BalkansCat

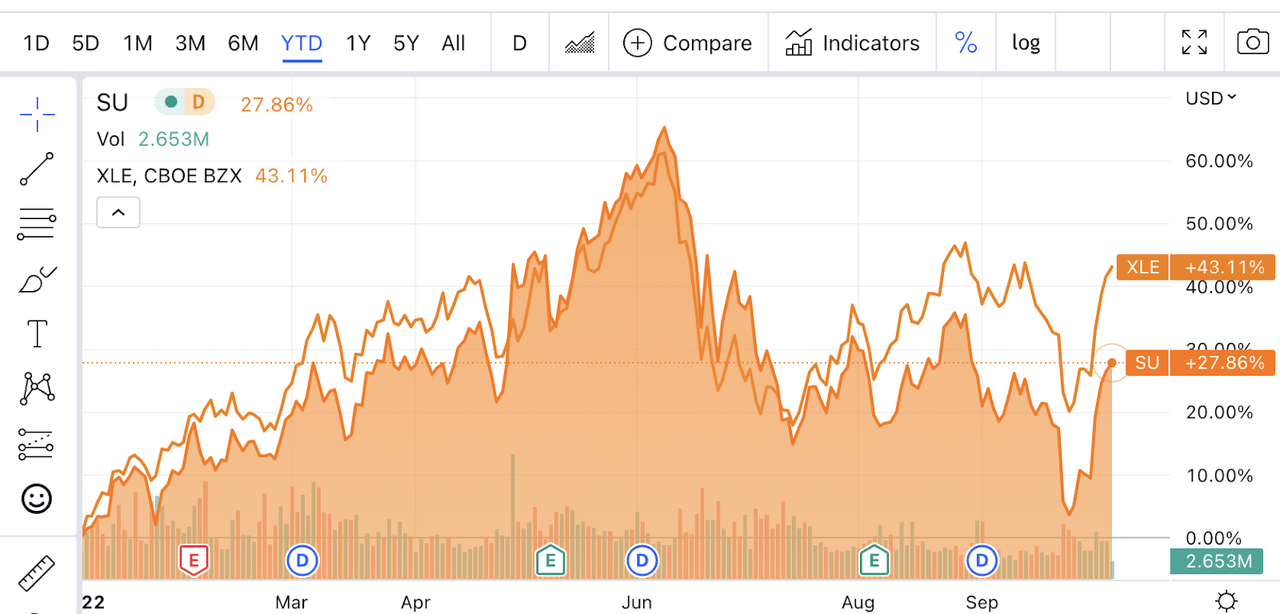

Suncor Energy (NYSE:SU)(TSX:SU:CA) stock just doesn’t want to get moving. For the year, it’s only up 27%, while the SPDR Energy Sector (XLE) ETF is up 43%. So, SU is underperforming its sector by a wide margin.

Suncor vs XLE (Seeking Alpha Quant)

This underperformance is peculiar because Suncor is not doing worse than other oil companies in terms of fundamentals. Since the beginning of the year, exploration and production (E&P) companies have been growing revenue and earnings by high double digits. Suncor’s results from its most recent quarter were consistent with the sector’s performance. In the second quarter, Suncor delivered $3.996 billion in earnings, up 360%, and $5.3 billion in adjusted funds from operations, up 126%. This is very strong growth, comparable to the growth of energy companies whose stock prices have risen more.

Of course, there’s more to an investment thesis than just growth. Balance sheet health, profitability and other such factors are part of the picture. Suncor does well on many of these factors. It scores an ‘A’ on profitability in Seeking Alpha’s Quant System, and it also has a healthy balance sheet, as I’ll explain in a dedicated section on financials later.

Given that Suncor is performing reasonably well as a company, its stock performance should be at least in line with its sector. However, SU has actually lagged its sector. As a result, it is now cheaper than most energy stocks. So there is a chance that Suncor will outperform other energy stocks if its next few earnings releases are good. Of course, this entire thesis depends on the energy sector as a whole doing well. We shouldn’t take that as a given, as many people believe that the Fed’s rate hikes will eventually crash the price of oil. So, I’ll start building a bullish thesis on Suncor by establishing that the oil sector as a whole will do well, then I’ll move on to an analysis of Suncor itself.

Oil Prices are Likely to Stay Relatively Strong

Most readers will be familiar with the oil price situation this year. Oil prices rose dramatically in the first half of the year, resulting in massive outperformance by the big oil names. Prices fell over the Summer, but they began rising again in recent weeks.

I have been bullish on oil all year long, and have explained my reasons for being bullish in past articles. To summarize briefly:

-

The conflict in Ukraine is still ongoing.

-

Job growth is occurring.

-

People are back to travelling following the COVID-19 travel slump.

-

The strategic petroleum reserve (“SPR”) is being rapidly depleted.

All of these points are as valid today as they were when I wrote about them earlier in the year. But now, we have another bullish sign for oil:

OPEC+ is considering cutting output by 2 million barrels a day. At a recent meeting, the OPEC+ nations resolved to produce 28 million barrels per day, instead of the current 30 million. Saudi Arabia and other OPEC nations have been missing their production targets lately, so drastically lower targets are one way for them to achieve their objectives. It appears that OPEC just didn’t have the spare capacity needed to produce the amount of oil Western nations wanted, so now they’re making lower production a policy.

Some kind of production cut by OPEC was to be expected. If you can’t maintain output at a certain level, then there is little reason to have that level as your target: you’ll miss it most of the time. What is interesting about OPEC’s new target is just how extreme the reduction is. 2 million barrels per day is 6.66% of OPEC’s total output. Such a drastic cut will be felt around the world. Notably, it is double the amount that the U.S. is currently releasing from the SPR: 1 million barrels a day. So, unless Biden wants to ramp up SPR releases to a level that risks depleting the reserve, we’re likely to see an upward trajectory in oil prices.

The big question mark here is the Federal Reserve’s response. The Fed wants to get inflation down, but higher oil prices will drive the CPI higher. Gasoline itself is a big part of the CPI, and oil prices influence prices of goods that are physically transported on gas-powered vehicles. If the Fed sees oil prices spiralling out of control, then it will want to keep raising interest rates aggressively.

Key word: want. The Fed has made clear that it believes higher rates are the right response to inflation, but the chorus of institutions demanding less rate hikes is growing louder. Just recently, the UN joined the WTO and World Bank in saying that the Fed’s policies risk causing a recession and political instability. Wall Street has been complaining about the interest rate hikes for some time now, but international organizations are a whole other level of pressure. The UN is stereotyped as being powerless, but UN-affiliated organizations (the IMF, World Bank, the WHO) have a lot of clout. The WHO set the tone for government policies during the COVID-19 pandemic, and the IMF influences developing countries’ fiscal policies through its loans program. So, the UN actually does have some say in world affairs. Given that it has joined the “no more rate hikes” chorus, the UN could make the Fed’s job harder going forward.

Suncor vs Other Energy Stocks

Having established that oil prices are likely to remain strong for the rest of the year, we can turn to Suncor Energy’s performance compared to other energy stocks. I already showed that Suncor is underperforming XLE. To make the comparison more concrete, I can compare Suncor’s fundamentals to those of two big XLE components:

Exxon Mobil (XOM) and Chevron (CVX). These are the #1 and #2 biggest XLE holdings by market cap. Their results for the second quarter are summarized in the table below:

|

XOM |

CVX |

|

|

Revenue |

$115 billion, up 70%. |

$65 billion, up 81%. |

|

Gross profit |

$35.6 billion, up 75%. |

$25.3 billion, up 66%. |

|

Operating profit (“EBIT”) |

$21 billion, up 318%. |

$12.7 billion, up 307%. |

|

Net income |

$17.9 billion, up 280%. |

$11.61 billion, up 277%. |

|

Free cash flow (“FCF”) |

$16.9 billion, up 60%. |

$7.5 billion, up 65%. |

So we have solid growth rates for both XOM and CVX. The profitability ratios implied by the table above are good too. For example, XOM’s net margin is 15.5% while CVX’s is 17.8%.

Is Suncor doing notably worse than either of these two companies? Let’s check its most recent earnings release. In Q2, Suncor delivered:

-

$16.14 billion in revenue, up 76%.

-

$4 billion in earnings, up 360%.

-

$7.8 billion in gross profit, up 77%.

-

$4.6 billion in EBIT, up 393%.

-

$2.5 billion in free cash flow, up 177%.

All of these growth rates are actually faster than those reported by Exxon and Chevron in the same period. Additionally, Suncor’s 24% net margin is far higher than either of those companies’. So, we’ve got Suncor with a win on growth and profitability.

What about balance sheet health?

According to Seeking Alpha Quant, Suncor sports the following balance sheet metrics:

-

$67 billion in assets.

-

$36 billion in liabilities.

-

$30.8 billion in equity.

-

$13.4 billion in debt (down 21% since December 2020).

-

$12.8 billion in current assets.

-

$11.3 billion in current liabilities.

These metrics yield a 0.43 debt-to-equity ratio and a 1.13 current ratio. These ratios suggest high liquidity and solvency: generally you want a debt/equity ratio below 1, and a current ratio above 1. Suncor passes both tests.

