Sitthiphong/iStock via Getty Images

Word in the Twitter streets is of a commodity blood bath:

So, are CTAs, managed futures, and trend followers also getting crushed? They were, after all, crushing it (on the good side) riding the inflationary moves higher in everything from energies to grains to metals. What goes up must come down?

Not so fast… take a look at the quarterly performance so far this year.

Commodity Prices, SG Trend Index – Q1, Q2 Performance (Author)

If you’re new here, be sure to check out these few simple definitions between trend following, CTAs, and managed futures on Jeff Malec’s Twitter feed

So why has the SocGen Trend Index, approximating performance of trend followers, held up the past month and a half despite some rather violent commodity retracements:

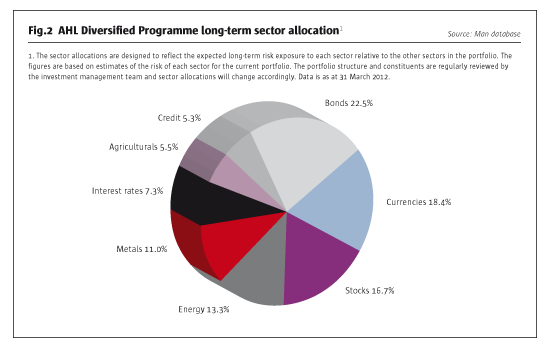

The first takeaway is that there is more going on in trend following than just commodities. Commodities are typically between 25% and 75% of a trend followers’ portfolio – typically, the bigger the CTA’s assets, the less commodities.

Take a look at a look at this old chart from Man AHL showing their portfolio breakdown:

AHL Diversified Programme Long-Term Sector Allocation (Man AHL)

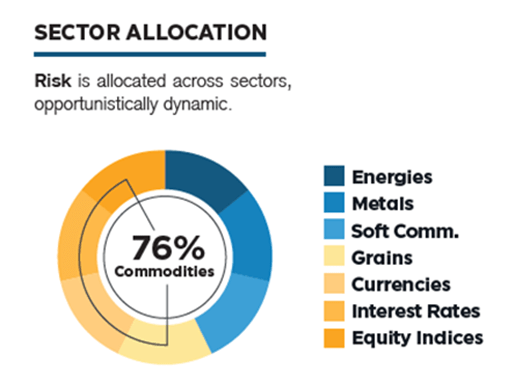

And here’s a more recent one from a more diverse commodity-focused program from Tim Pickering @AuspiceTim at Auspice Capital:

Auspice Capital Commodity-Focused Programme Sector Allocation

So if we know that commodities make up a healthy part of the portfolio, but sometimes not too much, the ability for trend to be up while commodities reversed down is likely one of two things:

- They’ve perfectly timed the reversal and are now short commodities.

- Commodities have passed the perfect baton on to other areas.

Trend isn’t known for nailing reversals, and if anything, their main risk is taking it in the face from sharp reversals… so it probably isn’t door #1 above. (PS – Getting hit with sharp reversals was a big reason why we helped the team at Mutiny to build a hard-to-kill ensemble of lookbacks in the Trend Strategy inside their Cockroach Fund, where different trend algos/models react differently to reversals depending on whether they use a short-, medium-, or long-term lookback.)

We’ve seen it definitely be more of door #2 above, with a sort of “passing of the baton” trend world the past 12 months, handing off the exposures as the environment shifts to keep the party going.

H2 ’21 = equities ↗️, bonds ↘️, commodities ↗️

Q1 ’22 = equities ↘️, bonds ↘️, commodities ↗️

Q2 ’22 = equities ↘️, bonds ↘️, commodities ↘️

If we think of trend kind of like a three-legged stool, at least two of the legs (and in Q1 and most of Q2 this year all three legs) have been working for most of the past 12 months. In short, trend strategies have been on the right side of bonds the whole time, on the right (long) side of commodities in two of three quarters, and on right side of equities in two of three quarters.

And don’t worry if you got lost in our stool legs analogy, here’s what that looks like graphically. We took the quarter-end positioning of each market in the SocGen Trend Indicator and calculated the percent long or short for each sector as of the end of each quarter. For example, if crude oil, RBOB gasoline, and heating oil were all long but natural gas was short, we would show that as 75% long (3 of 4 markets long).

Quarter-End Positioning Of Each Market In The SocGen Trend Indicator (Author)

The surprising thing to many may be just how dynamic these exposures are, shifting quite a bit over a year period, and how each sector is rarely an all-in bet (long or short) in that sector. But this is what trend does. Trend following models are designed to shift exposures between long/short in a specific sector and even switch sectors to create as many unique bets as possible. We talked about the number of unique bets climbing higher after years of being at all-time lows on this pod here with Rodrigo Gordillo @RodGordilloP.

Back to commodities and their big sell-off the past few weeks. They are often lumped into that neat word and treated as one thing, but they are anything but a unified asset class that moves all together. Just think about it: cotton has different drivers than crude oil. Cocoa has different supply factors than copper. Here’s what the past 12 months’ exposures have looked like just inside the commodity world:

Quarter-End Commodity Exposures (Author)

In summary, there’s two main things going on. One, while many commodities are showing signs of retracing into a downtrend, it’s nor prevalent across the dozens of markets across the energy, metals, meats, grains, and softs sectors, which we collectively call commodities.

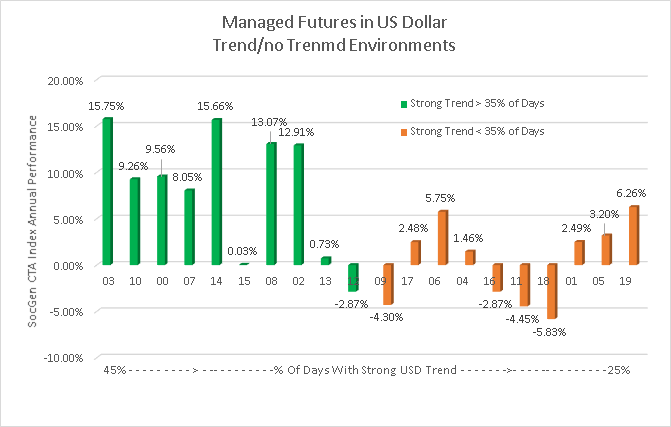

And two, there are other non-commodity markets in the trend portfolio which are stepping up to the plate and picking up the proverbial slack. Markets like bonds and currencies, where managed futures and CTA programs love a trending U.S. dollar.

Managed Futures In USD Trend/No Trend Environments (Author)

Disclaimer

The performance data displayed herein is compiled from various sources, including BarclayHedge, and reports directly from the advisors. These performance figures should not be relied on independent of the individual advisor’s disclosure document, which has important information regarding the method of calculation used, whether or not the performance includes proprietary results, and other important footnotes on the advisor’s track record.

Benchmark index performance is for the constituents of that index only, and does not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self reporting, and instant history.

Managed futures accounts can subject to substantial charges for management and advisory fees. The numbers within this website include all such fees, but it may be necessary for those accounts that are subject to these charges to make substantial trading profits in the future to avoid depletion or exhaustion of their assets.

Investors interested in investing with a managed futures program (excepting those programs which are offered exclusively to qualified eligible persons as that term is defined by CFTC regulation 4.7) will be required to receive and sign off on a disclosure document in compliance with certain CFT rules The disclosure documents contains a complete description of the principal risk factors and each fee to be charged to your account by the CTA, as well as the composite performance of accounts under the CTA’s management over at least the most recent five years. Investor interested in investing in any of the programs on this website are urged to carefully read these disclosure documents, including, but not limited to the performance information, before investing in any such programs.

Those investors who are qualified eligible persons as that term is defined by CFTC regulation 4.7 and interested in investing in a program exempt from having to provide a disclosure document and considered by the regulations to be sophisticated enough to understand the risks and be able to interpret the accuracy and completeness of any performance information on their own.

RCM receives a portion of the commodity brokerage commissions you pay in connection with your futures trading and/or a portion of the interest income (if any) earned on an account’s assets. The listed manager may also pay RCM a portion of the fees they receive from accounts introduced to them by RCM.

See the full terms of use and risk disclaimer here.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment