PeopleImages/iStock via Getty Images

This article was originally published for ROTY subscribers on June 14th and sports a 15% gain in the Core Biotech portfolio. It has been updated where necessary.

Shares of CNS-disease specialist Supernus Pharmaceuticals (NASDAQ:SUPN) have fallen by 30% over the past 5 years and have risen +12% so far for 2022.

The name popped up on my radar for a number of reasons, including:

- Lucrative opportunity in ADHD for key drug Qelbree in ADHD and positive trends in prescription growth

- Respected biotech investor O’Neil Trader’s suggestion to tune into Jefferies presentation

- Prior commentary from Dr. Kenneth Pittman including revisit of his prior work

I had looked in on this name a few times in the past, but never found it overly attractive. Rather, it seemed to be more of a “steady eddy” as opposed to having that high upside potential we look for (also a potentially crowded market in ADHD).

That changed after I tuned into Jefferies presentation, which revealed a lucrative niche to fill for Qelbree in adult ADHD, stable growth in Parkinson’s portfolio and deep early stage behind these including a first-in-class molecule for treatment-resistant depression (all backed by management’s 30+ years of expertise in diseases of CNS or central nervous system). Balance sheet also looked remarkably stable to weather such turbulent times in biotech.

Thus, I chose to prioritize this name for the Core Biotech portfolio and bring it to the attention of my readers.

Chart

Figure 1: SUPN weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares march up from mid-teen lows to a high in the mid-thirties over the past couple years. From there, the stock corrected to mid-twenties which was the opportunity we needed to initiate a long-term position in the company. Post Q2 report, shares have rebounded to new 52-week highs and I expect further continuation.

Jefferies Presentation Notes (Link)

CEO Jack Khattar starts by reminding listeners that the company has been around for 30+ years (1997 to 2005 as part of Shire) with strong experience in CNS (specifically, in ADHD). Historically, they’ve developed 4 products in the ADHD space and currently they have 8 products on the market

Figure 2: Current and prior approved products, along with deep pipeline in CNS (Source: corporate slides)

They have very significant R&D capabilities as would be expected for the amount of time the company has been around (along with CMC and drug delivery technologies).

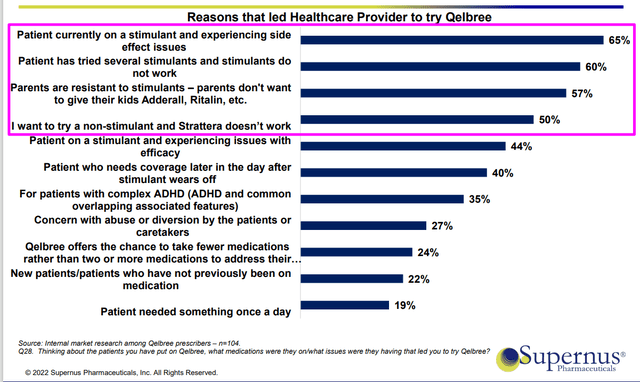

Moving onto Qelbree in adult ADHD, they just received approval at the end of April and launched the product in adult market two weeks before Jefferies presentation. Qelbree is a novel non-stimulant, non-controlled substance and was launched in 2021 for patients aged 6 to 17 years of age. They have a 195 representative salesforce promoting the product and strong clinical feedback confirms data observed in phase 3 program. The product works early in the treatment (as early as week 1 observed in children, week 2 in adults) and works in both inattention and hyperactivity. Convenience is another benefit, as it’s easy to use with easy titration along with encouraging tolerability (discontinuation rates of 2% to 4%). Company does a survey on monthly basis and it’s interesting to note that 3 of the top reasons for physicians to put their patients on Qelbree are stimulants (drawing patients in from stimulant market to non-stimulant).

Figure 3: Top reasons ADHD patients try Qelbree (Source: corporate slides)

90% of prescriptions are stimulants and 10% non-stimulants, so again we can easily see the opportunity to change the treatment paradigm here.

IP position is strong (to 2033) and market is significant (80M prescriptions on annual basis and continues to grow). 67% of the market is in adults (double the size of the pediatric opportunity). Even small market penetration 5% to 10% would equate to a billion-dollar opportunity for Supernus.

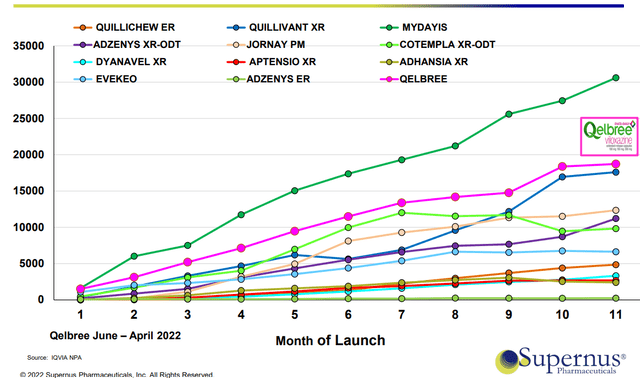

Figure 4: ADHD launch-aligned monthly prescriptions (Source: corporate slides)

Qelbree is the second best most-successful launch in the past decade in this space. Of note, Qelbree was the only product on the above chart launched during Covid pandemic (unique circumstances, lack of physician access, etc).

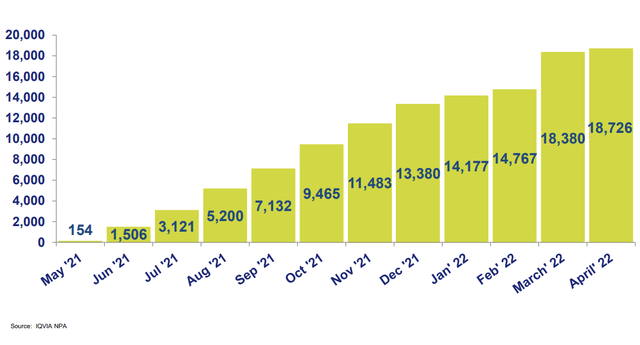

Below, we can see that monthly prescriptions in March and April closed in above the 18,000 level (hopefully touching 20,000 or higher in for May). Much higher momentum should come as a result of adult launch in the near to medium term.

Figure 5: Qelbree monthly prescriptions since launch (Source: corporate slides)

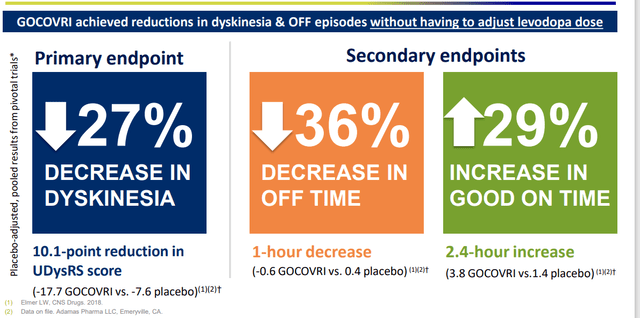

Moving onto Parkinson’s, they have excellent presence with 3 products on the market (Xadago, Apokyn and Gocovri). Gocovri is unique in that it’s the only product indicated for treatment of dyskinesia and “off” episodes (a lot of products out there in Parkinson’s indicated to treat solely the latter). Also, for many products as disease progresses and dose needs to be increased, they cause more dyskinesia.

Figure 6: Three key benefits of Gocovri treatment in Parkinson’s disease (Source: corporate slides)

Increase in “good on time” is quality time that they can function without the muscle twitching and weakness associated with dyskinesia. Net sales of Gocovri in 2021 was $88M (owned the product for partial year as Supernus bought out Adamas Pharmaceuticals for $400M). Q1 2022 results showed 23% growth versus Q1 2021 which should continue to trend nicely (huge addressable population, “we haven’t even scratched the surface yet”). 1 million patients in the US and 200,000 that get dyskinesia, also 200k to 300k patients that get the OFF episodes.

Moving onto SPN-830, this is a novel infusion device of apomorphine with PDUFA date in early October ($100M-175M estimated peak sales). It’s a non-invasive, dopaminergic stimulation therapy providing continuous treatment of ON-OFF episodes in Parkinson’s. This is designed for patients who get so many OFF episodes during the day that they cannot do a lot of injections of apomorphine. This could become a key option for patients who otherwise would resort to deep brain stimulation or GI surgically implanted levodopa/carbidop infusion. Plan is to launch the product in Q1 2023 if all goes well.

