mevans/E+ via Getty Images

Investment Thesis

Daqo New Energy (NYSE:DQ) remains a speculative buy, despite its stellar fundamental performance due to its Chinese ADR status. Assuming that the risks are removed from the equation, DQ might have easily doubled its market cap and share prices by now, if not more.

Nonetheless, as iterated in our recent Alibaba (BABA) article, the investment risks are similarly inherent in many companies based in the US and EU. Even the delisting fears are overblown, since DQ is already listed on the Shanghai Stock Exchange from July 2021 onwards. Therefore, we believe the risk/reward ratio for investing in DQ still looks relatively attractive now, despite the recent recovery. Nonetheless, we recommend any interested investors to wait for the current rally to be digested, before adding at the next dips. Patience, for now.

DQ Continues To Execute Brilliantly With Excellent Margins

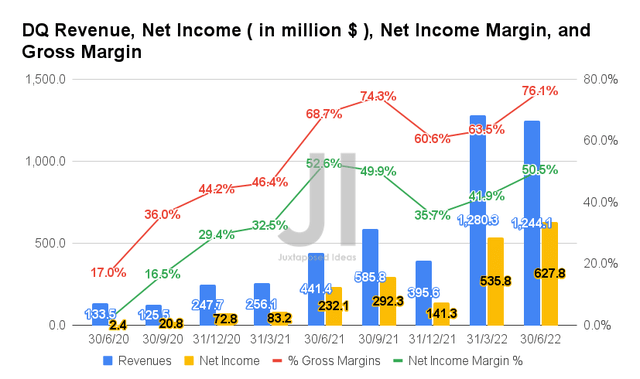

DQ has had a bull run in the past two years, given the massive growth in its revenues and net incomes. By FQ2’22, the company reported revenues of $1.24B and gross margins of 76.1%, representing impressive YoY growth of 281.8% and 7.4 percentage points, respectively. Otherwise, a gargantuan increase of 931.9% and 59.1 percentage points from FQ2’20 levels, respectively.

In the meantime, DQ reported net incomes of $0.62B and net income margins of 50.5% in FQ2’22, representing an increase of 270.4% though a decrease of 2.1 percentage points YoY, respectively. Otherwise, an increase of 26158.3% and 48.7 percentage points from FQ2’20 levels, respectively.

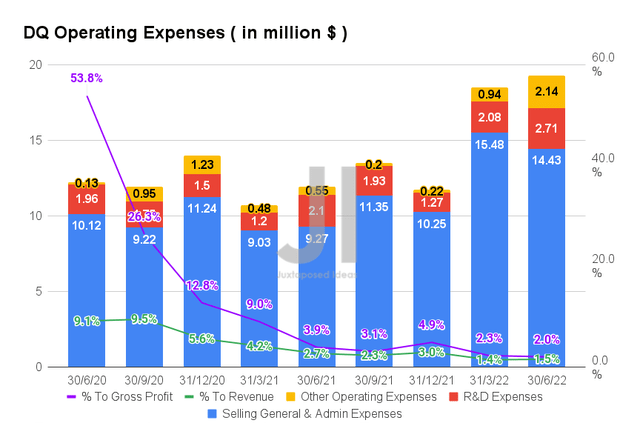

Despite DQ’s apparent increase in operating expenses thus far, at $19.28B in FQ2’22 representing an increase of 61.7% YoY, the ratio to its growing revenues and gross profits has also declined drastically. By FQ2’22, the company reported a decrease in ratio to 1.5% to its growing revenues and 2% of its growing gross profits, compared to FQ2’21 levels of 2.7% and 3.9%, or FQ2’20 levels of 9.1% and 53.8%, respectively.

Thereby, drastically improving DQ’s net income profitability thus far, though it is important to note that these low margins are only possible in certain countries such as China, where there are much lower labor costs in comparison to those in the US.

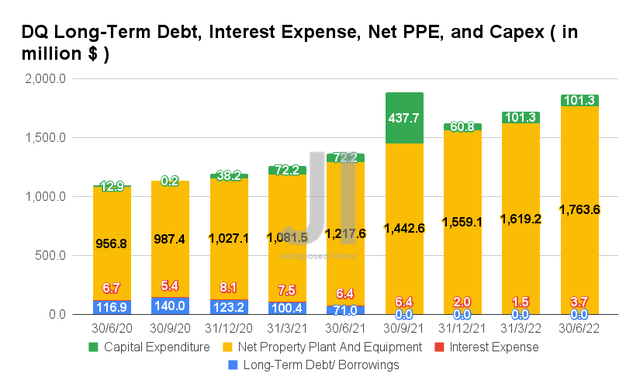

In the meantime, DQ has also been steadily increasing its production capacity, with total net PPE assets of $1.76B reported in FQ2’22, representing a massive increase of 45.4% YoY and 85.2% from FQ2’20 levels. In the meantime, the company continues to invest in its production capacity, with $101.3M of capital expenditure reported in FQ2’22. However, it is essential to note that DQ is practically debtless since FQ3’21, which highlights the management’s highly strategic capital allocation during the windfall thus far.

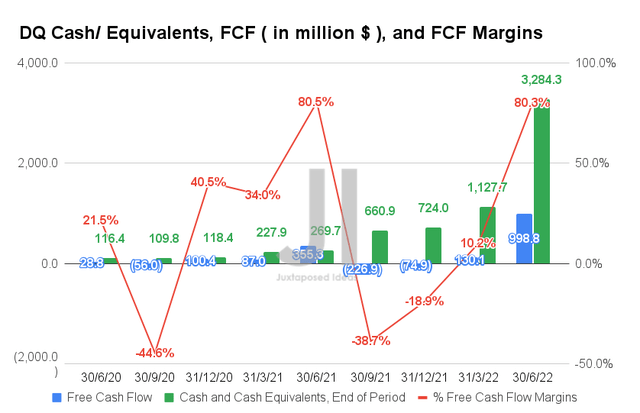

Therefore, we are not surprised by DQ’s improved Free Cash Flow (FCF) generation thus far, with an FCF of $998.9M and an FCF margin of 80.3% reported in FQ2’22. Thereby, boosting its cash and equivalents to $3.28B at the same time. As a result, DQ obviously has more than enough capital for its aggressive expansion plans in Inner Mongolia worth $1.57B, while also increasing its production capacity to 270K MT by 2024.

We Expect To See A Massive Upwards Re-Rating Of DQ’s Sales and Profitability Ahead

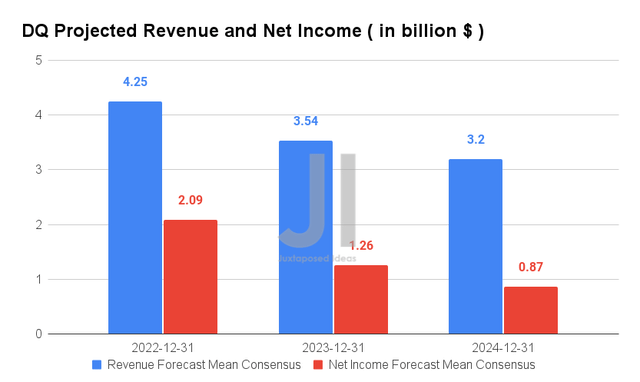

Over the next three years, DQ is expected to report an apparent normalization of revenue and net income growth at an impressive adj. CAGR of 55.67% and 96.73%, respectively. Its net income margins are also expected to improve over time, from 8.4% in FY2019, to 44.6% in FY2021, and finally to a projected 27.1% in FY2024. For FY2022, consensus estimates that DQ will report revenues of $4.25B and net incomes of $2.09B, representing YoY growth of 254.4% and 279.4%, respectively.

In the short term, we may see temporary headwinds to DQ’s profitability, since the Chinese government seems keen on curbing soaring PV prices there. However, we expect an upward re-rating of DQ’s growth, due to its upsized production output by the end of 2024. Thereby, indicating a 2-fold upside from its current capacity and doubled sales/ profitability ahead, despite the potentially normalized PV prices in China.

This is due to the massive Chinese exports of PV products worth $25.9B in H1’22, despite the tariffs and trade sanctions from the US, India, and the EU, with up to $100B worth of exports expected by the end of 2022. The projected sum represented an enormous 352.1% YoY increase from FY2021’s exports of $28.4B. In China alone, the total installed solar power capacity stands at 340 GW in H1’22, with up 399 GW expected by the end of the year, and a total of 1,200 GW of wind and solar capacity planned by the end of the decade.

Therefore, we are highly optimistic about DQ’s potential moving forward, since the global solar PV market is also expected to grow tremendously from $199.26B in 2021 to $1T in 2028, at a CAGR of 25.9%.

So, Is DQ Stock A Buy, Sell, or Hold?

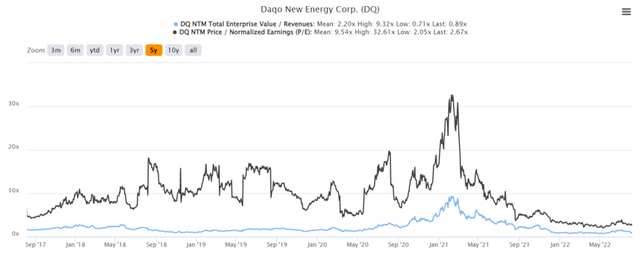

DQ 5Y EV/Revenue and P/E Valuations

DQ is currently trading at an EV/NTM Revenue of 0.89x and NTM P/E of 2.67x, lower than its 5Y mean of 2.2x and 9.54x, respectively. The stock is also trading at $64.10, down 20.9% from its 52 weeks high of $81.10, though at a 99% premium from its 52 weeks low of $32.20.

DQ 5Y Stock Price

Nonetheless, despite our aggressive price target of $100, consensus estimates are more conservative with a lower target of $77 and a minimal 20.12% upside from current prices. There is no doubt that DQ faces political implications from the Chinese Communist Party, which has been and will continue to negatively impact its stock valuations for now and in the future.

The same could be said about the Alibaba stock, whose prices have swung wildly both ways, depending on the latest news from the Chinese government and up/downgrades from the market analysts. As a result, Chinese ADRs in general are only suitable for investors with a higher tolerance for risk, given the potential volatility in the intermediate term, especially worsened by the delisting fears.

In the meantime, DQ is also trading at a high now, due to the recent optimism from its FQ2’22 earnings call and the broad recovery surrounding the solar industry. We reckon the $40s would be a better entry point for investors with a long-term view, due to its historical support level. However, it is unlikely that we will be seeing those prices anytime soon, so interested investors may potentially nibble once the rally is digested meaningfully.

Therefore, we rate DQ stock as a Hold for now.

Be the first to comment