mgstudyo

Investment Thesis

I think that Genie Energy Ltd. (NYSE:GNE) is a profitable company because it has set record profitability and strong returns over the past few months, and its valuation implies that it is currently trading below the fair value, which leads me to rate the stock as a Buy. The company is doing reasonably well even when energy prices are volatile. I also think management is excellent at risk management due to hedging strategies (reducing commodity volatility risk) and improving its position by lessening its forward obligations in the market.

Record Quarter Results

GNE has set record second-quarter results which have been the company’s strongest second-quarter results in the company’s history. The company’s revenue decreased by 1.8% ($1.35 million) from $75 million compared to Q2’21’s result of $76 million. However, gross profit did increase in its second-quarter results by a whopping 218.2% to $67.5 million (impacted by the market-to-market gain on international hedges), increasing the gross margin by 89.9% compared to Q2’21’s 27.7% gross margin. The increases reflect the company’s risk management portfolio of “Hedging strategies to reduce commodity volatility risk” back in the first quarter of 2022 to be effective in advance of an increase in recent energy prices.

Genie Energy Segments

GNE operates in three different segments:

Genie Retail Energy (‘GRE’) – supplies electricity and natural gas to residential and small business customers in certain portions of deregulated markets within the United States.

Genie Retail Energy International (GRE International) supplies electricity to Scandinavia residential and small business customers.

Genie Renewables – Four lines of businesses:

-

Genie Solar Energy (Genie Solar) – Designs and builds a local solar installation for commercial-size customers.

-

CityCom Solar – Recruits customers to purchase electricity generated by community solar fields.

-

Prism Solar Technologies – Designs and manufactures niche solar panels for wholesale distribution.

-

Diversegy (Diversegy) – An energy broker for commercial customers.

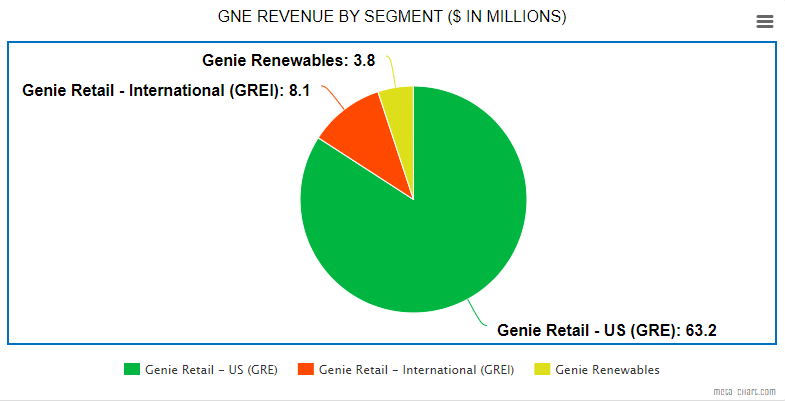

Author – Data from Sec.Gov – Chart from mega-chart

In the Q2’22 results, GRE accounted for most of the company’s revenue and had a revenue of $63.2 million, while GRE International had second-quarter revenue of $8.1 million, followed by Genie Renewables of $3.8 million.

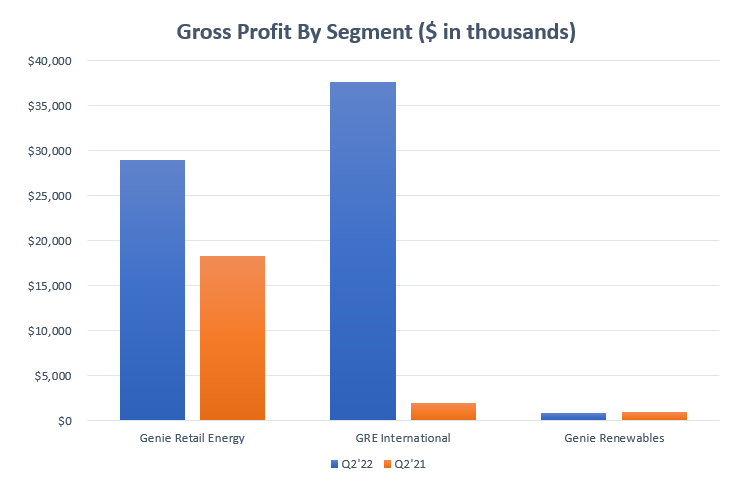

Author – Data From GNE Second-Quarter Results

Gross profit by segment (three months ended June 2022 & 2021):

GRE: 2022 second-quarter results gross profit of $29 million vs. $18.3 million in Q2’21.

GRI: 2022 second-quarter results gross profit of $37.8 million vs. $1.9 million in Q2’21 (appreciation of the value of the forward hedges).

Genie Renewables: 2022 second-quarter results gross profit of $818,000 vs. $922,000 in Q2’21.

Operating income increased from $4.5 million to $48.5 million due to an increase in consolidated SG&A expenses (corporate overhead included), which increased from $16.7 million in Q2’21 to $19 million in Q2’22, reflecting an increase in GRE’s customer acquisition expenses and general overhead.

Operating income by segment (three months ended June 2022 & 2021):

GRE: 2022 second-quarter operating income of $14.4 million vs. $5.4 million in Q2’21.

GRI: 2022 second-quarter operating income of $36.4 million vs. $144,000 in Q2’21.

Genie Renewables: 2022 second-quarter operating income loss of $519,000 vs. $334,000 in Q2’21.

GNE also announced that they will be paying a quarterly dividend of $0.075 for class A and class B stockholders and has repurchased 639,000 class B common stock shares amounting to $4.4 million, averaging about $6.90 per share.

I think GNE’s hedging strategies proved effective in energy price volatility and increased the company’s profitability over the second quarter of 2022. GNE’s share price was around $6.30 back in May and is currently trading at $10.69 or a 69% increase in the past quarter, and surprisingly enough, the company is still below fair value.

The company’s balance sheet is looking robust. The company has been strengthening its balance sheet by having low debt levels and increasing its cash growth. According to Michael Stein, the CEO of GNE:

“Our solar strategy includes creating value with robust returns by putting our strong balance sheet to work.”

The company has total cash & cash equivalents of $67 million or $2.58 per diluted share. Although the company’s cash grew 32% compared to last year’s second quarter results, GNE’s cash balance declined by $28.1 million, a 29% decrease compared to the past quarter. Avi Goldin, the company’s CFO, has this to say regarding the decrease in cash:

“Cash balance declined compared to last quarter as we move cash to the administrator of our former UK business as the insolvency process there moves forward.”

– GNE Q2 2022 Results – Earnings Call Transcript

Overall, management suggests that the growth in profitability will continue in the following quarters. Most of the success in the second quarter results was from mark-to-market gains on the company’s forward electricity hedges. Due to volatility in energy prices, geopolitical risks, and the overall global economic situation, the company is further improving its position by lessening its forward obligations in the market, starting with selling the Swedish book (which kind of means that they are reducing their geographic diversity, but I think it is a step into the right direction given the volatility and risks with operating in these regions). Michael Stein, GNE’s CEO, also stated:

“In summary, we had record bottom line results during the first half of the year and we expect to continue to generate strong year-over-year consolidated adjusted EBITDA expansion in the second half. We have also taken several steps to lay the foundation for long-term growth in our emerging renewable businesses. And finally, we continue to fulfill our commitment to return capital to shareholders.”

– GNE Q2 2022 Results – Earnings Call Transcript

This can be seen through the company’s share repurchasing and a dividend of $0.075 per share to be paid in the quarter. Overall, I think GNE is doing well in risk management. I believe the company will be profitable in the coming months and hopefully continue to be profitable in the coming years when it can expand its geographic diversity once the economic situations stabilize.

Valuation

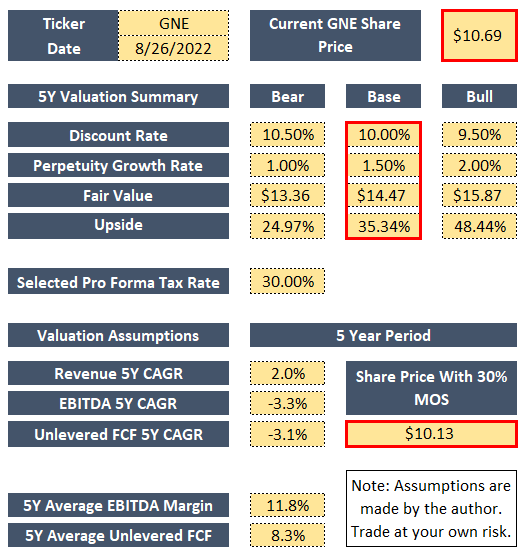

Author – Data from Sec.Gov

I think that GNE is currently trading below its fair value. By using a DCF model, the stock’s fair value is $14.47, which features a 35% upside compared to today’s price of $10.69. As shown in the image above, I used a discount rate of 10% and a perpetuity growth rate of 1.50%. With my revenue assumptions of 2% and average unlevered FCF of 8.3% (with a pro forma tax rate which is slightly higher compared to the tax rate in recent quarters), I have the fair value for the following scenarios:

Bear: Fair value of $13.36, add a 30% MOS, and we get a target price of $9.35, which is 14% less the current share price.

Base: Fair value of $14.47, add a 30% MOS, and we get a target price of $10.13, which is -6% less the current share price.

Bull: Fair value of $15.87, add a 30% MOS, and we get a target price of $11.11, which is 4% above the current share price.

Overall, the stock’s share price is trading below its fair value, leading me to rate the stock as a Buy. Management is doing pretty well with risk management by lessening its forward obligations in some of its volatile markets and its hedging strategies.

Risks

A volatile global economic situation and geopolitical risks are the current risks for GNE. The energy markets are volatile, and we can reasonably expect that natural gas and energy prices will be subject to fluctuations in the future. Until the global economic situation stabilizes, GNE will always be subject to these risks. Volatility in energy prices can expose GNE to massive gains or massive losses, and investors should consider this before engaging with the stock.

Conclusion

Overall, I think GNE is a profitable company doing well in unfavorable market conditions while still setting record income from operations. Management is doing pretty well with risk management as well. The stock is currently trading below its fair value, which leads me to a Buy rating. If GNE can pull off great results in unfavorable markets, they can certainly pull off better results in more stabilized markets.

Thank you so much for your time, have a great day.

Be the first to comment