Luis Alvarez

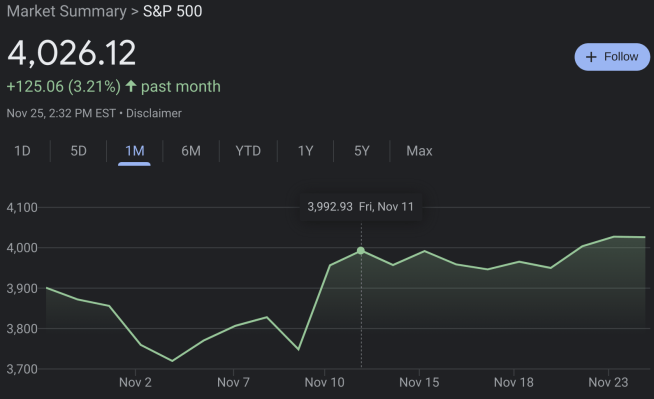

Welcome back to another dividend stock watch list article! The stock market is still down almost 16% year-to-date, as November showed a positive return. The S&P 500 has dipped a few times in the 20%+ territory, but there is still time to find discounted stocks.

What does that mean? Undervalued dividend stocks to buy now, baby! As a frugal individual and dividend investor, I love nothing more than buying dividend stocks on sale! Bring it on recession and upcoming interest rate hikes, just bring it!

Therefore, as I do every month, here is the Dividend Stock Watch List for December 2022!

Dividend stock watch list

Another dividend stock watch list! The stock market has been more volatile than ever since the pandemic of 2020. What does that mean? New undervalued dividend stocks are coming to light baby! It’s all about buying dividend income-producing stocks – the best source of passive income source on your journey to financial freedom!

The stock market, specifically the S&P 500, is just above 4,000, yet again. Your stomach needs to be iron clad to go through this volatility and stay the course. From October 27th to November 27th, the S&P 500 is up 125 points or over 3%. The S&P 500 is now down only 16% year-to-date. What a ride Mr. Market has been on.

The stock market has been swinging wildly, as they guess on the inflation data, future interest rates and interest rate plans from the Federal Reserve, housing statistics and the like. It’s a turbulent time, no doubt.

From the all-time highs of 4,800, dropping to almost 3,500 and holding steady at 4,000. We were in recent bear territory, but have come back up from being down over 20% to now down 16%. What a volatile time period we are in! Chart is below:

Interest rates are steadily rising on High Yield Savings Accounts, with many over 3.00%!

We have a 50-basis point increase coming up in a couple of weeks from the Fed, more than likely. Then, we’ll see maybe 2 more in 2023. Therefore, all of the interest rate increases have increased those savings rate. Ally, where I hold a significant amount of cash, is yielding 3.00%. However, there is one specific Bank / Fintech application that I use so much more now…

I keep more savings in my SoFi savings account – as it earns me – now – 3.00% on my savings with 2.50% on my checking account.

In addition, I’ve been buying stocks on SoFi’s investing application.

In addition, given the uncertainty, I continue to make weekly investments into Vanguard Exchange Traded Funds (ETFs). The specific ETF my wife and I have been loading up on is Vanguard High Dividend Yield (VYM). We are investing approximately $400 to $600 per week into Vanguard (pending the VYM stock price), to stay invested in the market, during the uncertain times. In addition, I am also investing $60 per day into Vanguard S&P 500 ETF (VOO)!

Therefore, on the road to financial freedom, acquiring assets that produce cash flow or income is the goal! Like I always say, there is always a diamond in the rough. How do I find an undervalued dividend stock? Time to introduce our beloved Dividend Diplomat Stock Screener!

Dividend Diplomat Stock Screener

If you don’t know already, we keep the stock screener metrics to three simple items. They are:

- Price to Earnings Ratio – We look for a price to earnings ratio < than the overall Stock Market.

- Payout Ratio – We aim for a payout ratio of less than 60%.

- Dividend Growth – We like to see history of dividend growth in a company.

Time to find the answer to… how did the dividend stocks on my watch list grade on the stock screener?

Dividend stock watch list

Here is the list of dividend stocks that are on my radar going into the month of December 2022. I typically like to keep it at 2-3 dividend stocks, keeping the focus locked in. Finding dividend stocks isn’t easy, but there are also other factors, such as composition of my portfolio by industry (such as – am I overweight/underweight in an industry), as well as exposure to one stock and the concentration there.

There, the dividend stocks on my list cater to those other facets when building a dividend stock portfolio. This is a fairly defensive, consumer goods-intensive, dividend stock watch list!

Intel Corp.

Intel (INTC) is back on my stock watch list. Down 45% this year and I currently own 182 shares and want to get to 200 shares. I have been a long-term investor with Intel and believe in their turnaround.

In addition, they are pouring billions into our buckeye state of Ohio, to ramp up production of chips to be used across their products and to be delivered to the world.

Therefore, I am going to keep buying Intel Stock, at least until I get to 200 shares, not including dividend reinvestment. Therefore, I have 18 shares to go for this bad boy!

Yahoo Analysts are only expecting $1.88 for 2023 earnings at the time of this writing (November 27th). Therefore, we will be using that for the earnings per share metric in the evaluation of the P/E Ratio and Payout Ratio.

First, however, we must run Intel officially through the Dividend Diplomats Stock Screener, which is focused on these 3 metrics.

- Price to Earnings Ratio: Earnings is approximately $1.88 in earnings per share for 2023. Therefore, Intel is trading at 15.6x forward earnings at this time. Not the cheapest stock and not the most expensive stock. I believe this is super conservative at this time.

- Payout Ratio: Intel’s current dividend payout ratio, using that metric, is actually at a blistering 77%, much higher than where they usually are. I usually only like stocks below 60%. Could this be temporary?

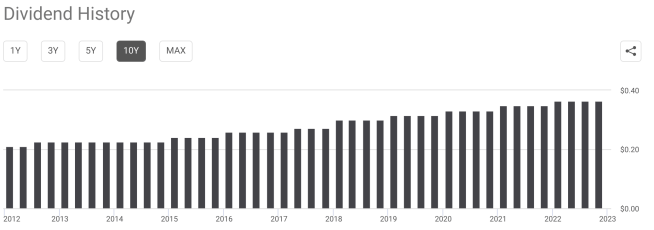

- Dividend Growth: Here are the last 10 years of dividend history for Intel. As you can see, the Intel Corp. dividend continues the wave upward. Intel has increased their dividend for 7+ years, as 2013/2014 did not see the increase. The 5-year average rate is above 6%, but I would anticipate 2-4% for the next year, due to the supply chain issues and capital being used for building & production.

The dividend yield is at 4.98%, which is almost a full 2% higher than their 5 year dividend yield average (3.06%). Therefore, you are getting paid to wait, in my mind. Let’s go Intel and turn this earnings production around, and yes – make more chips.

United Parcel Service

Yes, United Parcel Service (UPS) stock is staying on my dividend stock watch list. This is even after the stock price of UPS has gone up $15 per share since my last article or 9%. UPS is heading into their peak holiday season and I believe they are an under the radar dividend growth stock.

UPS is a recognizable company across the world. Given the world is built on e-commerce and shipping/logistics, UPS plays a major part in the global economy.

UPS is set to earn over $100B in revenue and they’ve been able to have a solid year in 2022, by passing on costs to the consumer.

UPS has a current ratio of 1.39x, with $11B in cash and equivalents. Therefore, UPS has the ability to stay agile and mobile during an ever-changing global economy.

UPS has also consistently raised their dividend every year. They also increased their dividend 50% this year. What a great dividend growth stock, right?

Let’s run UPS through the dividend stock metrics, to see if this could be a dividend stock to buy now.

- P/E Ratio: UPS analysts are anticipating $12.28 of earnings for the year 2023. At a share price of $182.52, the price to earnings ratio is 14.86.

- Dividend Payout Ratio: UPS pays a quarterly dividend of $1.52 per share or $6.08 per year. That equates to a dividend payout ratio of less than 50%. UPS has no doubt they can pay and increase the dividend going forward.

- Dividend Growth Rate: UPS has increased the dividend for over 12 years, with an average dividend growth rate of over 6%. As stated earlier, they increased their dividend by almost 50% in the last year!

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now. The yield for UPS is now yielding 3.33%.

Armanino Foods of Distinction

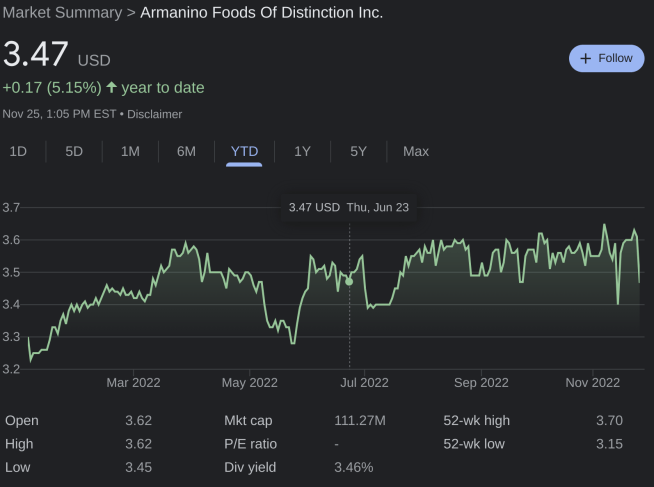

This is a consumer goods micro stock with a market cap of 111M. Armanino (OTCPK:AMNF) makes meatballs, cheese, pesto, sauce, pasta you name it. A company that is in the food business, serving consumers from grocery stores and supplying food industries is in a good business. We all have to eat, right? Also – funny enough, the stock is up YTD – that’s called a recession and inflation proof company. Let’s go.

I have owned this company for years, possibly even 5 years +. They’ve been on my dividend stock watch list before and I am closing in on 1,000 shares of this stock. I can’t wait to see if the metrics are saying this is a stock to buy right now, as I believe this could be a great, recession proof stock.

Let’s run AMNF through the dividend stock metrics to see if this could be a dividend stock to buy now.

- P/E Ratio: I am anticipating earnings per share of $0.215 for the year of 2022. That is a P/E ratio of 16, decent value.

- Dividend Payout Ratio: Armanino Foods pays a dividend of $0.03 per share per quarter, or $0.12 per year. The dividend payout ratio is approximately 55%.

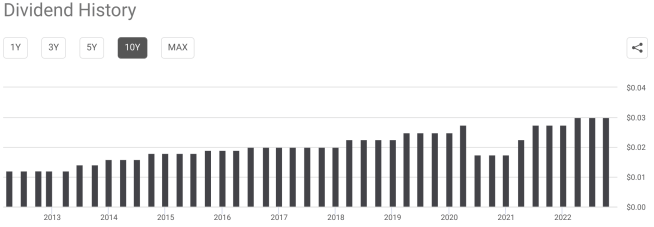

- Dividend Growth Rate: Armanino Foods is back on the dividend growth path, increasing their dividend 3x since 2021. They reduced their dividend during the pandemic, to help their cash flow and pay down debt. Therefore, Armanino was prudent, paid down debt with the cash in lieu of a dividend and are roaring back the dividend. Love it!

Therefore, I almost own 1,000 shares of Armanino Foods and it would be “fun” to have a 4 digit share count on my list. Obviously, the dividend stock metrics look great for AMNF.

Other Dividend Stocks to buy

I am also considering, as a quick hitter approach here, my eyes are on a few other stocks. Those stocks are 3M (MMM), T. Rowe Price (TROW), Paramount (PARA) and GSK (GSK). Stocks that are just beat up, no doubt.

I own each stock and am constantly evaluating the stock market, to see if there are undervalued dividend stocks to buy in this wild market.

Dividend Stock Watch List Conclusion

Dividend investing is real and is happening.

Of course, prior to making any purchase, I definitely will make sure to run them through the Dividend Diplomat Stock Screener once more.

I may have to add routinely to all 3 dividend stocks mentioned above. I think these are dividend stocks to buy in December 2022, but again – I highly encourage you do your own research as this is not financial advice (quick disclaimer!).

As always, stick to your investment strategy and dividend stocks will be there. What do you think of these stocks above? Thank you, good luck and happy investing everyone!

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment