Michael M. Santiago/Getty Images News

Thesis

Intercontinental Exchange (NYSE:ICE) is a wonderful company at a fair price. Its financials are excellent; around 50% operating margins, adjusted EPS CAGR of approximately 16% from 2006 to 2022 (even during the financial crisis in 2008, the company has grown its EPS), attractive cash returns, and 50% recurring revenues.

Not only has the company very attractive financials, but it also operates in an industry surrounded by high barriers to entry. As a global marketplace, ICE operates a two sided-platform matching buyers and sellers. The platform profits from network effects as each additional buyer or seller increase the platform’s value to all participants. The economies of scale are the last piece of the puzzle for this great business. The company can spread its fixed costs over more transactions as the platform grows and transaction volume increases.

ICE’s management has a fantastic track record of fueling growth by acquiring other companies. Over the years, they have had the right insights to foresee trends and made the needed investments to profit from them. Examples of this would be the International Petroleum Exchange in 2001, the New York Board of Trade in 2007, the Climate Exchange in 2010, Endex in 2013, and so on. Currently, management is focused on expanding its offering in the mortgage space with acquisitions like Simplifile in 2019, Ellie Mae in 2020, and the current pending acquisition of Black Knight (BKI). Management’s long-term goal is to make ICE an all-weather company that performs in all economic environments. To achieve this goal, management follows a specific strategy; diversification across various asset classes and continuously increasing the amount of recurring revenues.

Based on the assumptions made in my analysis, ICE’s stock is fairly valued. Thus, I rate it as a Hold.

Show Me The Money

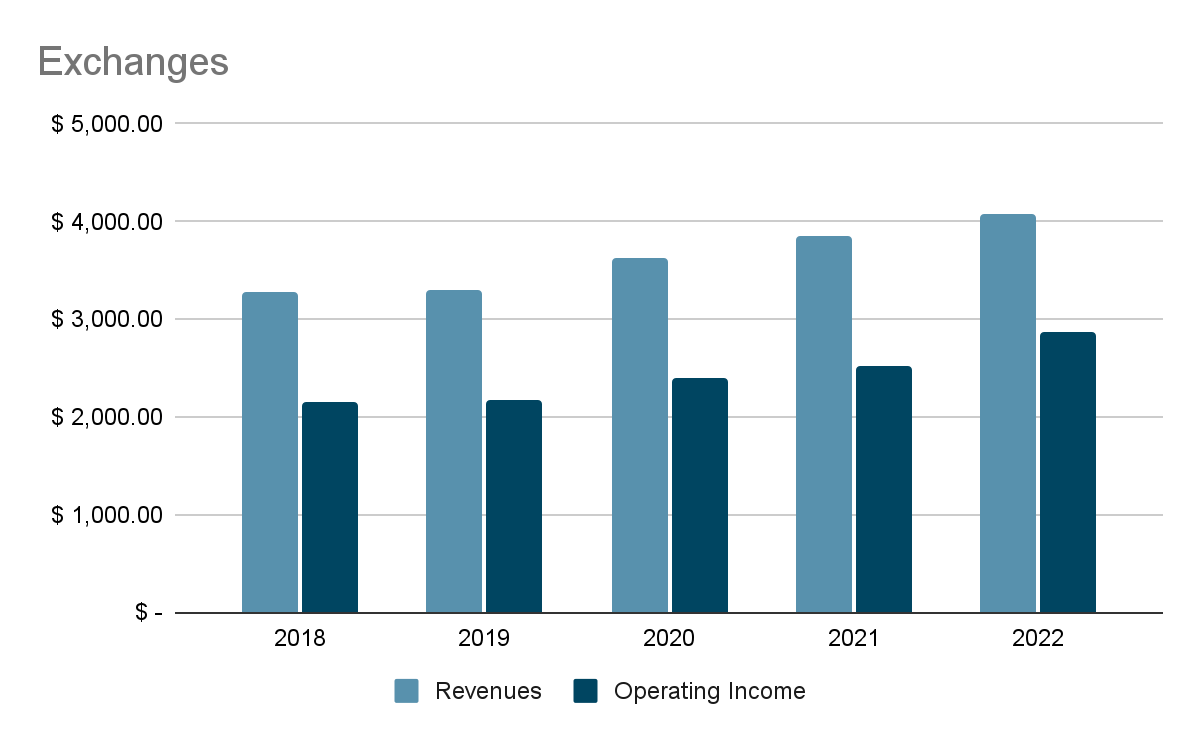

Revenues and Operating Income in the Exchanges Segment (Company Financials)

ICE operates regulated exchanges on a global scale. The most prestigious venue under the ICE umbrella is the New York Stock Exchange. Over 70% of the S&P 500 and 77% of the Dow Jones are listed on the NYSE, which makes it a critical part of the global financial markets. The exchanges segment generates revenues by offering a marketplace to trade various derivatives contracts and securities, offering data and connectivity services, and collecting listing fees. In 2022 revenues came in at around $4,071 billion, making up approximately 56% of ICE’s total revenues. The segment has operating margins of approximately 70%, and about 34% of the segment’s revenues are recurring. Over time, management has built a highly diversified platform, capturing tailwinds in every economic environment with high operating margins and an increasing amount of recurring revenues.

The highly diversified nature of ICE’s products puts the company in an excellent position to capture the current tailwinds in the energy market. The company’s mission is to provide each market participant with the proper risk management tools and price transparency to navigate the volatility in the energy market. The ongoing war in Ukraine has reshaped the global energy supply chain and created new risks for market participants. As the lead provider of services in the primary energy categories like; oil, gas, LNG, and clean energy, ICE provides its customers with an essential service to manage its customer’s exposure to the current price risks.

Another current tailwind is the transition towards cleaner energy. According to Ben Jackson during the Q3’21 earnings call, energy consumption is expected to double over the next three decades, and carbon emissions are expected to be reduced by 50%. This imbalance will cause a lot of uncertainty and volatility. Management anticipated the trend towards cleaner energy and made the necessary investments with the acquisition of the Climate Exchange back in 2010. Today, ICE has a strong presence (around 95%, according to Benjamin Jackson, Q2’21) in the marketplace for market-based mechanisms to price carbon.

