Ultima_Gaina

Introduction

Great Elm Capital Corp. (NYSE:NASDAQ:GECC) (the “Company“) is an externally managed business development company (“BDC”) under the Investment Company Act of 1940, as amended. BDCs, like the Company, are in the business of lending to small- and medium-size companies. Its external manager is Great Elm Capital Management. The Company is the surviving corporation of a 2016 merger. As of the time of writing (late August), the Company’s common stock has lost more than one-third (1/3) of its value year to date and more than 40% of its value over the prior year.

I am BEARISH on the Company for a variety of reasons, including poor quarterly financial results for the most recent quarter (June 30, 2022); a significant decline in net asset value per share for the quarter and consistent declines in net asset value throughout its history; the misalignment of incentives associated with external management; the current market environment (i.e., rising rates and rising credit risks); the Company’s inability to deliver a consistent dividend (cut recently as noted below); and the Company’s overall unimpressive track record.

In addition to its common shares, the Company has some publicly traded “baby bonds” outstanding, including the unsecured publicly traded notes maturing on June 30, 2024 (GECCN), January 31, 2025 (GECCM) and June 30, 2026 (GECCO) (collectively, the “Outstanding Notes“). At current prices, I do not find any of the Outstanding Notes to offer sufficient value relative to the risks. Moreover, I do not think the Company will be able to refinance the Notes without its cost of capital rising.

The Business of the Company

Per its recent 10Q Filing for the quarter ended June 30, 2022 (page 3), the Company seeks to generate current income and capital appreciation via debt and income-generating equity investments, including investments in specialty finance businesses. Specifically, the Company invests in secured and senior secured debt instruments of middle market companies, as well as income-generating equity investments in specialty finance companies.

Management styles itself as a value manager, investing in investments that offer sufficient downside protection and have the potential to generate attractive returns. The Company generally defines middle market companies as companies with enterprise values between $100 million and $2 billion. The Company will make investments throughout other portions of a company’s capital structure, including (without limitation) subordinated debt, mezzanine debt, and equity/equity linked securities.

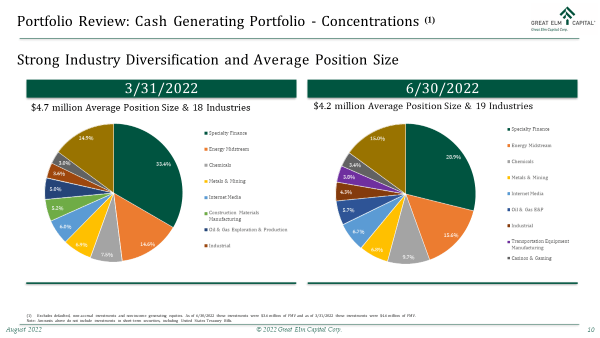

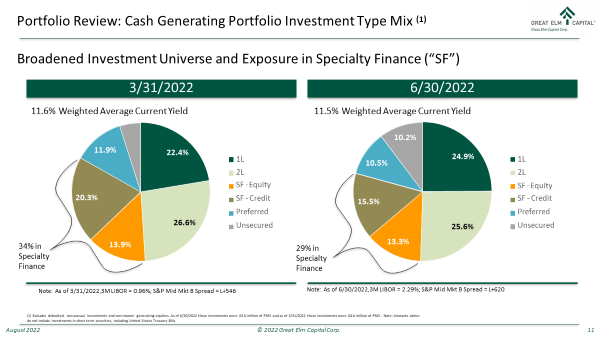

Details concerning the Company’s portfolio of investments are found in the slides below from the Company second quarter earnings presentation.

Q2 2022 Earnings Presentation Q2 2022 Earnings Presentation

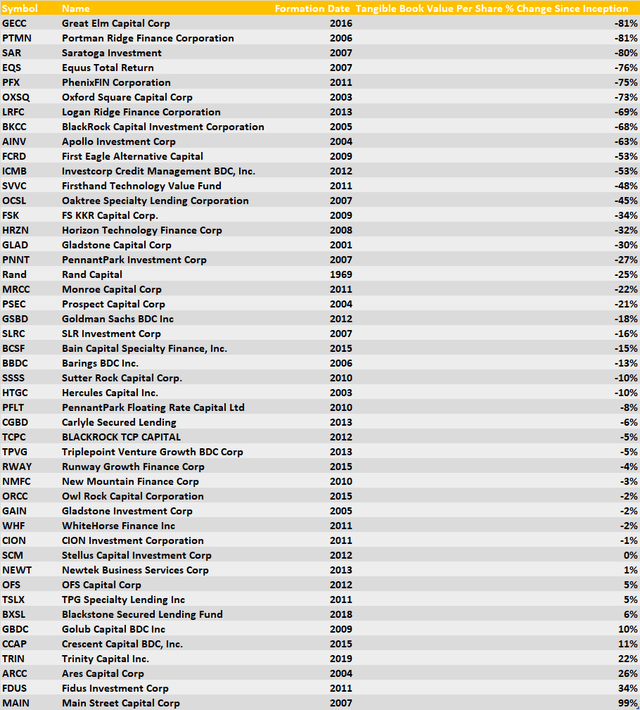

Since the merger in 2016, it is fair to say the Company is, at a minimum, among the worst performers in the BDC space. The Company has destroyed value at an astonishing pace, as evidenced by the table below.

