KanawatTH/iStock via Getty Images

The SPDR S&P Bank ETF (NYSEARCA:KBE) is an exchange-traded fund offering exposure to U.S. banking stocks. The fund’s benchmark index is the S&P Banks Select Industry Index, a subset of the S&P Total Market Index which tracks the broader U.S. equity market. The fund had 100 holdings as of April 7, 2022, and all the top 10 holdings each represented less than 1.50% of the fund’s portfolio by weight (data available on SSGA.com).

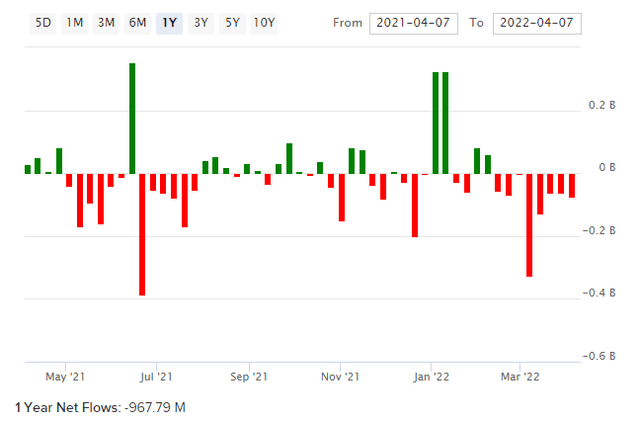

Meanwhile, KBE’s assets under management totaled $2.65 billion as of April 7, 2022, and this follows generally negative outflows (notwithstanding sporadic periods of positive inflows). Over the past year, net negative outflows sum to about $1 billion.

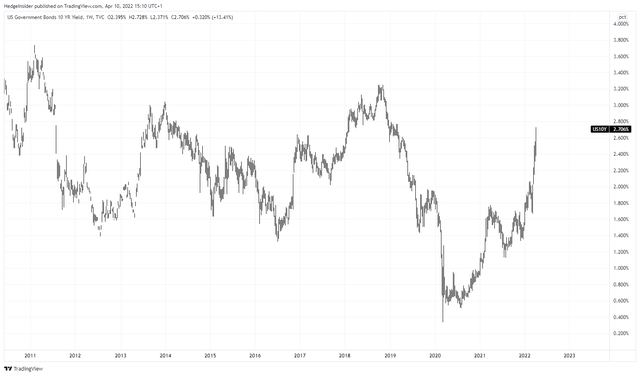

A fund with assets of $2-3 billion is generally recognized as being an established fund, if not popular. However, clearly banking stocks are not currently enjoying positive sentiment. This is somewhat unusual given that long-term interest rates are rising at the moment; see for example the U.S. 10-year yield below, since 2011.

The spike in the 10-year yield since the lows of 2020 would ordinarily help banking stocks. And indeed KBE did initially benefit, the price pictured below over the same time frame, but more recently banking stocks are finding negative pressure.

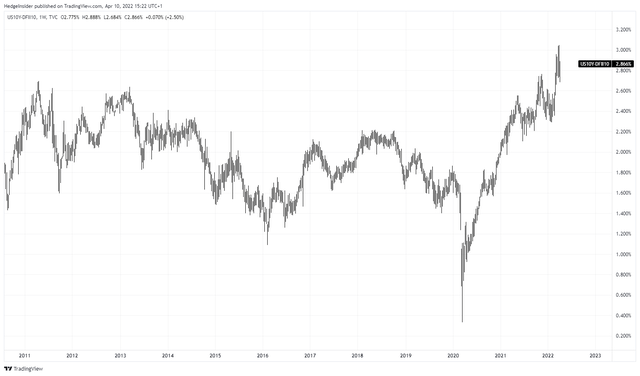

One reason may be curve inversions. Although the typically more instructive 10-year, three-month U.S. treasury yield spread has not inverted, plenty of other popular U.S. yield curve spreads have inverted. An important one is the 10-year, two-year spread, pictured below.

Curve inversions are important for at least two reasons. One reason: when longer-term rates fall under shorter-term rates, it signals possible economic weakness in the longer run (including a possible recession in the medium term). That is the bond market is implicitly saying, “short-term rates are too high for the economy to manage in the longer run”, or otherwise “short-term rates should be lower”. Another reason: when long-term rates are low relative to shorter-term borrowing costs, banks have less incentive to lend. Also, weak spreads between longer-term rates and shorter-term rates compresses commercial bank profit margins. So, it’s a triple-whammy: recessionary risk, fewer incentives to lend driven by weaker profit margins, and weaker absolute (forward) earnings driven by the first two factors.

Even if the U.S. avoids a recession in the medium term, therefore, banks can still suffer from a lack of the right incentives in place. Because banks mostly pay very little to their depositors nowadays, hikes in short-term rates can actually boost earnings. So, perhaps yield curve inversions are not as bad as they might have been for bank earnings in the more distant past. But official rates are actually still low (the upper limit on the federal funds rate is still only 0.50%). While inflation expectations are still high. So, real rates are still low. The chart below is the difference between the 10-year nominal yield and the 10-year Treasury Inflation-Protected Securities yield, an albeit noisy proxy for the forward 10-year inflation rate.

To recap: the bond market is saying that the economy will not be able to withstand higher rates in the long term, there are weak incentives to lend to the real economy, inflation is likely to remain elevated, and we can see that actual short-term rates are still close to zero. This is why banking stocks are struggling, because at best they can tread water in this environment.

One leading indicator is the credit impulse (bank credit to the private non-financial sector, scaled by GDP). BIS data tells me that this ratio was 54.2% in the United States in Q3 2020, and 50.4% in Q3 2021. So, there is a negative “credit impulse” to Q3 2021. Assuming a lag of circa 6-12 months (two to four quarters), you would expect corporate earnings to surprise to the downside from Q1 2022 to Q3 2022. I would say Q2 2022 to Q3 2022 would be a reasonable bet.

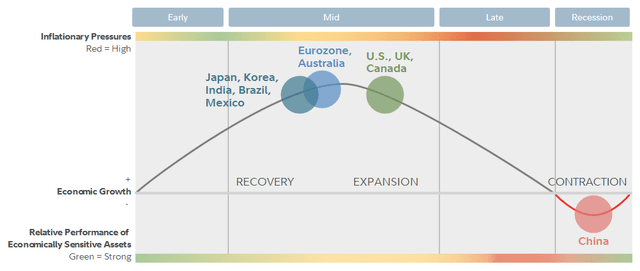

Yet even if this occurs, it does not necessarily mean a recession is due, especially if inflationary pressures driven by higher commodity prices (not helped by the ongoing Russo-Ukrainian War) begin to settle. Per analysis from Fidelity, the United States was still in the mid-phase of its current business cycle, not even in the ‘late’ stage prior to recession.

Somewhat off consensus: what I think is that recession will be avoided in the medium term, but we may well see a hit to valuations in the second half of the year if/when broader earnings underwhelm expectations. However, the U.S. economy will likely keep on trucking along, and markets will recover into the late stage of the cycle until we perhaps see a more significant correction (but that is looking too far ahead).

Since KBE invests in banking stocks, and since banking stocks are implicitly macro bets at least in aggregate, I would say KBE probably has a fairly positive correlated future with this unfolding path. KBE will probably coast until the latter part of the year, at which point it is possible that the fund will fall under some pressure.

Per Morningstar data, KBE’s price/book ratio was 1.17x as of April 8, 2022, with a three- to five-year earnings growth expectation of circa 11.20%. Also, the forward adjusted price/earnings ratio was 10.83x, signaling a forward return on equity in the range of about 10.8%. The forward earnings yield of about 9.2% is actually pretty strong though. If we assume that even if earnings growth rates under-perform they are nonetheless positive in real terms, and we strip out the 10-year yield of 2.7% from the forward earnings yield of 9.2%, the implied equity risk premium is 6.5%.

However, the fund’s longer-term beta is quite high at 1.33x. So, while the current U.S. equity risk premium might be circa 5.00% (Damodaran, April 2022), perhaps scaling this by 33% would indicate a fair ERP of 6.65% for KBE’s portfolio. Adding the 10-year back in, we have a total cost of equity estimate of 9.35%, which is actually higher than our forward earnings yield.

On one hand, earnings growth rate estimates have ticked down for KBE in recent months, so a lower deserved valuation makes sense. However, equity risk premiums are generally higher at the moment given that stocks have sold off on various reasons, such as concerns over inflation, and war in Europe. The longer-term U.S. equity risk premium is closer to 4.0-4.5%, which would probably imply that KBE is undervalued, but probably not any more than a wider basket of stocks.

In summary, I think in light of lower forward earnings growth rate estimates, and probable negative surprises later this year, KBE is probably not going to be an especially favorable position to hold in the medium term. However, the market does seem to have assigned (in light of elevated historical relative volatility, i.e., higher beta) a higher equity risk premium to KBE. This can work both ways. In a market downturn (such as possibly later this year) KBE could suffer more than the broader market. Following any correction though, since KBE’s ERP is already implicitly elevated, this would probably be the time to load up on banking stocks. I just don’t think now is quite the right time.

Be the first to comment