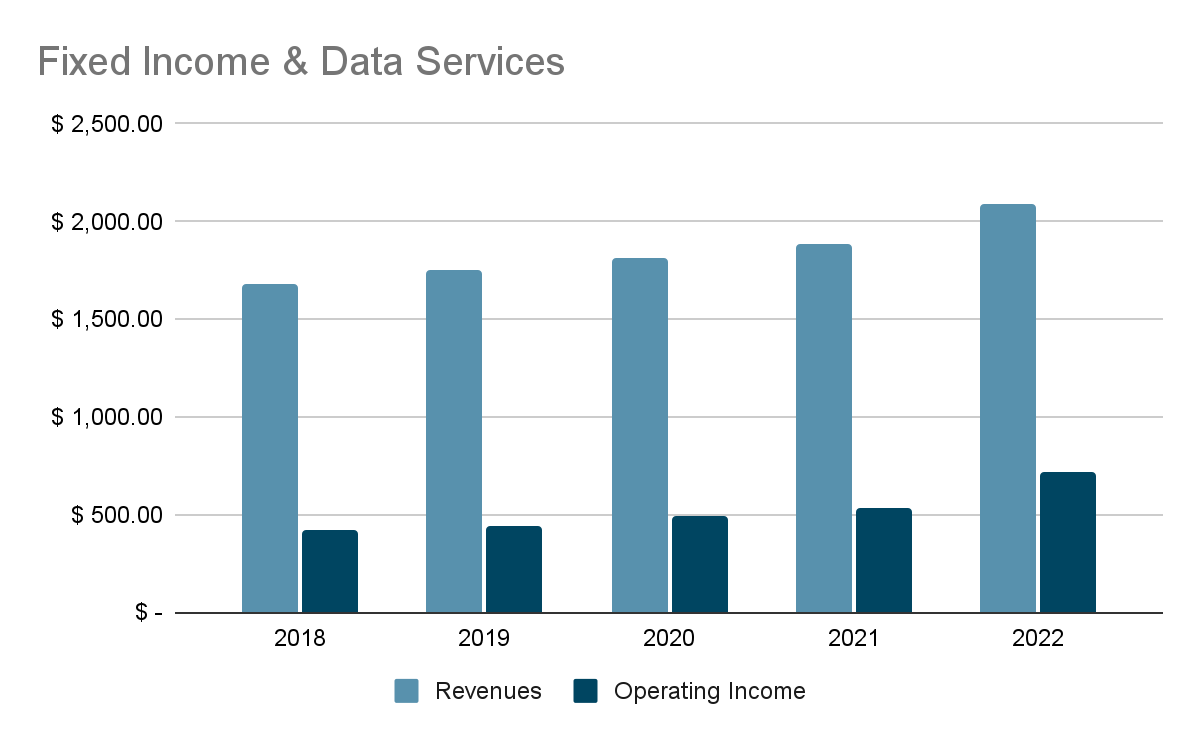

Revenues and Operating Income in the Fixed Income Segment (Company Financials)

ICE’s fixed-income and data services are another critical segment of ICE’s all-weather nature. In 2022 the segment made up about 29% of ICE’s total revenues. It gives the company exposure to the vast fixed-income markets. While rate hikes are generally bad for markets, the fixed-income segment usually emerges as a winner. Revenues in this segment saw 11% growth between 2021 and 2022, while between 2021 and 2020, revenues only grew around 4%. Operating margins improved from 28% in 2021 to 34% in 2022. While revenue growth and operating margins improved, this segment’s recurring revenues dropped from 87% in 2021 to 80% in 2022. The fixed-income segment is positioned to capture the tailwinds from the interest rate hikes, while the mortgage segment usually underperforms during rate hike cycles.

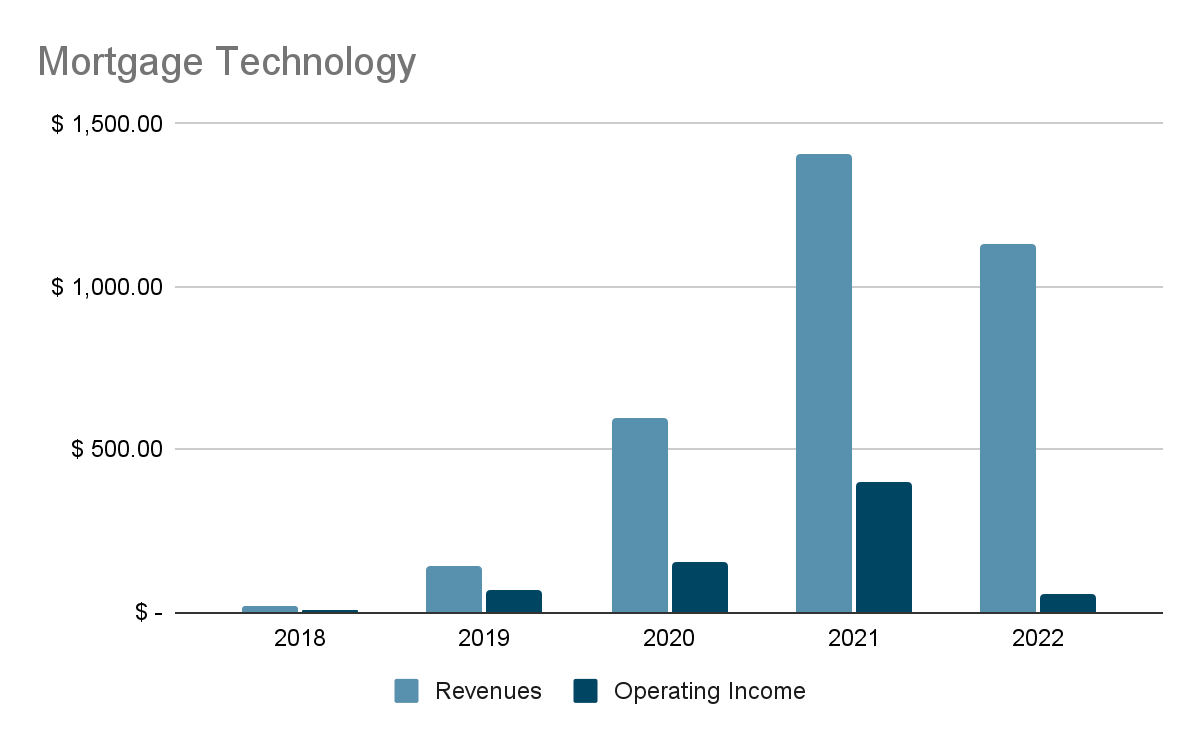

Revenues and Operating Income in the Mortgage Technology Segment (Company Financials)

