Jay_Zynism/iStock via Getty Images

Initiating Coverage

We are initiating coverage on Warby Parker (NYSE:WRBY) and recommending a “HOLD” as we believe that there are no catalysts to boost the stock price higher and as a result of some upside risks that we believe makes the company a dangerous proposition to short. In sum, Warby Parker’s recent quarterly performance has been abysmal and we’ve been seeing meaningful deceleration in growth and a weakening balance sheet which are likely to be worsened by any deterioration in the U.S. economy.

Company Overview

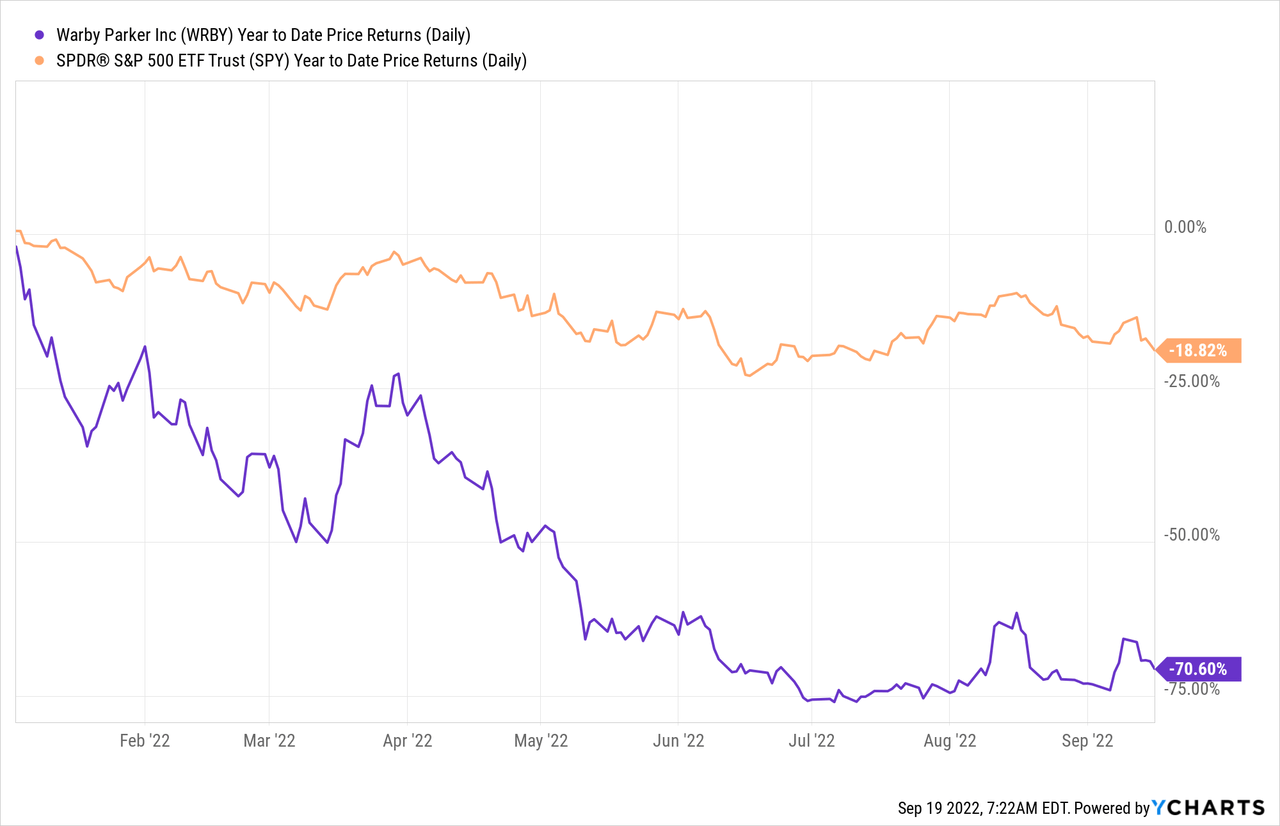

Warby Parker is a retailer that sells sunglasses, contacts, eyeglasses, and other fashion goods online as well as in a few retail locations. The company completed its initial public offering on September 29, 2021 and directly listed at a $5 billion valuation. Since then, the company has seen a precipitous drop in valuation, and now the company trades at $1.58 billion in valuation, which is a 68.4% decline in valuation in less than a year. Year-to-date, the company has significantly underperformed the S&P 500, as the company’s stock declined -70.60% compared to S&P 500’s decline of -18.82%.

