Michael Vi

PagerDuty (NYSE:PD) is a software-as-a-service company focused on IT operations. Primarily, it provides services to ensure the reliability of computing and cloud computing for its customers. This includes a wide gamut of offerings, including observability (tracking software systems in realtime) as well as more standard cloud infrastructure offerings. For the technically inclined, PagerDuty can be categorized as a SaaS offering for DevOps/ITOps. Basically it keeps systems running even when they encounter various kinds of problems; its suite of services is centered around this core focus.

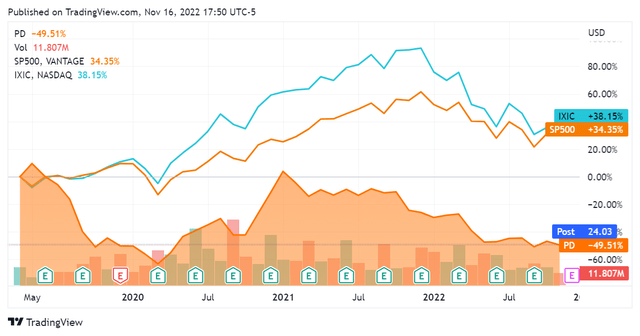

Founded in 2009 through a collaboration with the well-known incubator Y Combinator, PagerDuty conducted an initial public offering in Q2 2019 at a price of $24 per share. It is now trading roughly in line with its IPO price.

Like most other technology stocks the firm has underperformed the S&P 500 and the Nasdaq throughout this time. This article will review the company’s fundamentals in order to see if its valuation and share price are still sensible.

Financials

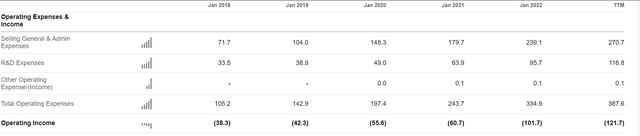

PagerDuty reports year-end results for the previous fiscal year on January of each year, and the financials highlighted reflect this.

Starting with revenue we see a picture of growth, although perhaps not a particularly exciting one as far as software companies go. Trailing twelve month revenues were still 4.09x that of its 2017 fiscal year, implying basically that the company has quadrupled its yearly revenues over the last five years. That’s solid. As expected for a SaaS company, cost of revenues have grown significantly less than revenue throughout this timeframe.

Unfortunately, the company is still dealing with an increasing cost curve and its operating loss has actually increased during this period. Worth noting is that the size of the increase went up between its 2020-21 fiscal reporting periods as contrasted with previous results. Offhand, I would assume that this is due to the significant labor inflation that we saw during this time.

Right away these books reflect the reality of PagerDuty as a growth stock. The increasing rate of investment in R&D implies that they are investing in their offering, as well as capturing the tax benefits of research and development; a deep dive into this is outside the scope of this article.

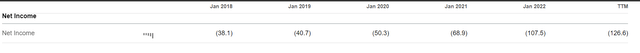

Net income has also been negative throughout. The disparity between operating income and net income is not overly significant, however, which tells us that there should not be too much concern around costs that are outside of its operating cycle, such as debt.

Looking further into this we see that the company has actually began to take on debt as of its 2020 fiscal reporting period. The net debt figure, however, has stayed negative – indicating that the company has consistently had more cash and cash equivalents on hand versus liabilities.

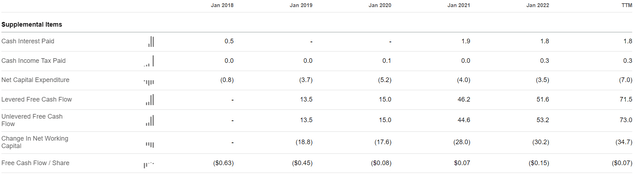

Nonetheless, PagerDuty is posting $305.8M of debt as per its latest reporting period, and it is worth seeing the cost that it is paying for this. Cash interest payments appear to still be less than $2M yearly, which stands at less than 1% of its TTM yearly revenue figure – nothing to worry about, basically.

The cash flow statement is where this company starts to get interesting. SaaS companies are known to have exceptional economics once they cross a certain threshold of scale, and that is proven (or not) by a company’s ability to generate free cash flow.

PagerDuty has been generating free cash flow since its 2018 fiscal reporting period (see January 2019 column). Additionally, the small disparity between levered and unlevered cash flow indicate a relatively insignificant dollar amount of debt service throughout that time, confirming the previous look into its debt/cash position.

The company’s free cash flow growth appears significant. With $13.5M of FCF in fiscal year 2018, it reported $51.6 in levered FCF for fiscal year 2021. As per the previous look at revenue, the company has also quadrupled its free cash flow in line with its revenue growth. This is quite good to see from any software company indeed.

Additionally, PagerDuty is reporting results that are quite close to 0 around its FCF/share. Since its 2019 fiscal reporting period, this variance appears to have decreased significantly – and its 2020 fiscal reporting period actually showed a positive number. I would not be surprised if their next earnings report in two weeks showed another positive number for this, and this would add conviction to any bullish take on the stock.

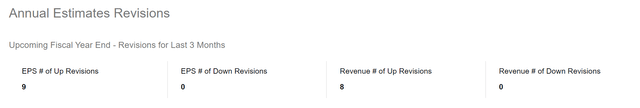

Wall Street seems to be looking at its upcoming results favorably, as there have been a significant number of upward revisions for its EPS for the last three months. Worth noting is that this is actually for two reporting periods out; the next earnings release will be for Q3 2022 and will not constitute a full year’s performance. Nonetheless, it’s another bullish signal.

Conclusion

PagerDuty may not be the most exciting or well-known technology company out there, but it is seeing continued demand for its services. This is evidenced by its consistently growing revenues year over year, with no downturn being apparent during the pandemic.

Additionally, the cash flow situation of the company looks good to me. While it has taken on additional debt, it is not doing so to maintain operations – it is clearly doing so to scale. This makes sense as it is participating in one of the most significant secular trends of our time: the ever-increasing presence of software.

As more software gets built and maintained, PagerDuty’s services should face an increasing demand curve overall. The counterpoint to this would be competition from established cloud players, but that relative value comparison will be left for another time. In its own right, I think PagerDuty looks solid and I agree with the increasing optimism around this stock (consensus revisions).

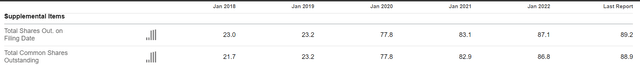

Since the company is still around its IPO price, it would be easy to call it a buy. Before doing this, however, we must also note that the company has ~4x the amount of common shares outstanding that it did during its IPO reporting period. This means that PagerDuty’s market cap is already 4x that of what it was before, and investors are still no better off for it.

Nonetheless, the pace at which the company has been creating new shares appears to have slowed drastically; most of the growth in the number of shares actually occurred between its 2018 and 2019 fiscal reporting periods. The numbers since then have been a trickle compared to what we saw previously. We can extrapolate this further out and assume that it has matured as a technology company, with less reliance on share-based compensation going forward.

Considering all of this together, I think this is a quality SaaS play. With a quality cash flow picture and a decreasing growth as to its float (quantity of shares outstanding), PagerDuty could very well begin to see solid appreciation in the near term. I rate it a buy.

Be the first to comment