jhorrocks/E+ via Getty Images

Overview

A lot has changed over the past year. The transitory inflation narrative has been hastily binned as conflict in the Donbas boosts commodity prices, heightens geopolitical tension, and drags on the global economy.

To tackle this, central banks have taken discernible action. Some sovereign banks have been resolute in pushing restrictive monetary policy (US, UK, Europe) while others (Japan) have figuratively taken the opposite side of the trade. Consequently, currency markets have been thrown into a tailspin.

When the dust settles, there appears more capital market volatility throughout the world.

Restrictive monetary policy is not without impact on risk capital. High PE technology plays with fanciful earnings projections, yet little in the way of cash, have been pulled back towards earth as discount rates ballooned.

The same is true for the real estate sector, which, beyond technology, is the most interest rate sensitive sector in the S&P 500.

Effectively, tight monetary policy is putting the real estate industry in a world of pain, making Direxion Daily Real Estate Bear 3x shares ETF (NYSEARCA:DRV) a compelling tactical trading tool.

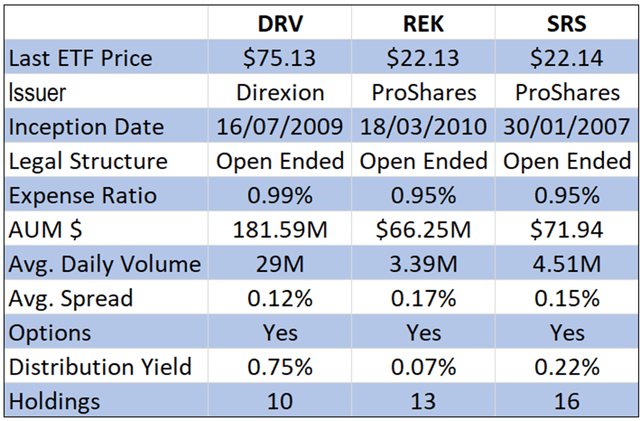

Spreadsheet developed by author with inputs from ETF.com & Koyfin

Comparative overview DRV v (REK) v (SRS)

Real Estate Industry

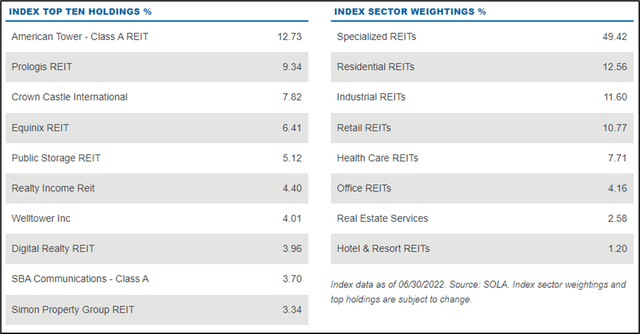

To grasp the underpinnings of Direxion Daily Real Estate Bear 3x Shares ETF, it’s fundamental to build broad based knowledge of the Real Estate sector. While DRV takes inverse leveraged exposure to the Real Estate Select Sector Index, (XLRE) – the Sector Spdr – provides a good proxy for real estate’s make-up in the S&P 500.

Real estate makes up only roughly 3% of total S&P 500 holdings, with broadly 2 industry groups making up the sector – real estate investment trusts and real estate management & development.

Holdings in XLRE are big cap, low P/E equities with income-paying characteristics (dividends). REITs make up the lion’s share (tax-exempt) with Real Estate Management & Development (taxable) plays making up the rest.

REITs provide interesting characteristics as they have bond like cash flows, coupled with possible equity-like future upside. For certain money managers, this is particularly attractive.

Multiple factors characterize the real estate sector – with both the business cycle and interest rate sensitivity being key drivers of positive risk adjusted returns.

Simply said, as interest rates rise, mortgages head North, putting pressure on household disposable income. It also makes prospecting for a new home less enticing as acquisition costs skyrocket, financing becomes more difficult to acquire, and onerous to maintain.

The business cycle in real estate is approximately a 20-year period that witnesses several phases. A boom phase typified by rising house prices, and rental occupancy, which subsequently generates a phase of new property development and supply.

As property supply often has a notable lag factor, this often creates oversupply, subsequently pressuring prices. Demand starts to subside, price pressure increases, vacancy rates intensify. The impact remains worse if these downturns occur when the world is on the cusp of a broader global recession. Queue 2022 & 2023.

Product Structure

DRV Direxion Daily Real Estate Bear 3x Shares ETF provides traders with 3x leveraged inverse risk expose to the Real Estate Select Sector Index. In layman’s terms, as the real estate sector stumbles, this hyper leveraged ETF increases in value, as best seen on the chart below.

