Andy Feng/iStock Editorial via Getty Images

Shares of NIO (NYSE:NIO) revalued lower after the Chinese electric vehicle maker submitted its earnings card for the final quarter of FY 2021 at the end of last week. The plunge occurred chiefly due to NIO’s Q1’22 delivery forecast which was considered weak. Longer term, however, NIO is going to ramp up production of SUV and sedan models aggressively and the stock has a lot of potential to revalue higher. The 10% drop on Friday is exaggerated and creates another opportunity to engage!

Investors are too impressed with short-term delivery forecasts

NIO presented earnings results for Q4’21 last week and the stock crashed about 10% although deliveries are set to bounce back hard in March and beyond. In January and February, NIO delivered a total of just 15,783 electric vehicles, mostly ES6s, largely because of Chinese holidays and a shorter trading month in February. Because of the Chinese holiday season, I expect a strong rebound in March regarding delivery volume for NIO and I see the EV startup return to delivering about 10 thousand EVs a month. It is also important to highlight that delivery volumes in January and February dropped off in January and February for all Chinese electric vehicle manufacturers, so NIO was not the only company affected by a sales and delivery slowdown.

|

Deliveries |

December |

Dec Y/Y Growth |

January |

Jan Y/Y Growth |

February |

Feb Y/Y Growth |

|

NIO |

10,489 |

49.7% |

9,652 |

33.6% |

6,131 |

9.9% |

|

XPEV |

16,000 |

181.0% |

12,922 |

115.0% |

6,225 |

180.0% |

|

LI |

14,087 |

130.0% |

12,268 |

128.1% |

8,414 |

265.8% |

(Source: Author)

Outlook for Q1’22

NIO projects to produce and deliver a total of 25 thousand to 26 thousand electric vehicles in the first quarter, showing an increase of approximately 24.6% to 29.6% compared to the year-earlier period. The guidance for Q1’22 implies deliveries of at least 9,217 electric vehicles in March, which would indicate at least a 50% delivery rebound, month over month. As deliveries start to exceed 10 thousand units per month again, NIO could achieve up to 190 thousand electric vehicle deliveries in FY 2022 as new models launch.

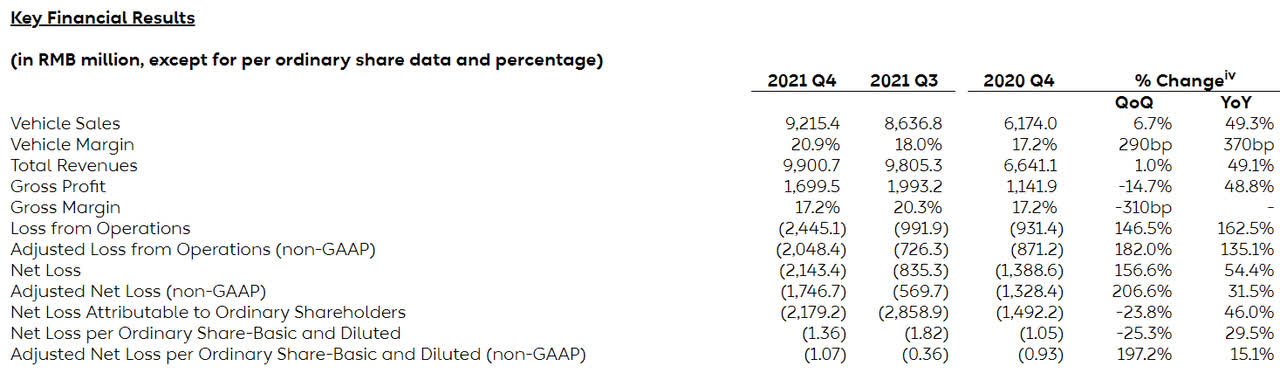

Commercial results including higher vehicle margins indicate strong business momentum

NIO’s stock price has not shown lately that NIO’s business is going well, but it really is. Vehicle sales surged 49.3% year over year to 9.22B Chinese Yuan in the fourth quarter which calculates to $1.45B while total revenues increased 49.1% year over year to 9.90B Chinese Yuan ($1.55B). What is especially impressive is that despite NIO’s production and delivery ramp — and chip supply problems in FY 202 — vehicle margins are increasing rapidly. In Q4’21, NIO’s vehicle margins increased to 20.9%, adding 3.7 PP year over year, meaning NIO is becoming more profitable on a per-unit production basis. While NIO is still generating losses, the EV startup is making significant progress and moving towards profitability in FY 2023.

NIO

NIO grew deliveries by 109% in FY 2021 to 91,429 electric vehicles and the EV startup has continual momentum on its side as it gets ready to launch new sedan models, the ET5 and the ET7, later this year in China. For that reason, and because Chinese holidays are over, NIO is likely going to see continual delivery growth in the remaining quarters of FY 2022.

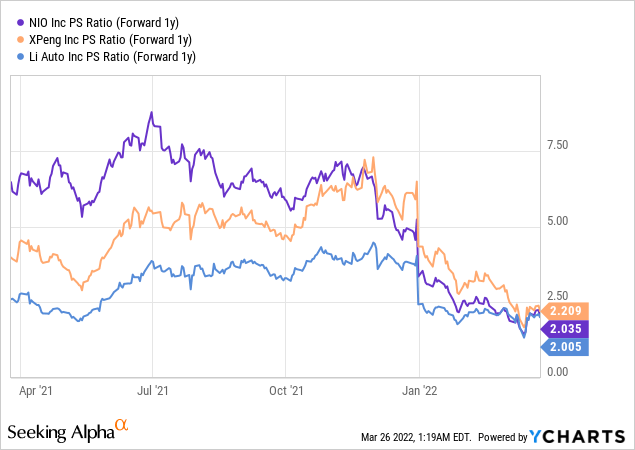

NIO has become significantly undervalued

NIO’s commercial prospects in the Chinese electric vehicle market are undervalued and Friday’s 10% drop in NIO’s valuation is completely undeserved. NIO’s first quarter delivery guidance was considered weak, but things are set to get better as the Chinese holiday period is over and NIO is set for a major rebound in deliveries based off of NIO’s Q1’22 delivery guidance. From a revenue and delivery growth perspective, NIO has become too cheap, I believe, and the stock continues to represent deep value at a P-S ratio of just 2 X… especially considering that NIO traded at a much higher market-capitalization-to-sales ratio in 2021. As the firm launches new models, NIO is facing some promising catalysts that could drive the share price higher as well.

Risks with NIO

NIO has short-term timeline and production risks. Computer chip supply issues affected factory output in the global auto industry in FY 2021 and they are still a risk for NIO and other EV manufacturers. NIO lowered its delivery forecast in 2021 due to a strained semiconductor supply situation. If the flow of computer chips, which are vital for EV production, gets disrupted even more, NIO may grow electric vehicle production and deliveries not as fast as anticipated which could further add pressure on the firm’s valuation.

Final thoughts

The risk-reward looks extremely attractive here for NIO, I believe. The production outlook for the first quarter indicates a large rebound in March, which is what I already expected. At this point, I still believe that NIO could produce and deliver about 190 thousand electric vehicles in FY 2022 which translates to roughly 100% annual delivery growth.

The market seems to overreact to NIO’s Q1’22 production guidance and supply chain issues and the resulting 10% drop is not deserved. Based off of NIO’s production ramp and delivery prospects in FY 2022 and beyond, the stock remains a buy!

Be the first to comment