Over the past few years, ICE has been heavily investing in its mortgage business. With the acquisitions of Mortgage Electronic Registry Service in 2018 and Simplifile in 2019, management laid the groundwork to build the infrastructure to profit from the long-term secular trend of digitalizing the mortgage process. Ben Jackson defined ICE’s goal during ICE’s Q3’22 earnings call to take on the most analog asset classes and turn it digital. The shift towards a more digital process and the millennial generation entering their homeownership years should provide the segment with an 8% to 10% average annual growth rate over the long haul. (doubling pro-forma 2020 revenues over the next 10 years, according to 2022 investor overview)

With the acquisition of Ellie Mae in 2020 and the FED’s easy money policy, ICE’s mortgage segment started to show considerable revenue growth. Growing from $595 million in 2020 to $1,407 million in 2021. In 2022, revenues dropped to $1,129 million due to a 50%+ decline in origination volumes, probably caused by the more restrictive monetary policy. The segment currently makes up around 15% of ICE’s total revenues. While operating margins have decreased considerably from 28% in 2021 to 5% in 2022, ICE has increased recurring revenues from 39% in 2021 to 56% in 2022. The current economic uncertainty and the rate hikes hurt ICE’s mortgage segment, which can be seen in the considerable drop in revenues. But the recurring revenue increase of nearly 50% from the previous year is yet another sign of the high quality of ICE’s management. It reflects their ambition and high focus on increasing recurring revenues to make ICE a truly all-weather company.