SOURCE OF TABLE: Bashar Issa

Recent Financials and Earnings

The unaudited balance sheet of the Company included in its latest quarterly filing with the SEC (10-Q linked above; page F-22) shows a decline in Total Assets over the six month period ended June 30, 2022, of approximately $80 million; a decline in Total Liabilities of approximately $103 million for the period; and Net Asset Value per share declining materially (more on that below) for the period.

The Company’s stock was trading around $12.20 at the time of writing. The Company’s Earnings Call for the quarter ended June 30, 2022 highlighted, among other things, the following:

Our NAV per share was $12.84 as of June 30, 2022 versus $15.06 as of March 31, 2022 and $23.40 as of June 30, 2021. Quarter end NAV per share was impacted by the approximate three million shares issued in the rights offering in June. Details for the quarter-over-quarter change in NAV can be found on Slide 7 of the investor presentation.

As of June 30, 2022 GECC’s asset coverage ratio was approximately 166.9% compared to 147.5% as of March 31, 2022. GECC reported a net loss of $0.87 per share in the second quarter, compared to a net loss of $1.12 per share in the prior quarter. NII per share was $0.23, compared to $1.31 in the prior quarter, which included the impact of the incentive fee waiver.

All per share amounts are based on weighted average shares and have been adjusted for the 6-for-1 reverse split that became effective on February 28, 2022. As of June 30, our total debt outstanding was approximately $145.9 million, comparable with the March 31, 2022 outstanding. Our $25 million line of credit remains fully undrawn.”

[Emphasis Supplied.]

A few notable things. First, the external manager has waived a portion of the management fees owed to it by the Company; if the Company does well in the future, however, the management company is likely to claw back the waived fees. Per the 10Q (page 16), recent amendments to the management agreement also appear to make it easier for the external manager to earn incentive fees (not shareholder friendly). Second, the reverse stock split effectuated earlier in 2022 is clearly a sign of weakness. Third, the NAV declines achieved by management have been breathtaking, falling almost 50% over the prior year. Fourth, asset coverage is required to be at 150% or higher under applicable Investment Company Act regulations; this will result in future dilutive issuances of equity unless the Company can improve financial performance and asset coverage, in particular.

In terms of cash flows, per the 10-Q linked above (page F-25), net cash flows from operating activities were approximately negative 9.6 million at June 30, 2022 compared to approximately $15 million at June 30, 2021; net cash from investing activities were roughly negative $37 million at June 30, 2022 and June 30, 2021, respectively; and net cash from financing activities was approximately negative $30 million at June 30, 2022 versus approximately $43.1 million at June 30, 2021. Overall cash and cash equivalents are less than $2 million as of June 30, 2022. Due to liquidity issues, the Company was forced to issue stock pursuant to a rights offering during the quarter, and that offering was acknowledged to be dilutive on the earnings call (transcript linked above). In addition to the dilution, the Company has cut the quarterly dividend from $0.60 per share to $0.45 per share. If the Company cannot increase liquidity, future dividend cuts may be necessary. The Company may also have to sell assets at inopportune times.

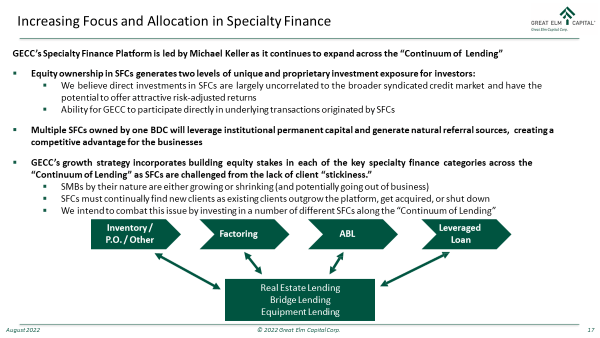

Overall, the Company is performing poorly (the Company has realized $27 million in investment losses through June 30, 2022), has historically performed poorly (see table above) and now seeks to focus on investments in the specialty finance space (see slide below from earnings call presentation). I am doubtful that this change of course will prove transformative.

Q2 2022 Earnings Presentation

Concluding Thoughts

For the reasons noted above, I am BEARISH on the Company’s common shares.

At current prices, I am also BEARISH on the Outstanding Notes of the Company. Income investors might want to consider the baby bonds of Great Ajax Corporation (AJXA) instead (see my article about that company here).

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment