Eloi_Omella

Investment Thesis

A little over a month ago I wrote my initial coverage on Enphase Energy (NASDAQ:ENPH) and I rated the stock a buy. I was being a bit conservative with my buy rating as I was afraid that Enphase maybe put the bar a little too high for its third-quarter earnings. Yet, when the company presented its earnings for Q3 it blew away everyone, again. Enphase just manages to keep performing and growth remains high. Maybe I should not be as surprised as I am since the company has a lot of tailwinds and Europe keeps seeing explosive growth in the solar energy sector. With Europe still struggling for energy, the boost for renewable alternatives is still very high.

Enphase remains one of my favorite stocks on the market thanks to its pure dominance in the industry and its high-quality microinverters. The stock price has increased by over 17% since my previous article and the stock price is 60% higher YTD, which is a massive outperformance compared to the S&P 500.

Within this article, I want to give you an update regarding the third quarter results and show you why this stock is still a buy, despite the increase in share price.

Quarterly results

Enphase saw another record quarter with revenue coming in at $634.7 million which was a 20% increase compared to 2Q22 and an 80% increase YoY. This means Enphase saw growth accelerate compared to 2Q22 and this is highly impressive when taking into consideration the difficult macroeconomic conditions such as high inflation and a pending recession. Even more, Enphase managed to increase margins, despite inflation, to a very impressive 42.9%. I will just say it again to you can let it sink in… Enphase is a company growing 80% YoY while increasing margins to 42.9%. Please tell me if you know a company posting even better results.

Now operating income was $194 million and EPS was $1.25. Free cash flow came in at $179.1 million. Enphase shipped over 4.3 million microinverters during the quarter and 133.6 MW/h in IQ batteries.

It was a massive quarter for Enphase as shown by the financial results. The company saw continued strength in Europe as all countries try to move away from fossil fuel dependency. Growth in Europe was 70% quarter over quarter, which is massive. The increase in margins was mainly due to a better sales mix as Enphase managed to sell more of its most advanced IQ8 microinverter. The IQ8 now constituted 47% of total shipped microinverters.

As for the balance sheet, Enphase exited the third quarter with $1.42 billion in total cash. This is an increase from the $1.25 billion with which it entered the third quarter.

The outlook for the fourth quarter which Enphase gave off was also above analysts’ estimates. Enphase expects revenue to come in between $680 – $720 million with gross margins between 40% – 43%. This means Enphase expects revenue to increase by 10% QoQ at the midpoint. This is a slowdown compared to last quarter’s 20%. Yet I expect Enphase to beat revenue again and I feel like $725 million is still a safe estimate. This would be closer to a 15% increase QoQ.

Business update

For a real deep dive into the business and the products, I would recommend reading my previous article on Enphase. Enphase did provide us with a new investor presentation for October so it is interesting to see if there are any updates.

I remain to be very enthusiastic about the business of Enphase. Their product offering keeps expanding and Enphase already offers a very strong ecosystem of products. The main product of Enphase is its microinverter and the ecosystem it builds around these. Enphase has a very strong position in the microinverter market, but it is not the most high-tech industry, so it is important for Enphase to create more of a competitive advantage. It does this by creating a lot of upsides for Enphase microinverters. Here is a small explanation of microinverters:

A microinverter converts the direct current power generated by a solar panel into grid-compatible alternating current for use or export. So why would consumers pay extra for a microinverter over a built-in central inverter in their solar system? Well, if a solar panel with a central inverter built in fails, solar production stops completely. With just one microinverter per solar module, solar production keeps working even if a microinverter stops working.

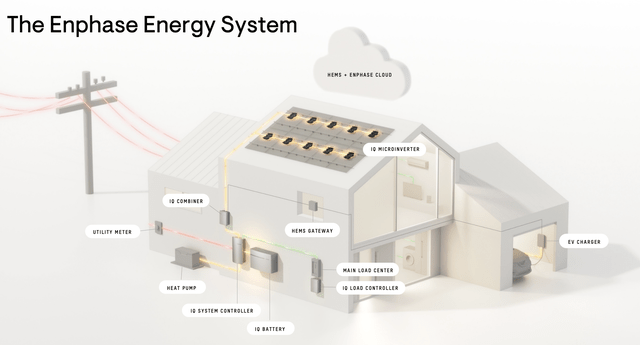

Enphase’s microinverters offer the opportunity to control them through your phone. With the same app, you can control all Enphase equipment within your system like IQ batteries or EV chargers. The image below illustrates what the perfect Enphase ecosystem would look like.

Enphase Energy ecosystem (Enphase Energy)

By offering its customers the option to combine their solar systems with additional equipment from Enphase and control all through one app, it is increasing its competitive advantage. In addition to this, more equipment options increase the upsell possibilities and therefore the ability to earn more dollars from every microinverter sold. That Enphase has a strong market position is proven by this part I wrote in the previous article:

A seeking alpha news article recently reported that Dutch energy company Gaslicht.com reported that 75% of Gaslicht.com’s customers have chosen Enphase microinverters for their solar systems. This shows us the dominance of Enphase within the microinverter business, also in Europe.

Conclusion

Enphase delivered a stunning third quarter with growth of 80% YoY and 20% sequentially. Enphase managed to improve its margins despite inflationary pressure which not many businesses can say at the moment. 70% sequential growth in Europe proves once more that Europe is a massive growth opportunity for Enphase as it is increasing its market share in the continent. It is already the dominant player in countries like the Netherlands and Germany. The outlook for the fourth quarter is projecting another quarter of strong growth and is above analyst expectations.

Enphase is a beautiful business with strong long-term growth potential driven by the shift towards green energy and solar in particular. Enphase has a strong business model with great management. Enphase keeps expanding the business with new products, new acquisitions, and partnerships. Yet, my main worry is a slowdown in Europe as a result of less consumer spending and a possible deep recession. Now, with 70% growth QoQ, we can easily say there is still some room for growth to slow down in Europe and remain strong. For the long term, I do not see many other risks for Enphase as the company has incredible management which is dealing with the current difficult environment well. Enphase is extremely well-positioned and management is expanding the business in the right directions.

The one larger problem for Enphase is its valuation. The company is still valued at a forward P/E ratio of 69 which earns the company a D- from Seeking Alpha Quant. It is interesting to see that Enphase was similarly valued at my previous coverage despite the 17% increase in share price. This is thanks to analysts’ estimations being revised upwards and therefore Enphase gets a B+ from Seeking Alpha Quant. This does mean that my opinion regarding its valuation stays mostly the same, but I do think Enphase has proven that it is worth the higher share price as growth seems to remain strong and Enphase keeps outperforming its outlook. Analysts are projecting a significant slowdown for 2023 to just 23% revenue growth and I believe this is fair, but I also think growth will come in at least above 30% and possibly above 40%. This would then bring down the valuation significantly as well. Yet, this will depend on the severity of a possible recession as Enphase will not be completely immune.

Enphase is not cheap, that is a fact. But I am very willing to pay a high price for a brilliant business with a stellar outlook. Enphase will benefit from the increase in the solar energy sector. I rate Enphase a buy at current prices. Starting a small position or adding to your position at current prices seems fair. Yet, I believe a price closer to 250 per share would be better and that is why I can’t rate Enphase a strong buy. The current economic turmoil will continue, and I believe the markets have not bottomed yet.

I don’t change my rating and still rate Enphase as a buy.

Be the first to comment