Olemedia/E+ via Getty Images

Welcome to the March 2022 edition of the lithium miner news. The past month saw lithium prices surge to new record highs then begin to stabilize at a very high level.

The past month was all about North America. The USA and Ontario Canada both announced support for local critical minerals miners and the EV (and green energy) supply chains. I counted roughly 6 new announcements last month for plans for a new battery or battery materials facility in North America.

My Trend Investing article linked below was very well timed.

Lithium spot and contract price news

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up 1.8%. Lithium hydroxide prices were up 8.86% the past 30 days. Lithium Iron Phosphate (Li 3.9% min) prices were up 2.24%. Spodumene (6% min) prices were up 2.61% over the past 30 days.

Benchmark Mineral Intelligence as of mid-March reported China lithium carbonate prices of US$76,700/t (battery grade), and for lithium hydroxide $71,825/t, and stated (no link available): “Benchmark continues to hear reports that inventory levels for hydroxide, carbonate, and spodumene feedstock remain very low in the Chinese domestic market, indicating that robust demand for material, and hence high prices, will be sustained in the near-term, with expectations that the seasonal recommencement of supply from domestic Qinghai brines in the coming months will provide little relief to the growing market deficit.”

Metal.com reports lithium spodumene concentrate (6%, CIF China) price of CNY 18,234 (~USD 2,863/mt), as of March 18, 2022.

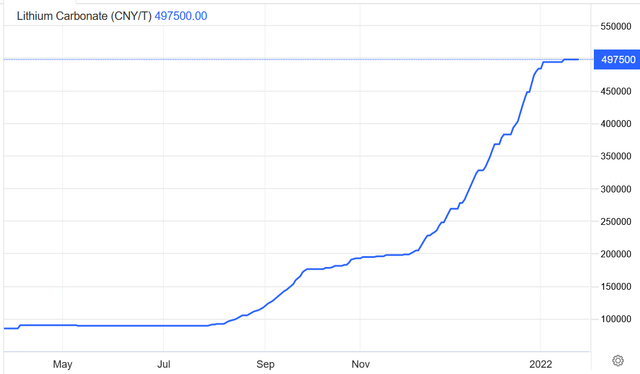

China Lithium carbonate spot price – CNY 497,500 (~USD 78,127)

Source: Trading Economics

Lithium demand versus supply outlook

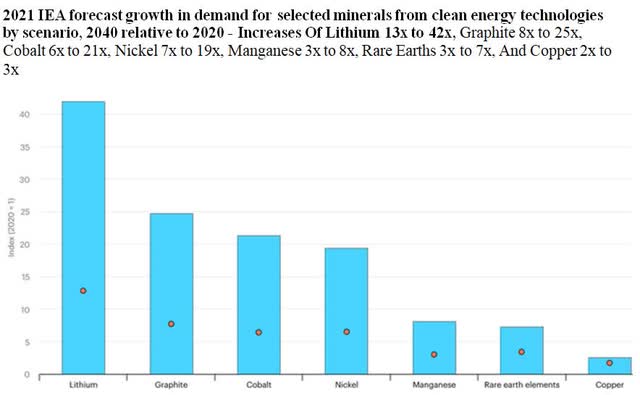

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

Source: International Energy Agency 2021 report

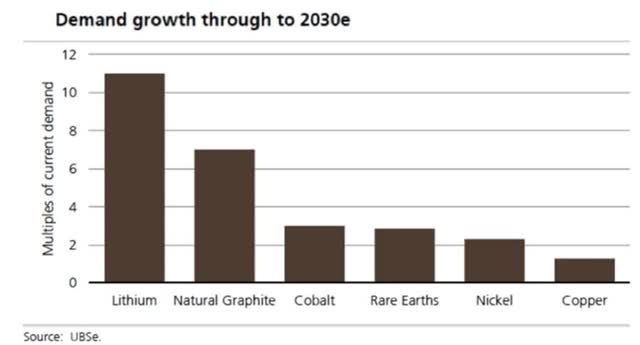

UBS’s EV metals demand forecast (from Nov. 2020)

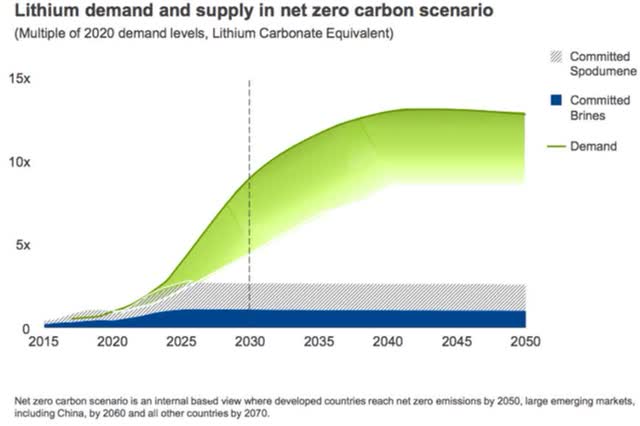

Rio Tinto’s lithium emerging supply gap chart (October 2021)

Source: Mining.com courtesy Rio Tinto

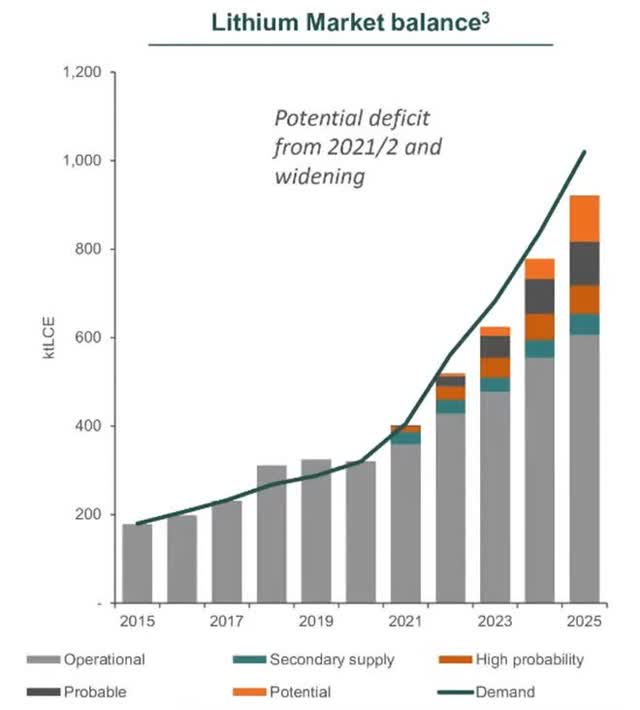

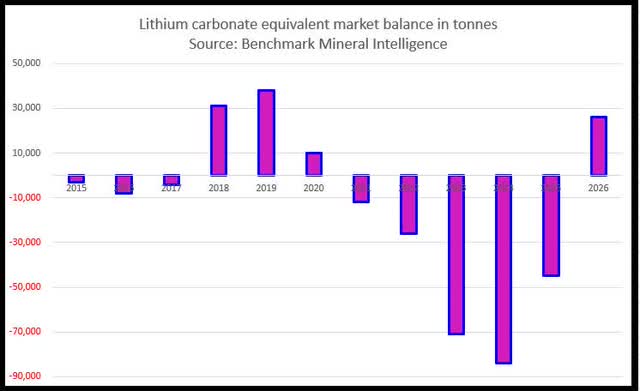

Lithium demand v supply forecast by Benchmark Mineral Intelligence in Q3 2021

Source: Allkem company presentation courtesy Benchmark Mineral intelligence

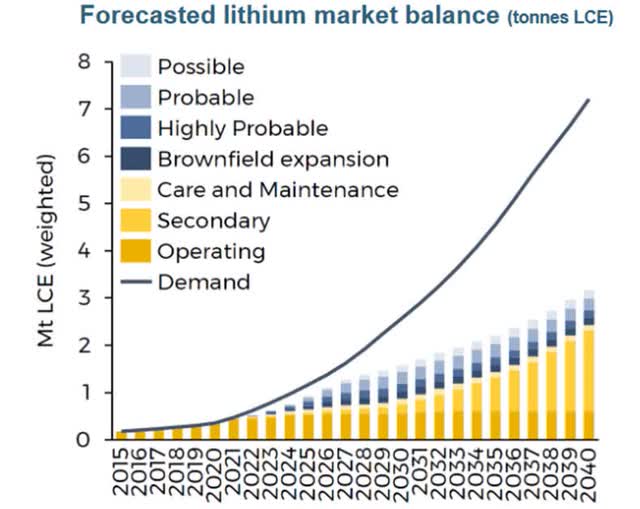

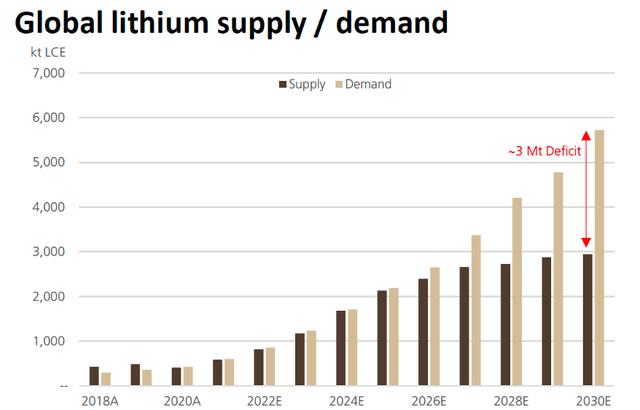

If supply can be rapidly ramped in future years it can come close to meeting surging demand

Source: Savannah Resources mid 2021 presentation courtesy of Benchmark Mineral Intelligence

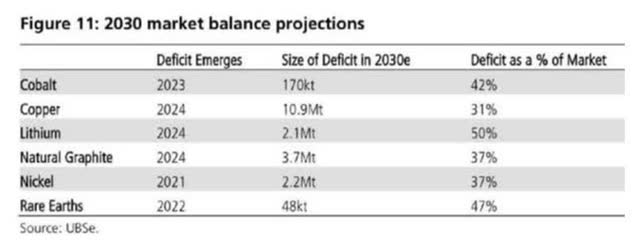

UBS forecasts Year battery metals go into deficit (chart from 2021)

Source: UBS courtesy Carlos Vincens LinkedIn

Macquarie’s lithium demand v supply forecast (July 2021) – Deficits from 2022 growing bigger from 2027

Source: Core Lithium presentation courtesy Macquarie

BMI 2022 lithium forecast – Deficits from 2021 to end 2025

Source: Reuters courtesy BMI

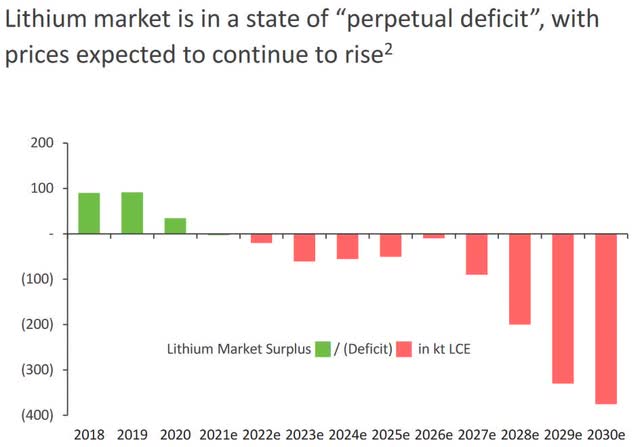

UBS lithium demand v supply forecast to 2030

Source: Lake Resources newsletter courtesy UBS

Lithium market and battery news

On February 16 Fastmarkets reported:

Yongxing Materials, Jiangxi Tungsten setting up JV for lithium carbonate production. The joint venture, which will be located in Jiangxi province’s Yichun city and built in two stages, will have a total annual capacity of 20,000 tonnes of lithium carbonate, Yongxing Materials said on Wednesday February 16. The first stage of the joint venture will have an annual capacity of 10,000….

On February 22 the White House announced:

FACT SHEET: Securing a made in America supply chain for critical minerals. Biden-Harris Administration, companies announce major investments to expand domestic critical minerals supply chain, breaking dependence on China and boosting sustainable practices……These minerals—such as rare earth elements, lithium, and cobalt……are also key inputs in clean energy technologies like batteries, electric vehicles, wind turbines, and solar panels. As the world transitions to a clean energy economy, global demand for these critical minerals is set to skyrocket by 400-600 percent over the next several decades, and, for minerals such as lithium and graphite used in electric vehicle (EV) batteries, demand will increase by even more—as much as 4,000 percent…… to announce major investments in domestic production of key critical minerals and materials….President Biden will announce that the Department of Defense’s Industrial Base Analysis and Sustainment program has awarded MP Materials $35 million to separate and process heavy rare earth elements at its facility in Mountain Pass……She will also discuss $3 billion in BIL funding to invest in refining battery materials such as lithium, cobalt, nickel, and graphite, and battery recycling facilities….has established an Interagency Working Group (IWG) that will lead an Administration effort on legislative and regulatory reform of mine permitting and oversight…….In addition to BHE Renewables, Controlled Thermal Resources [CTR] and EnergySource Minerals have established operations in Imperial County to extract lithium from geothermal brine. GM will source lithium for EV batteries from CTR. The companies are also working with the state-authorized Lithium Valley Commission to develop a royalty structure that would invest profits from their operations in infrastructure, health, and educational investments for the residents of the surrounding region.

On February 23 Stockhead reported:

Eye on Lithium: Biden backs Warren Buffett’s energy division for lithium extraction in California’s Salton Sea…..Biden flagged efforts to extract lithium from California’s Salton Sea, where Warren Buffett’s Berkshire Hathaway Energy (BHE) is among several companies working on extracting lithium from geothermal brine.

On February 25 Bloomberg Hyperdrive reported:

Northvolt plans a third battery-materials factory in Sweden…..When operating at full capacity, the site will be able to produce more than 100 gigawatt hours of cathode material a year and will also feature cell production. It will be powered with renewable energy.

On March 3 seeking Alpha reported:

Panasonic to build huge U.S. battery plant to supply Tesla – NHK. The Japanese company is looking at sites in Oklahoma and Kansas to build the plant because of their proximity to Texas, where Tesla is preparing a new electric vehicle plant, according to the report…..

On March 4 BASF announced: “BASF acquires site for North American battery materials and recycling expansion in Canada.”

On March 7 Mining.com reported:

Chile a step closer to nationalizing copper and lithium. Chile’s constituent assembly, in charge of writing the country’s new Constitution, approved on Saturday an early-stage proposal that opens the door to nationalizing some of the world’s biggest copper and lithium mines…….The proposal, targeting mostly large-scale mining of copper, lithium and gold has yet to be approved by two thirds of the full assembly to become part of Chile’s new charter, which will be put to a national referendum later this year…… The analysts believe that, while the likelihood of outright nationalization as proposed is small, a radical new royalty regime stands a much better chance.

On March 8 Reuters reported:

General Motors Co and South Korea’s POSCO Chemical will build a $400 million facility to produce battery materials in Canada as the carmaker ramps up plans to produce mainly electric vehicles (EVs) in the future, the companies said on Monday….The plant will produce cathode active material [CAM] for vehicle batteries in Becancour, Quebec……The plant’s construction will begin immediately and the goal is to have it running by 2025……It is the second CAM plant announcement for Becancour in less than a week. On Friday, BASF SE said it was planning one there, too.

On March 9 BNN Bloomberg reported:

China Lithium Tech to file for $1.5 Billion Hong Kong IPO, sources say. China Aviation Lithium Battery Technology Co. plans to file for a Hong Kong initial public offering as early as this week, according to people familiar with the matter. The Jiangsu-based electric vehicle battery maker is working with Huatai Securities Co. on the listing…..

On March 9 electric-vehicles.com reported:

According to a new market research report published by Meticulous Research, the Electric Vehicle (EV) Battery market is expected to grow at a CAGR of 26% from 2021 to 2028 to reach $175.11 billion by 2028.

On March 11 BNN Bloomberg reported: “Senators urge Biden to invoke Defense Act for battery materials.”

On March 12 Reuters reported:

CERAWEEK As EV demand rises, Biden officials warm to new mines……U.S. regulators are warming to approving new domestic sources of electric vehicle battery metals……Granholm told conference attendees she would work to streamline permitting for new sources of EV minerals, eliciting loud applause. “It takes forever to get a new permit. How crazy is that?” said Granholm. Granholm’s department has already received applications for $2 billion in loans to fund U.S. strategic minerals projects from Lithium Americas Corp, ioneer, Piedmont Lithium Inc and others.

On March 13 NPR reported:

How a handful of metals could determine the future of the electric car industry…..Companies are betting hundreds of billions of dollars on electric cars and trucks. To make them, they’ll need a lot of batteries. And that means they need a lot of minerals, like lithium, cobalt and nickel, to be dug up out of the earth. These minerals aren’t particularly rare, but production needs to scale up massively — at an unprecedented pace — to meet the auto industry’s ambitions……Beijing controls about three-quarters of the market for the minerals that are essential for batteries…….Demand for some mined products could scale up tenfold within a handful of years……

On March 15 Reuters reported:

Electric-car makers should rethink raw material supply chains -RBC……”Either way, the lesson for autos is to re-think value chains, especially as the industry moves to battery electric vehicles,” Spak wrote, noting the recent jump in nickel prices could translate to a $1,000-$2,000 increase in the cost of a battery pack for an electric-car maker. A variety of input prices, including for lithium, nickel, cobalt and copper, could move “a lot” in the next few years due to mismatches in demand and supply, he added.

On March 15 Bloomberg Quint reported:

Ford plans giant EV battery plant in Turkey with SK, Koc…..Ford’s Turkish partner will join forces with the U.S. automaker’s battery venture to build one of the world’s largest battery plants by 2025.

On March 17 GlobalNews.ca reported:

Ontario announces critical minerals strategy aiming to attract investment….. The premier announced a critical minerals strategy Thursday, a five-year roadmap…..a framework for connecting resources and industry in the north to manufacturing in the south, tapping into markets, and securing Ontario’s place in the global supply chain. “Doing so has never been more important as we secure game-changing investments in our auto sector to build the electric vehicles and batteries of the future using Ontario minerals”…

On March 18 BNN Bloomberg reported:

Stellantis, LG Energy pick Ontario for battery plant……The pair said construction of the plant is due to begin next quarter, with production slated to kick off in early 2024.

Note: The official news here on March 23. It mentions a $5.1-billion EV battery plant in Windsor, Ontario, Canada.

On March 19 Bloomberg Hyperdrive reported:

Tesla supplier CATL weighs sites for $5 billion battery plant. Chinese battery maker considering Mexico, U.S., Canada sites. Plant to have 80 gwh annual capacity, supply multiple firms…..A manufacturing footprint in North America will be crucial for Ningde, Fujian-based CATL to avoid costly trade tariffs while supplying Tesla and other automakers……CATL has 145 gigawatt-hours of battery manufacturing capacity online and has announced or is in the process of building another 579 by 2026, according to data compiled by BloombergNEF.

On March 21 Bloomberg reported:

China tells EV battery chain it wants ‘Rational’ Lithium Prices. Government summons industry officials to discuss soaring costs. Lithium is almost 500% more expensive than a year ago.

