MarsBars

BDCs remain a great place for high yields, with many names still trading at bargain valuations. This includes Sixth Street Specialty Lending (NYSE:TSLX), which still trades well below its $23-24 trading range from as recently as April of this year. TSLX recently posted its Q2 results, and in this article, I highlight what makes it a high-yield buy, so let’s get started.

Why TSLX?

Sixth Street Specialty Lending is a BDC that invests in the U.S. middle market space, primarily through senior secured loans, and equity investments in portfolio companies. It benefits from its affiliation with its external advisor, Sixth Street, a global investment firm with over $50 billion in AUM. This robust management platform gives TSLX valuable line of sight and deal sourcing opportunities that it would not otherwise have.

At present, TSLX has a $2.54 billion investment portfolio spread across 94 companies (up from 72 in the prior year period). It carries a rather safe investment profile that’s comprised of 92% secured debt (90% first-lien, 2% second-lien) and 7% equity, which gives its net asset value upside potential through capital appreciation.

What makes TSLX stand out is its strong track record of total returns. As shown below, TSLX has produced a 56% total return, outpacing the VanEck Vectors BDC Income ETF (BIZD) over the same timeframe.

TSLX Total Return (Seeking Alpha)

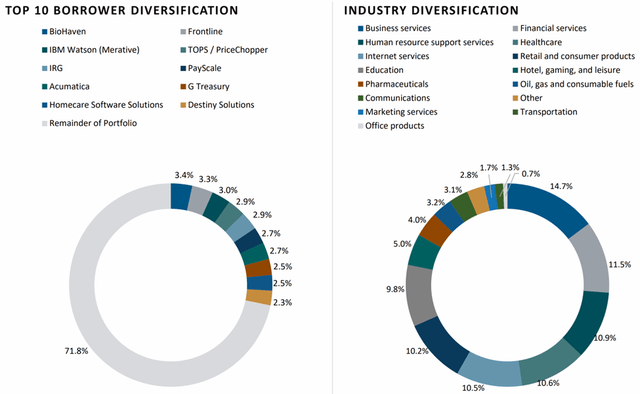

The portfolio is also well balanced, with low exposure to more economically sensitive industries such as hospitality and energy. As shown below, business, financial, HR, internet services, and healthcare make up TSLX’s top 5 segments, making up 58% of the portfolio value, and no one investment makes up more than 3.4% of the portfolio total.

TSLX Portfolio Mix (Investor Presentation)

TSLX recently reported respectable Q2 results, with adjusted net investment income per share coming in at $0.42, giving management the comfort to raise the quarterly dividend by $0.01 to $0.42 per share. It’s worth noting, however, that net asset value per share did decline by 3.4% on a sequential basis to $16.27.

While this NAV decline may appear to be concerning on the surface, it’s important to dig a bit deeper to understand why. The decline was not the result of realized losses on the investment portfolio, but rather due to unrealized losses stemming from the impact of widening credit spreads and lower implied equity values of portfolio investments.

I don’t believe this to be cause for concern, as private company valuations tend to follow that of volatility in equity markets, and in a recessionary environment, valuations of debt instruments get marked down relative to treasury bonds as investors require a higher risk premium. Moreover, portfolio quality remains in excellent shape, with nonaccruals representing just 0.1% of cost.

Looking forward, TSLX is well-positioned for continued rising rates with 99.2% of its debt portfolio being floating rate. Its debt to equity ratio also declined on a quarter-on-quarter basis from 0.95x to 0.9x at the end of June, sitting below management’s target leverage of 1.25x. This gives TSLX plenty of balance sheet flexibility to expand its portfolio. Management also sees incremental earnings from rising rates, as noted during the recent conference call:

We expect to see meaningful positive asset sensitivity in the back half of the year. The combination of the rising rates in Q2 are now well above our average floor levels on our debt investments and the shape of the forward LIBOR or SOFR curve support that expectation. The rising rates will drive incremental interest income and outweigh the increases in the cost of our liabilities. To date, this has been largely muted because applicable reference rate resets occurred earlier in the quarter.

Based on the shape of the forward curve and reset dates of our issuers, we project the remainder of this year that rate movement loan will result in approximately $0.13 per share of incremental net investment income purely from the core earnings power of the portfolio relative to what we experienced in Q2. In addition, to the extent we see portfolio growth over this period, the core earnings power of our business will be further enhanced.

I find TSLX to be attractively valued at the current price of $18.92 with a forward PE of just 9.7x, with analysts estimating annual growth in the mid single digit through the end of next year. Sell side analysts have a consensus Buy rating with an average price target of $22.45. This equates to a potential one-year 28% total return including dividends.

Investor Takeaway

I believe TSLX to be an attractive income play at the current price, with a well-covered dividend yield of 10.3% and plenty of balance sheet flexibility to continue growing the portfolio. While there may be some short-term volatility in net asset value due to the impacts of widening credit spreads, I believe this to be more than priced in at the current level, making TSLX an attractive income play for long-term investors.

Be the first to comment