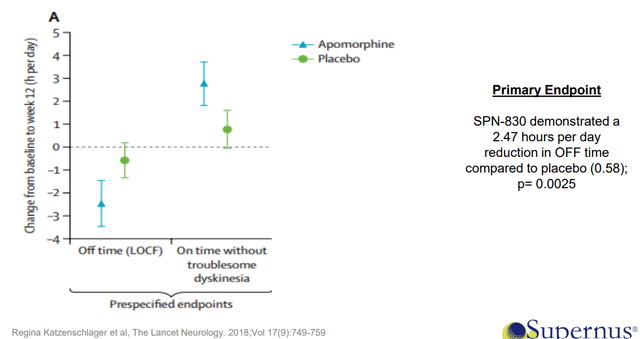

Figure 7: TOLEDO phase 3 data for SPN-830 achieved high statistical significance (Source: corporate slides)

Pivotal data above shows almost 2.5-hour reduction in OFF time and gives patients more quality ON time without troublesome dyskinesia.

As for SPN-820, CEO believes this is a major asset that is underappreciated by the investor community. This is a first-in-class mTORC1 activator with unique mechanism of action for the treatment of treatment-resistant depression or TRD. It enhances synaptic activity and improves cellular metabolism in the brain. This drug candidate stems from a 2020 codevelop deal with privately-held Navitor Pharmaceuticals (Supernus pays for phase 2 development up to $50M, acquired option to license global rights ex-China prior to initiation of phase 3 studies). Deal terms involved payment to Navitor of $25M upfront (option fee and acquired 13% ownership stake) and Supernus is on the hook for up to $450M in milestone payments). Initial data in TRD showed encouraging efficacy signal on the HAMD-6 scale with rapid onset of action at 2 hours (very meaningful effect in terms of treating symptoms of depression). MAD (multiple ascending dose) study demonstrated drug penetration and target engagement (solid safety & tolerability profile to boot). They looked at plasma concentration and CSF (cerebrospinal fluid) concentration to determine whether there is correlation between the two with biomarker concentration. Correlation between CSF concentration and 3 biomarkers is observed, giving them reassurance that drug is getting where it needs to go and engaging target.

Phase 2 trial was initiated 6 or so months ago (clinical trials gov shows May 2023 primary completion date). As for market opportunity, there are 17 million people with depression in the US with one-third of them being treatment resistant.

SPN-817 is an exciting program in epilepsy entering phase 2 trials this year (also a novel mechanism of action). They nominated a couple new molecules last year in Fall as clinical candidates for further development (including SPN-443 for ADHD and SPN-446).

Company is positioned for long term growth, has a diversified portfolio in CNS, neurology and psychiatry. They currently have 3 different salesforces, from ADHD to Parkinson’s to neurology (Oxtellar XR and Trokendi XR). Keep in mind that Trokendi loses exclusivity next year.

As for Q&A, Vyvanse was a $2 billion product that Shire did a good job of launching and differentiating versus competition (has a 14-hour profile). Strattera was the first non-stimulant peaked around $720M global sales (long time ago). They believe Qelbree can be bigger than these drugs given clinical profile. Some of the more recent drugs on market are reformulations of amphetamines and methylphenidates (chewables and liquids) which are more niche-type products (more in $50M to $100M range). Takeda’s Mydayis is a bit bigger but also has less promotional effort behind it at this point. For Qelbree, they will continue with heavy sampling (they are the only company who can do this because it’s non-controlled substance) to get patients started on the product and see for themselves its benefits. The company is upfront that it’s spending heavily on marketing and patient education along with direct-to-consumer efforts. As for growth trajectory, they expect linear to continue and an inflection as adult segment is double size of pediatric (no back to school seasonality either).

Other Information

For Q2, the company reported cash and equivalents of $508M as compared to expected full year 2022 positive operating earnings of $20M to $40M (not burning cash).

Full year 2022 revenues are expected to total $640M to $680M versus combined R&D and SG&A expenses of $460M to $490M (rare for us to be able to find such fiscally responsible companies).

As for the highlights, Q2 revenues rose 20% to $170.1M.

