Vertigo3d/E+ via Getty Images

Summary

Globant S.A. (NYSE:GLOB) is a fast growing, high free cash flow generating company that is off the radar screen for many investors. Since its IPO in 2014 the company has consistently beat market expectations, grown at over 20% a year and has seen its valuation rise from 20x to 45x P/E. I came across Globant in early 2016 at a Latin American investor conference. I knew very little about the company except it was based in Argentina and exported IT services. Post that meeting and subsequent investment and continued coverage, I believe it is a secular growth story ideally suited for buy and hold or buy and forget investors.

On Seeking Alpha I have read several Globant over views that describe the company in good detail. I would add that it’s a constantly evolving entity, adding new IT verticals or studios/pods as they call them, to broaden product/service base and keep clients permanently engaged/contracted. The most recent is a WhatsApp enabled crypto wallet, auto reinvention interaction for EVs and increased block chain depth. While Globant is still a relatively small company when compared to Accenture (ACN), Capgemini (OTCPK:CAPMF), Cognizant (CTSH) or even EPAM (EPAM), it competes on that level and counts as key clients Disney (DIS), Google (GOOG), Walmart (WMT), Rockwell (ROK), Nestle (OTCPK:NSRGY) etc.

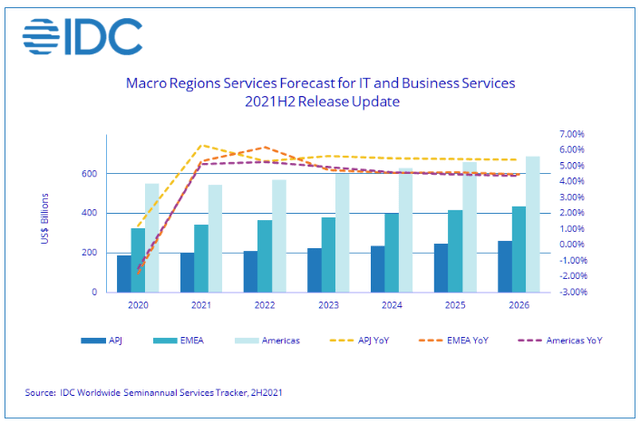

IT Business Service Market Estimates (IDC)

Global IT business service is an over US$1 Trillion market growing over 5% a year while digital transformation demand or investment across all relevant sectors could be US$6 Trillion. Very large numbers and certainly subject to criticism but it gives one a sense of the size and growth potential for a still small company like Globant.

Operating Model

The company provides businesses with software engineering, design and consulting to digitize front end sales/customer interactions and back-end production/administration as well as implement Block Chain, Big data and Artificial Intelligence etc.

Globant has a human-capital intensive operating model where IT engineers, of all disciplines, execute customer projects on a contact bases. Clients usually have 6 month or longer contracts, which provides for a good forward view of revenue and earnings. The industry charges by manhours required to meet project needs while costs are predominantly wages. The key margin drivers come from sourcing human capital in lower cost markets in Latina America/India that have solid pools of talent at lower wages. Operating leverage comes from higher utilization of this work force, i.e., the level of engagement in a client project vs down time.

Globant’s growth is driven by customer satisfaction, repeat and enlarged contract work as well as winning new clients. It’s a very competitive business and one may view it as a sector with low barriers of entry. However, to grow and thrive in this market a company needs to have the manpower, manage 25,000 IT engineers and deliver results, not an easy feat. In addition, companies like Globant look to smaller scale M&A on a regular basis. They acquire niche software providers that have developed some core competencies that can be rapidly assimilated into Globant’s larger ecosystem of services.

Revenue model

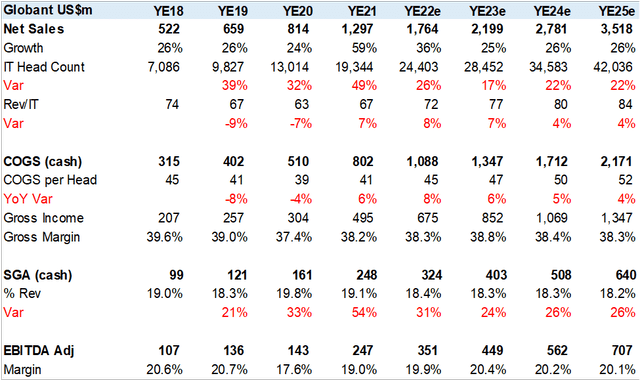

Globant’s revenue model is relatively straight forward and provides very good growth and earnings visibility. The company is contracted to execute a wide variety of IT projects at set price per man hour. Revenue is then a function of IT head count or delivery personnel multiplied by average revenue charged per head count. As can been seen in the table below, the main driver is more man hours, more IT personnel working on client projects. This requires constant hiring and administration to meet deadlines etc. Globant has more than tripled its work force in 4 years on new client contracts as well as maintaining / renewing current contracts and M&A. I assume IT head count growth will revert to 22% post pandemic spike.

Prices for contracts or revenue per IT personnel suffered some contraction in YE19 on M&A, the companies acquired had lower valued pricing. The pandemic also hurt pricing on execution delays but Globant did not stop expanding. For YE22/23 I assume contract prices increase on inflation and then decline to a 4% growth level.

Globant Operating Model Estimates (Created by author with data from Globant)

Cost model

I break down costs into two items, the wages for IT delivery personnel and SGA costs excluding stock compensation, which is a noncash item. As can be seen IT costs per head move a bit lower than revenue per IT head, this is due to exchange rate differential. In many markets Globant pays staff in local currency, such as the Argentine or Colombian peso, which suffer devaluation vs the USD and thus create positive margin spreads. This wage gap usually does not last very long given the demand for software engineers and programmers, but wages are rarely a head wind. SGA costs (sales, general and administrative) are where the company has seen and should garner some scale gains. However, since much of it growth is human capital intensive and requires hiring, opening offices in new market etc., I do not factor in much margin gain.

Financial Estimates

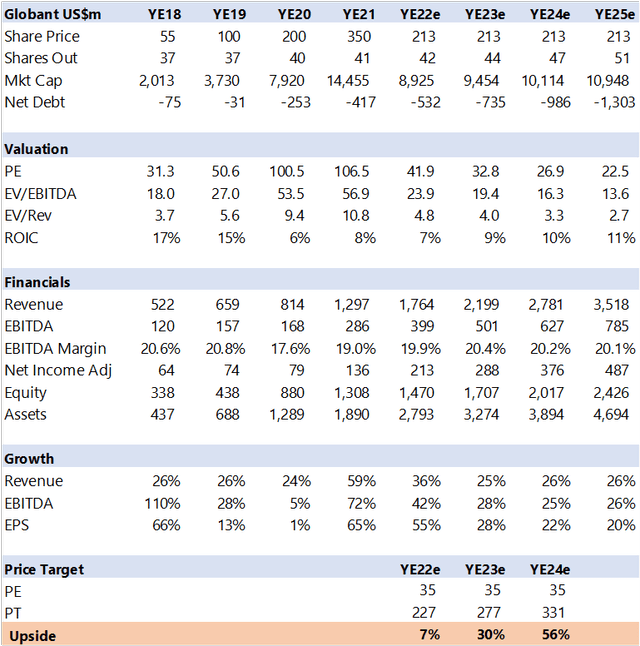

In the table below are summary historic and estimated financials and ratios. It’s important to note that Globant is asset light, it does not need to invest in working capital, machinery, data centers or computing power to achieve growth targets. This makes it free cash flow positive; it generates more cash than it spends, which has been used for M&A.

Globant Financial and Valuation Estimates (Created by author with data from Globant)

Consensus

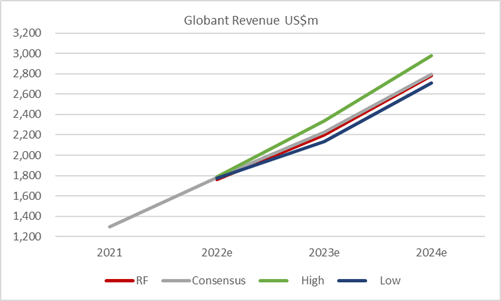

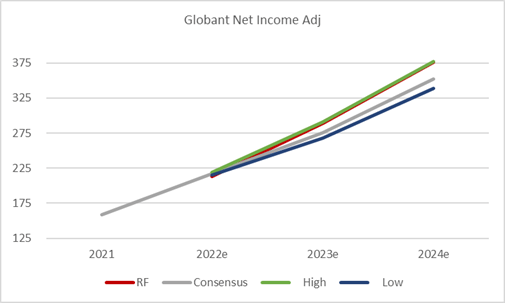

There are 11 analysts covering the stock with a consensus price target of US$284, which backs into an implied PE target of 45x. As you can see in the charts below my estimates are in line with consensus. Keep in mind that I adjust earnings for stock-based compensation, but I use expected fully diluted shares i.e. assuming the options are vested and converted.

Globant Revenue Consensus Range (Created by author with data from Capital IQ) Globant Net Income Consensus Range (Created by author with data from Capital IQ)

Valuation

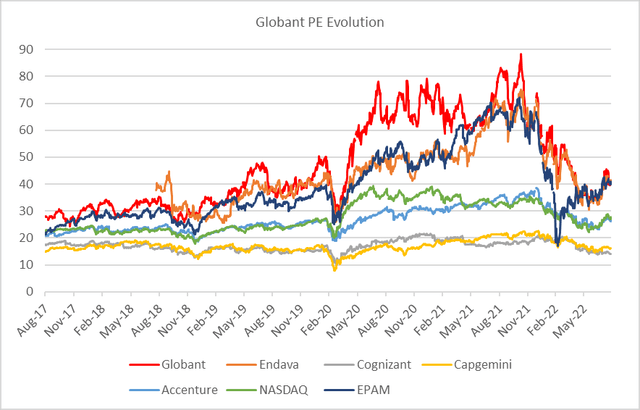

I value the stock at 35x P/E, which is below its historic average given the market has entered a high interest rate environment. Nonetheless I do not find this level excessive given high and profitable growth rates combined with proven execution.

Globant PE Range (Created by author with data from Capital IQ)

Peers

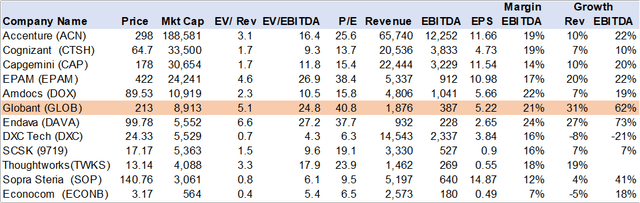

Some very large and recognizable peers include Accenture and Cognizant. The primary difference in valuation is due to growth, smaller companies like EPAM, Globant and Endava (DAVA) have room to grow faster, at least for the next 5 years.

Globant Peer Comps (Created by author with data from Capital IQ)

Smaller is better

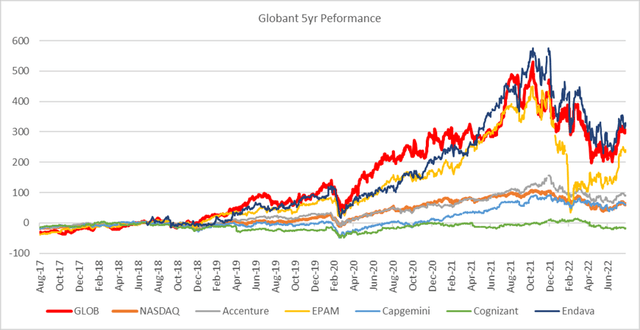

The smaller stocks in the peer group have performed substantially above the larger companies. This is directly attributed to growth, delivery and potential.

Globant share price vs Peers (Created by author with data from Capital IQ)

Conclusion

Globant is a secular growth company in a large and growing addressable market, highly profitable, free cash flow positive and with excellent earnings visibility. Valuation is not cheap but reasonable vs. its growth. In my view Globant can deliver 20%+ annual growth for the next 5yrs.

Be the first to comment