Disappointing Q2 Results

Slowing Growth

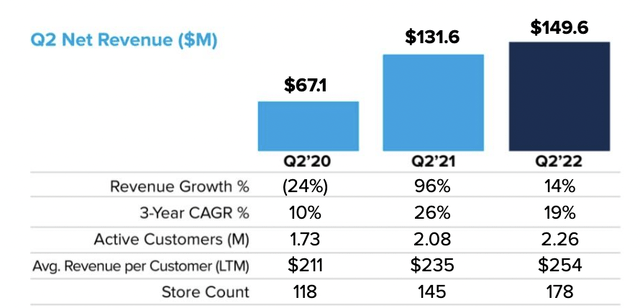

Warby Parker reported decelerating growth metrics, such as revenue growth, active customers, and average revenue per customer. The company reported a Q2 revenue of $149.6 million, which represents a 14% YoY growth. Compared to the 96% revenue growth that Warby Parker had in Q2 of 2021, the most recent revenue growth is a significant deceleration. The number of active customers has also declined from 8.7% YoY growth in Q2 2022 compared to 20% YoY growth seen in Q2 2021. The average revenue per customer has also decelerated from a 11.3% YoY growth in Q2 2021 to a 8.1% YoY growth in Q2 2022. We also calculated revenue per store count by dividing the quarterly revenue by the number of store count at the end of each quarter. Such metric showed a meaningful YoY decline, as the $0.84 million per store in Q2 2022 represents a 23.6% decline from $1.1 million per store in Q2 2021. We view these results to show an overall picture of declining efficiency and revenue potential of the company’s growth plans.

Warby Parker Q2 2022 Earnings Report

Weakening Balance Sheet

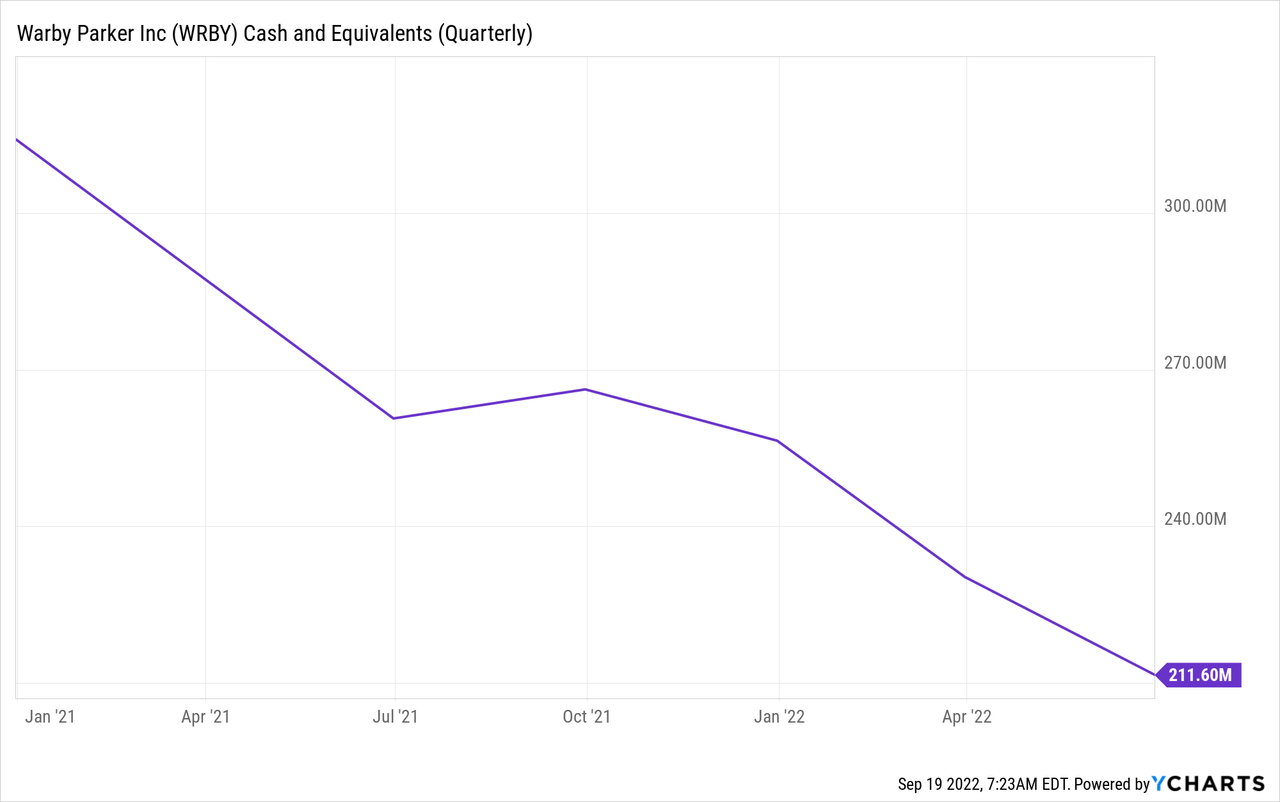

Since the beginning of 2021, Warby Parker’s balance sheet has weakened considerably. In Q2 2022, Warby Parker reported a net loss of $32.2 million, which represents a 47.0% increase in net loss compared to Q2 2021 when the company reported a net loss of $21.9 million. Such continued streak of losses has significantly impacted the company’s liquidity position, and now the company has $211.6 million in cash and cash equivalents. Based on the most recent quarterly loss, that provides a runway of only ~7 quarters assuming no access to other sources of liquidity. Given the deteriorating macroeconomic environment and an increased likelihood of declining consumption, we view the current balance sheet as highly problematic that could threaten the viability of the company.

Heavy Exposure to U.S. Consumption

We view the tightening monetary policy and the subsequent reduced U.S. consumption as factors that could significantly impact Warby Parker’s business model. The company operates in the consumer discretionary sector and sells products like sunglasses which are fashion products. In addition, the company sells products with price points that are fairly high, with sunglass prices starting at above $195. If rates continue to rise and the economy goes into a more severe recession as measured by consumption and unemployment rate, Warby Parker’s sales would likely be impacted significantly as consumers shy away from paying $200+ for fashion products.

Risks to Upside

There are a couple of upside risks that investors should consider. One risk that we often mention for a beaten down stock like this is a potential “short squeeze”. Currently Warby Parker’s short interest ratio is near ~29.76%. When short interest ratio nears 10%, the likelihood of a “short squeeze” is high. Compared to the 10% benchmark, the current short interest ratio is extremely high at near ~30%. Therefore the risk is high that the stock price may rally well beyond its fundamentals as a result of short positions being covered. Given the cheap valuation, another upside risk that investors should consider are potential rumors or news of acquisitions and mergers, as the company may be the target of an acquisition by well-capitalized private equity firms or fashion companies.

Conclusion

Warby Parker is a company that is facing many headwinds, such as decelerating growth in key metrics, weakening balance sheet, and a declining macroeconomic environment. Despite these negatives, we are recommending a HOLD due to the abnormally high short interest ratio and potential upside risk stemming from acquisition/buyout offers.

Be the first to comment