Nordroden/iStock via Getty Images

Investment thesis: although the stock is outperforming the SPY, set a sell-stop to lock in profits.

I wrote about Cleveland-Cliffs (NYSE:CLF) on January 6. At that time, several factors came together, including

1.) A positive macroeconomic environment

2.) A strong earnings history

3.) A stock chart that was either topping or consolidating (it was consolidating).

The stock has since rallied from the mid-20s to the mid-30s.

Let’s reevaluate the stock by first looking at the macroeconomic backdrop.

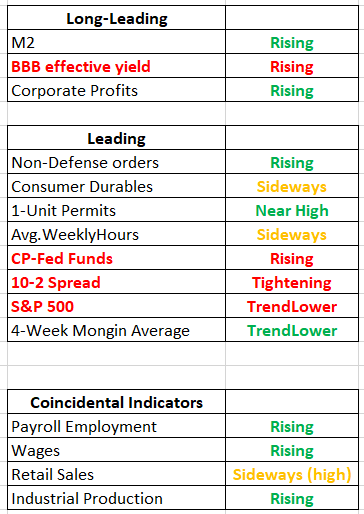

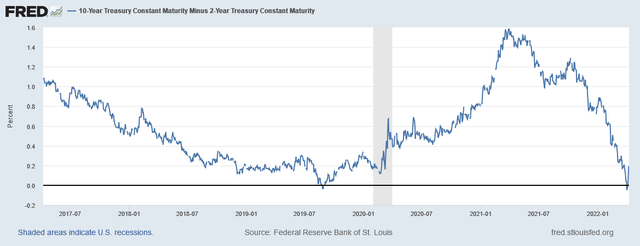

Long-leading, leading, and coincidental indicators (Data from FRED system; author’s calculations)

The above data summarizes the long-leading, leading, and coincidental indicators, an economic system first developed by Arthur Burns and Geoffrey Moore. The financial market indicators are now softer.

Perhaps most importantly, the 10-year-2-year treasury market spread recently inverted. This has preceded most post-WWII recessions.

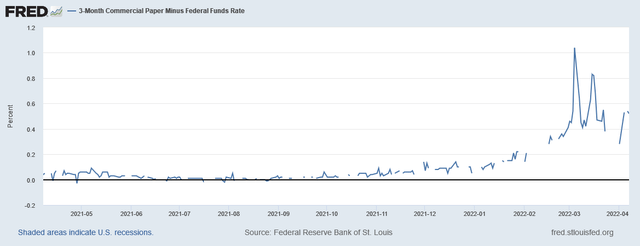

Commercial paper spread (FRED)

The commercial paper spread has also widened.

The reason for both is that, due to high inflation, the Fed is now taking a far more hawkish tone. All of this was noted in the most recent Federal Reserve Meeting Minutes, which I cited in my regular weekly market summation.

At the same time, industrial activity is still very strong. The following from the latest ISM Manufacturing report summarizes the current situation (the author has written permission to use the latest month’s data).

Fiore continues, “The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment. In March, progress was made to solve the labor shortage problems at all tiers of the supply chain, which will result in improved factory throughput and supplier deliveries. Panelists reported lower rates of quits and early retirements compared to previous months, as well as improving internal and supplier labor positions. March brought back increasing rates of price expansion, due primarily to instability in global energy markets. Suppliers are not waiting to experience the full impacts of price increases before negotiating with their customers. Panel sentiment remained strongly optimistic regarding demand, with six positive growth comments for every cautious comment, down from February’s ratio of 12-to-1.

The data confirms this situation:

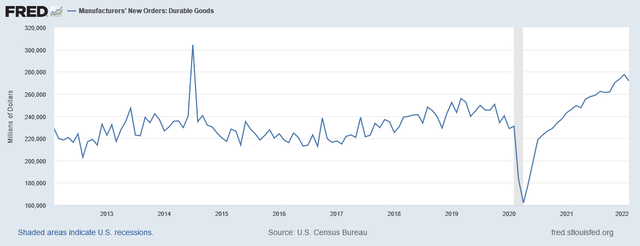

New orders for durable goods (FRED)

New orders for durable goods are just shy of a cycle high.

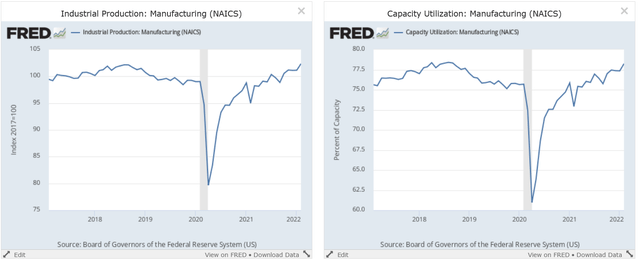

Industrial production and capacity utilization (FRED)

Both industrial production (left) and capacity utilization (right) are at highs for this economic cycle.

While the data is encouraging, the macroeconomic environment has noticeably changed. The Fed’s now aggressive position on interest rates is of the most concern, followed by preliminary weakness in the financial markets, and, as linked to above, tightness in the credit markets.

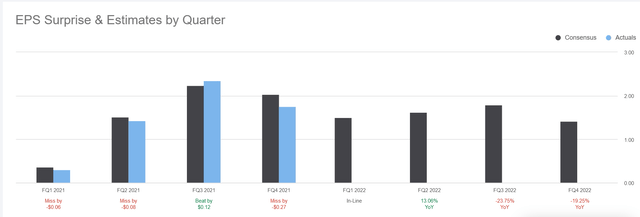

Next, observe that the company’s earnings outlook has weakened:

Cleveland-Cliffs Earnings (Seeking Alpha)

The company missed its latest earnings release.

Cleveland-Cliffs Earnings Estimates (Seeking Alpha)

50% of (CLF) analysts have revised their company earnings lower.

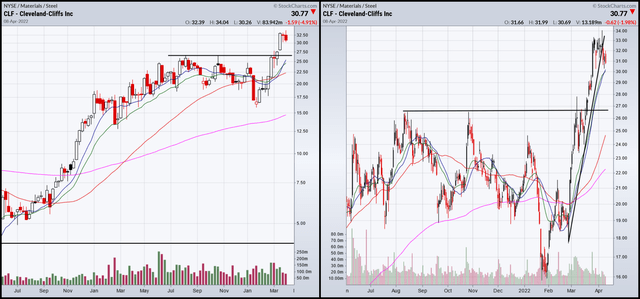

Finally, let’s take a look at three charts.

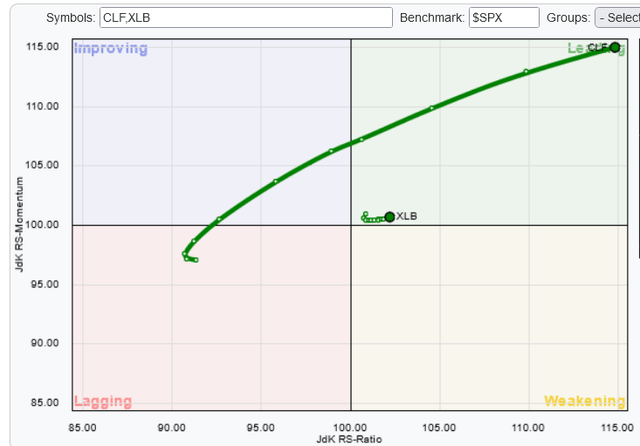

Relative rotation graph for CLF and XLB (StockCharts)

Both (CLF) and the XLB are outperforming the SPY. In the case of (CLF), the outperformance is by a wide margin.

CLF weekly and daily charts (StockCharts)

Prices have clearly broken out on the weekly (left) and daily (right) charts. However, the right chart shows that the rally is very steep. This is the kind of rally that can quickly reverse on negative news.

Let’s wrap this up. The macroeconomic picture is now softer with a far more hawkish central bank. Industry data is still positive. The earnings picture is cloudy but the chart is still pretty strong.

At a minimum, set a sell-stop. The current environment is one that can quickly lead the company to suddenly reverse. You don’t want to lose any profits you’ve made.

Be the first to comment