iQoncept/iStock via Getty Images

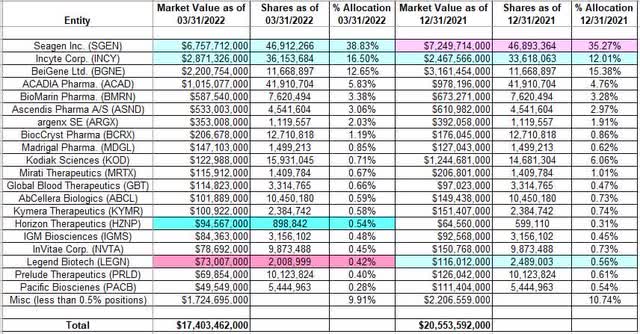

This article is part of a series that provides an ongoing analysis of the changes made to Baker Brothers’ 13F stock portfolio on a quarterly basis. It is based on Baker Brothers’ regulatory 13F Form filed on 5/16/2022. The 13F portfolio value decreased this quarter from $20.55B to $17.40B. Although there are ~120 positions in the 13F portfolio, the holdings are concentrated among a few large stakes. There are 20 positions that are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Seagen, Incyte, BeiGene, ACADIA Pharma, and BioMarin Pharma. They add up to ~77% of the portfolio. Please visit our Tracking Baker Brothers Portfolio series to get an idea of their investment philosophy and our previous update the fund’s moves during Q4 2021.

Baker Brothers, a biotech investment firm, was founded by Julian & Felix Baker in 2000. Despite a losing win-record, the firm has managed to post outstanding returns thru prudent position sizing. As a percentage of AUM, allocation to the highest conviction picks can be very high at over 30%. Over the years, the firm had a number of home runs as the invested firms got acquired at huge premiums. Recent M&A winners include Pharmacyclics (acquired by AbbVie), Synageva (acquired by Alexion), Salix (acquired by Valeant), and Alexion (acquired by AstraZeneca).

Stake Increases:

Seagen Inc. (SGEN): SGEN is currently the largest position by far at ~39% of the entire portfolio. It is a very long-term stake that has been in the portfolio for over fifteen years. The position was built to ~20.5M shares in the 2004-2011 timeframe at prices between low-single-digits and low-20s. Q1 2014 to Q1 2016 saw another stake doubling at prices between ~$30 and ~$55. Since then, the activity has been minor. The stock currently trades at ~$177.

Note: They have ~25% ownership stake in the business.

Incyte Corporation (INCY): INCY was already a 1.67M share stake in their first 13F filing in Q2 2003. The stake had roughly doubled by 2006. The 2007-2008 timeframe saw the position increased from ~3.2M shares to ~11.1M shares at prices in the high single digits. Major activity in the last decade follows. Q3 2015 saw a ~30% stake increase at prices between ~$105 and ~$130. Q1 2016 saw another ~20% stake increase at prices between ~$65 and ~$100. That was followed with a ~45% stake increase in Q1 2017 at prices between ~$100 and ~$150. The stock currently trades at ~$76 and it is a top-three stake at ~17% of the portfolio. There was a ~13% stake increase over the last two quarters at prices between ~$63 and ~$80.

Note: Baker Brothers controls ~16.5% of the business.

Horizon Therapeutics (HZNP): HZNP is a small 0.54% of the portfolio stake that saw a ~50% stake increase this quarter at prices between ~$86 and ~$110. The stock currently trades below that range at $79.76.

Stake Decreases:

Legend Biotech (LEGN): The small 0.42% of the portfolio stake in LEGN saw a ~20% reduction during the quarter.

Kept Steady:

BeiGene Limited (BGNE): The large (top three) ~13% BGNE stake has been in the portfolio since their US listing in Q1 2016. Shares started trading at ~$24 and currently goes for ~$162. Q4 2016 saw a stake doubling at prices between ~$28 and ~$36. H1 2018 saw the stake built from ~3.8M shares to ~12M shares at prices between ~$100 and ~$215. Since then, the activity has been minor.

Note: Baker Brothers controls ~13% of the business.

ACADIA Pharmaceuticals (ACAD): The 5.83% ACAD stake was established in the 2012-2013 timeframe at very low prices. Last major activity was in Q4 2018 when there was a ~40% stake increase at prices between ~$14 and ~$22. The stock currently trades at ~$14.

BioMarin Pharmaceutical (BMRN): A small stake in BMRN was first purchased in 2006 but was eliminated the following year at higher prices. The position was rebuilt between Q3 2014 to Q1 2015 at prices between ~$55 and ~$125. Last major activity was a ~60% stake increase in 2017 at prices between ~$80 and ~$95. The stock is now at $82.87, and the stake is at 3.38% of the portfolio.

Ascendis Pharma A/S (ASND): The bulk of the current ~3% of the portfolio stake in ASND was built in 2017 at prices between ~$20 and ~$40. Q3 2021 saw a ~28% stake increase at prices between ~$113 and ~$177. The stock currently trades at ~$93.

Note: Baker Brothers controls ~8.5% of the business.

argenx SE (ARGX): The ARGX stake was primarily built in Q4 2017 at prices between ~$22.50 and ~$63. There was a ~10% stake increase in Q1 2021 at prices between ~$268 and ~$380. The stock currently trades at ~$379 and the stake is at ~2% of the portfolio.

Madrigal Pharmaceuticals (MDGL) and Mirati Therapeutics (MRTX): These two small (less than ~1% of the portfolio each) stakes were kept steady this quarter. Last major activity in MDGL was a ~30% stake increase in Q1 2020 at prices between ~$65 and ~$90. The stock is now at $71.58. Last major activity in MRTX was a ~50% selling in Q3 2019 at prices between ~$76 and ~$106. The stock currently trades at $67.13.

Note: Baker Brothers controls ~10% of Madrigal Sciences.

BioCryst Pharmaceuticals (BCRX): BCRX is a very long-term stake that has been in the portfolio since 2004. It is still a small position at 1.19% of the portfolio. Last major activity was in 2019 when Q2 to Q4 saw a roughly one-third selling at prices between ~$1.60 and ~$8.70. The stock currently trades at $10.58.

Note: Baker Brothers controls ~10% of BioCryst Pharmaceuticals.

Kodiak Sciences (KOD): KOD is now a small 0.71% of the portfolio position. The original stake goes back to funding rounds prior to its Q4 2018 IPO. Shares started trading at ~$10 and currently goes for $7.64. Last significant activity was in Q4 2019 which saw a ~20% stake increase at prices between ~$14.50 and ~$76. They have a ~30% ownership stake in the business.

Note: In December 2019, Baker Brothers stuck a deal for a capped 4.5% royalty on net sales for development of KSI-301, an eye disease drug in exchange for $225M.

Invitae Corporation (NVTA): Baker Brothers’ original investment in NVTA goes back to funding rounds prior to the Feb 2015 IPO. Shares started trading at ~$20 and currently goes for $2.44. Recent activity follows. Q4 2018 saw a ~55% selling at prices between ~$9.50 and ~$15. The position was rebuilt in Q3 2019 at prices between ~$18.50 and ~$27. Q2 & Q4 2020 saw a two-thirds stake increase at prices between ~$12.50 and ~$57.50. There was a ~35% reduction in Q2 2021 at prices between ~$26 and ~$40.50. Next quarter also saw a minor ~4% trimming. The position is now at 0.45% of the portfolio.

AbCellera Biologics (ABCL): ABCL had an IPO in December 2020. Shares started trading at ~$49 and currently goes for $10.65. Baker Brothers’ stake goes back to funding rounds prior to the IPO.

Prelude Therapeutics (PRLD): PRLD is a 0.40% of the portfolio position. The stake goes back to funding rounds prior to their IPO last September. Shares started trading at ~$33 and currently goes for $5.22. There was a marginal increase in Q1 2021.

Note: Baker Brothers controls ~29% of the business. Julian Baker joined the board in January 2021.

IGM Biosciences (IGMS): The 0.48% of the portfolio stake in IGMS goes back to funding rounds prior to the September 2019 IPO. The position has remained almost steady since. There was a marginal increase in Q2 2021. Shares started trading at ~$18 and is currently at around the same price.

Note: They have a ~12% ownership stake in the business.

Global Blood Therapeutics (GBT), Kymera Therapeutics (KYMR), and Pacific Biosciences (PACB): These two very small (less than ~0.65% of the portfolio each) stakes were kept steady this quarter.

Note: Baker Brothers has significant ownership stakes in the following businesses – Aeglea BioTherapeutics (AGLE), Achilles Therapeutics (ACHL), Aligos Therapeutics (ALGS), Altimmune (ALT), Amarin (AMRN), Aerovate (AVTE), DBV Technologies (DBVT), Entrada Therapeutics (TRDA), Heron Therapeutics (HRTX), Immatics (IMTX), Immunocore (IMCR), Kystal Biotech (KRYS), Neoleukin Therapeutics (NLTX), Nurix Therapeutics (NRIX), Opthea Ltd. (OPT), Otonomy (OTIC), Rhythm Pharma (RYTM), Surrozen (SRZN), Talis Biomedical (TLIS), TScan Therapeutics (TCRX), Verastem (VSTM), and Zymeworks (ZYME).

The spreadsheet below highlights changes to Baker Brothers’ 13F holdings in Q1 2022:

Baker Brothers’ Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Baker Brothers’ 13F filings for Q4 2021 and Q1 2022.

Be the first to comment