BrianAJackson

Thesis

In 2008 the housing market crashed the global economy. Could it happen again? And how soon? While I don’t want to play the role of Mr. Doom, in this article I would like to highlight a few notable developments that could prove to turn out enormously important for the stock market. Personally, I see the beginnings of a major downturn in the housing market, as: mortgage rates have surged over the past few months, home sales are plunging, housing inventory is accumulating, and house price appreciation is slowing. Until now, investors in the stock market have largely ignored the cracks in the housing market. But if the situation worsens further, the dangers that a crashing housing market poses will be too pressing to be ignored.

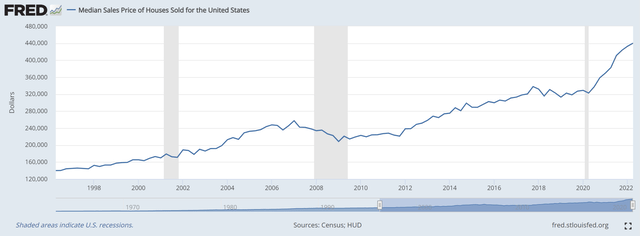

During the past decade, supported by record-low mortgage rates and quantitative easing, housing prices in the U.S. have appreciated at a rate that rivals the pre-2008 run up. And sentiment was bullish, if not bubbly. Only recently Redfin agent Shauna Pendleton commented on the unsustainably high expectations of home buyers/flippers:

They priced (their house sales) too high because their neighbor’s home sold for an exorbitant price a few months ago, and expected to receive multiple offers the first weekend because they heard stories about that happening.

4 Danger Signals

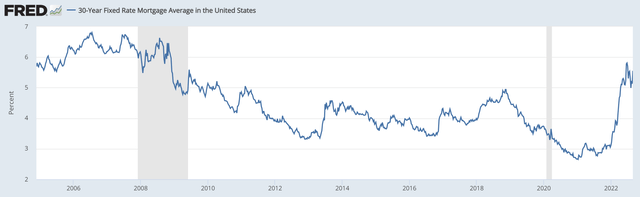

But the monetary policy tailwind has now flipped—with mortgage rates rising fast and quantitative easing becoming quantitative tightening. And the market sentiment changed accordingly. I would like to present four key metrics and charts to anchor my thesis.

Rising Mortgage Rate

First, and perhaps most notably are surging mortgage rates, which pressure the availability and affordability of home purchase funding. The 30-year fixed rate average mortgage rate in the U.S. has more than doubled since early 2021, rising from 2.65% to 5.7% as of August 2022.

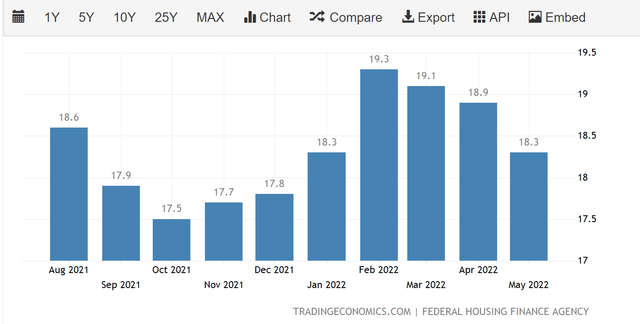

Slowing Price Appreciation YoY

Secondly, and surely also a function of the rising mortgages rates, the price appreciation of house prices has sharply decelerated.

True, housing prices have not yet started to show negative growth. But this could simply be a function of the illiquid nature of the real estate asset class, where a downturn is first reflected in inventory accumulation due to sticky prices—followed by an aggressive repricing of said inventory.

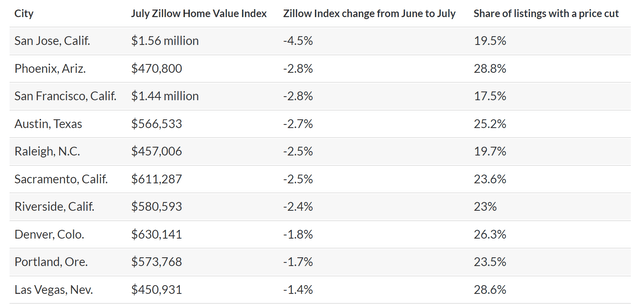

But in some selected markets, prices are already starting to fall–as per data from Zillow.

Home Sales Are Falling

Thirdly, home sales are falling fast. Notably, the number of nationwide home sales dropped by 19% year over year in July. New home sales appear to be falling off a cliff.

On August 23, Toll Brothers, Inc. (TOL), the U.S.’ largest builder for luxury homes, announced earnings for the June quarter. It reported a crash in quarterly orders by 60% from a year earlier. Moreover, the company also cut its FY sales outlook and named rising interest rates and slowing housing demand as key challenges. Toll Brother’s CEO Douglas Yearly commented:

we saw a significant decline in demand as the combined impact of sharply rising mortgage rates, higher home prices, stock market volatility and macroeconomic uncertainty caused many prospective buyers to step to the sidelines

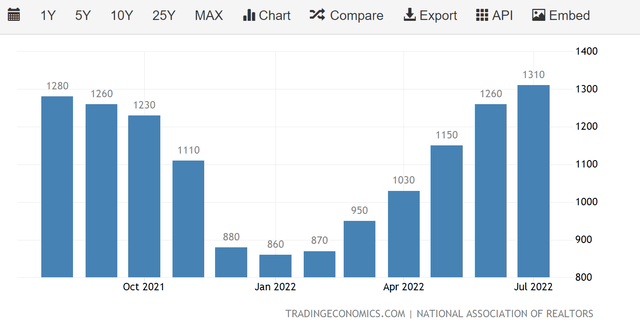

Accumulating Inventory

Fourth, home inventory is accumulating.

Lawrence Yun, chief economist at NAR said in a statement:

We’re witnessing a housing recession in terms of declining home sales and home building.

Investor Implication

The importance of the housing market for the health of the economy, and consequently for the stock market can not be understated. A stable housing market supports financial stability through mortgages lending, consumer confidence through wealth effects and economic activity through various building and construction.

As the U.S. housing market starts to show some very significant danger signals, as outlined in this article, I would like to advise to investors to be very cautious with their stock market exposure and capital allocation. Personally, and also as a consequence of the broader macro-economic weakness, I would advise investors stay underweight cyclical industries such and financials, materials and construction and overweight on strong technology companies with high margins, resilient balance sheets and relatively low-risk growth—that is connected to secular trends such as digitalization and decarbonization.

Be the first to comment