ipopba/iStock via Getty Images

A Quick Take On AppFolio

AppFolio (NASDAQ:APPF) reported its Q2 2022 financial results on July 28, 2022, beating expected revenue and EPS estimates.

The company provides property and investment management software to the real estate industry.

With the firm entering the slower year-end part of its seasonal activity, it is hard to see a near-term catalyst to the stock, especially given its increasingly negative GAAP earnings and still-generous valuation by the market.

As a result, I’m on Hold for APPF for the near term.

AppFolio Overview

Santa Barbara, California-based AppFolio was founded in 2006 to provide a range of software capabilities to real estate owners, managers and investors.

The firm is headed by Chief Executive Officer Jason Randall, who was previously Sr. Director, Product Management at Citrix Systems and Director, Product Development at SupplySolution.

The company’s primary offerings include:

-

Real Estate Property Management

-

Real Estate Investment Management

The firm acquires customers via its direct sales and marketing efforts as well as through partner referrals.

AppFolio has over 17,800 customers of all sizes managing over 6.8 million units worldwide.

AppFolio’s Market & Competition

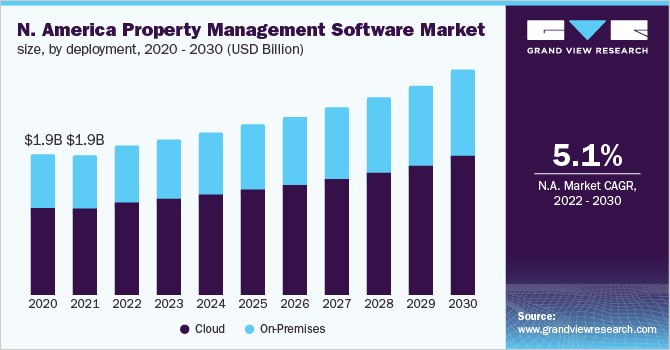

According to a 2022 market research report by Grand View Research, the market for real estate property management software was around $3 billion in 2021 and is forecast to reach $4.9 billion by 2030.

This represents a forecast CAGR of 5.6% from 2022 to 2030.

The main drivers for this expected growth are a changing real estate landscape and increasing demand from buyers for more advanced and integrated offerings that increase business efficiencies across the organization.

Also, below is a chart showing the historical and projected future growth trajectory of the North American property management software market:

N. America Property Management Software Market (Grand View Research)

Major competitive or other industry participants include:

-

CoreLogic (CLGX)

-

Console Australia Pty. Ltd.

-

Entrata

-

InnQuest Software

-

IQware

-

MRI Software

-

RealPage

-

REI Master

-

Yardi Systems

AppFolio’s Recent Financial Performance

-

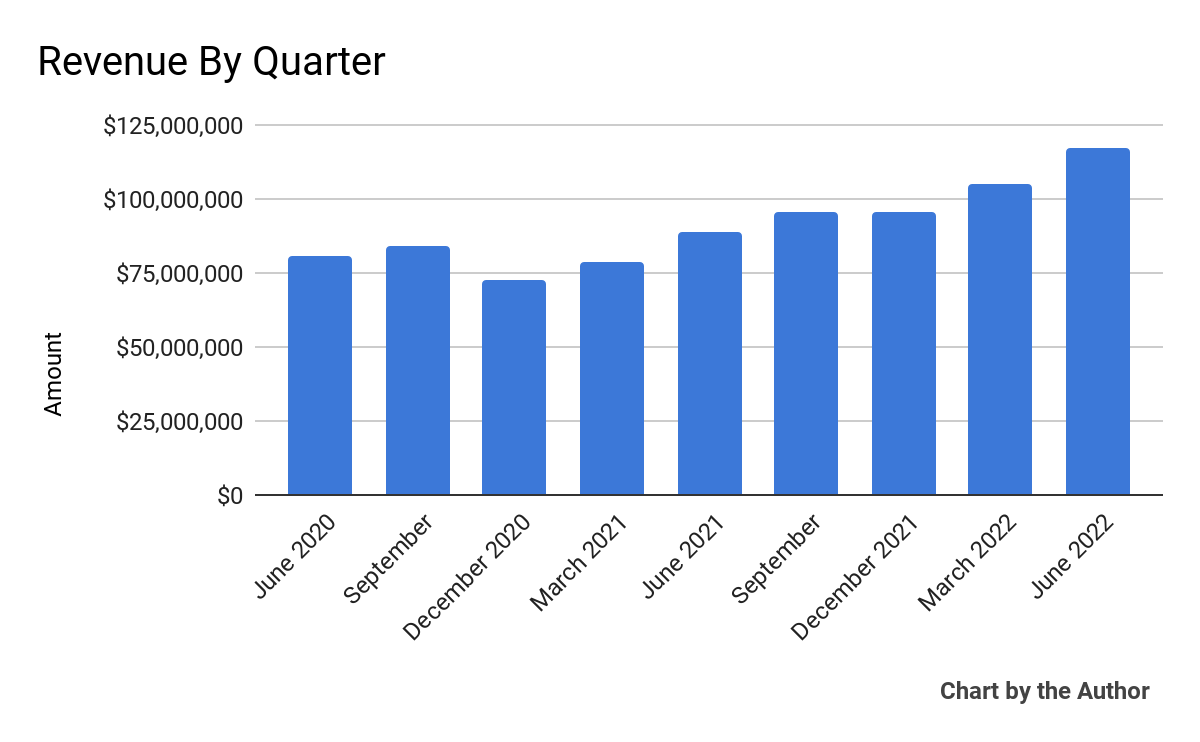

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

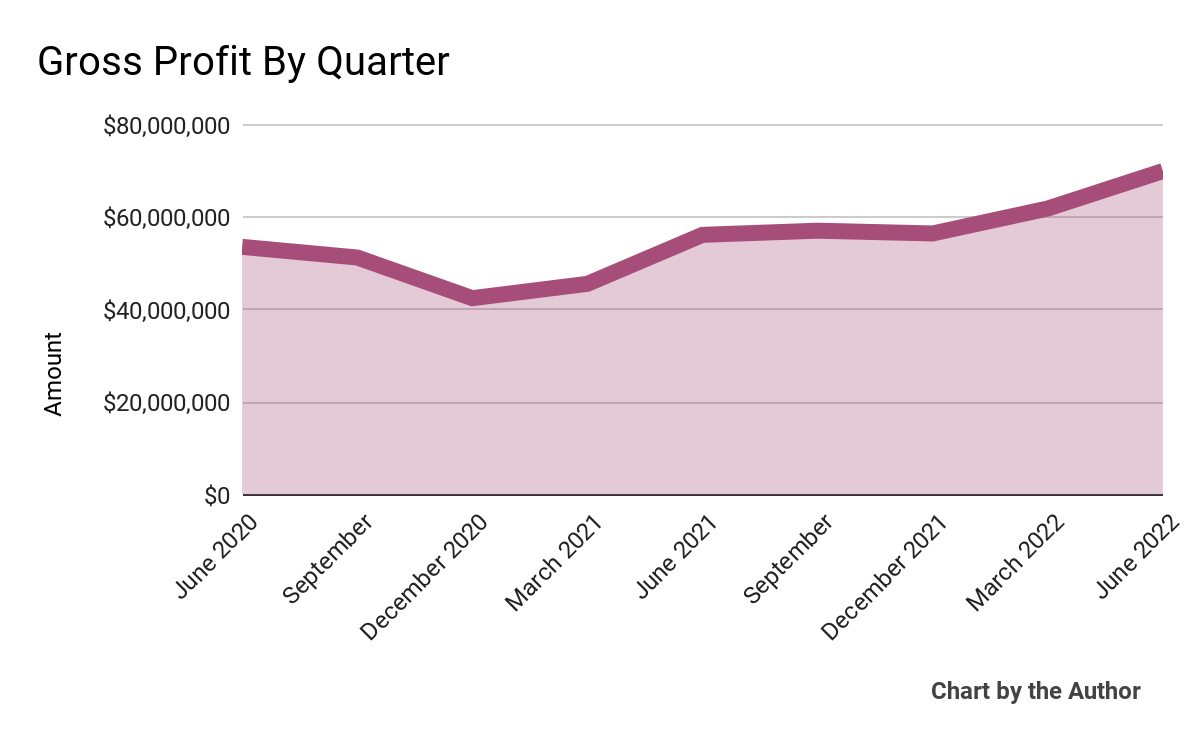