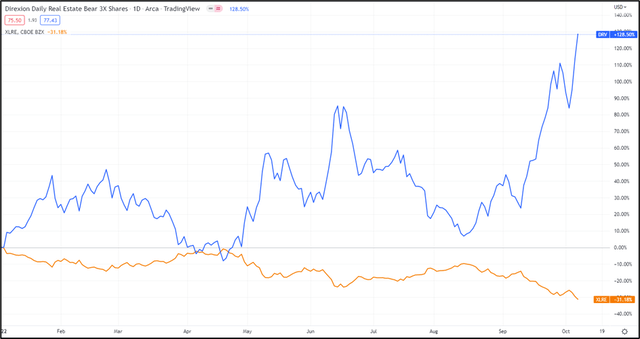

Tradingview

Year-to-date total returns DRV v XLRE – Naturally, DRV has boosted to the upside following the capitulation of the US real estate sector amid strengthening interest rates.

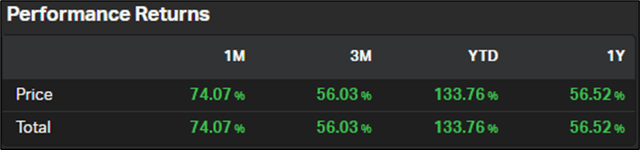

Koyfin

Returns have been breathtaking for the inverse leveraged housing play.

Because DRV is leveraged by nature, it suffers product structure issues such as daily rebalancing and a difficulty in predicting long-term returns due to path dependency and compounding.

Accordingly, this is strictly a tactical trading instrument that should be used to take on housing risk exposure or hedge it out on a very short-term basis. In no case whatsoever should this be considered a long-term bearish holding in a balanced portfolio of risky assets.

Leverage is often tricky to manage, so this ETF sits firmly dedicated to sophisticated investors taking a negative bet on the US housing sector. This leverage, married with a daily reset feature, means positioning needs active monitoring and control.

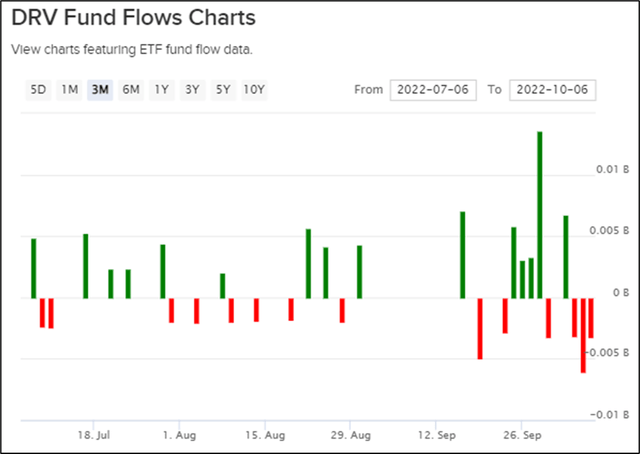

ETFDB.com

The past 3 months have witnessed fund inflows increase by $34 million as traders have started taking punctual bets on housing’s interest-rate induced demise.

The fund holds roughly $181M in assets under management. Volume is understandably low given the fund’s size and net fees & expenses post on the high side (0.99%) reflective of the exotic nature of the security.

Inverse leveraged ETFs also provide optionality for long only money managers to seek negative housing market risk exposure, while complying with mandates described in an investment policy statement.

Simply said, you can short the US property market by effectively going long.

The fund resorts to derivatives – normally a basket of swaps, US dollar treasuries – or simply cash. Because these derivatives are contracted with other investment banks, the ETF does hold some degree of counterparty risk in the event of a complete market meltdown.

Direxion

Fund composition provides risk exposure to real estate staples, represented by a handful of REITs.

Risks

- Beyond risks linked to shorting the US housing market, a lot of the risks linked to DRV are structural.

- It’s a 3x inverse leveraged ETF – to get that lift, the issuer resorts to derivative contracts with investment banking counterparties. This explicitly builds in counterparty risk to the product.

- Leverage cuts both ways – breathtaking gains can be just as easy to build as catastrophic losses. As such, it needs to be handled with care – this is a tactical trading tool used to take on punctual risk-off exposure to US housing. It is not a buy-and-hold investment.

- Its leveraged nature, path dependency, and daily compounding mean that this position needs close attention and active management.

Key Takeaways

- The US housing market is reeling under interest rate pressure pushed by Central Banks throughout the world.

- Subsequently, this has massively impacted the most interest rate sensitive parts of the market, such as housing.

- DRV provides traders inverse leveraged risk exposure to housing’s demise. As the real estate sector capitulates, this fund gains in value.

- Yet its product attributes mean that it should only be put in the hands of experienced traders who understand the perils of leverage, daily compounding, and counterparty risk.

Be the first to comment