What about Exxon and Chevron? After taking a look at their balance sheets, I calculated their debt/equity and current ratios, which I’ve reproduced in the table below:

|

Exxon |

Chevron |

|

|

D/E |

0.22 |

0.169 |

|

Current |

1.16 |

1.30 |

Here, we do see a bit of an edge for Exxon and Chevron: their current ratios are both higher than Suncor’s, and their debt/equity ratios are lower. They beat Suncor on balance sheet health going by the two metrics used here. Note, however, that Suncor’s debt has been reduced by 21% in under two years. If it keeps paying off debt at the rate it has been, then it may eventually catch up with Exxon and Chevron on balance sheet strength.

So, taking everything into account, Suncor is performing similarly to Exxon and Chevron this year. Its earnings in the most recent quarter were better than those companies’ earnings were, while its balance sheet was only slightly worse than theirs. However, Suncor’s stock is far cheaper, as you can see by looking at the valuation multiples below:

SU valuation (Seeking Alpha Quant) |

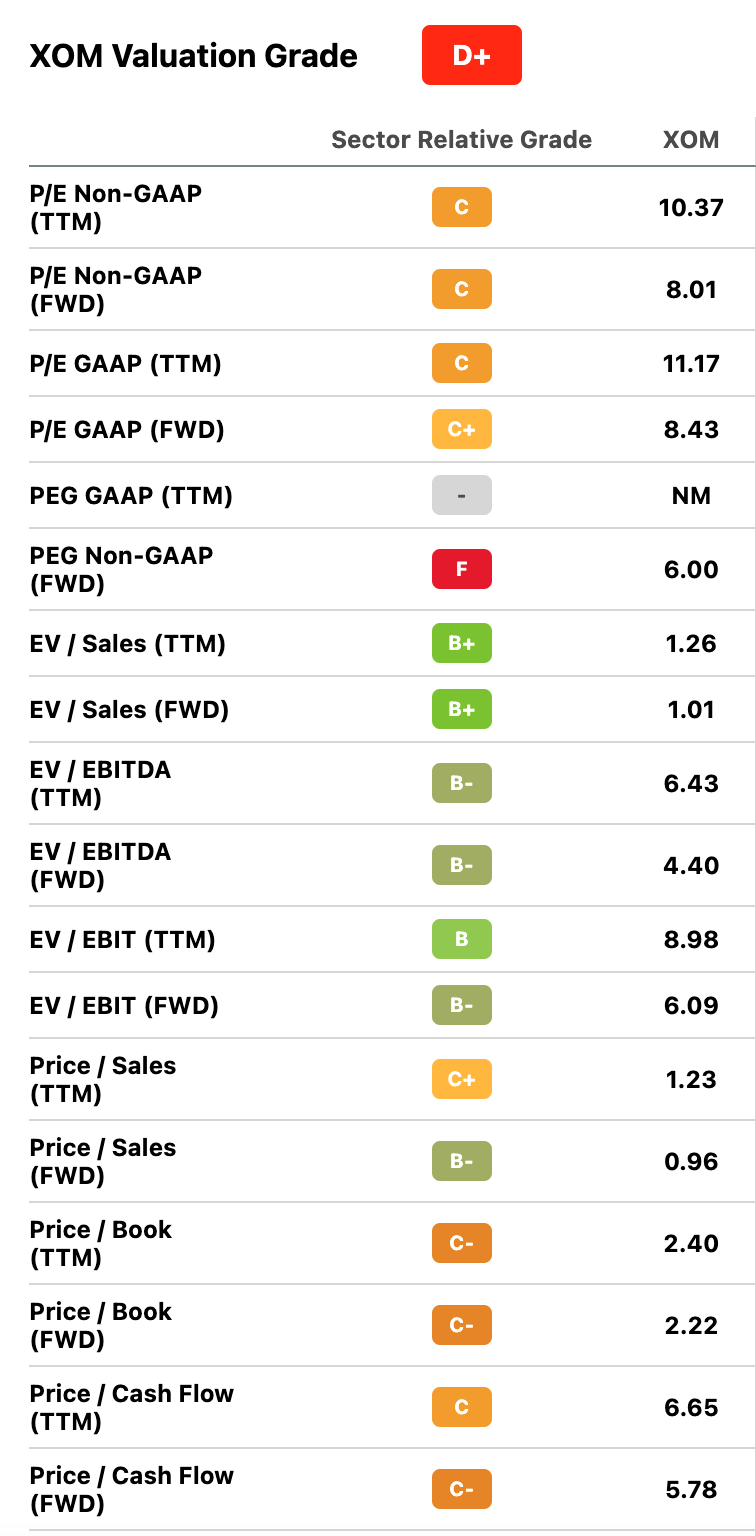

XOM valuation (Seeking Alpha Quant) |

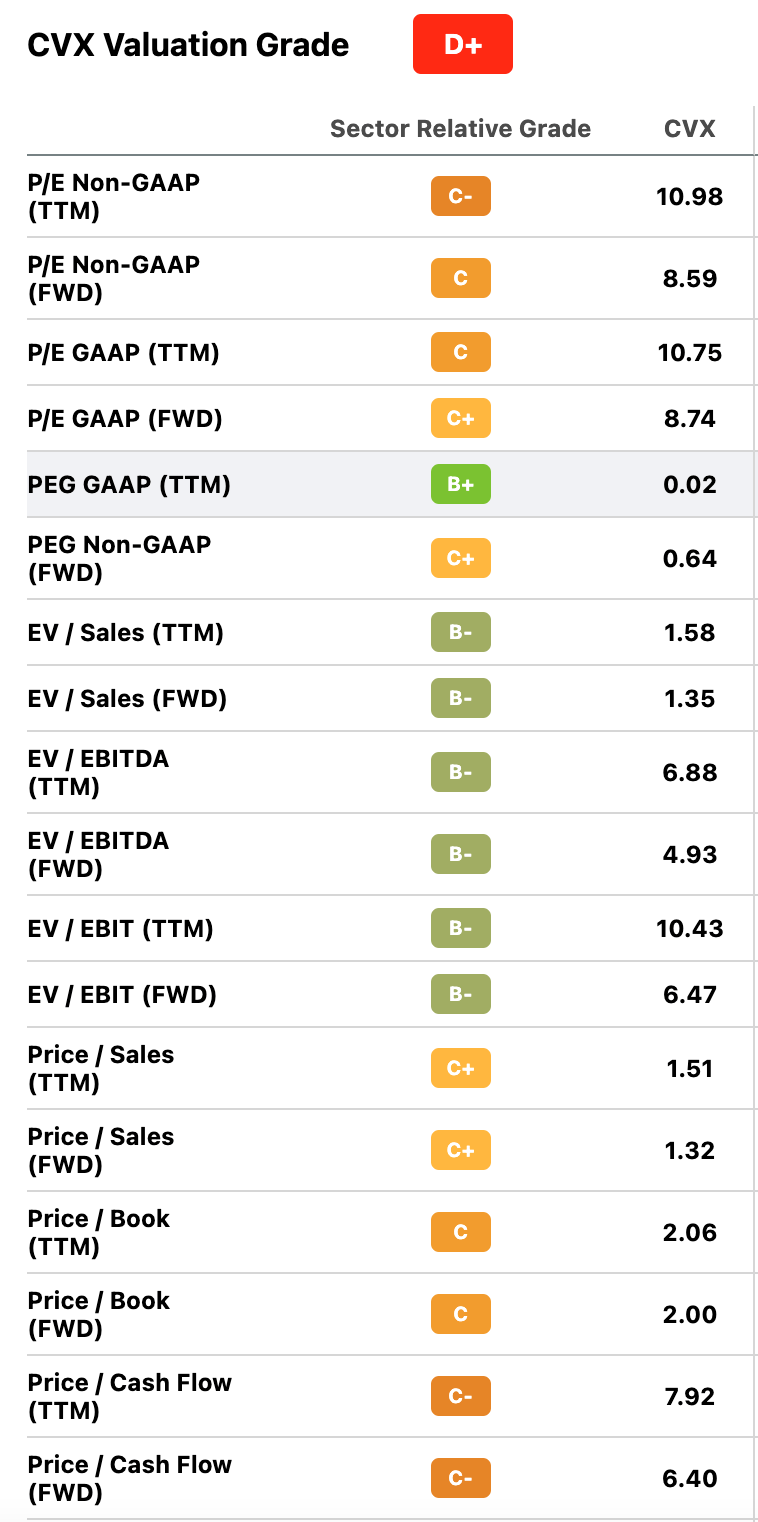

CVX valuation (Seeking Alpha Quant) |

As the table shows, SU has much lower P/E, price/book, and price/cash flow multiples than XOM and CVX. When you look at these companies’ performance and valuation multiples side by side, you get a strong case that Suncor’s stock performance will eventually catch up with that of its two larger peers.

The Big Risk

As I’ve shown in this article, Suncor stands a good chance of outperforming other oil stocks this year. It’s performing just as well as the other companies in the industry, yet its stock hasn’t risen as much. So, Suncor should catch up with its larger peers if the oil market remains healthy.

There is, however, a tail risk that investors will want to keep in mind:

An unexpected decline in the price of oil. If oil falls to a level where Suncor stops being profitable, then it will have a hard time. Suncor is much more indebted than Exxon and Chevron are, so it will have a harder time surviving a period of prolonged lower oil prices than those companies will. When oil prices drop to a level where profits aren’t possible, oil companies often need to borrow to survive. Such a scenario would be crippling for Suncor as it has a fairly heavy amount of debt already.

On the whole, though, things are looking bright for Suncor. The company’s balance sheet is strong in an absolute sense, and its recent earnings were above average. It’s a quality stock that I have owned in the past and would probably own again were I not fully invested in other things.

Be the first to comment