muhammet sager/iStock via Getty Images

Introduction

Upon entering 2022, the operating conditions for Kinder Morgan (NYSE:KMI) were looking strong and as my previous article highlighted, one way or another, their dividends are going higher, thereby boosting their already high yield of 6.47%. Whilst their latest general guidance confirms this aging company is slowing down, this grandpa of the midstream industry is still worth visiting despite having passed their younger growth-focused era, as discussed within this follow-up analysis.

Executive Summary & Ratings

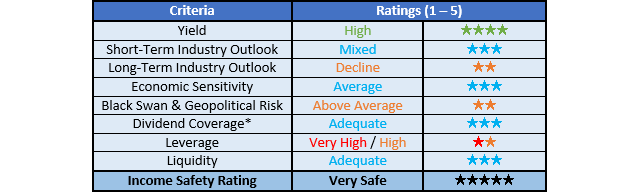

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

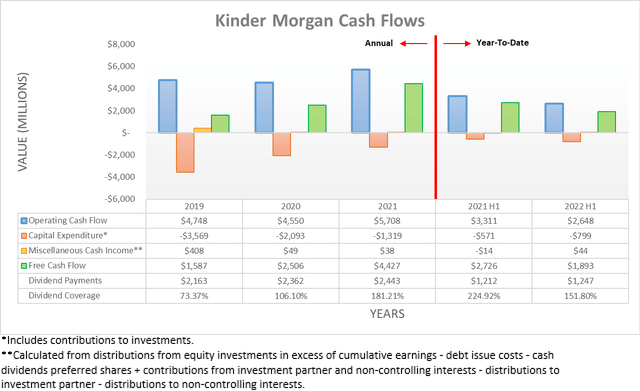

Following their very strong cash flow performance during 2021 on the back of the one-off benefit from the Texas Winter Storm dubbed Uri, they faced a tough comparison heading into 2022 with their original accrual-based guidance down between 9% and 14% year-on-year, as per my previously linked article. Upon reviewing their operating cash flow during the first half of 2022, its result of $2.648b is down 20.02% year-on-year versus their previous result of $3.311b during the first half of 2021. Even if removing the temporary impacts of their working capital movements, their underlying operating cash flow of $2.73b during the first half of 2022 is still down 16.67% year-on-year versus their previous equivalent result of $3.276b during the first half of 2021.

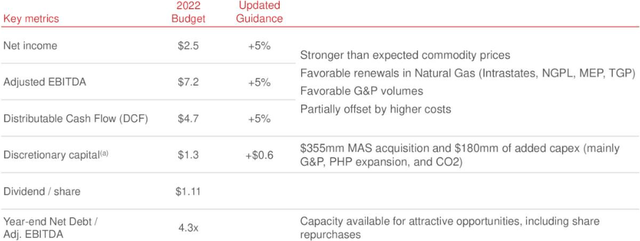

Whilst seemingly even worse than expected, the storm boosted their first quarter results during 2021 and thus makes this comparison particularly tough. As we see results for the second half of 2022, this gap should narrow, especially now they are forecasting stronger than expected financial performance given their updated guidance, as the slide included below displays.

Kinder Morgan September 2022 Investor Presentation

When reviewing their updated guidance for 2022, it can be seen they are now forecasting their adjusted EBITDA will be around 5% higher than the $7.2b result originally expected, which in theory should translate comparably to their operating cash flow given their positive correlations. Although their free cash flow will not see much benefit, as they have also increased their growth capital expenditure in tandem by $180m, thereby lifting it from circa $1.3b to circa $1.5b. Whilst they also include a further $355m relating to their MAS acquisition, when conducting my analyses, inorganic growth investments of this nature are not counted in free cash flow to help comparability across both companies and years.

Now that 2022 is quickly approaching its end, the bigger question is what to expect when looking ahead into 2023 and beyond, as they enter a new era of low growth that in my eyes, makes them alike to the grandpa of the midstream industry. These days, there are many midstream operators, often the subsidiaries of oil and gas companies, such as Antero Midstream (AM) but few are anyway near as large as the good old Kinder Morgan. This did not simply come about overnight but rather stems from their growth-focused younger years but after slowing down in 2021, their latest general guidance for 2023 and beyond well and truly sees their growth-focused era in the past as they slow down and metaphorically speaking, settle into retirement.

To this point, their latest general guidance points towards growth capital expenditure of between only $1b and $2b per annum going forwards, as per slide seventeen of their September 2022 investor presentation. When aggregated with their usual circa $900m per annum of maintenance capital expenditure, as per my previous analysis, their forecast capital expenditure is between circa $1.9b and $2.9b per annum going forwards. If their underlying operating cash flow during the first half of 2022 is annualized, it sees a result of circa $5.5b and thus if utilized as a basis point, leaves their estimated free cash flow at between circa $3.6b and $2.6b per annum going forwards. This shows that even during the lower point of this range, they could still provide adequate dividend coverage because these cost circa $2.5b per annum, given their dividend payments of $1.247b during the first half of 2022.

Initially, this may not seem too exciting but thankfully, there is more to consider because since their future capital expenditure is not forecast to increase, any higher operating cash flow should translate directly into higher free cash flow, which in turn, makes room for dividend growth. Equally as important, they are still making growth investments and thus at minimum, they should support their current earnings base but more likely, help it grow larger across time. Whilst this would obviously be at a far slower than in the past, circling back to the previous point, all of the additional operating cash flow would flow through to their free cash flow and thus should still result in steadily growing free cash flow. Furthermore, during the years when their capital expenditure is towards its low point, they should still have circa $1.1b of excess free cash flow after dividend payments, which raises the ability for either share buybacks or deleveraging.

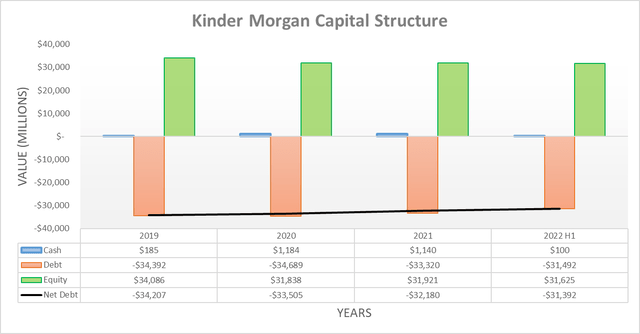

Thanks to their free cash flow being weighted towards the first half of 2022, their net debt is down almost $1b lower than the end of 2021, thereby leaving it sitting at $31.392b versus its previous level of $32.18b. When looking ahead into 2023 and beyond, their net debt should trend lower across time given their prospects to generate excess free cash flow after dividend payments, excluding any share buybacks and relatively minor routine small acquisitions and divestitures, such as their previously mentioned $355m MAS acquisition and upcoming $565m Elba Liquefaction divestiture.

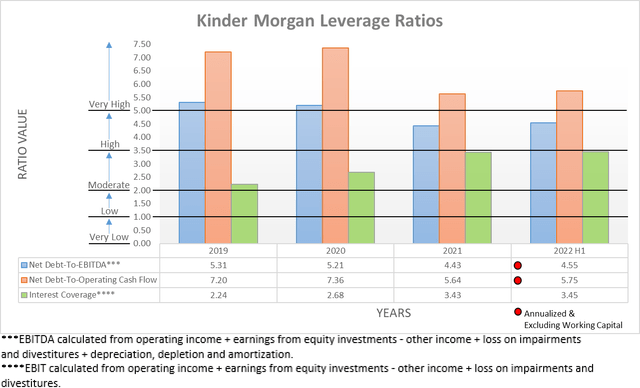

When conducting the previous analysis, their leverage was expected to increase by circa 10% year-on-year during 2022, as they lap their storm-boosted results of early 2021. Thanks to their lower net debt, their net debt-to-EBITDA and net debt-to-operating cash flow barely increased during the first half with their respective results of 4.55 and 5.75 only an immaterial circa 2% higher versus their previous respective results of 4.43 and 5.64 at the end of 2021.

Whilst these results are sitting across the high territory of between 3.51 and 5.00 and the very high territory of above 5.01, they should trend lower along with their net debt heading into 2023 and beyond. The combination of steadily growing free cash flow and steadily declining leverage bodes very well for higher dividends, as the resilience of the midstream industry makes deleveraging less of a priority, despite their otherwise lofty leverage.

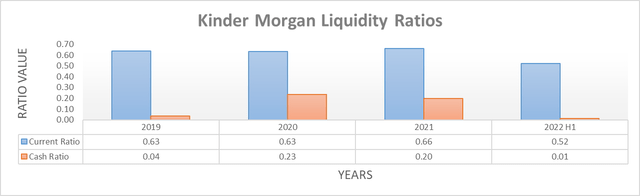

Quite unexpectedly, the biggest change following the first half of 2022 was actually their liquidity seeing its cash ratio drop from its previous result of 0.20 at the end of 2021 to only 0.01, as they ran down their cash balance to almost zero. Whilst this may sound rather concerning, especially since their current ratio dropped to 0.52 versus 0.66 across these same two points in time, thankfully their liquidity remains adequate. Apart from their consistent free cash flow generation, they still retain $3b of credit facility availability and because they are one of the largest companies in the midstream industry, they have superior access to capital markets, even if central banks further tighten monetary policy.

Conclusion

Their younger fast-moving days appear well and truly in the past, although this does not mean they are not worth visiting, especially because they are very generous with their dividends. When looking ahead into 2023 and beyond, their latest general guidance sees a solid base for both steadily growing free cash flow and steadily declining leverage, which means despite passing their younger growth-focused era, they can still reward shareholders with years of dividend growth. Even though this will almost certainly be confined to the low to single-digit per annum range, given their resilient high near 6.50% dividend yield, I still believe that maintaining my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Kinder Morgan’s SEC filings, all calculated figures were performed by the author.

Be the first to comment