On March 22 The Korea Economic Daily reported:

LG Energy considers billion-dollar battery plant in Arizona….. According to media reports on Tuesday, LG Energy, the world’s second-largest electric vehicle battery maker, has obtained approval on an area development project for the construction of a $2.8 billion manufacturing facility, widely thought to be an EV battery plant, in Queen Creek, Arizona……Industry watchers said the Arizona plant, if confirmed, will be supplying batteries to Arizona-based electric semi-truck manufacturer Nikola Corp.

Lithium miner news

Albemarle (NYSE:ALB)

No significant news for the month.

Upcoming catalysts:

Early 2022 – 50ktpa Kemerton Lithium Hydroxide Plant converter in WA due for completion (60:40 joint venture between Albemarle and Mineral Resources Limited).

Q3 2022 – Wodgina Lithium Mine (60% ALB: 40% MIN) plans to restart. Note the recent non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV.

Sociedad Quimica y Minera S.A. (NYSE:SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV)

On March 2, SQM announced: “SQM reports earnings for the fourth quarter of 2021.” Highlights include:

- “SQM reported net income for the twelve months ended December 31, 2021 of US$585.5 million. Earnings per share totaled US$2.05 for the twelve months of 2021, higher than the US$0.63 reported for the twelve months of 2020.

- Revenue during 2021 were US$2,862.3 million.”

Upcoming catalysts:

H2 2024 – Mt Holland production to begin (SQM/Wesfarmers JV) as well as their lithium hydroxide [LiOH] refinery.

Investors can read SQM’s latest presentation here or my quite recent Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTC:GNENF) (OTCPK:GNENY)

No news for the month.

Investors can read my recent Trend Investing article on Ganfeng Lithium here.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

No news for the month.

Livent Corp. (LTHM)[GR:8LV]

No news for the month.

Allkem [ASX:AKE] [TSX:AKE] (OTCPK:OROCF)(formerly Orocobre)

On February 28, Allkem announced: “FY22 half year financial results.” Highlights include:

- “Mt Cattlin and Olaroz delivered strong production volumes, in line with targets and customer requirements and specifications.

- Group revenue for the period was US$192.3 million, including US$114.9 million from Mt Cattlin and US$65.6 million from Olaroz.

- Revenue from Mt Cattlin was generated from sales of 96,871 dry metrics tonnes (dmt) of spodumene concentrate, grading 5.7% Li 2O, at an average price of US$1,186/tonne CIF for the period from 25 August 2021. Gross profit margin of 62%.

- Revenue from Olaroz was generated from sales of 5,915 tonnes of lithium carbonate, a 143% revenue increase from the previous corresponding period (PCP), largely due to average FOBpricing increasing by 218% to US$11,095/t. Gross profit margin of 68%.

- Gross profit was US$118 million with group EBITDAIX of US$97.9 million and consolidated net profit after tax of US$13.0 million (31 December 2020: loss of US$29.1 million) reflecting improved product prices and comprehensive cost management mitigating inflationary pressures.

- Group capital expenditure for the half-year totalled US$99.6 million (31 December 2020: US$43.8 million).

- Olaroz Stage 2 reached 68% completion and commissioning is anticipated in H2 CY22.

- Construction of the Naraha lithium hydroxide plant in Japan is largely complete, with mechanical completion expected by the March quarter and first production to follow in the H1 CY22.

- Construction at Sal de Vida commenced in January 2022 and commissioning and first production is now expected by H2 CY23.

- The Feasibility Study and Maiden Ore Reserve for James Bay was released in December 2021 and engineering advances alongside stakeholder engagement.

- As at 31 December 2021, Allkem had cash and cash equivalents of US$449.8 million.

- Upwards pricing momentum for lithium products continues with March quarter FY22, indicative pricing for 43.5kt of spodumene concentrate shipments of US$2,500/t CIF for 6.0% Li2O.

- Lithium carbonate prices for H2 FY22 are expected to be ~US$25,000/t FOB, up ~125% on the H1 FY22 and up 25% from previous guidance.”

Upcoming catalysts include:

- H1 2022 – Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%).

- H2 2022 – Olaroz Stage 2 commissioning followed by a 2 year ramp to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- H2 2023 – Sal De Vida production targeted to begin.

You can read the latest investor presentation here. You can read my recent Orocobre article here.

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On February 23, Pilbara Minerals announced: “December 2021 half-year financial report. Inaugural $114m interim profit as burgeoning lithium raw materials demand continues to drive prices higher.” Highlights include:

- “170,228 dry metric tonnes (dmt) of spodumene concentrate shipped; a 49% increase on the 114,239 dmt shipped for the December 2020 half-year.

- Record sales revenue of A$291.7M achieved (1H FY2020: $59.1M) on buoyant market pricing conditions.

- Substantial improvement in operating gross margin1 to $172.1M (1H FY2020: $13.2M).

- Positive uplift in EBITDA1 to $151.1M (1H FY2020: $3.2M).

- Statutory profit after tax of $114M (1H FY2020: statutory loss after tax of $21.2M).

- 31 December 2021 cash balance of $191.2M (June 2021: $99.7M). Balance increased to $245.0M once $53.8M of irrevocable bank letters of credit are included.“

On February 23, Pilbara Minerals announced:

Pilbara Minerals announces CEO succession. The Board of Pilbara Minerals Limited has been advised by the Company’s Managing Director and CEO, Ken Brinsden, of his intention to step down from the role by the end of 2022……

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (60% ALB: 40% MIN) plans to restart during Q3, 2022. (Note the recent non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV). The 50ktpa Kemerton Lithium Hydroxide refinery (60% ALB: 40% MIN) is due for first sales in H2, 2022.

On March 14, Global Lithium Resources [ASX:GL1] announced:

$30 million placement attracts Mineral Resources as Cornerstone Investor. Proceeds to fast track lithium exploration and study work at Marble Bar and Manna Lithium Projects.

Investors can read my quite recent Trend Investing article on Mineral Resources here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

On February 23, AMG Advanced Metallurgical Group NV announced: “AMG Advanced Metallurgical Group N.V. reports fourth quarter and full year 2021 results.” Highlights include:

Strategic Highlights

- “…AMG Brazil will increase its spodumene production by 40,000 tons, bringing its production capacity to 130,000 tons per annum. The project is currently in detailed engineering, with construction planned to commence at the beginning of the second half of 2022, and mechanical completion at the end of the first quarter of 2023.

- Site preparation and building site facilities have started in Bitterfeld, Germany and commissioning for the first module of the battery grade lithium hydroxide upgrader will commence in the third quarter of 2023.

- AMG’s first lithium vanadium battery (“LIVA”) for industrial power management applications is proceeding as planned.

- In December, AMG announced that it will bring its lithium value chain under one new corporate entity to further increase the long-term value of AMG’s lithium activities. AMG Lithium activities are comprised of AMG’s Brazilian mining and processing plants as well as the German hydroxide project and include the Lithium solid-state battery research and development activities in Frankfurt.”

Financial Highlights

- “Revenue increased by 30% to $330.4 million in the fourth quarter of 2021 from $253.5 million in the fourth quarter of 2020.

- EBITDA was $43.9 million in the fourth quarter of 2021, 95% higher than the fourth quarter 2020 EBITDA of $22.5 million, marking the sixth straight quarter of sequential improvement. On a full-year basis, EBITDA in 2021 of $136.7 was more than double full year 2020 EBITDA.

- Cash from operating activities was $30.2 million in the fourth quarter of 2021, and $90.8 million on a year-to-date basis, compared to $19.6 for full year 2020.

- AMG’s liquidity as of December 31, 2021, was $508 million, with $338 million of unrestricted cash and $170 million of revolving credit availability.

- The total 2021 dividend proposed is €0.40 per ordinary share, including the interim dividend of €0.10, paid on August 13, 2021.

- In November, AMG entered into a new $350 million 7-year senior secured term loan B facility and a $200 million 5-year senior secured revolving credit facility….”

On March 11, AMG Advanced Metallurgical Group NV announced: “AMG Advanced Metallurgical Group N.V. publishes 2021 annual report.”

You can view the latest company presentation here.

Upcoming catalysts:

2022 – Progress on lithium projects in Zeitz, Germany and in Zanesville, Ohio, both in the planning stage.

Q2 2023 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin.

Q3 2023 – Lithium hydroxide facility in Bitterfeld-Wolfen Germany with production set to begin.

Lithium Americas [TSX:LAC] (LAC)

On February 25, Lithium Americas announced:

Lithium Americas receives final key state permits for Thacker Pass; Provides update on Federal Permitting Timeline. “With the final key state environmental permits in hand, Lithium Americas can begin to advance Thacker Pass towards construction,” said Jonathan Evans, President and CEO. “Thacker Pass provides an opportunity to enable a US-based battery supply chain for the growing electric vehicle market. Our commitment to developing Thacker Pass in the most environmentally responsible way is demonstrated from over a decade of conducting the necessary planning, design and engagement.”

On February 28, Lithium Americas announced:

Lithium Americas submits Draft Loan Application to the US Department of Energy; Exploring possible separation of its US lithium business. “Thacker Pass is a unique, large-scale and advanced-stage lithium project representing one of the most significant opportunities to create a truly domestic lithium supply chain to support the production of electric vehicles in the US,” said Jonathan Evans, President and CEO. “We are pleased to submit our draft application and look forward to engaging with the DOE to accelerate the growth of the domestic lithium industry in response to increased demand and interest from US-based consumers.”

On March 17, Lithium Americas announced: “Lithium Americas reports 2021 full year and fourth quarter results.” Highlights include:

Caucharí-Olaroz

- “Construction continues to advance with a revised timeline; currently the project is approximately 85% complete and commissioning is targeted to commence in H2 2022. 1,500 workers are on site with 100% of the workforce having received at least two doses of a COVID-19 vaccine. Around the end of 2021, construction activities were impacted by COVID-19 Omicron disruptions impacting supply chains and availability of the main contractor. Activities have returned to normal and the Company continues to monitor the situation closely. Additional resources have been added to accelerate and de-risk commissioning and ramp-up timeline.

