bjdlzx

(Note: This article was in the newsletter May 19, 2022, and has been updated as appropriate).

Crescent Energy Company (NYSE:CRGY) has made several accretive acquisitions. Contango (MCF) joined with the company to acquire size so that larger deals could be made. The company also in effect “went public” through that acquisition. This new company combines two parties with impressive track records of investment gains in a rare public vehicle.

The last deal involving the Unita Basin acquisition is looking very good because prices have risen considerably above the assumptions used for the acquisition. That means that initial profits from this acquisition should run above budget as long as commodity prices remain stronger than the assumptions used for the acquisition. That is very good news for shareholders.

But the real test of many of these acquisitions will be the performance of the assets during the next industry downturn. Older production often has higher lease operating expenses as volume declines. This usually continues until the older wells no longer generate cash flow. At that point, the well is either shut-in until a cyclical recovery ensures better commodity prices, or the well is abandoned because there is no hope of profitability.

In this case, management appears to be in a very good position because that older production was purchased either in bankruptcy court or during a time of considerably lower prices. But Mr. Market will still want to see that outperformance during an industry downturn. In the meantime, management is able to spend the generous cash flow to optimize acquired operations while drilling new production to increase the performance of the properties acquired. This increases the chances of financial outperformance during the next industry downturn.

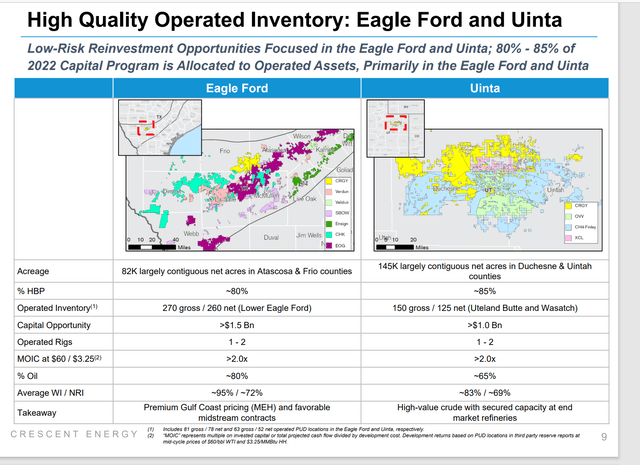

Crescent Energy Production Growth Strategy In Eagle Ford And Uinta (Crescent Energy First Quarter 2022, Earnings Conference Call Slides)

The company has begun to branch out from acquiring older production and optimizing those operations to some operations that involve drilling and production increases from new wells. This was probably to be expected as the company grew and was able to acquire larger deals.

The Eagle Ford, in particular, is one of the most profitable basins in the United States. The beauty of operating here is that “everyone” wants to be in the Permian to the point that the Permian had bottlenecks that led to significant pricing discounts in the last business cycle. That did not happen in the Eagle Ford where the oil was generally sold at a premium to the corresponding benchmark. So, there was an unexpected benefit that probably made Eagle Ford operations more profitable during the peak of the last business cycle.

Right now, it looks like that may happen again. Even though geology may usually give the advantage to Permian operators, there is nothing like a good old-fashioned bottleneck in the midstream capacity to completely obliterate that advantage. I personally think the Eagle Ford may yet come out on top at the top of the business cycle one more time.

The Uinta is probably more problematic. These assets represent the majority of the old EP Energy (OTCPK:EPEG) company. That company itself filed bankruptcy with too much debt. The problem with a lot of companies that filed was the market often focused on the production decline rate as well as the lack of cash flow in the history. Both of those have changed considerably in the last few years. Now it always takes a few years for new techniques and technological advance to predominate. That few years though has lowered costs considerably to make previously uneconomical acreage economic while moving other acreage into Tier 1 territory. This has been going on for as long as I can remember and it appears to be continuing for the foreseeable future.

Then again, the whole reason for acquiring assets is to improve performance. A large acquisition like this could take some years because of the size. However, the higher than projected current prices often shield a situation like this from cash flow issues until enough new wells and lower costs have been established throughout the purchase. There is always a possibility that prices could drop before shareholders see the benefits of new operational techniques or that management was too confident. Right now, though, I like the chances of management to succeed with this acquisition.

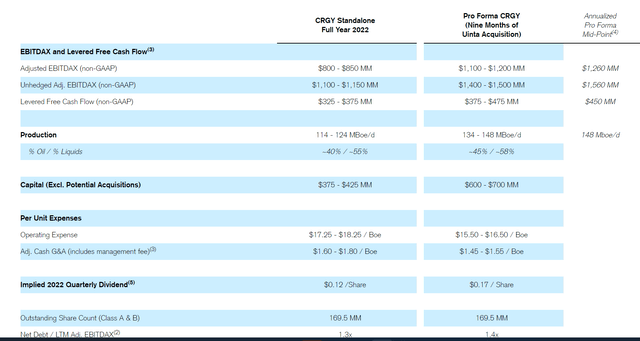

Crescent Energy Management Guidance With Uinta Acquisition (Crescent Energy Press Release February 2022.)

Management is now raising the guidance shown above due to the stronger than expected commodity prices. That means this acquisition will payback faster than expected. Generally, a faster payback raises the profitability of the acquisition. In the meantime, management will use the latest techniques and future technology improvements to continue to lower costs. That should increase the competitiveness of the Uinta assets.

Because management continues to shop for bargains, there is likely to be more acquisitions that will materially change guidance during the current fiscal year. That sort of makes the guidance given during the first quarter earnings press release, conference call, and earnings slide presentation somewhat transitory in nature.

It also makes it hard for the market to value the current collection of assets. Therefore, expect Mr. Market to take his time assigning a decent value to the assets. In the meantime, the “shop ’til you drop” attitude is ok as long as the discipline remains in place to ensure relatively fast paybacks of assets purchased.

The ability to increase the dividend combined with low debt rate hint at better times to come. Also, as the company becomes larger, each acquisition will become less material to the company so that recurring operations begin to dominate results.

The continuing low debt ratio also hints at bargain purchases. But management has to also demonstrate that there is enough free cash flow to repay the debt while growing production and maintaining operations properly. Much of the market is still fixated upon the negative cash flow days that are very unlikely to return to the industry. There is a fear of great ratios without the necessary cash to pay investors.

The industry has largely moved past that several years back. But now Mr. Market demands proof of the ability to pay investors while growing the business profitably. That should happen without any extraordinary actions of management. But the evaluation of that ability by any investor considering an investment in this entity will be crucial as to the viability of the investment proposal.

The management does have a decent history in the oil and gas business. The costs appear more than reasonable. The risk here is the future performance of the business. Management experience should reduce the risk of fast growth and the chance of failure. The company intends to grow through cheap acquisitions rather than solely organically. That is an unusual strategy that may not be properly valued by the market. On the other hand, the company management appears ready to patiently “wait out” the market until the market recognizes the value here. Whether or not you as a potential investor want to do the same is up to you.

Be the first to comment