HJBC

It has been a wild year in the global natural gas markets. Prices had already been trending higher from the mid-2020 lows, when U.S. natural gas futures reached a twenty-five-year low of $1.44 per MMBtu. While the price recovered in 2021, the events in early 2022 turbocharged the U.S. rally, sending the energy commodity to a fourteen-year high. In Europe, Russia’s invasion of Ukraine sent prices to record highs.

The U.S. annual injection season, when natural gas stockpiles rise, begins in March and runs through November. We are weeks away from the withdrawal season, when stocks decline and heating demand peaks during the winter.

Meanwhile, U.S. nearby natural gas futures prices have dropped from over $10 per MMBtu in August to below $6 on October 19. European prices have also declined, but seasonality could make the recent bearish price action a short-term phenomenon. The United States Natural Gas ETF, LP (NYSEARCA:UNG) product is unleveraged and follows the price of the U.S. futures on the CME’s NYMEX division higher and lower.

The UK turns to Cheniere

In an October 14, 2022, article on Seeking Alpha, Carl Surran outlined that the UK government is negotiating “substantial purchase agreements” with LNG producers, including Cheniere Energy (LNG).

Europe is going into the 2022/2023 winter season with significant energy concerns. The war in Ukraine has caused European natural gas prices to rise to record highs earlier this year. Aside from the high prices, availability is a primary concern, as Russia, the primary supplier of the energy commodity, is using natural gas as a weapon against “unfriendly” countries supporting Ukraine.

The UK, Western European countries, and NATO members dependent on Russian natural gas supplies are scrambling to secure heating fuel for the coming months.

Explosive and implosive price action

Over the past years, U.S. natural gas prices have become highly sensitive to worldwide prices as liquefied natural gas now travels the globe by ocean vessels. Before technological advances allowed for processing gas into liquid form, U.S. supplies were limited to the North American pipeline network. The United States and Russia lead the world in natural gas production. While the U.S. is the leading producer, Russia is the top exporter. Europe depends on the Russian pipeline network.

Retaliation over NATO’s support for Ukraine has put natural gas in the crosshairs of the ongoing war on Western Europe’s doorstep. Earlier this year, European gas prices rose to record peaks.

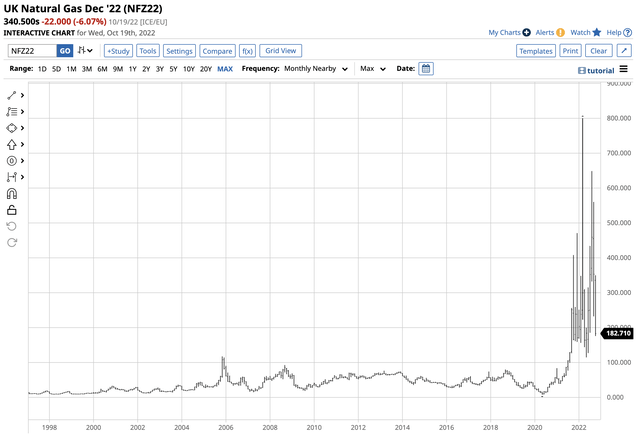

Chart of UK Natural Gas Futures Prices (Barchart)

The chart shows UK natural gas prices rose to 800 in March 2022. The furious rally took the energy commodity far above the pre-2021 all-time peak of 117. While nearby natural gas prices were at the 182.71 level on October 19, the December contract was at 340.50, almost triple the cost of the pre-2021 high.

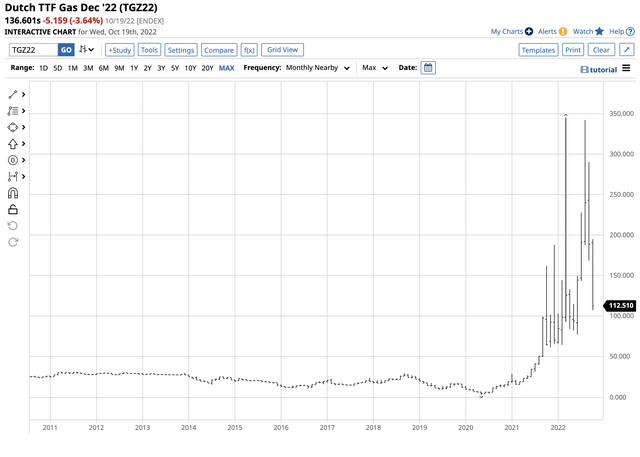

Dutch Natural Gas Futures Prices (Barchart)

The natural gas price in the Netherlands rose to 345 in March 2022, and the pre-2021 high was 31.04 in 2011. The December futures contract at the 136.601 level on October 19 was over 4.4 times higher than the pre-2021 peak.

Europeans will be paying record-high prices for natural gas over the coming winter months. Moreover, limited supplies could jeopardize natural gas availability, causing rationing. A frigid winter will only exacerbate the supply situation.

Prices have declined in the U.S. and Europe

European prices have come down from the sky-high levels seen in March but remain at record levels compared to the pre-2021 highs. Natural gas has a long history as one of the most volatile energy commodities. In the U.S., 2022 has been a year of explosive and implosive price action, as U.S. prices have become highly sensitive to global supply and demand fundamentals.

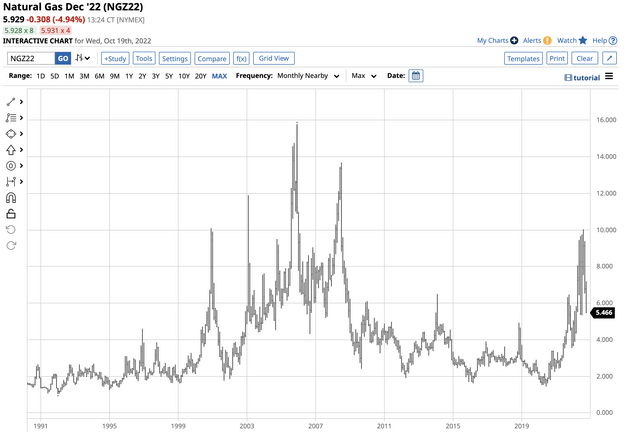

US NYMEX Natural Gas Futures Prices (Barchart)

The chart shows U.S. natural gas prices did not reach record levels in 2022, but they rose to a fourteen-year high at $10.028 per MMBtu in August. Over the past weeks, the price collapsed below the $6 per MMBtu level on the December NYMEX futures contract on October 19. U.S. natural gas has experienced explosive and implosive price action this year. The 2022 injection season ends next month, and inventories remain below last year’s level and the five-year average.

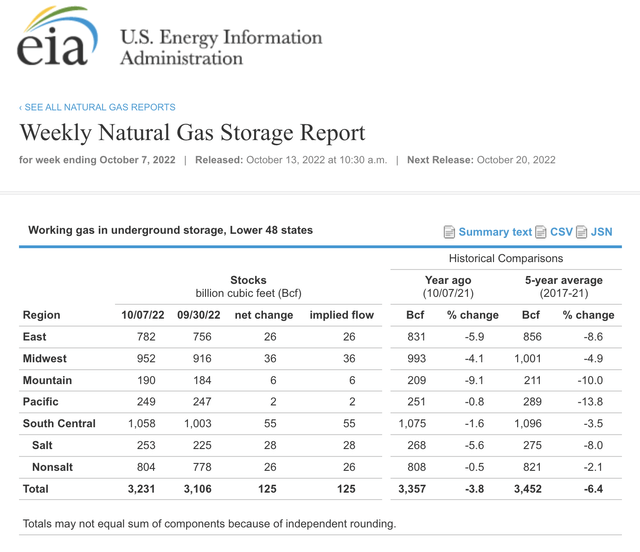

US Natural Gas Inventories as of the week ending on October 7, 2022 (EIA)

The chart shows U.S. natural gas inventories were 3.8% below last year’s level and 6.4% under the five-year average for the week ending on October 7. The EIA will report stockpile data for the week ending on October 14 on Thursday, October 20. The current expectations are for a 100 bcf increase. While Europe is scrambling for supplies, the U.S. inventory balance sheet is tight.

UNG is the most direct U.S. natural gas ETF product for a risk position

The most direct route for a risk position in the U.S. natural gas market is the futures and futures options traded on the CME’s NYMEX division. The US Natural Gas ETF product tracks the price action in the futures arena and is an unleveraged product. At $19.10 on October 19, UNG had $444.362 million in assets under management. The exchange-traded fund (“ETF”) trades an average of over 4.782 million shares daily and charges a 1.35% management fee.

Nearby NYMEX November natural gas futures rallied from $5.46 on June 30 to $10.04 per MMBtu on August 23, an 83.9% gain.

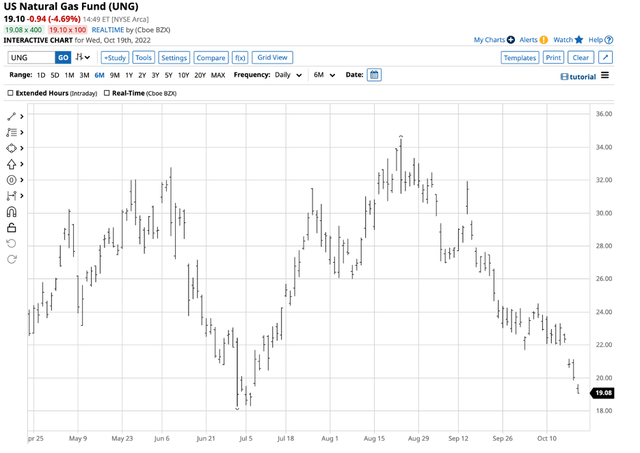

Chart of the UNG ETF Product (Barchart)

The chart illustrates UNG’s rise from $18.28 to $34.50 per share over the same period, as the ETF rallied 88.7% and did an excellent job tracking the futures market. UNG has declined with the natural gas futures market since the late August peak.

Expect lots of volatility during the winter

The peak season for natural gas demand will start in a few weeks, and the European and Russian supply situation makes the weather conditions secondary for the 2022/2023 peak demand season. At below $6 per MMBtu, natural gas is back in the buy zone as the risk of long positions has decreased with the price. After months of explosive and implosive price behavior, seasonality and geopolitical tensions favor the upside.

Natural gas is a market that takes no prisoners, tending to shock market participants on the up and downside. Picking bottoms and tops in natural gas are dangerous as the energy commodity has caused more than a few speculators to lose their shirts.

I expect lots of volatility over the coming weeks and months. An end to the war in Ukraine would be bearish for prices, while an escalation and Russian retaliation against Western Europe could be very bullish. The trend is always your best friend until it bends, and as of October 19, it remains bearish in the natural gas futures arena. However, when the price finds a bottom and turns higher, natural gas trends have offered substantial gains for those who go with the flow in the volatile energy commodity.

The best advice for any risk position is to remember that you are long or short at the current price, not at the original execution level. Adjust risk-reward dynamics on all positions to reflect the current market. On October 19, I am watching natural gas to signal that the price action is turning bullish, but remain on the sidelines during the current slide.

Be the first to comment