Michael Vi

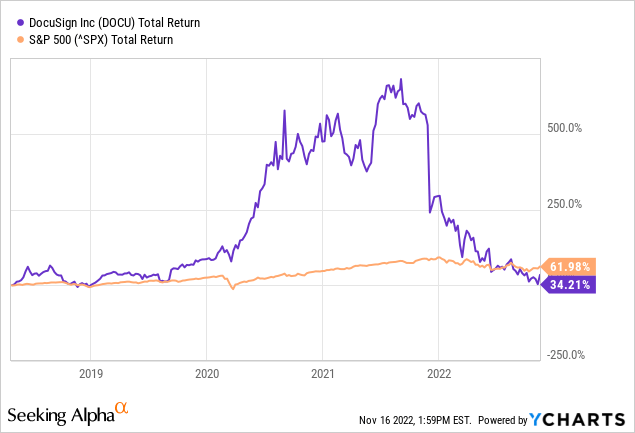

DocuSign (NASDAQ:DOCU) saw strong growth during the COVID-19 crisis as many worked from home. Important documents such as contracts and agreements were signed with DocuSign. The stock price got a boost and investors made wonderful returns.

DocuSign is a growth company that did not turn a profit at the time. Now, the company generates a high free cash flow margin of 21%. Yet the stock has fallen because of growth stagnation. Growth expectations are still positive, and the new CEO – Allen Thygesen of Google (GOOG)(GOOGL) – will enable further international expansion. The reduction in the workforce and the favorable stock valuation makes the stock a buy.

Company Overview

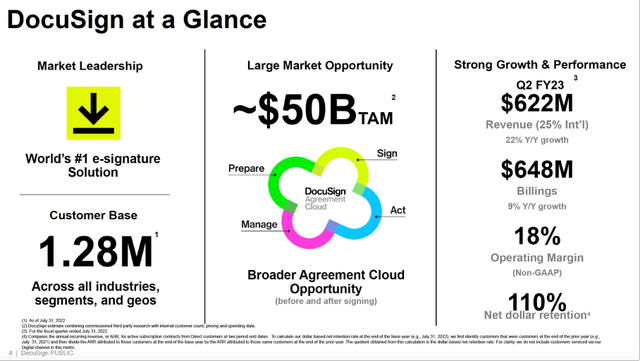

DocuSign at a Glance (Second quarter FY23 Investor Presentation)

DocuSign’s core business is the international supply of electronic signature software that allows companies to prepare, sign, act, and manage agreements digitally. In addition to their electronic signature software, DocuSign offers the following:

- CLM, which automates workflows across the entire agreement process.

- CLM+, which provides AI-driven contract lifecycle management.

- Salesforce add-ons:

- Gen, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

- Negotiate, which supports for approvals, document comparisons and version control.

- Resources for signatures:

- Guided Forms, which enable complex forms to be filled via an interactive and step-by-step process.

- Insights, to search and analyze agreements by legal concepts and clauses.

- Analyzer, which helps customers understand what they’re signing.

- Identify, a signer-identification option for checking government-issued IDs.

- Standards-Based Signatures, which support signatures that involve digital certificates.

- Payments that enable customers to collect signatures and payment.

- Remote Online Notary is a solution using audio-visual and identify verification technologies to enable notarization.

- Monitor using advanced analytics to track DocuSign eSignature web, mobile, and API account.

- Cloud offerings:

- Rooms for Real Estate, which provides a way for brokers and agents to manage the entire real estate transaction digitally.

- Rooms for Mortgage, which offers digital workspace to create and close mortgages.

- FedRAMP, an authorized version of DocuSign eSignature for U.S. federal government agencies.

DocuSign enables users to sign documents faster, easier, more cost-effective and risk-reducing. DocuSign is a well-diversified company and leader in the e-signature market. DocuSign helps about 1.28M customers and has a TAM of as much as $50B. With a fiscal 2022 revenue of $2.11B, it still has the potential to gain a large market share in upcoming years.

DocuSign Customer Sneak Peak (2Q23 Investor Presentation)

Earnings Topped Expectations

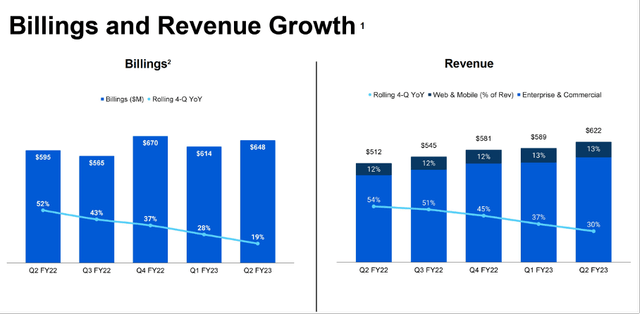

Revenues rose strongly in the second quarter of fiscal 2023, up 22% year on year. Total billings were up 9% and earnings per share were slightly higher than expected, down slightly 6% year on year. Gross margin is very high at 82%. Free cash flow was down 35% due to the implementation of a new ERP system. Free cash flow margin in the current period was still a strong 17%. In the long term, DocuSign is targeting margins of 20% to 25%.

Revenues are primarily generated by Enterprise & Commercial customers, which account for approximately 87% of revenue. Enterprise & Commercial customers constitute a small group of about 15% of the customer base (191,000 Enterprise & Commercial customers out of 1.28 million total customers).

Billings and Revenue Growth (2Q23 Investor Presentation)

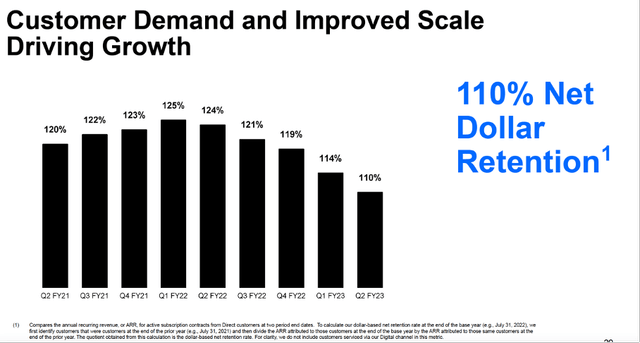

What is somewhat concerning is that net dollar retention is declining. The declining retention rate was to be expected because sales growth is also stagnant. Still, net dollar retention rate is a solid 110%. A further decline in dollar retention may mean less use of DocuSign products by its customers. The declining dollar retention rate is something to keep a close eye on in the upcoming quarters.

Net Dollar Retention Rate (2Q23 Investor Presentation)

For the third quarter of fiscal 2023, DocuSign expects revenue of $624M to $628M (growth of 14% to 15% YoY). For fiscal 2023, DocuSign expects revenue of $2.47B to $2.48B (growth of 18% to 19% YoY). DocuSign is focused on further international expansion to penetrate deeper into $50B TAM. The large TAM could provide further growth in revenue, earnings, and free cash flow.

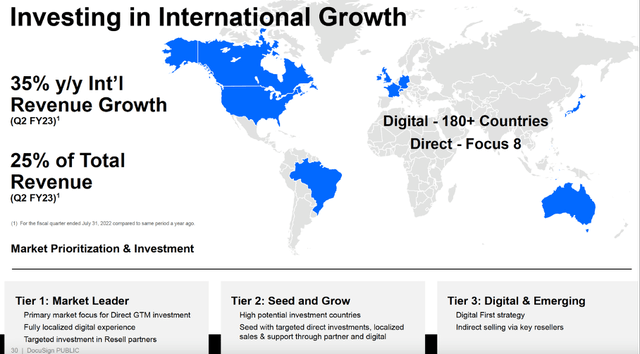

Investing in Internation Growth (2Q23 Investor Presentation)

New Execution, Better Results

Allan Thygesen joined DocuSign as its new CEO effective Oct. 10. The company is undergoing a new transition making way for further international expansion. Thygesen is one of Google’s top executives and former president of the Americas & Global Partners at Google, where he led the advertising business in the Americas. Prior to joining Google in 2010, Thygesen led investments in startups at The Carlyle Group in sectors such as e-commerce, mobile advertising, and imaging. Allan brings these competencies to DocuSign’s for continued growth.

In late September, prior to Thygesen joining the company, DocuSign announced a restructuring plan with 9% reduction in workforce. The reduction in workforce will improve operating margin to support the company’s growth, scale and profitability goals. DocuSign will incur costs between $30M and $40M in the next and fourth quarters of fiscal 2023, respectively, related to the restructuring plan. These will primarily consist of cash expenses related to employee transition, termination and severance payments, employee benefits and related costs, as well as non-cash expenses related to the vesting of share-based awards.

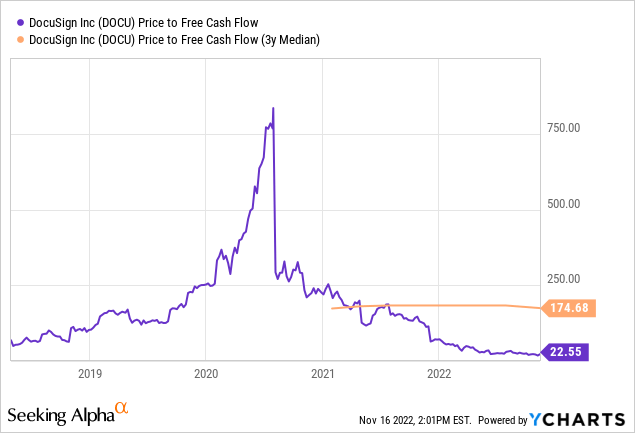

Share Valuation Finally Looks Cheap

DocuSign’s strong growth resulted in an expensive stock valuation in recent years. The stagnation of revenue growth scared investors, causing the stock to fall from its high of $300 to $40. The strong overreaction caused the stock price to become favorable, resulting in a favorable price/free cash flow ratio of 22. The high free cash flow margin of over 21% in fiscal year 2022 gives an FCF yield of nearly 5%.

Conclusion

DocuSign experienced strong growth due to the COVID-19 crisis as many employees worked from home. Working from home demanded for a fast and secure way to digitally sign documents, agreements and contracts securely. DocuSign is the market leader in this sector, helping some 1.28 million customers and has strong growth ahead with a TAM of $50 billion. Revenues are mainly generated by their Enterprise & Commercial customers, these account for about 87% of total revenues.

Revenues in the second quarter of FY 2023 grew strongly by 22% year on year. Gross margin is very high at 82% and free cash flow margin of 17% is also very strong. DocuSign is targeting an FCF margin of 20% to 25%. Reducing their total workforce by about 9% will save costs to improve operating margin. The retention rate of net dollars is 110%, very strong but declining compared to previous quarters. The declining retention rate may be related to stagnant revenue growth. This is something to keep an eye on for the coming quarters.

Thygesen was one of Google’s top executives and, as the new CEO, will ensure further international expansion of DocuSign. Thygesen has extensive experience leading investments in startups in various industries. He brings these competencies to DocuSign’s for continued growth and international expansion.

DocuSign’s high free cash flow margin makes the stock attractive. The share price relative to free cash flow quoted very high for years because DocuSign showed strong growth. DocuSign is a growth stock; investors panicked when DocuSign showed stagnant growth. This caused a sharp drop in the share price, making the valuation now very favorable. The stock price is attractive because of the strong growth, high free cash flow margin, cost reduction, the recently appointed CEO, and favorable stock valuation.

Be the first to comment