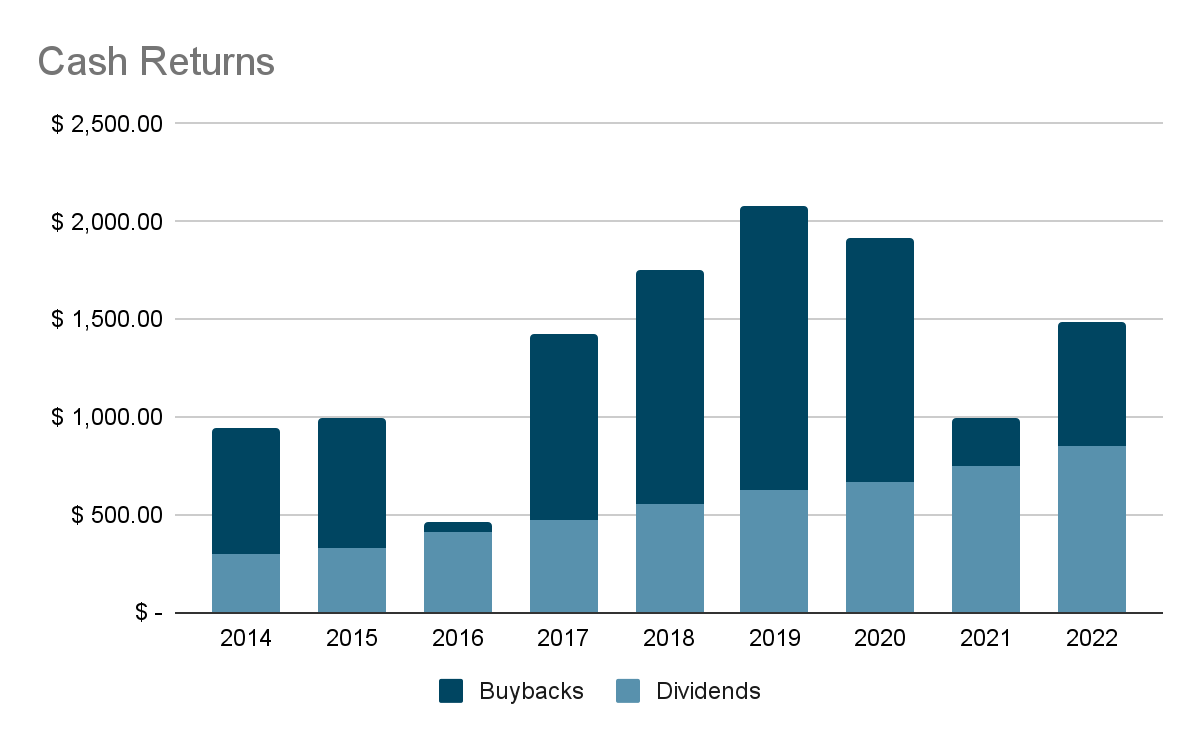

Cash Returns

Dividends and Buybacks (Company Financials)

Stocks are not just pieces of paper; stocks represent ownership in a company. Investors buy stocks not only with the expectation of price appreciation but also expect that the company returns cash to its shareholders in the form of dividends and/or buybacks. ICE has an attractive capital return philosophy. The company has grown the dividend by approximately 15% YoY since 2013. The company’s philosophy on share repurchases is that the free cash flow left over after strategic investments have been made, and dividends paid, will be put towards buybacks. Looking at the graph, we notice consistent growth in dividends. The Buybacks have been less constant. There have been significant drops in the year following big acquisitions; Interactive Data Corporation in 2015 and Ellie Mae in 2020. This is a sign that management pays attention to the company’s health. If management continues this pattern and the pending acquisition of Black Knight gets approval, I expect a drop in buybacks in 2023.

Risks

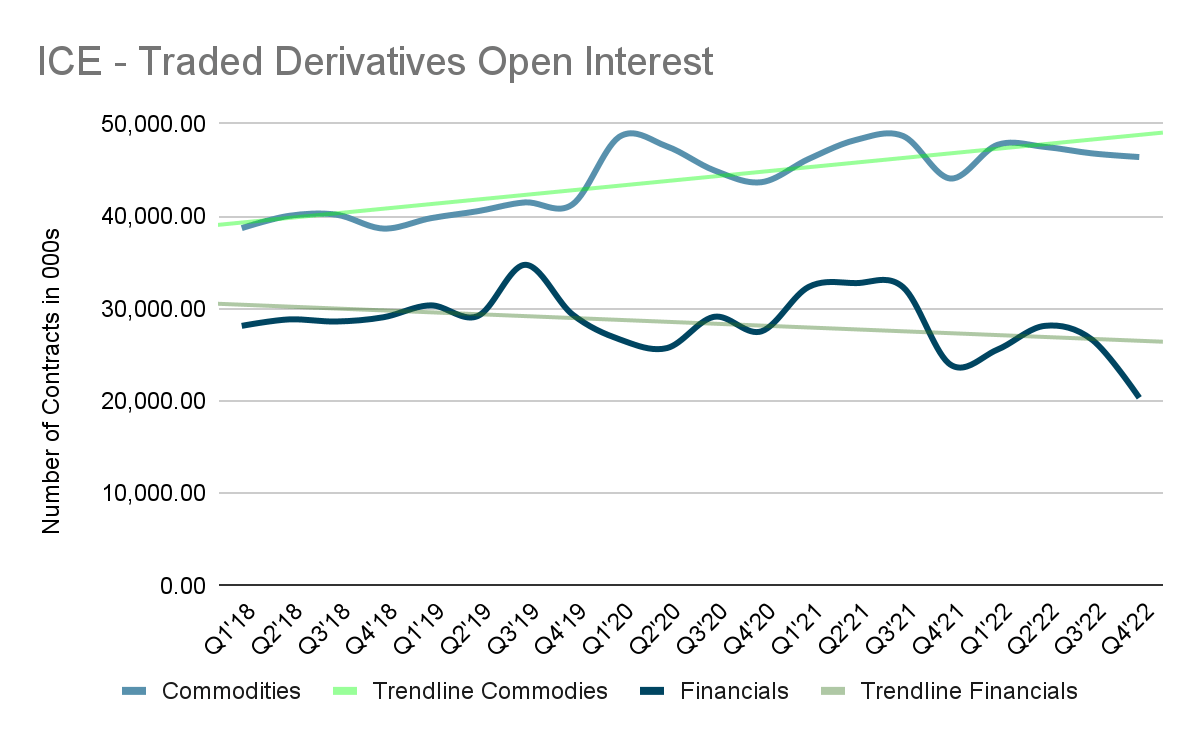

Open Interest (Investor Resources, Company Financials)

At the end of each trading day, exchanges compute the number of open contracts (contracts from opened trades subtracted by closed contracts). This amount of non-settled contracts is called open interest. More money flows into the market when open interest increases and vice versa. According to comments made by CEO Jeff Sprecher during ICE’s Q1’22 earnings call, open interest is the best indicator for future volume and, thus, revenue growth for the company. As half of ICE’s revenues depend on trading, those revenues are affected by market sentiment and activity. If trading volumes decrease, it directly negatively impacts ICE’s trading revenues. Open interest in commodities (energy, agriculture & metals) started to move below its trend line in Q2’22. Open interest in financials (interest rates, equity indices, and FX) is also decreasing. It moved below its trend line in Q3’22. In both cases, this could indicate a trend reversal and the start of a downward trend, negatively impacting ICE’s revenue growth.

Reasons for a decline in trading volume can range from negative sentiment, pushing investors towards pulling capital out of the market, rising interest rates making it more attractive for investors to put money into a savings account, and pushing risk capital out of the market, leading to companies doing fewer IPOs and SPACs, or the trend towards more passive investing.

Moreover, interest rates have a direct impact on ICE’s mortgage segment. Higher interest rates lead to higher mortgages, resulting in a drop in demand for those mortgages, thus, less need for ICE’s mortgage technology services.

Valuation

In an interview with the BBC in 2012, Charlie Munger explained that no matter how wonderful a business is, it is not worth an infinite price. To make money from an investment, you need to buy the company for less than it is worth. So first, we need to figure out what ICE is worth. To put a price on ICE’s stock, I use a DCF model.

| CAGR in Revenues | 5% |

| Operating Margin | 50% |

| Sales-to-Capital Ratio | 0.20 |

| Average WACC over the 10 Year Period | 5% |

ICE is a mature company with a 9% CAGR over the past five years. This growth accelerated to a 12% CAGR over the past three years. This acceleration came from ICE’s investments in the mortgage space. As we advance, I expect ICE to grow at a 5% CAGR over the next 10 years, reflecting a growth rate slightly higher than the economy’s growth rate, giving the company revenues of $11.78 billion in its terminal year (year 10). After that, the company will grow at the economy’s growth rate (I use the 10-year U.S. Treasury Bond rate as a proxy). Operating margins will stay around 50% as the company has maintained those high margins for the past 10 years, and I expect no significant changes. The sales-to-capital ratio is used to calculate ICE’s reinvestment needs. This ratio connects the revenues to the total capital invested in the company. I use the revenues as a nominator as it is a driver of growth. In the denominator, I use the invested capital in the firm, equity, and debt, and I subtract cash. This ratio shows how many dollars of output Spotify will generate with one dollar of input. Here I will use ICE’s historical sales-to-capital ratio of 0.20. For every dollar invested in the company, ICE generates $0.20 in revenues. Discounting everything by a weighted average cost of capital of 5% (reflecting the low risk in ICE’s cash flows), I arrive at a per-share value of around $110.49 for ICE, which suggests that ICE is fairly valued.

Final Thoughts

ICE is a fantastic business. Sitting in the driver’s seat is CEO and founder Jeff Sprecher. Over time he and his team have built an all-weather compounder with high margins, attractive cash returns, and 50% recurring revenues. ICE’s balanced portfolio makes the company a durable fortress that can operate in all economic conditions and provide investors with good cash returns and downside protection.

The company is fairly valued, with a price tag of around $108.85 (13.02.2023). The current downward trend of the open interest and the comments from the FED that future rate hikes are needed might push the stock price into the buy range.

Be the first to comment