- Total capital cost estimates have been revised to $741 million (on a 100% basis), up 16% from $641 million, to reflect additional resources and manpower, engineering modifications and inflationary cost pressures. As of December 31, 2021, 76%, or $565 million, of the $741 million budget has been spent.

- Progress on the second stage expansion of at least 20,000 tonnes per annum (“tpa”) of lithium carbonate equivalent (“LCE”) continues to advance with additions to the technical leadership team and drilling program underway.”

Pastos Grandes

- “In January 2022, the Company completed the acquisition of Millennial Lithium Corp. and the 100% owned Pastos Grandes for total consideration of approximately $390 million.

- In February 2022, the Company hired Carlos Galli as Senior Director, Project Development, Latin America, to oversee the development planning for Pastos Grandes and integration and expansion of a team of over 50 workers based in Salta, Argentina.”

Arena Minerals

- “In November 2021, the Company increased its strategic investment in Arena Minerals Inc. (TSX-V: AN) to approximately 17.4% for $10 million.”

United States

Thacker Pass

- “In October 2021, Measured and Indicated (“M&I”) Resource estimates were updated to 13.7 million tonnes (“Mt”) LCE at 2,231 parts per million lithium (“ppm Li”). See the Company’s news release dated October 7, 2021 for full details.

- The Company continues to advance the Feasibility Study with an increased targeted capacity of 40,000 tpa lithium carbonate and incorporating a second phase expansion to reach a targeted total capacity of 80,000 tpa lithium carbonate. Results of the Feasibility Study are expected in H2 2022.

- The Company is continuing to optimize engineering to complete capital and operating estimates. Capital costs are expected to substantially increase due to the incorporation of increased scale, additional processing and related infrastructure changes, and the results of engineering and testing, as well as to account for external factors such as inflationary pressures and supply chain considerations

- The Lithium Technical Development Center is expected to be operational in Q2 2022 to support ongoing optimization work and to provide product samples for potential customers and partners.

- In February 2022, the Nevada Department of Environmental Protection (“NDEP”) issued the final key state-level environmental permits: Water Pollution Control Permit, Class II Air Quality Operating Permit and Exploration and Mine Reclamation Permits.

- An appeal on the Record of Decision continues to advance through Federal court process with a ruling expected in Q3 2022…

- Discussions continue with potential strategic partners and customers.”

Corporate

- “As at December 31, 2021, the Company had $511 million in cash and cash equivalents with an additional $75 million in available credit…..”

Upcoming catalysts:

- H2 2022 – Thacker Pass FS and early construction works planned to commence.

- H2 2022 – Cauchari-Olaroz lithium production to commence and ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2023 – Possible lithium clay producer from Thacker Pass Nevada (full ramp by 2026).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy. Argosy is now producing at a small scale and ramping to 2,000tpa lithium carbonate starting June 2022.

On March 1, Argosy Minerals announced: “Rincon 2,000tpa Li2CO3 operational update.” Highlights include:

- “61% of total construction works now complete – first production of battery quality Li2CO3 product targeted from mid-2022.

- 2,000tpa lithium carbonate process plant development works progressing on schedule and budget.”

On March 7, Argosy Minerals announced:

Rincon 2,000tpa Li2CO3 operation brine systems work complete. As part of the 2,000tpa lithium carbonate operational works – the brine systems work is completed.”

On March 9, Argosy Minerals announced:

Rincon 2,000tpa Li2CO3 plant & equipment progress. Plant and equipment procurement and delivery in progress, with; German manufactured dryer/evaporator and vibrator equipment delivered. First batch of process tanks and reactors received. Chillers/coolers delivered and on-site installation completed. Press and belt filters from Asia delivery expected during April.

Investors can view the company’s latest investor presentation here, and my recent Argosy Minerals article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% own the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China’s Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a “high potential for additional resources from 500km2 covering 100s of pegmatites.” Fully funded and starting mining with a planned Q4 2022 production start.

On February 28, Core Lithium Ltd. announced: “Core completes acquisition of six highly prospective Mineral Leases adjacent to Finniss, NT.” Highlights include:

- “Core has completed the purchase of six granted Mineral Leases that include over 30 historic pegmatite mines.

- Acquisition adds significant value to the Finniss Project, enabling the acceleration of resource and mine-life expansion objectives.”

On March 2, Core Lithium Ltd. announced: “Core Lithium and Tesla enter into binding Term Sheet for the supply of lithium.” Highlights include:

- “Core Lithium and Tesla execute legally binding Term Sheet for the supply of lithium spodumene concentrate from Core’s Finniss Lithium Project.

- Core to supply up to 110kt of spodumene concentrate to Tesla over 4 years, with pricing referenced to market price for spodumene concentrate.

- Tesla to support Core with planned development of lithium chemical processing capacity.

- Term Sheet subject to execution of a definitive agreement.”

On March 4, Core Lithium Ltd. announced: “S&P Dow Jones Indices announces March 2022 quarterly rebalance of the S&P/ASX Indices.” Core Lithium was added.

On March 9, Core Lithium Ltd. announced: “High-grade lithium intersections at Carlton.” Highlights include:

- “High-grade lithium intersections continue to be delivered at the Finniss Lithium Project near Darwin, NT.

- 2021 diamond drill holes at Carlton have produced high-grade spodumene-rich intersections, including: 24.5m @ 1.46% Li2O in NMRD007. 30.0m @ 1.78% Li2O in NMRD011. 40.3m @ 1.53% Li2O in NMRD012.

- Intersections outside and near the boundary of the current Mineral Resource at Carlton expected to deliver substantial extensions.

- 2022 resource growth and exploration drilling to recommence at Finniss during Q2 2022.”

On March 10, Core Lithium Ltd. announced: “Interim consolidated financial statements for the half-year ended 31 December 2021.” Highlights include:

During the period, Core achieved the following key milestones:

- “Completed a Definitive Feasibility Study [DFS] and Expansion Scoping Study [ESS] for the Project confirming a mine life of 7 years and 10 years respectively.

- Secured capital to fully fund the construction of the Finniss Project.

- Made a Final Investment Decision [FID].

- Awarded contracts to Lucas Total Contract Solutions (Lucas) for mining services and Primero Group (Primero) as Engineering, Procurement and Construction [EPC] for the Dense Media Separation [DMS] processing plant.

- Secured a binding offtake agreement with Ganfeng Lithium (which is in addition to its binding offtake with Sichuan Yahua, also over four years).

- Commenced construction of the Project.“

Investors can read a company presentation here, or my past Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- Q4 2022 – Lithium spodumene production at Finniss targeted to begin.

Sigma Lithium Resources [TSXV:SGML](SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On February 24, Sigma Lithium announced:

Sigma Lithium selected by Bank of America Research Team as one of top 50 stocks with exposure to 10 Scarcity Themes across all sectors globally.

Catalysts include:

- Q4 2022 – Production targeted to begin at the Grota do Cirilo Project in Brazil and ramp to 220,000tpa spodumene.

Investors can read the latest company presentation here or my Trend Investing article Sigma Lithium Looks To Be A Potential 2022 Lithium Producer With Significant Next Stage Expansion Potential back when Sigma was trading at C$5.00.

Lithium miner ETFs

The LIT fund was higher in March. The current PE is 25.98. My model forecast is for lithium demand to increase 4.3 fold between end 2020 and end 2025 to ~1.5m tpa, and 10.4x this decade to reach ~3.5m tpa by end 2030 (assumes electric car market share of 32% by end 2025 and 80% by end 2030).

Note: A Nov. 2020 UBS forecast is for “lithium demand to lift 11-fold from ~400kt in 2021 through to 2030.”

LIT Fund 10 year price history

Source: Seeking Alpha

Conclusion

March saw lithium prices surge higher then stabilize at record levels.

Highlights for the month were:

- Biden-Harris Administration announce major investments to expand domestic critical minerals supply chain.

- Yongxing Materials, Jiangxi Tungsten setting up JV for lithium carbonate production.

- Northvolt plans a third battery-materials factory in Sweden.

- Panasonic to build huge U.S. battery plant to supply Tesla.

- BASF acquires site for North American battery materials and recycling expansion in Canada.

- Chile a step closer to nationalizing copper and lithium.

- GM and South Korea’s POSCO Chemical will build a $400 million facility to produce battery materials in Canada.

- The EV battery market is expected to grow at a CAGR of 26% from 2021 to 2028 to reach $175.11 billion by 2028.

- As EV demand rises, Biden officials warm to new mines.

- Senators urge Biden to invoke Defense Act for battery materials.

- A handful of EV metals could determine the future of the car industry.

- Electric-car makers should rethink raw material supply chains – RBC.

- Ontario announces critical minerals strategy aiming to attract investment.

- Stellantis, LG Energy pick Ontario for battery plant.

- Tesla supplier CATL weighs sites for $5 billion battery plant, considering Mexico, U.S., Canada sites.

- LG Energy considers billion-dollar battery plant in Arizona.

- SQM, Allkem, Pilbara Minerals, and AMG all announce strong revenue boosted by higher lithium prices with more to come in 2022.

- AMG Brazil will increase its spodumene production by 40,000 tons, bringing its production capacity to 130,000 tons per annum.

- Lithium Americas receives final key state permits for Thacker Pass. LAC exploring possible separation of its US lithium business.

- Argosy Minerals Rincon Project 61% of total construction works now complete. First production of battery quality Li2CO3 product targeted from mid-2022.

- Core Lithium completes acquisition of six highly prospective Mineral Leases adjacent to Finniss, NT.

- Sigma Lithium selected by Bank of America Research Team as one of top 50 stocks….

As usual all comments are welcome.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment