Nazar Rybak/E+ via Getty Images

ING Groep (NYSE:ING) remains cheap, trading in a pretty grim range since the beginning of the year. The dividend yield is decent and the PE is low. The dividend has been higher in the past which is negative, but concerns around the European economy and the need for provisioning has driven it down, and explains in part low P/Bs. Moreover, the buybacks have more than compensated for dividend declines, with total yields above 14%. In general ING isn’t so poorly positioned. It has a pretty large retail facing business and residential mortgages is absolutely the plurality of the business. Mortgage payment will continue to rise in Europe and expendable income will fall on higher living costs, but mass defaults aren’t terribly likely. The Russia exposure continues to be winded down slowly, and ING benefits from not cutting the business completely. Finally, the business loans are decently sectorally exposed and ING should see NIM (net interest margin) improvements as interest rates rise. Yield likely to remain high for ING and it’s a solid income play.

Quick Discussion of Q2 Results

So far the growth in interest income is being driven still by loan growth. Net interest margins have been stagnant.

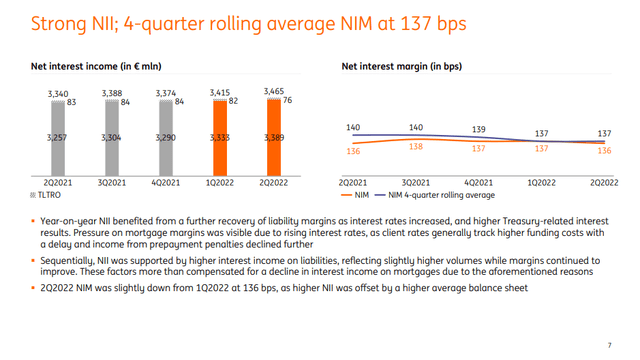

NIMs (Q2 2022 Pres)

They have fallen slightly even, but now have plateaued at 136 bps. The idea is that the lending rates are trailing the funding costs a bit, so this is the current spread that ING is looking to keep, but our questions about duration gap were somewhat founded from our last article. ING says that they are fine when rates rise as long as the yield curve is upward sloping, which it isn’t right now. It is mostly flat, and is very likely to invert given recent jobs data and the likelihood of further hikes. Yields will rise on the 40% or so of the portfolio that turns over within a year, and mortgages tend to be variable rate, which means that even longer-term assets are well levered to rates. In no way is ING worryingly exposed to rates, but the benefit might be a little more limited than other organisations.

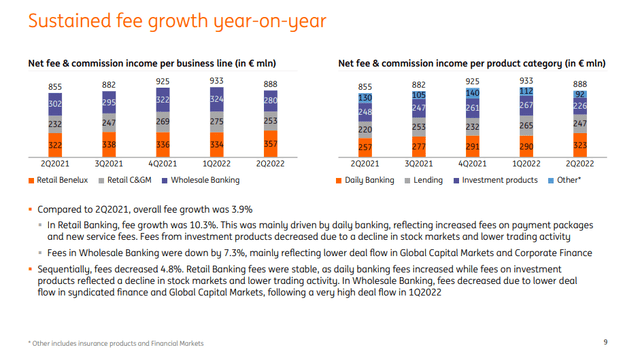

Fee Income (Q2 2022 Pres)

From fee income, the only weak segment was the wholesale banking fees on falling DCM activity. In general, the absence of an actual recession for the moment is keeping growth going. When winter comes things will likely change.

Remarks

Provisioning is starting and there will be pressure on borrowers in Europe as incomes fall on higher costs of living in Europe, which will just worsen in the winter. Still, P/Bs are extraordinarily low at 0.63x, and PEs are low too with 9x forward figures. Yields are also high. The dividend yield is 4% and the buyback yield is 10%. The price is compressed in other words. Moreover, there is some resilience certainly in the wholesale banking portfolio.

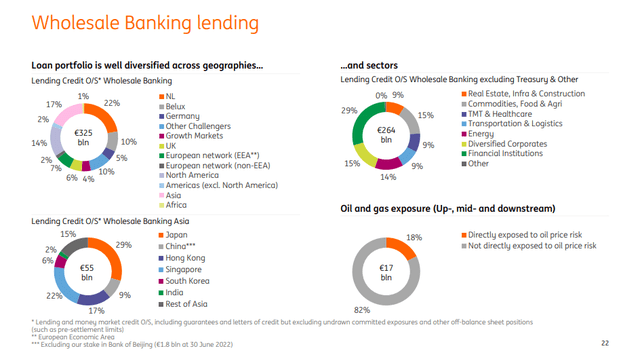

Wholesale Breakdown (Q2 2022 Pres)

Energy is becoming protected by regulatory authorities, so credit risk has declined here. Otherwise, Commodities, TMT, transportation and other financial institutions should be pretty solid too. Real estate and infra which is 9% of the wholesale banking assets (overall 25% of the book) is maybe the only more sensitive wholesale area. Moreover, the 0.5% exposure to Russia is limited and covered 50% by capital, with the slower wind down paying off well.

Really the main concern is just vaguely on whether the company has properly provisioned so far for the economic environment. The additional provisions this quarter are only 13 bps of average customer lending, and on the whole book the provision appears to be pretty ordinary at a little below 1%. Given the potential severity of the extraordinary economic and geopolitical situation, our concern would be on provisions still being a bit too low. Remember that a lot of the current provisions (20%) are related to the small Russian book, so the effects on the broader world are perhaps not being totally acknowledged, although who knows.

Overall, ING is pretty resilient, very cheap, and works well as a yield play. With the buyback over, we should be getting back to more dividend yield next year, if not a resumption of the buyback.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment