Kevin Moloney

Lockheed Martin (NYSE:LMT) recently reported its second quarter earnings for 2022, in which it missed expectations. The company generated $15.45 billion in revenue, which was $575.82 million below analyst estimates. GAAP earnings per share came out to $1.16, which also fell below estimates by $0.07. Volume decreased throughout the industry, and Lockheed Martin had to deal with decline in demand for F-35s which attributed to revenue and operating profit dropping. The company is once again putting an emphasis on its shareholders’ value, as it announced it returned $1.1 billion of cash to shareholders through share repurchases and dividends. This reflects a sustainable 20 consecutive years of dividend growth. Lockheed Martin effectively navigated the 2008 recession, and will likely do so again if another downturn comes due to its cash position and impressive acquisitions. Despite a disappointing 2Q22, the company is fairly undervalued and has a lot of potential in the coming years. Therefore, I will apply a buy rating to LMT stock.

Second Quarter Brings Disappointment

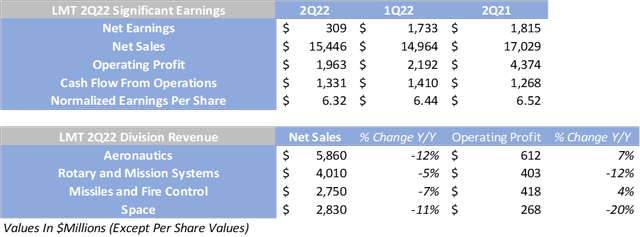

Lockheed Martin released its 2Q22 earnings report on July 19, which fell below expectations for the most part. In the second quarter, the company had revenue of $15.45 billion, which missed expectations by $575.82. GAAP earnings per share was $1.16, which also missed estimates by $0.07. Net earnings dropped significantly as it came in at $309 million, dropping from $1.7 billion in 1Q22 and 1.8 billion in the year-earlier quarter. Net sales grew from $14.96 billion to $15.45 billion Q/Q, but is down by $1.58 billion Y/Y. Operating Profit has also dropped substantially from $4.37 billion in 2Q21 to $1.96 billion in this recent quarter. Cash flow from operations came out to $1.33 billion which did outperform its year-earlier quarter of $1.27 billion, but fell below its first quarter cash flow of $1.41 billion. In the second quarter normalized earnings per was $6.32 which was a $0.12 drop Q/Q and a $0.20 drop Y/Y.

LMT 2Q22 Significant Earnings and Divisions (Created By Author)

To better understand why Lockheed Martin performed under expectations in the second quarter, we can look into how each division of the company performed in the quarter and potential reasons for it. In the aeronautics division, revenue fell by 12% Y/Y. This can be partially attributed to the Pentagon decreasing its request of F-35 production by 35% in March. Aeronautics operating profit, however increased by 7% Y/Y which can be explained by margins increasing due to Lockheed Martin’s improved classified program performance.

Looking into the rotary and mission systems division, revenue decreased by 5% Y/Y. This is due to lower volume throughout Sikorsky Aircraft and in mission systems. Operating Profit also dropped by 12% Y/Y which can also be attributed to the impacts of lower volume throughout the company and from lower profit rate adjustments.

In the missiles and fire control system, revenue decreased by 7% Y/Y. Reasons for this drop include the withdrawal from Afghanistan which brought lower sustainment of equipment and a decrease in volume of tactical and strike missile production. Operating profit did increase by 4% in this division which could be explained by the higher profit rate adjustments and contract mix.

Lastly, the space division saw an 11% drop in revenue Y/Y. This can be attributed to the Atomic Weapons Establishment contract closeout which considerably impacted revenue. The drop was slightly offset by higher development volume in regards to the Next Generation Interceptor. Operating profit also fell by 20% Y/Y in the space division, because of the company’s investment in United Launch Alliance which had successful launches during the quarter. However, decreases in operating profit were partially offset by an increase of $30 million for strategic and missile defense programs which primarily included the Fleet Ballistic Missile programs.

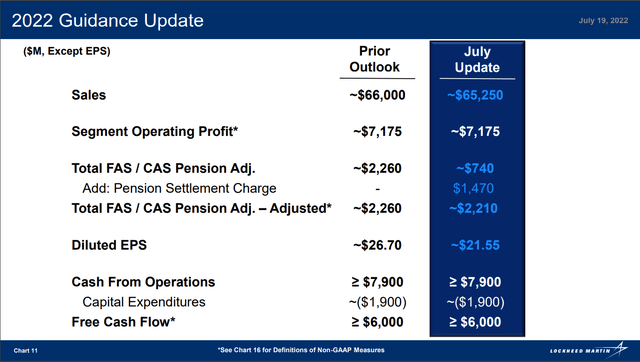

Lockheed Martin cut its guidance for revenue by about 1.14%, which is fairly minimal. However, the company also strikingly cut its guidance for diluted earnings per share by 19.3%. The lowering of these targets can be attributed to F-35 production dropping and the negative impacts of the Covid-19 pandemic.

LMT 2022 Guidance Update (Lockheed Martin)

Focusing On Shareholders

With Lockheed Martin’s earnings report, the company announced it returned $1.1 billion of cash to shareholders through share repurchases and dividends. CEO James Taiclet explained how the company overcame the challenges of the second quarter to achieve this.

Although revenue in the period was affected by supply chain impacts and the timing of customer contract negotiations, our cost management initiatives resulted in margin expansion. Moreover, our robust cash generation also continues to provide the resources to invest in building the foundation for future revenue and margin growth opportunities through our classified program capex projects, hypersonic development efforts, and our 21st Century Security and internal Digital Transformation initiatives.

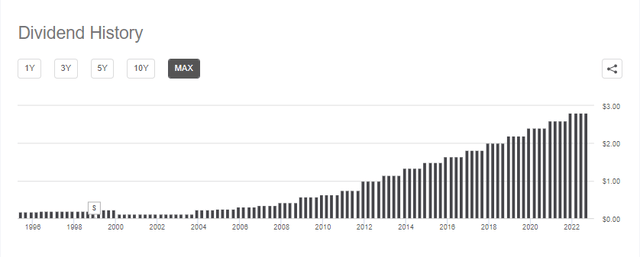

The company proves to put an emphasis on its shareholders as it has grown its dividend payout for an impressive 20 consecutive years. Lockheed Martin pays an $11.20 dividend which equates to a 2.87% yield. This dividend is very sustainable, as the payout has been growing over time and the company proves its investors are valued.

LMT Dividend History (Seeking Alpha)

Ability to Navigate Recessions Effectively

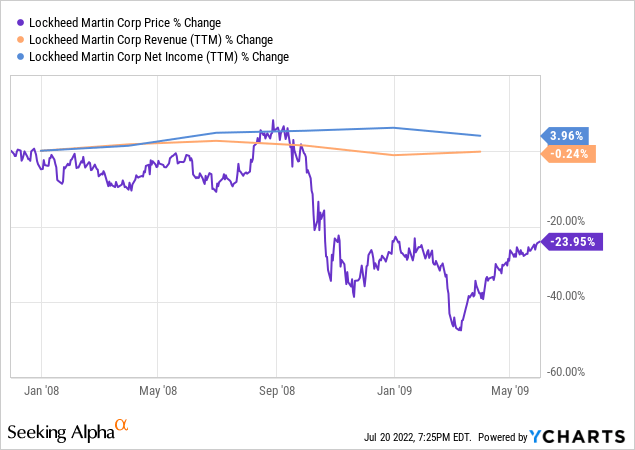

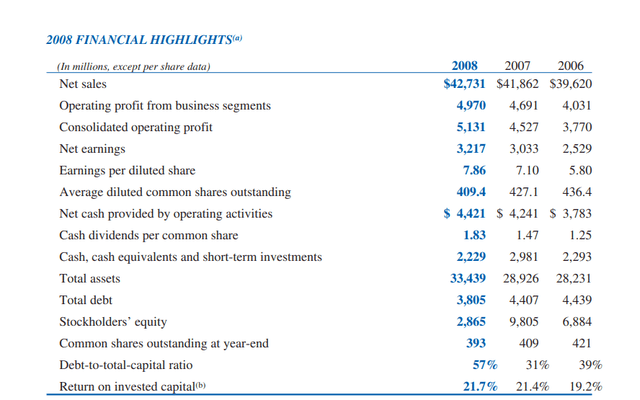

Lockheed Martin was able to pretty effectively navigate the 2008 recession. The company was able to increase its net income by nearly 4%, while its revenue was relatively in line throughout the downturn. Its share price fell by almost 24%, however Lockheed Martin was able to perform fairly well. Looking deeper into the company’s financials, net sales, operating profit, net earnings, total assets, and return on invested capital all increased from 2007 to 2008, while debt and cash decreased over this span. Considering that we are likely in a technical recession, Lockheed Martin could potentially perform well again. The company has a strong cash position which can allow for flexibility during times of uncertainty. It is frequently utilizing its cash to acquire other companies that bring new aspects to the company. Lockheed Martin has made a total of 10 company acquisitions costing over $13.40 billion since being founded in 1995. The company’s acquisitions of Eagle Group International and Aculight Corporation in 2008, helped it combat the bear market. Lockheed Martin’s free cash flow, ability to expand and make acquisition, and its navigation of the Great Recession lead me to believe that the company will be able to survive and be successful in another recession.

Lockheed Martin 2008 Annual Report (Lockheed Martin Corporation)

Valuation

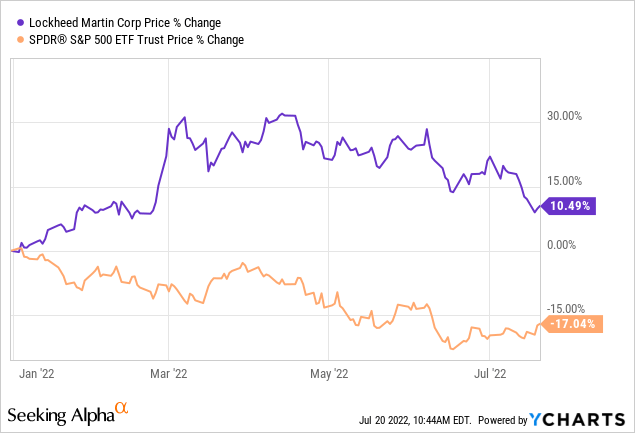

Over the past year, Lockheed Martin is outperforming the market by over 27%, as the current share price is up over 10%. The stock is likely still undervalued, which is why it could be an attractive option for investors looking for value options.

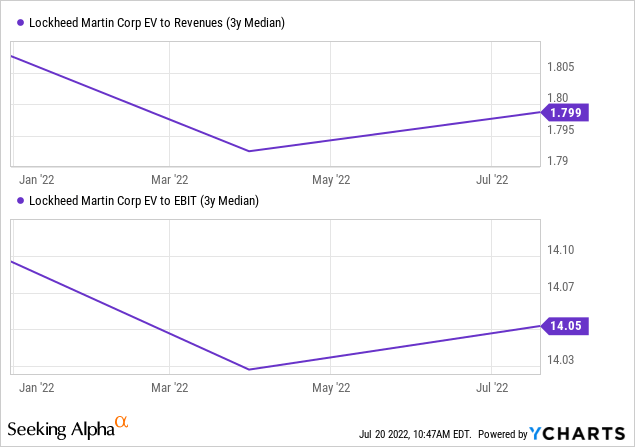

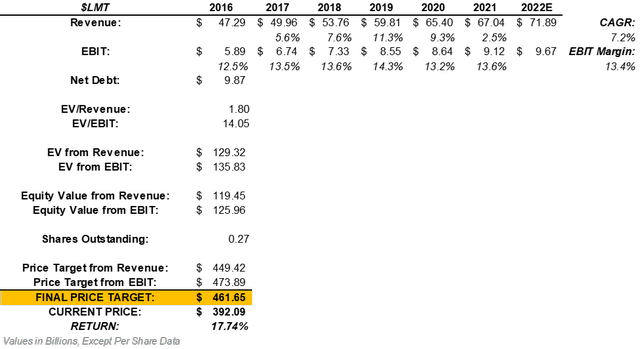

Over the past 6 years LMT grew its revenue from $47.29 billion to $67.04 billion. This reflects a CAGR of 7.2% which can be applied into the company’s next fiscal year. Thus projecting the company to generate $71.89 billion in revenue in 2022. Additionally, LMT has seen an average EBIT margin of 13.4%. Multiplying this margin by the estimated revenue of $71.89 billion projects the company to produce $9.67 billion in EBIT in the upcoming fiscal year. After multiplying these projections by its 3-year median EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s estimated enterprise values for net debt, we can find LMT’s projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets bring us to a final price target of $461.65. This means that LMT stock could return an upside of 17.74%.

LMT Valuation (Created By Author)

The Takeaway For Investors

Lockheed Martin recently reported its 2Q22 earnings, in which it posted disappointing numbers. The company generated revenue $575.82 million under estimates and GAAP earnings per share which were $0.07 below expectations. Volume dropped industry-wide, and Lockheed Martin had to deal with this directly as the Pentagon dropped its request for F-35s by 35%. However the company announced it was able to return $1.1 billion of cash to shareholders through share repurchases and dividends. Dividend payouts have grown for 20 straight years, proving Lockheed Martin to be a great option for dividend investors. The company effectively navigated the Great Recession, and will likely do so during another recession due to its cash position and frequent large-scale acquisitions. Despite an underwhelming second quarter, the company is undervalued by almost 18%. Lockheed Martin has a lot of potential in upcoming years. Therefore, I will apply a buy rating to LMT stock.

Be the first to comment