Qelbree prescriptions grew 33% over Q1 2022 to 62,938 prescriptions. Qelbree net product sales of $11.1M increased 34% compared to Q1 2022. Keep in mind adult ADHD launch just got underway in May (early innings).

As for the Parkinson portfolio, Gocovri prescriptions grew 16% to 10,929 compared to Q1 2021.

Moving onto the conference call, management states that Qelbree was launched into adult ADHD market (largest segment) in May and represents the first novel nonstimulant to be introduced in 20 years. Adult market represents 68% of total market’s prescriptions and is growing at faster rate than pediatric market and tends to be less seasonal. June prescriptions reached highest monthly total since the launch of the product, with prescriber base increasing from over 9,200 (up from 6,900 in Q1 2022). Commercial spend will increase as Qelbree momentum grows in adult market and back to school season approaches. ADHD market is growing much more than they thought, and even 5% to 10% market share is billion-dollar opportunity. Historically, Strattera was around 7% market share and management feels Qelbree’s profile merits this type of number if not more.

SPN-830 launch in Parkinson disease could come Q1 2023 assuming FDA approval.

For SPN-820 in treatment-resistant depression, phase 2 multi-center study continues to enroll patients (n=270).

They are also on track to initiate open label phase 2 study with SPN-817 in Q4 in patients with treatment resistant seizures.

Oxtellar XR continues to perform well (net product sales of $30M, 20% increase compared to same period last year). Trokendi XR net product sales were $72M, down from $79M last year.

They continue to be active in business development (looking for high value CNS assets to scoop up).

For Trokendi generic competition, they are looking at 90% erosion over the next 12 months (could weigh on shares). This can be considered to be the base case scenario, and hopefully better clarity will be given in January and February in terms of number and timing of generics.

I also suggest readers revisit Kenneth Pittman’s older article titled “Supernus Is Once Again A Super Value” as it helps to provide some context as to where the company has come from (also viewpoint of a practicing physician in this area, which I am not).

As for institutional investors of note, Armistice Capital owns a 7.8% stake. As for insiders, Founder, President and CEO Jack Khattar certainly has skin in the game (owns over 1M shares or $26M worth).

As for executive compensation, I thought CEO’s pay for 2021 was a bit on the high side ($870k cash component, ~$2.9M stock awards, ~$3.4M option awards, $887k non-equity incentive plan compensation). To be fair, they are not the typical cash burning biotech given positive quarterly earnings thanks to currently approved drugs.

As for caliber of management team, CEO Jack Khattar served prior as Board member, President and CEO of Shire Laboratories (drug delivery subsidiary of Shire). Multiple other executives also served together prior at Shire. For the board of directors, chairman Charles Newhall is the co-founder of venture capital firm NEA.

Moving onto IP, ten issued Trokendi XR patents expire no earlier than 2027 per the 10-K filing. Supernus entered into settlement agreements with third parties permitting sale of generic version January 1, 2023 or earlier under certain circumstances. Oxtellar XR nine issued US patents expire no earlier than 2027. Qelbree pending patents, if issued, could extend protection from 2029 to 2033. Gocovri issued patents expire through 2038 (settlement agreements via Adamas predecessor permitting generic sales for March 2030).

As for helpful nuggets from the ROTY community, Dr. Kenneth Pittman (Child & Adolescent Psychiatry Specialist) added the following commentary in Chat after our pilot purchase:

Nice to see both Jonathan Faison and Oneil Trader on the SUPN boat at the same time as me. I know Oneil has been there quite a bit with me in the past. It has been my largest holding for a long time and nothing they’ve done recently (including negative marketing by competitors) has convinced me to change that. I am very happy with Qelbree overall as it filled a big need, but their portfolio is much more than Qelbree now. They will probably have a down year or two profit wise as they transition from Oxtellar/Trokendi to Qelbree and their other newer drugs, but I still believe the future is bright for them. Qelbree has a very very good shot at being the #1 branded ADHD drug on the market by 2024 (Vyvanse will be generic at that point and the other 4 stimulant contenders are fighting over market share with each other).

Qelbree scripts at my office have been very strong compared to most ADHD meds. I have a decent number, but some of my NPs are using it even more than I am. We are having somewhere around 10 new starts every week and about 70% of these are staying on Qelbree as far as I can tell. Pretty heavy with the lower dose/younger kid element, but some adolescent and adult usage as well (if counting the practice that I work with that sees adults). Azstarys from KemPharm is doing fairly well, but not nearly as well as Qelbree in terms of number of new starts.

ONeil Trader also provides the following clarity on generic competition:

It is worth mentioning that, while Trokendi is going generic in 2023, only the companies that settled with SUPN can launch a generic next year. Others have to wait until the last patent expires in 2027 (or try their luck in court and likely lose as they did with Oxtellar where the same tech was used to develop Trokendi and patents are similar). And SUPN gets royalties on sales of these generics through 2027 (terms not disclosed). This will by no means save Trokendi from a decline next year, but the company will still have a nice revenue tail through 2027 (some branded and declining Trokendi sales and royalties on generic Trokendi).

As for accumulated deficit since inception, as of December 31 2021 the company had retained earnings of $379.9M.

As for devil’s advocate case, the main one I see is a scenario where declining sales from existing products approaching patent expiration (i.e., Trokendi) fail to be offset by growth from Parkinson’s portfolio and Qelbree launch into a heavily crowded ADHD space. I see substantial differentiation for the drug and appreciate that the company’s marketing efforts can do heavy sampling for patients to try (due to being non-controlled substance). I’ve read parent commentaries where they are fed up with existing ADHD treatments due to side effects or other attributes and prefer a non-controlled substance that works well and quickly (imagine the same is applicable to adult segment). For example, as I understand it Strattera tends to work at week 5 or later versus Qelbree onset as mentioned above week 1 in children and week 2 in adults.

Pursuit of a market heavily dominated by generics is often a “deal-breaker” for me in biotech, but there are exceptions such as prior ROTY winner Xenon Pharmaceuticals (XENE) where high efficacy, convenience and tolerability for XEN1101 should give it a leg up over generic antiseizure medications.

As the CEO noted, market opportunity for SPN-820 in treatment-resistant depression is widely unappreciated by Wall Street as well (conservatively 5M addressable patients in the US).

Final Thoughts

To conclude, the value proposition for Qelbree here is clear as the ADHD drug draws patients from stimulant market (majority) to non-stimulant (providing patients a solid option in a non-controlled substance). The holy grail for this indication is a non-stimulant drug that really works, and that’s what we appear to have here (parents or patients don’t run out of patience and revert back to prior such treatments). Additionally, as we’ve learned the hard way with my prior losers, promising science is not enough and it matters who’s at the helm of the company in question.

Management’s vast CNS experience of 30+ years including prior at Shire gives me a measure of confidence, as does the proven execution observed in successful Qelbree launch thus far despite being the only medicine in this space doing so during a pandemic. I also like how management is “all in” on this product regarding marketing efforts due to belief in value proposition for patients and value creation for shareholders. Parkinson’s portfolio of assets provides additional growth drivers in the near to medium term, while deep early-stage pipeline offers us optionality in indications of high unmet need such as TRD. At the same time, I will not minimize the challenges of launching an ADHD drug into a heavily crowded market.

For readers who are interested in the story and have done their due diligence, SUPN is a Buy and I suggest taking advantage of market & sector volatility to add exposure on dips in the near term.

Again, this idea is most appropriate for long-term investors, which is why we own it in the Core Biotech portfolio.

As for risk rating (1=low, 5= high), I will keep this middle of the range at 3. Despite the solid balance sheet and positive earnings, ADHD space is quite crowded and management has their work cut out for them in gaining share from competitors. Declining sales from products where they will lose patent production is a headwind that should be considered, as is the higher risk overall of drug development in CNS indications versus other areas less prone to placebo effect. While they don’t necessarily need it, further dilution is always possible to raise more funds for aggressive marketing and pipeline expansion. While I don’t believe this is such a case, it’s important to remember case studies such as Kala Pharmaceuticals (KALA) launching an undifferentiated drug into a heavily crowded dry eye market (David going up against big pharma giant Goliath).

For our purposes in Core Biotech, I own a full size position with intention to stay patient for multi-year time frame.

OTHER LINKS OF INTEREST

Qelbree’s recent approval for adults with ADHD highlights need for non-stimulant treatment options

Be the first to comment