Gross profit by quarter has also grown in similar fashion:

9 Quarter Gross Profit (Seeking Alpha)

-

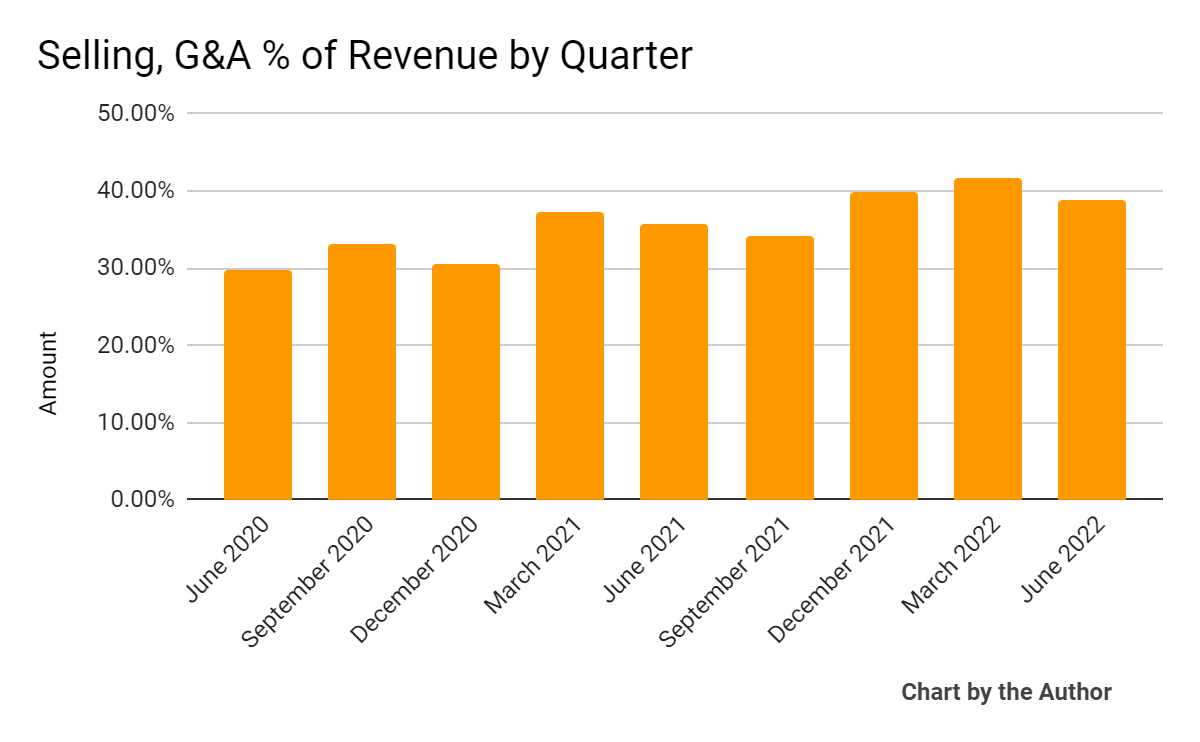

SG&A expenses as a percentage of total revenue by quarter have trended higher as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

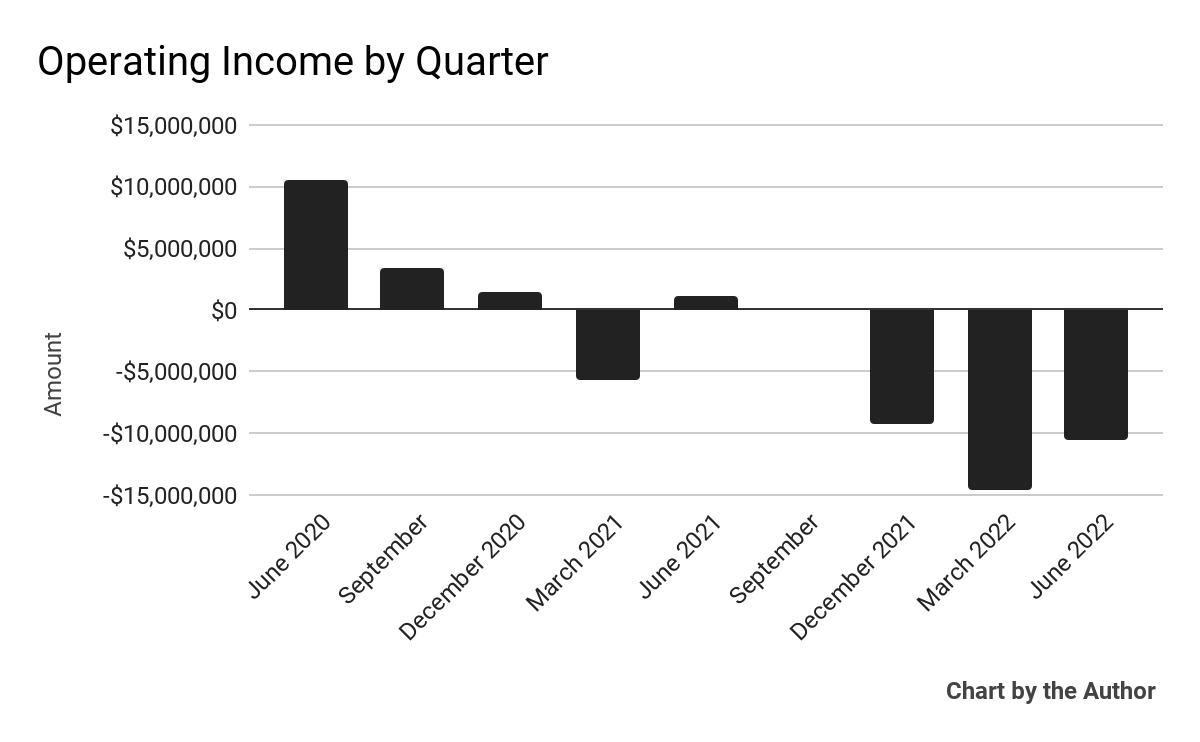

Operating income by quarter has turned negative in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

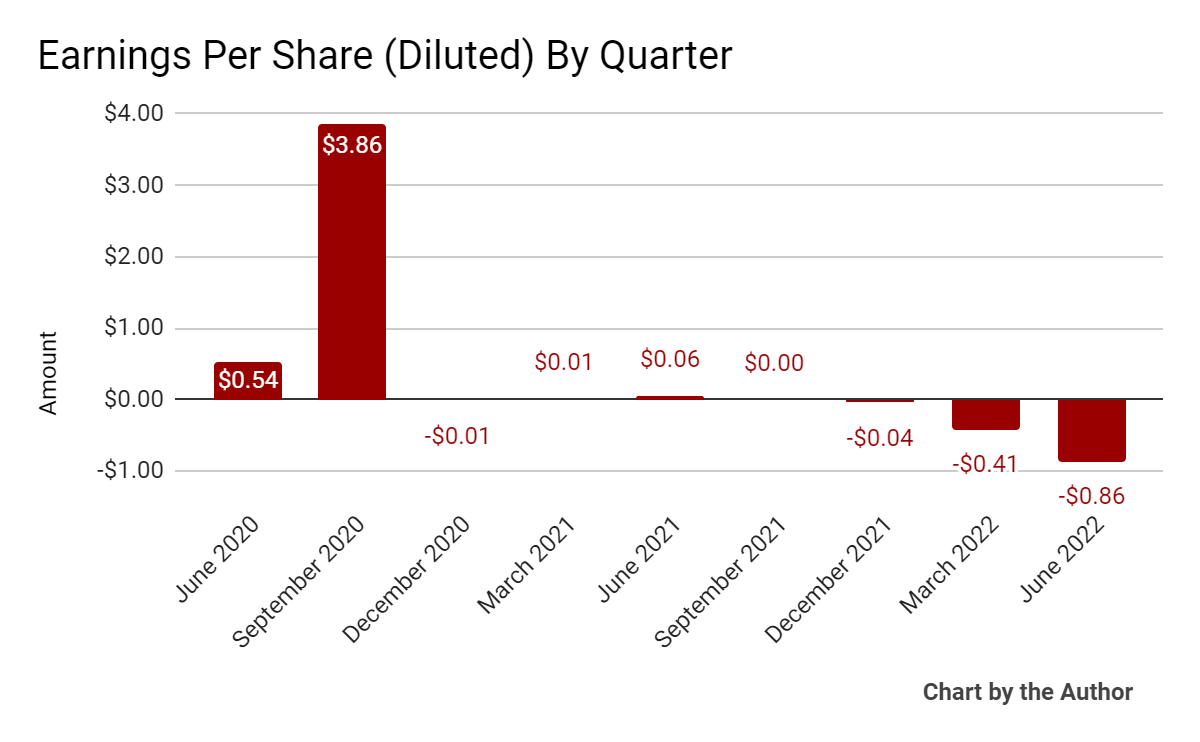

Earnings per share (Diluted) have also turned sharply negative recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

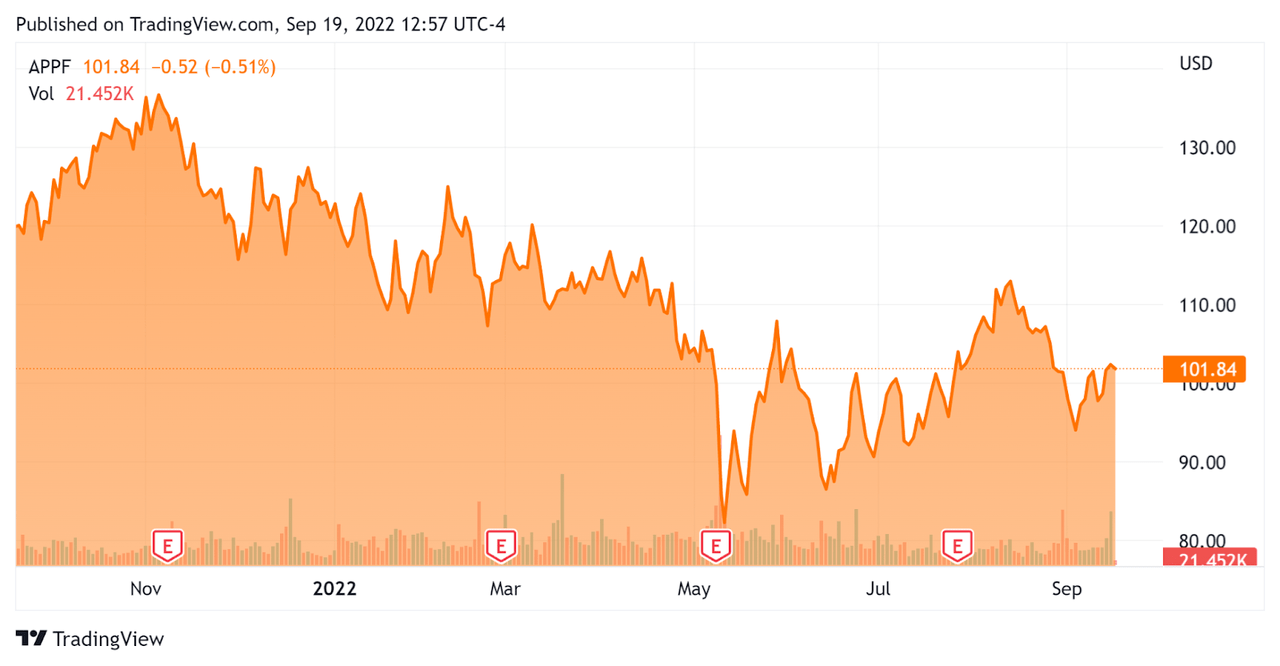

In the past 12 months, APPF’s stock price has fallen 14.7% vs. the U.S. S&P 500 index’s drop of around 11.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For AppFolio

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

8.50 |

|

Revenue Growth Rate |

27.6% |

|

Net Income Margin |

-11.0% |

|

GAAP EBITDA % |

-6.5% |

|

Market Capitalization |

$3,580,000,000 |

|

Enterprise Value |

$3,520,000,000 |

|

Operating Cash Flow |

$28,010,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.31 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

APPF’s most recent GAAP Rule of 40 calculation was 21.2% as of Q2 2022, so the firm needs improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

27.6% |

|

GAAP EBITDA % |

-6.5% |

|

Total |

21.2% |

(Source – Seeking Alpha)

Commentary On AppFolio

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the announcement of its AppFolio Stack, a new integration marketplace to make it easier to integrate customer legacy software with the company’s Property Manager system.

The firm announced a number of related partnerships, including one with Conservice, a utility billing service provider for multi-family and commercial properties.

APPF has also integrated with Plain to enable clients to link bank accounts to its system to utilize its automatic bank reconciliation features, saving time.

As to its financial results, revenue rose by 32% year-over-year to reach $117.4 million.

Cost of revenue rose from 36% in Q2 2021 to 40% due to a prior year benefit and a current quarter mix of value added services and related third-party service expenses.

Operating expenses rose due to higher headcount, with sales & marketing expenses rising from 19% to 21%, year-over-year.

As a result, operating income has remained negative in each of the last three quarters and earnings per share have worsened markedly.

Management did not disclose the company’s net dollar retention rate, which would provide greater visibility into product/market fit, sales & marketing efficiency and customer churn.

The firm’s Rule of 40 results have been moderate and in need of improvement.

For the balance sheet, the company ended the quarter with $168 million in cash, equivalents and investment securities.

Over the trailing twelve months, free cash flow has totaled $17.6 million.

Looking ahead, management increased its full year 2022 revenue guidance to $458 million at the midpoint of the range, which if achieved would represent a revenue growth rate of 27%.

Regarding valuation, the market is valuing APPF at an EV/Sales multiple of around 8.5x.

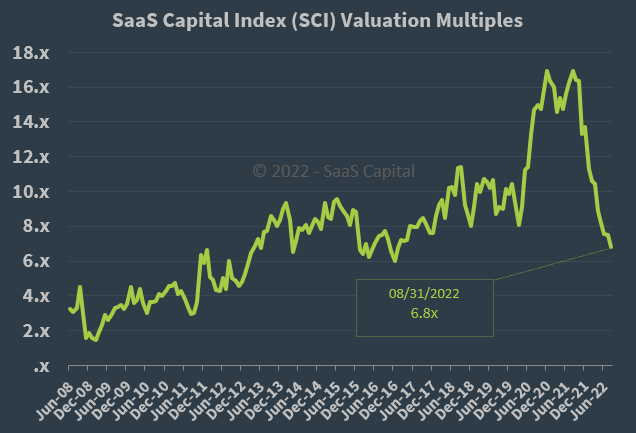

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, APPF is currently valued by the market at a premium to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles, rent activities and reduce its revenue growth trajectory.

With the firm entering the slower year-end part of its seasonal activity, it is hard to see a near-term catalyst to the stock, especially given its increasing GAAP earnings losses and still-generous valuation by the market.

As a result, I’m on Hold for APPF for the near term.

Be the first to comment