NaokiKim

Buying shares of a great company that’s exhibiting a growth spurt and that’s trading at levels that are considered affordable can be a fantastic way to generate a positive return in the market. Having said that, all good things must come to an end, and one company that has likely gotten to fair value or close to it is Advanced Drainage Systems (NYSE:WMS). This firm, which focuses on providing innovative water management solutions to both the stormwater and on-site septic wastewater industries, headstone fantastic from a fundamental perspective so far in its 2023 fiscal year. This led to a nice increase in share price even as the broader market declined. In the long run, I have no doubt that the company will continue to create value for its investors. But at the same time, it does seem to me as though the easy money has already been made. As a result, I have decided to lower my rating on the company from a ‘buy’ to a ‘hold’, reflecting my new belief that the company is likely to generate returns that more or less match the market for the foreseeable future.

Flowing upstream

The last time I wrote an article about Advanced Drainage Systems was back in July of this year. In that article, I talked about how impressed I was with the company’s return at a time when the broader market was tanking. I talked about how this performance was driven by strong fundamental growth achieved by the company. And I also discussed how management expected that performance to continue throughout the 2023 fiscal year. All of these factors combined led me to be confident in the ‘buy’ rating I had assigned the company. And since then, things have played out quite nicely. While the S&P 500 is down by 11%, shares of Advanced Drainage Systems have increased by 11.9%. The return disparity is even greater when looking at the article I wrote about the company back in February, in which I initially rated it a ‘buy’. Since then, shares generated a return of 13.2% compared to the 20% decline the broader market experienced.

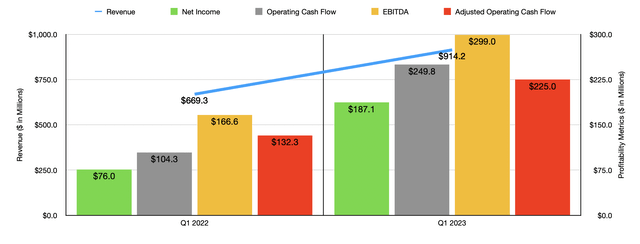

Such a massive return disparity was driven by strong fundamental performance achieved by management. To see what I mean, I would like to point to results reported for the first quarter of the company’s 2023 fiscal year. When I last wrote about the firm, we only had data covering through the end of its 2022 fiscal year. During the quarter, revenue came in strong at $914.2 million. That’s 36.6% higher than the $669.3 million in sales the company reported during the first quarter of its 2022 fiscal year. Double-digit sales growth in the US construction end markets pushed revenue significantly higher, with Domestic Pipe sales climbing 40.3%, Domestic Allied Products & Other sales up by 56.6%, and Infiltrator sales up 31.2%. For the most part, the company benefited from both higher shipment volumes and higher pricing. A change in product mix was also instrumental in pushing revenue higher. The one exception involves the Domestic Pipe operations of the company, which did benefit from improved pricing and product mix, but was negatively affected to some degree by lower production volumes caused by the agriculture market.

This increase in revenue brought with it a surge in profitability. Net income of $187.1 million dwarfed the $76 million reported for the first quarter of 2021. Much of this bottom line improvement came as a result of the company’s gross profit margin climbing considerably from 30% to 38.5%. Management attributed this improvement largely to an increase in net sales from improved pricing, some of which was offset by inflationary pressures associated with higher material and transportation costs, as well as higher manufacturing expenses. In short, management was successful in pushing on its higher pricing, and then some, onto its customers. Operating cash flow more than doubled, climbing from $104.3 million to $249.8 million. If we adjust for changes in working capital, the picture would have been slightly less bullish but still impressive nonetheless, with the metric climbing from $132.3 million to $225 million. Meanwhile, EBITDA for the company nearly doubled, jumping from $166.6 million to $299 million. Management has used this opportunity to buy back some stock. They repurchased around 800,000 shares in the first quarter alone, totaling $67.4 million in all. That leaves them with $932.6 million in capacity on their current share authorization.

For the 2023 fiscal year as a whole, management increased guidance. Previously, they were forecasting revenue of between $3.10 billion and $3.20 billion. That range has now been moved up to between $3.25 billion and $3.35 billion. At the midpoint, that would translate to a year-over-year improvement of 19.2%. The company is now anticipating EBITDA of between $900 million and $940 million. Previously, they thought this metric would be between $800 million and $820 million. No guidance was given when it came to other profitability metrics. But if we assume that net income and operating cash flow will increase at the same rate that EBITDA should, then we should get readings of $369.2 million and $702.4 million, respectively.

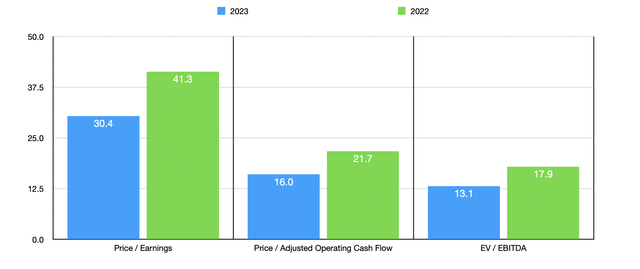

Based on these numbers, we can calculate that the company is trading at a forward price to earnings multiple of 30.4, add a forward price to adjusted operating cash flow multiple of 16, and at a forward EV to EBITDA multiple of 13.1. These numbers stack up favorably against the pricing that we get using data from 2022, with multiples of 41.3, 21.7, and 17.9, respectively. As you can see in the chart above, pricing is a bit more expensive than it was when I last wrote about the company. Also, as part of my analysis, I compared the firm to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 4.3 to a high of 17.8. Compared to the pricing that we get using the data from 2022, our prospect becomes the most expensive of the group. Using the price to operating cash flow approach, the range is between 3.8 and 25, with three of the five companies cheaper than our target. And using the EV to EBITDA approach, the range was between 3.2 and 14.4. In this scenario, four of the five companies are cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Advanced Drainage Systems | 41.3 | 21.7 | 17.9 |

| Builders FirstSource (BLDR) | 4.3 | 3.8 | 3.2 |

| Masco (MAS) | 13.6 | 13.6 | 10.4 |

| Allegion (ALLE) | 17.8 | 25.0 | 14.4 |

| Lennox International (LII) | 17.1 | 23.7 | 14.1 |

| Owens Corning (OC) | 7.5 | 6.0 | 4.8 |

Takeaway

All things considered, I continue to be impressed with the fundamental performance achieved by Advanced Drainage Systems. The company has been rewarded handsomely for this strength. Having said that, I do think the easy money has been made, and I also believe that current market uncertainty adds to the risk to some degree. Due to these factors, I do think that a more appropriate rating for the company at this time is a ‘hold’, but I could easily change my mind if fundamentals continue to improve and/or if shares of the company fall further from here.

Be the first to comment