AUSTRALIAN DOLLAR, AUD/USD, RBA, ABS, Monthly CPI -Talking Points

- The Australian Dollar has eased after a benign jobs report

- Overall employment was unchanged against hopes of a small gain

- US Dollar may dominate AUD/USD ahead of CPI data next week

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

The Australian Dollar slipped slightly after the jobs report today. The September unemployment rate was unchanged at 3.5% against 3.5% forecast.

The overall change in employment for the month was 0.9k instead of 25k anticipated. Full time employment increased 13.3k, while 12.4k part time jobs were lost in August.

The participation rate printed as expected at 66.6% and the same as the prior month.

Going into the data, the futures market had a 24 basis point (bp) lift in rates by the RBA priced in for October and not surprisingly, this remains the case.

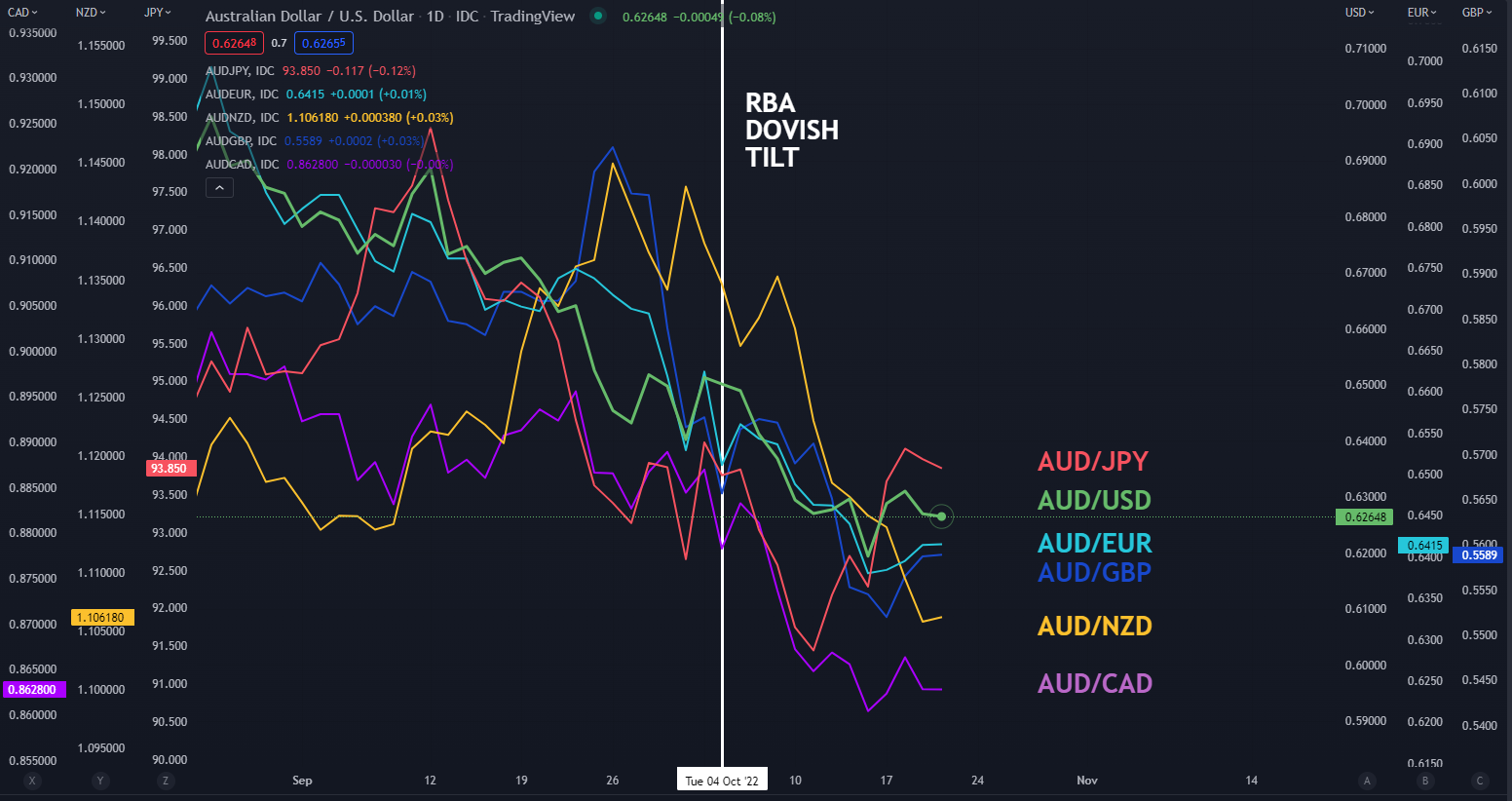

The RBA blinked earlier this month when they surprised the market at their monetary policy committee meeting by hiking by only 25 basis points (bps) rather than 50 bps anticipated. Next week’s CPI read for the third quarter will be in sharp focus to see if the bank will need to re-accelerate tightening or not.

It has created something of a ‘Catch-22’ situation for the central bank. By turning relatively dovish, the Aussie Dollar has sunk to new lows not just against the US Dollar, but to all trading partners.

In the bigger picture, if this trend is to continue, this may contribute to an environment where inflation could be imported. In this situation, domestic consumers are encouraged to substitute foreign goods and services for domestic alternatives, further fuelling heat within the local economy.

Next week’s Australian CPI will mark the beginning of a new era for the Australian Bureau of Statistics (ABS) in the measurement and publication of the data.

Quarterly CPI will remain the key inflation gauge, but they will also publish a read on price changes monthly. Until now, Australia and New Zealand were the only two developed economies not to do so.

This new monthly release will include 62 – 73% of the basket that is used to measure the quarterly figure. More information can be found on their website here.

AUD/USD continues to be pummelled by US Dollar gyrations that are being generated by a stoic Fed that is battling to rein in the highest inflation in 40-years.

US CPI last week saw a re-acceleration in price pressures, and this has contributed toward market expectations of another 75 bps jumbo hike at the Fed’s next Federal Open Market Committee (FOMC) meeting at the beginning of next month.

The rhetoric from speakers remain steadfastly hawkish and if this continues then the ‘big dollar’ may continue to appreciate, undermining AUD/USD.

Recommended by Daniel McCarthy

How to Trade AUD/USD

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Be the first to comment