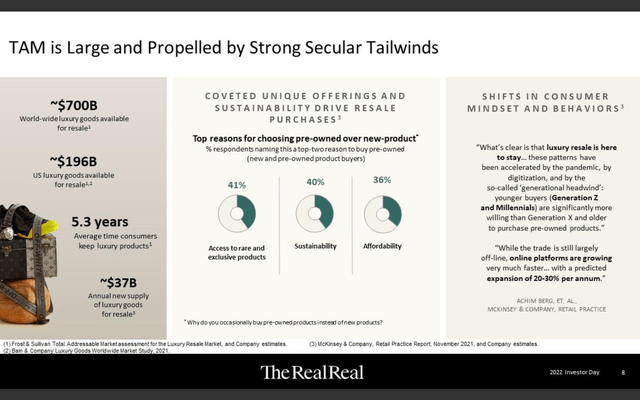

The RealReal has a huge TAM (total addressable market). The online luxury goods market has been growing rapidly due to the expansion in the economy, most attributed to the QE (quantitative easing) done by the Fed in the last decade. According to Farfetch, the global market for personal luxury goods is expected to increase from $322 billion in 2019 to $437 billion in 2025, representing a 5% CAGR (compounded annual growth rate). While the e-commerce market share for personal luxury goods sales is estimated to increase from 10% to 25% in 2025, representing a 2.5 times growth over the period.

Despite being a resale company, the RealReal benefits from the growth of the first-hand personal luxury goods market, as it allows them to have more new supplies of goods to sell. According to The RealReal, there is currently $196 billion worth of luxury goods available for resales, with $37 billion of new supply every year. The shift to second-hand items is accelerating due to the latest trend in sustainability and ESG. However, whether the trend can last remains the biggest question.

Fierce Competition

While the TAM for The RealReal is huge, it is also facing very fierce competition. The luxury goods market is a zero-sum market. Consumer spending is basically fixed, and it is up to companies to try to grab as much market share as possible. Therefore, The RealReal is not only competing with other resale companies, but also with other e-commerce luxury goods companies like Farfetch (FTCH) and legacy luxury brands like LVMH (OTCPK:LVMHF). In the resale market, the company is facing competition from the likes of Vestiaire Collective, Grailed, eBay (EBAY), and Depop, which is owned by Etsy (ETSY).

Vestiaire Collective operates with a nearly identical business model, while Grailed, eBay, and Depop are resale marketplaces that also focus on other categories besides luxury goods. The barrier to entry in this market is relatively low, therefore companies like Farfetch are entering the space, aiming to become both a first and second-hand luxury goods market space. It also has an advantage as it already has a large customer base. I believe there will be more companies entering in the future, which will further increase competition going forward. The RealReal is currently the leader in the second-hand luxury goods market, but it will need to develop a strong moat in order to solidify its position.

Strong Macro Headwinds

The current uncertainty regarding the macro environment will likely post significant headwinds on The RealReal. The inflation rate is remaining at high levels and the supply chain blockage continues. This resulted in decreasing consumer purchasing power, which weakens the economy. We are already seeing a significant slowdown in the economy across the board with companies like Target (TGT) lowering guidance, Snap (SNAP) issuing warnings on uncertainty, Tesla (TSLA) laying off employees, and more.

Julie Wainwright, founder, on inflation

The near-term risk to the business continued to be inflationary pressures on our transportation costs and attracting and retaining sales and operational talent. For transportation costs we are taking immediate steps to offset these increases. For sales and ops hiring, we exited the quarter in good shape. However, we are actively recruiting to fill positions, as we grow.

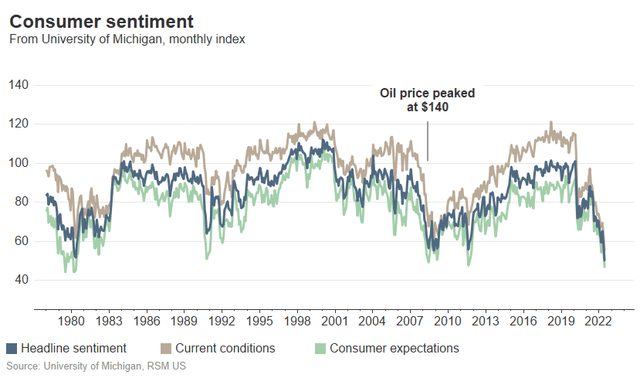

The RealReal is heavily exposed to these headwinds as it is a consumer-facing company. As purchasing power weakens, consumers now need to spend more on essentials, which reduces discretionary spending. According to Michigan Consumer Sentiment data, consumer confidence has plummeted and is now at levels now seen since the great financial crisis. I believe discretionary spending will continue to shrink and this will hurt The RealReal a lot as it focuses mainly on the higher-end market. The high fuel price will also increase the company’s logistics costs and further weakens its bottom line.

Profitability Remains An Issue

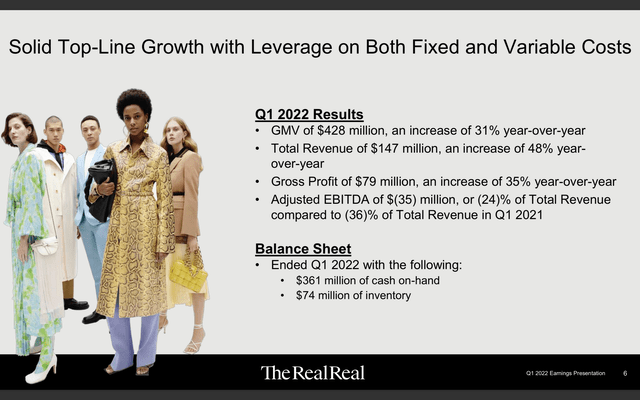

The RealReal announced its first-quarter earnings in May. It reported revenue of $146.7 million, up 48% YoY (year over year) from $98.9 million. Consignment and service revenue accounted for $97.9 million, while direct revenue accounted for $48.8 million. Gross profit was up 34.8% from $58.3 million to $78.6 million. GMV (gross merchandising volume) was $428 million compared to $327 million, representing a 31% increase. It ended the quarter with 828,000 TTM active buyers, up 21% YoY from 687,000. The average order value increased 3% to $487. The company is guiding FY22 revenue to be $635 million to $665 million, with adjusted EBITDA of negative $(100) to $(80) million. However, I believe the company’s growth rate will start to slow down due to the macro turbulence mentioned above.

Despite decent top-line numbers, profitability remains weak. Loss from operation widened from negative $(52.8) million to negative $(54.7) million. While adjusted EBITDA loss improved slightly from $(35.6) million to $(35.3) million. The loss is largely attributed to the increase in the cost of revenue, which was up 68.1% YoY from $40.5 million to $78.6 million. This is due to the increase in logistics costs as fuel price remains at a very high level. Operating cash flow was negative at $(49.3) million compared to $(47.8) million. Net loss per share was $(0.61), compared to $(0.62) a year ago. It is worth noting that the number of weighted average shares increased from 90 million to 93.5 million. This is a trend worth noting, as continuous dilution is very detrimental to shareholders. The company’s balance sheet is also quite shaky, with $605 million in debt and only $361 million in cash. This will be a problem as the company is still posting a loss and negative cash flow.

Conclusion

In conclusion, I believe The RealReal is operating in a very tough spot. Despite having a large addressable market, the company is facing more and more competition not only from resale companies but other luxury e-commerce companies too. The barrier to entry in this market is quite low, therefore, there will only be more and more competitors going forward. It is facing strong headwinds from the macro environment. Higher fuel cost is already weighing heavily on the company’s bottom line. As the economy continues to weaken and consumer confidence falls, it is likely that discretionary spending will contract quickly. The company is posting decent growth, but profitability remains a concern. It is still posting negative earnings and cash flow while having $244 million in net debt. The company’s share count is also increasing, which dilutes the shareholders. Therefore, I believe The RealReal is a sell at the current price.

Be the first to comment